A monthly review and outlook of the Global Listed Infrastructure sector.

Market review - as at February 2022

Global Listed Infrastructure delivered resilient performance against a backdrop of market turbulence triggered by Russia’s invasion of Ukraine, and the resulting swathe of financial and economic sanctions imposed on Russia by western governments.

The best performing infrastructure sector for a second consecutive month was Energy Midstream (+6%) following strong December quarter earnings numbers. Rising energy prices, reflecting the view that sanctions would impede Russia’s oil and natural gas exports, provided the sector with additional support. Airports (+2%) gained on healthy earnings numbers, the lifting of international travel restrictions and isolation requirements, and evidence that passenger numbers were recovering as coronavirus case numbers eased from their January peak.

The worst performing infrastructure sector was Towers / Data Centres (-7%) as persistent concerns for higher bond yields in coming months overshadowed the structural growth theme of increasing demand for mobile data. The Federal Reserve is expected to start raising interest rates in March, for the first time since 2018. Similar concerns weighed on the Water / Waste (-3%) sector.

The best performing infrastructure region was Japan (+4%), which is traditionally viewed as a safe haven from equity market volatility. The country’s economy grew strongly during the December quarter, after its COVID-19 state of emergency was lifted at the end of September 2021. The worst performing infrastructure region was the United States (-2%) owing to lacklustre returns from mobile towers and some of its large-cap utility stocks.

Fund performance

The Fund returned +1.0% after fees in February1, 100 basis points ahead of the FTSE Global Core Infrastructure 50/50 TR Index (SGD).

The best performing stock in the portfolio was US Liquefied Natural Gas (LNG) exporter Cheniere (+19%) which rallied after raising earnings guidance for 2022 by 20%, citing the early completion of its latest LNG “train” (large scale natural gas liquefaction and purification facility) and the sustained strength in global LNG markets. This strength is underpinned by growing demand for reliable LNG supplies, particularly given Europe’s need to reduce or eliminate its dependence on gas from Russia.

The portfolio’s other energy midstream holdings also rose. Pembina Pipeline (+7%), which operates a vertically integrated asset footprint of gathering & processing, fractionation, transportation, storage and export terminals in Western Canada, announced better than expected earnings for the December quarter, aided by the positive operating environment. Enterprise Products Partners (+3%), whose substantial assets include a 50,000 mile pipeline network and 14 billion cubic feet of natural gas storage capacity, announced robust December quarter earnings and noted a likely increase in demand for crude oil, natural gas and Natural Gas Liquids.

Notable performers in the utilities space included UK operator SSE (+8%), which gained on the view that renewables build-out would help to reduce Europe’s reliance on Russian oil and gas. In recent years SSE has transformed itself from a fossil fuel-heavy, integrated utility to focus on regulated electricity networks and renewables. US peer Sempra Energy (+4%) announced robust December quarter earnings and forecast earnings growth of between 6% and 8% per annum up to 2026, reflecting the healthy fundamentals of its high quality utility businesses and energy infrastructure assets.

Transport infrastructure achieved generally positive returns, led by PINFRA (+6%) which operates toll road networks focused on Mexico City, one of the world’s most congested regions. The company delivered better-than-expected December quarter earnings, aided by a faster-than-expected recovery in traffic on most of its roads. Mexican airport operator ASUR (+6%), whose assets include the concession for Cancun International Airport, also outperformed as strong retail spending (by passengers) and progressive increases in aeronautical tariffs (paid by airlines) underpinned better than expected December quarter earnings.

The worst performing stock in the portfolio was US tower operator American Tower (-10%) owing to concerns for higher interest rates, and as investors focused on the equity raising that is expected to form part of the financing package to pay for last year’s acquisition of data centre operator CoreSite. Peer SBA Communications (-7%) also underperformed as concerns for the interest rate outlook outweighed the company’s robust fundamentals. Italian peer Inwit (-5%) fared slightly better on continued speculation about the potential for consolidation within the European towers space.

Waste management company Republic Services (-6%) announced disappointing December quarter earnings numbers, as higher wage and fuel costs affected its margins. Over time we expect this impact to ease; waste management contracts are often linked to inflation (or better). A sceptical market reaction to its US$2.2 billion acquisition of hazardous waste specialist US Ecology (+66%, not in our focus list) provided an additional headwind to its share price.

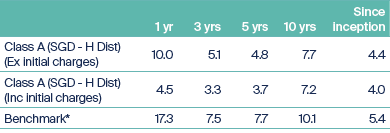

Annualised performance in SGD (%)2

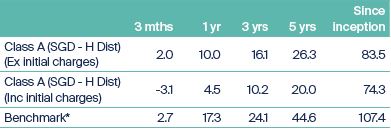

Cumulative performance in SGD (%)2

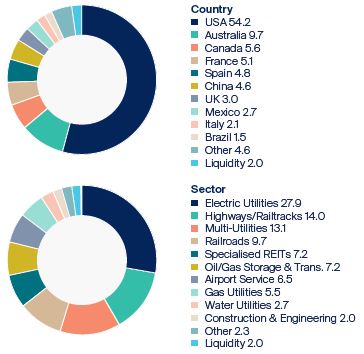

Asset allocation (%)2

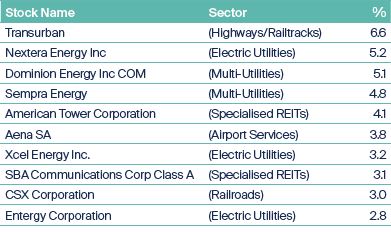

Top 10 holdings (%)2

1 First Sentier Global Listed Infrastructure Fund’s cumulative return over one month. The performance of the fund is based on the Singapore unit trust, net of fees, expressed in SGD terms.

2 Source: Lipper & First Sentier Investors. Single pricing basis with net income reinvested. Data as at 28 February 2022. Allocation percentage is rounded to the nearest one decimal place and the total allocation percentage may not add up to 100%. First Sentier Global Listed Infrastructure Fund inception date: 3 March 2008.

* From inception - 31 May 08 : S&P Global Infrastructure Index; From 1 Jun 08 – 31 Mar 15 : UBS Global Infrastructure and Utilities 50-50 Index; From 1 Apr 15 : FTSE Global Core Infrastructure 50/50 Index.

All stock and sector performance data expressed in local currency terms. Source: Bloomberg.

Fund activity

The Fund initiated a position in Danish-listed Ørsted, a leading global renewables developer and operator with a focus on offshore wind. The majority of Ørsted’s current projects are located in the North Sea. They include the world’s two largest wind farms, Hornsea One (already operational) and Hornsea Two (scheduled for completion in 2022). Built further out to sea than ever before and materially larger than current wind farms, they represent a new generation of offshore power station. The company also has a growing onshore wind and solar business in the United States, and growth ambitions in Asia. Government subsidies or tax incentive structures underpin stable returns from the company’s projects over long time frames, regardless of underlying energy market conditions. Rising net zero commitments from governments around the world are expected to underpin structural growth in demand for the company’s developments over coming years. After initiating the position, Ørsted’s share price spiked as the escalating crisis in Ukraine fuelled investor interest in alternative energy sources to Russian oil and gas.

Market outlook and fund positioning

The Fund invests in a range of global listed infrastructure assets including toll roads, airports, railroads, utilities and renewables, energy midstream, wireless towers and data centres. These sectors share common characteristics, like barriers to entry and pricing power, which can provide investors with inflation-protected income and strong capital growth over the medium-term.

The portfolio does not hold any Russian listed stocks. However, Russia’s invasion of Ukraine could have a number of potential implications for financial markets and the global listed infrastructure asset class.

1) Russia reduces / cuts gas supply to Europe

The most direct impact under this scenario would be on European utilities that source a high proportion of natural gas from Russia. We have long favoured US utilities over their European peers. As a result, the portfolio does not hold any European utilities with a material reliance on Russian natural gas. Our exposure to European utilities is focused on those with the scope to benefit from the build-out of renewables, such as Spain’s Iberdrola and Denmark’s Ørsted.

Such a move from Russia would also likely accelerate US LNG exports to Europe, to the benefit of portfolio holdings Cheniere Energy, the largest producer of LNG in the United States and the second largest LNG operator in the world; Sempra Energy, whose assets include Sempra Infrastructure, a developer and operator of substantial natural gas transportation networks and liquefaction facilities in the US and Mexico; and Dominion Energy, whose assets include Cove Point LNG Terminal, on the US Eastern Seaboard.

2) Tensions in the region cause global energy prices to rise

The portfolio should be reasonably hedged to this outcome. Rising energy prices would further improve the economics and strategic value of renewables projects, to the benefit of many of the portfolio’s utilities / renewables holdings (~46% of the portfolio at the end of February 2022). Higher oil and natural gas prices could also increase growth opportunities for the energy midstream space (7% of the portfolio). Offsetting this to a certain extent, the cost of travel would go up for transport infrastructure stocks such as Toll Roads (15% of the portfolio) and Airports (6% of the portfolio). The risk of political intervention in European power markets (for example where utilities are told to limit customer bill increases) may increase.

3) Geopolitical uncertainty and rising energy prices would likely bea brake on economic growth

This could push out expectations for increases in interest rates, which have been a headwind for infrastructure stocks.

More broadly, while the future remains uncertain, listed infrastructure can offer defensive characteristics in a volatile world. Listed infrastructure companies own and operate tangible assets that are difficult or impossible to replicate. Given the domestic focus of most infrastructure assets, the portfolio’s substantial North American exposure should also help to insulate it from events in Eastern Europe.

Source : Company data, First Sentier Investors, as of 28 February 2022.

Important Information

This document is prepared by First Sentier Investors (Singapore) (“FSI”) (Co. Reg No. 196900420D.) whose views and opinions expressed or implied in the document are subject to change without notice. FSI accepts no liability whatsoever for any loss, whether direct or indirect, arising from any use of or reliance on this document. This document is published for general information and general circulation only and does not have any regard to the specific investment objectives, financial situation and particular needs of any specific person who may receive this document. Investors may wish to seek advice from a financial adviser and should read the Prospectus, available from First Sentier Investors (Singapore) or any of our Distributors before deciding to subscribe for the Fund. In the event that the investor chooses not to seek advice from a financial adviser, he should consider carefully whether the Fund in question is suitable for him. Past performance of the Fund or the Manager, and any economic and market trends or forecast, are not indicative of the future or likely performance of the Fund or the Manager. The value of units in the Fund, and any income accruing to the units from the Fund, may fall as well as rise. Investors should note that their investment is exposed to fluctuations in exchange rates if the base currency of the Fund and/or underlying investment is different from the currency of your investment. Units are not available to US persons.

Applications for units of the Fund must be made on the application forms accompanying the prospectus. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by First Sentier Investors (Singapore), and are subject to risks, including the possible loss of the principal amount invested.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of FSI’s portfolios at a certain point in time, and the holdings may change over time.

In the event of discrepancies between the marketing materials and the Prospectus, the Prospectus shall prevail.

In Singapore, this document is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors (registration number 53236800B) is a business division of First Sentier Investors (Singapore).

First Sentier Investors (Singapore) is part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions..

MUFG and its subsidiaries are not responsible for any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

Get the right experience for you

Your location :  Singapore

Singapore

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom