A monthly review and outlook of the Asian Quality Bond market.

Market review - as at May 2025

It was a positive month for risk assets, despite ongoing macroeconomic uncertainties. The Federal Reserve kept interest rates unchanged, and the minutes from the Federal Open Market Committee (FOMC) indicated a cautious approach to future policy decisions. The impact of tariffs has yet to be reflected in economic data, and the markets shrugged off Moody’s downgrade of the US sovereign rating from Aaa to Aa1.

The yield on the 10-year US Treasury ended the month at 4.4%, up by 24 basis points. The yield curve steepened, particularly at the long end, while the spread between 2-year and 10-year Treasuries remained relatively stable at 50 basis points, narrowing by 6 basis points.

As macroeconomic uncertainty diminished, credit spreads experienced a relief rally, returning to levels seen before April’s sell-off. Investment Grade (IG) USD Asian bond spreads tightened by 15 basis points to 118 basis points. Despite higher US Treasury yields partially eroding total returns, total IG credit returns remained respectable at 0.11%.

It was a mixed bag of news for Investment Grade (IG) USD Asian bonds, but positive sentiments largely prevailed. Share prices of Chinese technology companies recovered Liberation Day losses as tariffs were delayed and China unveiled more supportive monetary easing measures. In credit fundamentals, a divergence in earnings emerged. Meituan and JD both achieved strong earnings in Q1 2025, despite rivalry concerns between the two companies’ food delivery lines. Alibaba achieved decent growth and stable earning margins, but the performance of its cloud business lagged behind market expectations. Indian IG corporates generally achieved decent earnings growth in Q4 FY25 across digital, retail, ports, and energy distribution businesses.

Adani Ports announced the issuance of INR 50bn in NCDs to the Life Insurance Corporation of India, extending the corporate’s overall maturities by 1.4 years. The company mentioned that they would use the proceeds to repurchase dollar bonds. The Adani curve saw a 2-4 point increase in its bond prices over the month.

In Asia Investment Grade Sovereigns, Indonesia’s Sovereign Wealth Fund, Danantara, continued to explore options to raise debt but faced disappointing news as Ray Dalio declined to join its board as an advisor.

Primary issuance volumes trended close to April levels, with an increase in issuances from quasi-sovereigns. PT Pertamina Hulu Energi, a subsidiary of Indonesia’s PT Pertamina, priced its debut bond, a USD 1 billion 5-year tenure, which was well received by the primary market.

Fund positioning

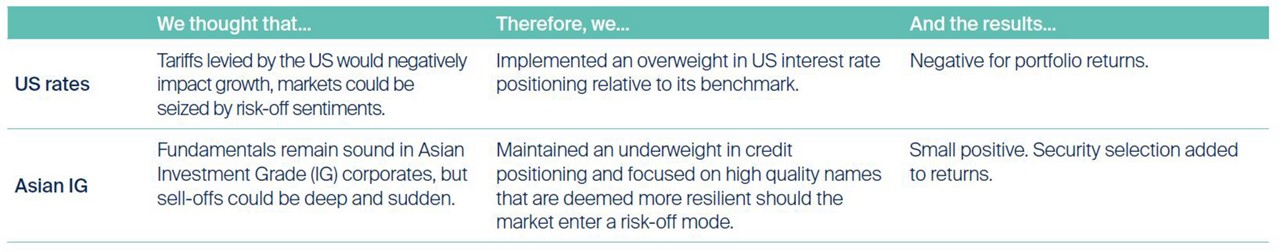

The Fund maintained an overweight in US rates in anticipation of a weakening macro backdrop, while maintaining a defensive stance in credit positioning. Small local currency allocations were maintained as diversifiers to a bearish dollar view.

Performance review

On a net-of-fees basis (SGD terms), the First Sentier Asian Quality Bond Fund returned -0.74% in May, underperforming its benchmark by -0.67%.

An underweight positioning in credit spreads was positive for performance, but the portfolio’s overweight in US rates detracted from returns. Local rates and currency exposure was flat for returns.

Source : Company data, First Sentier Investors, as of 31 May 2025

Read our latest insights

Important Information

This material is prepared by First Sentier Investors (Singapore) (Co. Reg No. 196900420D) whose views and opinions expressed or implied in the material are subject to change without notice. To the extent permitted by law, First Sentier Group accepts no liability whatsoever for any loss, whether direct or indirect, arising from any use of or reliance on this material. This material is published for general information and general circulation only and does not have any regard to the specific investment objectives, financial situation and particular needs of any specific person who may receive this material. Investors may wish to seek advice from a financial adviser and should read the Prospectus, available from First Sentier Investors (Singapore) or any of our Distributors before deciding to subscribe for the Fund. In the event that the investor chooses not to seek advice from a financial adviser, he should consider carefully whether the Fund in question is suitable for him. Past performance of the Fund or the Manager, and any economic and market trends or forecast, are not indicative of the future or likely performance of the Fund or the Manager. The value of units in the Fund, and any income accruing to the units from the Fund, may fall as well as rise. Investors should note that their investment is exposed to fluctuations in exchange rates if the base currency of the Fund and/or underlying investment is different from the currency of your investment. Units are not available to US persons.

Applications for units of the Fund must be made on the application forms accompanying the prospectus. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by First Sentier Investors (Singapore), and are subject to risks, including the possible loss of the principal amount invested.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Group’s portfolios at a certain point in time, and the holdings may change over time.

In the event of discrepancies between the marketing materials and the Prospectus, the Prospectus shall prevail.

In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Group (registration number 53507290B), First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business names of First Sentier Investors (Singapore).

First Sentier Investors (Singapore) is part of the investment management business of First Sentier Group, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Group includes a number of entities in different jurisdictions.

To the extent permitted by law, MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Group

Get the right experience for you

Your location :  Singapore

Singapore

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom