Introduction

The case for having listed property as a part of real asset portfolios should be considered on the basis of longer term returns, liquidity and ability to offer a strong inflationary hedge. In this paper, we examine these elements and highlight the investment opportunity in listed property as a complement to real asset portfolios.

Property characteristics

There are three main routes for investors to gain exposure to real estate: listed property (Real Estate Investment Trusts (REITs)), private property (unlisted property funds) and/or direct investment. There are some nuanced differences between these options primarily related to liquidity, cost and asset type. The key characteristics are:

Private property and direct investment

- Lower correlation with equities and REITs in the short term and higher correlation to REITs in the long term

- Valuations based on Net Asset Value rather than the stock market

- Very little demonstration of an inflationary hedge in recent times

- Liquidity:

- Closed end private property funds: Inflexible and illiquid, with liquidity windows pressured during downturns as assets need to be sold to realise investments

- Direct investment: Inflexible and illiquid, as the asset or joint venture interest needs to be sold to raise liquidity

- Closed end private property funds: Inflexible and illiquid, with liquidity windows pressured during downturns as assets need to be sold to realise investments

- Typically invested in traditional property types such as office, industrial and retail, with office and retail being more exposed to disruption

- Very high transaction costs for direct investment and high fees for exit on private property funds.

- Performance fees can be excessive

Listed property

- Liquid alternative to direct property investment, REITs are listed on equity markets

- Natural inflation hedge with stable cash flows and pricing power

- Flexibility to move into different real estate sectors and regions

- Less volatile than equities but more volatile than direct property funds (see Chart 1). It’s important to note that the long term trend beta is near 1. For long term investors, listed property offers the luxury of liquidity with a similar return profile. The rarer cyclical volatile events do create large pricing anomalies offering active investors excess return opportunities

- Assets within the REIT universe provide access to alternative property sectors such as data centres, healthcare, residential, life science and self-storage facilities (see Chart 2)

- De minimis transaction costs

Chart 1: 1 Year rolling Beta listed property versus direct property

Disclaimer: First Sentier Global Property Securities Strategy vs INREV Global Real Estate Fund Index. All data in USD. Past performance is not indicative of future performance. Source: Factset and inrev.org, 31st December 2023.

Chart 2: Asset types of listed property and direct property

Listed property

- Medical Office Buildings

- Private Hospitals

- Seniors Housing Assets

- Life Science Assets

- Apartments for Rent

- Detached Housing for Rent

- Land Lease Communities

- Student Accommodation

- Hotels and Leisure Assets

- Logistical Centres

- Industrial Warehousing

- Data Centres

- Self-Storage Facilities

- Shopping Malls

- Retail Shopping Centres

- Suburban Office Buildings

- CBD Office Buildings

Direct property

- CBD Office Buildings

- Suburban Office Buildings

- Shopping Malls

- Retail Shopping Centres

- Logistical Centres

- Industrial Warehousing

- Student Accommodation

Listed property

With listed property offering investor liquid exposure to high quality assets across various property subsectors, there are several other core characteristics of listed property that reinforce the aim to deliver resilient cash flows together with long-term capital appreciation:

Dependable cash flow

We believe REITs generate stable cash flows as their revenues come from contracted rental income streams across a diverse range of property types. The listed property universe includes asset types such as biotech laboratories, data centres, student accommodation, residential assets, self-storage facilities and logistics warehouses, which offer exposure to structural growth themes. These assets are usually less economically sensitive and their operating fundamentals are driven by factors such as societal change, technology adoption, data consumption growth and demographic shifts etc. The stable cash flows allow REITs to consistently provide attractive dividends to shareholders throughout economic cycles. Chart 3 demonstrates that global REITs have historically offered higher dividend yields compared to global bonds and equities.

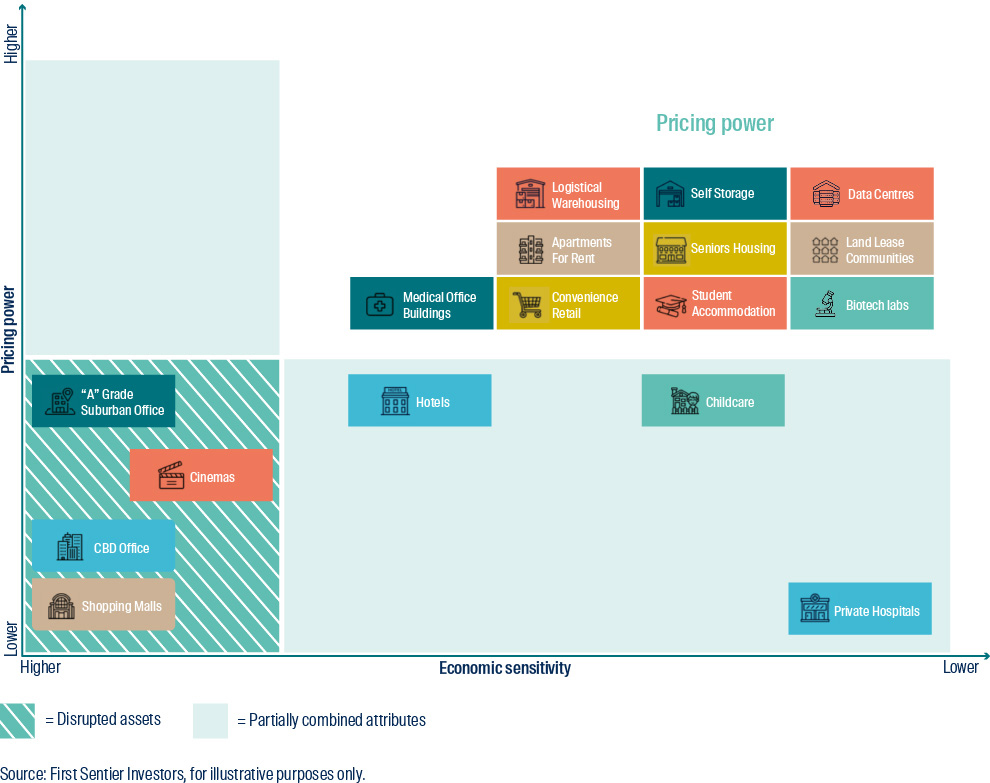

Many property types offer an inflation hedge to investors. Some property types have rental contracts with built-in clauses that automatically increase rents annually. These clauses can be fixed (typically around 2-3%), or tied to a published inflation rate, or a combination of both, which may take pricing floors or caps into consideration. In the short term, these lease clauses help pass higher landlord costs to tenants. However, for the inflationary hedge to be sustainable, the property must have pricing power. Without pricing power, the inflationary hedge may not be sustainable and could lead to tenant default and/or material falls in rents at the end of the lease. Assets that can maintain ‘pricing power’ (see Chart 4) are able to pass through inflationary pressures to tenants, providing a natural sustainable inflationary hedge that drives revenue growth. Rising inflation also increases the replacement cost of property assets and increases barriers-to-entry, reducing supply. This limited supply further supports market rental growth and property valuations.

Chart 3: Dividend yield (%)

Disclaimer: Data as at 31 March 2024. Global REITs as represented by the FTSE EPRA Nareit Developed Index. Global Equities as represented by the MSCI World index. Global Bonds as represented by Bloomberg Global Aggregate Bond Index. All data is in USD.

Chart 4: Pricing power within listed property universe by asset type

Source: First Sentier Investors, for illustrative purposes only.

As shown in Chart 4, the majority of the listed property sector assets are positioned in the top right quadrant. These assets exhibit strong pricing power, which drives the inflationary hedge with low economic sensitivity.

Understanding liquidity

For private investing, liquidity has been a core issue, especially during periods of volatility when Private Real Estate Funds have ‘gated’, preventing or delaying investor redemptions. For direct investment, capital market conditions may cause direct property markets to freeze, preventing asset sales.

In contrast, for listed property, whilst volatility may cause implied stock prices to fall below net asset values, liquidity is also available which allows for more efficient asset allocation. Volatility provides the flexibility to move between property segments, which may have different supply and demand dynamics. The appealing valuations in listed property also make a compelling argument, particularly for active management.

Chart 5 demonstrates that listed property and direct property have delivered similar long term returns until central banks began tightening monetary policy and increasing interest rates. The direct property valuation lag effect is very evident here, whereas listed property was revalued with immediacy. This lag effect in direct property valuation can create significant pricing dislocations in the short and medium term, as is the case today. We believe a further decline is expected in direct property valuations, listed property offers a distinct pricing anomaly with much higher total return expectations over the medium term.

Chart 5: Listed Property vs Direct Property performance (10 Years)

Disclaimer: Metrics are for the First Sentier Global Property Securities Strategy (USD) and the INREV Global Real Estate Fund Index. The First Sentier Global Property Securities Strategy is net of fees and the INREV Global Real Estate Fund Index is net of fees (assumption is 40 basis points). Past performance is not indicative of future performance. Data as at 31 December 2023.

The current large listed property pricing anomaly is highlighted in Chart 6, which displays the strategies discount/premium to net asset value over the past 10 years.

Chart 6: First Sentier Global Property Securities Strategy Net Asset Value

Disclaimer: Metrics are for the First Sentier Global Property Securities Strategy (OEIC). NAV (Net Asset Value) is our assessed value of property assets owned plus the value of other businesses operated. Past performance is not indicative of future performance. Data as at 31 March 2024. Source: First Sentier Investors.

Conclusion

With investors having the ability to gain exposure to real assets via differing avenues, the decision to choose one over another can be challenging. It is clear that both listed and direct property have historically delivered similar returns over the longer term, which makes a strong case for owning both as they complement each other. However, in our view, listed property is expected to offer higher returns over the medium term given the current pricing anomalies. There is also an argument for listed property to deliver higher returns over the longer term, given its sector make up primarily invested in alternative property types with a stronger inflationary hedge. Essentially, liquidity should not be overlooked – it isn’t important until it is. Combining higher return expectations and liquidity makes a compelling case for including listed property as an important part of real assets portfolios.

Global Property

Property markets are constantly evolving – and so are the investment opportunities

Based in some of the world’s most vibrant property markets, our team blends global analysis of the trends redefining the way we live and work, together with local perspectives of how this plays out for each stock. With a focus on capital preservation, we invest in well managed assets in high barrier to entry markets in many of the world’s bustling cities.

Important Information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business divisions of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

Get the right experience for you

Your location :  Singapore

Singapore

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom