US utilities are breaking ground on Small Modular Reactors in the hunt for carbon-free energy

The tech sector’s thirst for energy, driven by artificial intelligence (AI), is an accelerant for 24/7 clean power – renewable and nuclear

SMRs are carbon-free, dispatchable and enjoy bipartisan support, but development success, standardisation and scale will be required for cost effectiveness

Over the last decade the electricity sector has been at the forefront of decarbonisation, ahead of transport, industry and agriculture. We estimate that the rollout of renewable energy at the expense of older fossil fuel generating units has enabled ~80% of the net zero1 pathway for utilities to be understood and in progress. The final ~20% requires a carbon-free replacement for gas-fired power generation. US utilities are now seeking to determine whether Small Modular Reactors (SMRs) could serve as this substitute. This technology is now being included in their long-term planning, sites are being selected and we are even seeing the signing of SMR Requests for Proposals (RFPs). In this paper we discuss what an SMR is - the advantages / disadvantages of the technology, developments in progress and how the tech sector is both enabling and de-risking this buildout.

What are SMRs and what are their advantages?

SMRs are defined by the World Nuclear Association as “nuclear reactors generally 300MWe2 equivalent or less, designed with modular technology using module factory fabrication, pursuing economies of series production and short construction times”.

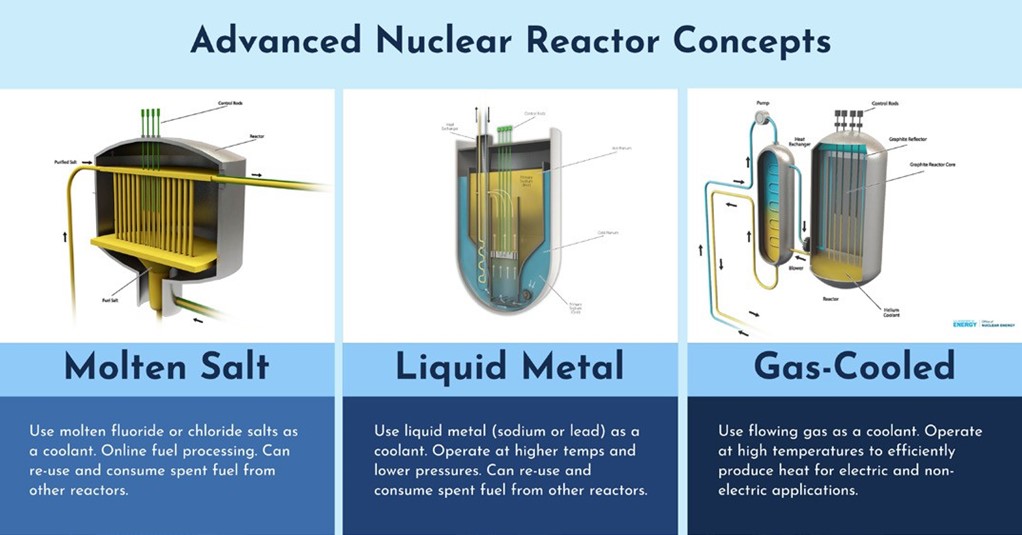

The most current nuclear reactors in operation today are light-water reactors that use water under high pressure as the cooling medium3. Advanced nuclear designs can also use other cooling sources such as molten salt, liquid metal or gas.

Source: Office of Nuclear Energy as at 5 February 2023.

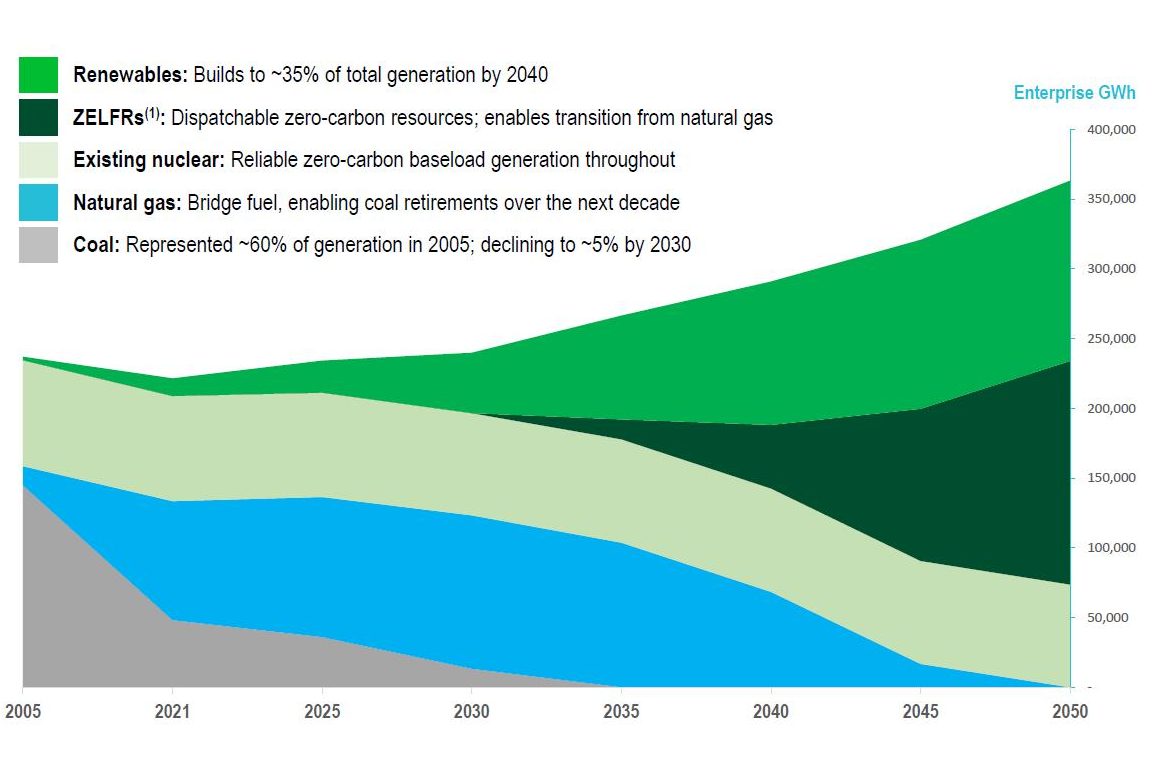

Gas-fired power generation has supported the rollout of renewables, providing dispatchable4 energy that compliments the intermittent nature of renewables. Greater use of gas-fired power generation, along with growth in renewables, has allowed coal fired power generation to be taken offline. This has already helped to reduce the electricity sector’s carbon intensity since natural gas emits around half as much carbon dioxide as coal, per unit of energy delivered5. In order for net zero to be achieved, natural gas will need to be replaced with an even lower carbon option. While batteries can be part of the equation, they don’t give us the whole answer. This is where SMRs come in.

The long-term generation mix forecast of Duke Energy, a large, regulated US utility, shows SMRs beginning to contribute in the 2030s and increasingly taking share from gas as we head towards 2050.

Duke Energy generation mix forecast

Source: Duke Energy as at 4 October 2022.

SMRs offer many advantages not provided by renewable energy sources:

- SMRs will provide dispatchable 24/7 energy that is carbon-free.

- Construction will take place in factories, allowing for centralised manufacturing that will lower the cost of this technology when scaled up.

- Being under 300MWe and having centralised manufacturing will allow for shorter construction times, increasing speed to site.

- SMRs can be housed at the sites of old coal plants with access to water and existing transmission grids, removing one of the largest obstacles cited in further renewable deployment.

- Nuclear energy is one of the only bipartisan aspects of US energy policy, shielding it from the shifting whims of election cycles.

The main disadvantage of this technology is its lack of development to date. Operational SMRs for power generation do not exist today. There are also multiple types of SMRs. This makes standardisation and cost reduction difficult until further development has been carried out. It is with standardisation, scale and learning that cost reductions will be achieved. The question of safe storage and disposal of radioactive waste will also need to be considered, given the sheer volume of capacity that will be required to meet net zero.

Recent Developments

Two SMRs in development in North America today are:

1. Darlington New Nuclear Project – The Canadian province of Ontario, in conjunction with Ontario Power Generation (OPG), has begun planning and licensing for the deployment of GE Hitachi Nuclear Energy (GEH) BWRX-200 SMRs. The project is scheduled to have four units online equating to 1,200MW by 2029.

Work has begun on the fabrication and pre-assembly buildings. Site grading for the fabrication shop is complete and the backfill of the building footprint will be finalised soon. OPG has applied to the Canadia Nuclear Safety Commission (CNSC) for a License to Construct. The CNSC has announced a two-part public hearing. The first one took place on 2 October 2024 with the second one scheduled for January 2025.

Darlington New Nuclear Project site

Source: Ontario Power Generation, Summer 2024.

2. Kemmerer, Wyoming - TerraPower, a company founded by Bill Gates in 2008 and PacifiCorp, a utility business owned by Warren Buffett’s conglomerate Berkshire Hathaway, are building their first SMR near the site of a retiring coal facility in Kemmerer in partnership with the US Department of Energy’s Advanced Reactor Demonstration project.

The US Nuclear Regulatory Commission (NRC) accepted TerraPower’s construction permit application this year. This started the clock on the NRC’s review process for the permit application, which will allow construction to begin on the nuclear reactor itself. Preliminary site construction started in June 2024 with the full project expected to come online in 2030.

Bill Gates breaking ground on TerraPower's SMR in Kemmerer, Wyoming

Source: Wyoming Public Media as at 10 June 2024.

Three SMR projects that have reached the site selection stage include:

- Duke Energy has selected Belews Creek, North Carolina, as the site for their first SMR. Duke plans to build a 600MW SMR by 2035 at this site, which currently houses a large two-unit coal plant. The NRC is currently engaging in pre-application activities with Duke Energy regarding an Early Site Permit. This allows discussions to take place, offering licensing guidance and identifying potential licensing issues early in the process.

- Dominion Energy has selected North Anna, Virginia as the site for its first SMR. The company has already issued an RFP from leading nuclear technology companies to evaluate the feasibility of developing an SMR at the North Anna site. This news was announced at the site alongside Virginia governor Glenn Youngkin and other local and state leaders.

- Tennessee Valley Authority have chosen Clinch River, Tennessee as their site for an SMR. They obtained an Early Site Permit for the reactor in 2019 and are partnering with OPG to work together on the design, licensing, construction and operation of the plant.

FSI site visit to Dominion Energy's North Anna SMR site

Source: First Sentier Investors as at 6 September 2024.

It is also worth noting that TerraPower - in conjunction with Southern Company, another large US utility - has completed the Installation Effects Test of a first-of-its-kind Molten Chloride Fast Reactor at TerraPower’s laboratory in Everett, Washington.

Big Tech enabling SMRs

Big Tech (Microsoft, Google, Amazon and Meta) has aggressively moved to secure 24/7 carbon-free energy for their data centres by signing both renewable and nuclear energy power purchase agreements (PPAs). The US Electric Power Research Institute estimates that by 2030, data centres will account for almost 10% of overall US electricity consumption.

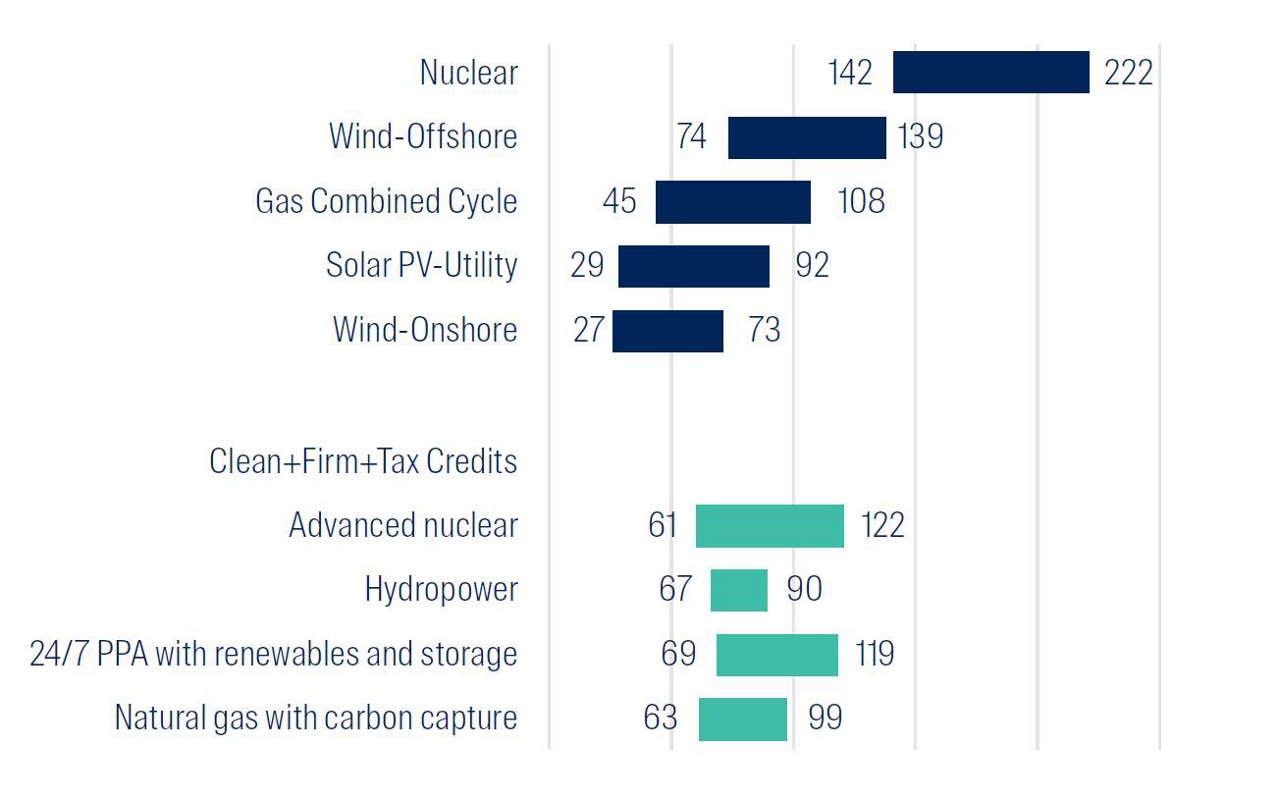

With regard to large-scale nuclear PPAs, Microsoft has recently signed a 20-year PPA with Constellation Energy to restart Three Mile Island nuclear power plant in Pennsylvania. The price is estimated to be between US$110 andUS$115 per megawatt hour (MWh), a large premium to PJM6 forward prices of around US$60 / MWh7. This premium is for access to 24/7 dispatchable power. At scale, SMRs’ levelized cost of energy is estimated to be between US$61 and US$122 per MWh – a premium to renewable energy but lower than large-scale nuclear.

Illustrative LCOE ranges US$/MWh

Source: Lazard LCOE, First Sentier Investors as at 30 September 2024

LCOE = Levelised Cost of Electricity

Another example is Amazon’s AWS subsidiary buying a 950MW data center in Pennsylvania, powered by a nuclear plant that is operated by utility company Talen Energy.

With these examples, it may appear a trend is emerging. However, the number of large-scale nuclear power plants available for commercial contracts is limited. We do not expect to see many of these types of contracts going forward.

We believe the focus is now moving to SMRs. In May 2024, Duke Energy signed a Memorandum of Understanding with Amazon, Google, Microsoft and steel manufacturer Nucor for a range of new power contracts including both renewables and nuclear. In mid-October 2024, Google ordered six to seven SMRs with a total capacity of 500MW from Kairos Power. They estimate the first commercial reactor will be online in 2030 and additional reactors by 2035. This once again highlights the tech sector’s urgent need for power, and its ability to help accelerate the commissioning of such facilities.

The sheer size of these technology companies (their respective market capitalisations are each over 10 times larger than that of Duke Energy – a substantial company in its own right8) allows them to accelerate the deployment of SMRs. Their involvement – either by taking direct ownership stakes, or by signing PPAs – de-risks these projects for utilities. While the rollout of renewables will play a role in this equation, utilities cannot build renewables quick enough to satisfy the insatiable demand that we see coming from the tech sector.

GE Hitachi's BWRX-300 reactor

Source: energyfacts.eu as at 6 February 2020.

Conclusion

SMRs provide 24/7 carbon-free dispatchable energy, significantly replacing gas and enhancing renewable energy in the race to net zero.

US utilities have advanced SMRs more in the past 12 months than over the past 12 years, with Duke Energy and Dominion Energy having selected sites for these plants.

Big Tech’s insatiable demand for energy to power new data centers can de-risk the buildout of SMRs through PPAs or potentially via direct equity into these plants. They have both the balance sheet and the urgent need for power to be an accelerant to this technology.

No matter which US political party is in power for the next four years we see this trend as very likely to continue, with SMRs being a rare area of US energy policy that enjoys bipartisan support.

Putting all this together it is very clear that full decarbonisation requires a blend of highly complementary technologies with different attributes. SMRs represent a firm, dispatchable compliment to renewables that has the promise to replace gas and support the achievement of net zero.

Global Listed Infrastructure

Infrastructure powers the world we live in – and when it comes to on-the-ground research, our team can be found on site

Investing in global listed infrastructure can offer inflation-protected income and steady capital growth from real assets delivering essential services. We search for best-in-class assets worldwide with high barriers to entry, structural growth and pricing power.

1 A target of completely negating the amount of greenhouse gases produced by human activity.

2 MWe: Megawatt electric, defined as one million watts of electric capacity.

3 Source: World Nuclear Association as at 27 August 2024.

4 A dispatchable power source is one that can be adjusted on demand by grid operators to match supply with electricity demand.

5 Source: Center for Climate and Energy Solutions as at 30 September 2024.

6 PJM is a regional transmission organization that coordinates the movement of wholesale electricity in all or parts of 13 eastern US states and the District of Columbia.

7 Source: Bloomberg as at 30 September 2024.

8 Source: Bloomberg as at 30 September 2024.

Source: Company data, First Sentier Investors, as of 30 September 2024. Companies mentioned herein may or may not be holdings of First Sentier Investors’ strategies at the time of writing.

Read our latest insights

Important information

This material is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should conduct your own due diligence and consider your individual investment needs, objectives and financial situation and read the relevant offering documents for details including the risk factors disclosure.

Any person who acts upon, or changes their investment position in reliance on, the information contained in these materials does so entirely at their own risk.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. To the extent this material contains any measurements or data related to environmental, social and governance (ESG) factors, these measurements or data are estimates based on information sourced by the relevant investment team from third parties including portfolio companies and such information may ultimately prove to be inaccurate. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Investors.

To the extent this material contains any ESG related commitments or targets, such commitments or targets are current as at the date of publication and have been formulated by the relevant investment team in accordance with either internally developed proprietary frameworks or are otherwise based on the Institutional Investors Group on Climate Change (IIGCC) Paris Aligned Investment Initiative framework. The commitments and targets are based on information and representations made to the relevant investment teams by portfolio companies (which may ultimately prove not be accurate), together with assumptions made by the relevant investment team in relation to future matters such as government policy implementation in ESG and other climate-related areas, enhanced future technology and the actions of portfolio companies (all of which are subject to change over time). As such, achievement of these commitments and targets depend on the ongoing accuracy of such information and representations as well as the realisation of such future matters. Any commitments and targets set out in this material are continuously reviewed by the relevant investment teams and subject to change without notice.

Past performance is not indicative of future performance. All investment involves risks and the value of investments and the income from them may go down as well as up and you may not get back your original investment. Actual outcomes or results may differ materially from those discussed. Readers must not place undue reliance on forward-looking statements as there is no certainty that conditions current at the time of publication will continue.

References to specific securities (if any) are included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Any securities referenced may or may not form part of the holdings of First Sentier Investors' portfolios at a certain point in time, and the holdings may change over time.

References to comparative benchmarks or indices (if any) are for illustrative and comparison purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities) that are different from the funds managed by First Sentier Investors.

Selling restrictions

Not all First Sentier Investors products are available in all jurisdictions.

This material is neither directed at nor intended to be accessed by persons resident in, or citizens of any country, or types or categories of individual where to allow such access would be unlawful or where it would require any registration, filing, application for any licence or approval or other steps to be taken by First Sentier Investors in order to comply with local laws or regulatory requirements in such country.

This material is intended for ‘professional clients’ (as defined by the UK Financial Conduct Authority, or under MiFID II), ‘wholesale clients’ (as defined under the Corporations Act 2001 (Cth) or Financial Markets Conduct Act 2013 (New Zealand) and ‘professional’ and ‘institutional’ investors as may be defined in the jurisdiction in which the material is received, including Hong Kong, Singapore, Japan, and the United States, and should not be relied upon by or be passed to other persons.

The First Sentier Investors funds referenced in these materials are not registered for sale in the United States and this document is not an offer for sale of funds to US persons (as such term is used in Regulation S promulgated under the 1933 Act). Fund-specific information has been provided to illustrate First Sentier Investors’ expertise in the strategy. Differences between fund-specific constraints or fees and those of a similarly managed mandate would affect performance results.

About First Sentier Investors

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Investors, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group (MUFG). Certain of our investment teams operate under the trading names AlbaCore Capital Group, FSSA Investment Managers, Stewart Investors and RQI Investors all of which are part of the First Sentier Investors group.

This material may not be copied or reproduced in whole or in part, and in any form or by any means circulated without the prior written consent of First Sentier Investors.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311)

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188)

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business divisions of First Sentier Investors (Singapore).

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

- United States by First Sentier Investors (US) LLC, authorised and regulated by the Securities Exchange Commission (RIA 801-93167).

- other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Investors Group

Personnaliser votre visite

Selectionnez votre pays ou region :  France

France

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom