A pivotal shift in the U.S. economic landscape is now visible in the hard data, and select market segments are beginning to reflect this transition. The recent rally in U.S. 10-year Treasury yields underscores growing investor conviction that the Federal Reserve may soon pivot toward easing—driven by a confluence of weakening labor market indicators and softening economic activity.

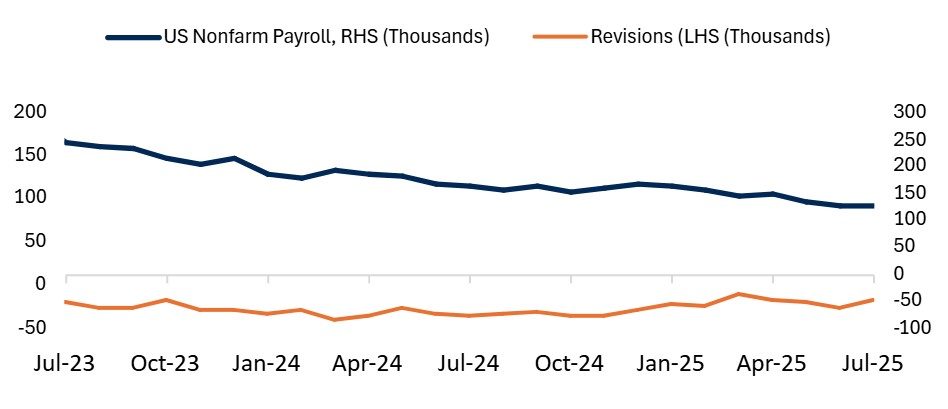

At the heart of this shift is the latest nonfarm payrolls report, which came in well below expectations. More strikingly, substantial downward revisions to prior months’ data have sparked political controversy, culminating in President Donald Trump’s dismissal of Bureau of Labor Statistics (BLS) Commissioner William McEntarfer. Trump cited the dramatic revisions—May’s payrolls slashed from 144,000 to just 19,000, and June’s from 147,000 to 14,000—as justification.

Source: Bloomberg, First Sentier Investors as of 31 July 2025.

While the headlines are politically charged, seasoned market participants recognize that such revisions are not unprecedented. Signs of labor market weakness had been building throughout 2024, with the BLS revising down its benchmark payroll growth by over 800,000 jobs for the year ending March 2024 (Source: S&P). These revisions occurred during the Biden administration, well before Trump’s tariff plans were introduced—reinforcing our view that the U.S. economy was already on weak footing.

Beyond labor data, broader economic indicators are also flashing caution. The July The Institute for Supply Management (ISM) Services purchasing managers index (PMI) unexpectedly fell to 50.1 (vs. 51.5 expected), barely above contraction territory. Several subcomponents—including employment, business activity, and new orders—registered month-on-month declines, pointing to a broader deceleration in service sector momentum.

Source: Bloomberg, First Sentier Investors as of 31 July 2025.

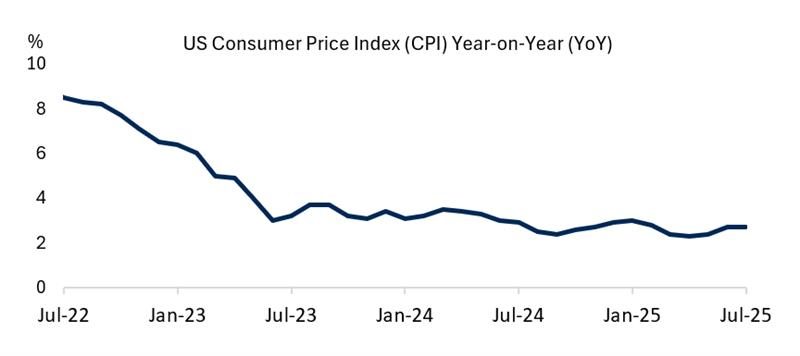

The inflation narrative is evolving as well. At the start of the year, we maintained that inflation—largely driven by tariff-related distortions—would prove transitory. That view remains intact. Inflation has not reaccelerated as it did prior to the Fed’s aggressive rate hikes. Notably, Owners’ Equivalent Rent (OER)—a key CPI component—has steadily declined from its 2023 highs, reflecting easing shelter costs and helping anchor inflation expectations.

Meanwhile, consumer demand continues to show signs of fragility. Discretionary spending remains subdued amid persistent growth uncertainties, further reinforcing the case for policy easing. With inflation moderating, labor market softness becoming more pronounced, and consumer sentiment weakening, the Federal Reserve faces mounting pressure to act.

Time is running out for policymakers to deliver the rate cuts that markets have increasingly priced in. The inflection point is no longer theoretical—it is unfolding in real time.

Read our latest insights

Important information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Group believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither First Sentier Group, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material. The information herein is for information purposes only; it does not constitute investment advice and/or recommendation, and should not be used as the basis of any investment decision. Some of the funds mentioned herein are not authorised for offer/sale to the public in certain jurisdiction.

The value of investments and the income from them may go down as well as up and you may not get back your original investment. Past performance is not necessarily a guide to future performance. Please refer to the offering documents for details, including the risk factors. Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Group’s portfolios at a certain point in time, and the holdings may change over time.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of First Sentier Group. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of First Sentier Group. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited. First Sentier Group (registration number 53507290B), First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business names of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Group, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Group includes a number of entities in different jurisdictions.

To the extent permitted by law, MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Group

Get the right experience for you

Your location :  Singapore

Singapore

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom