We believe global listed infrastructure is well placed to deliver strong returns in 2025

Unprecedented demand growth for electric utilities is a material positive for the asset class

A pro-growth US agenda should prove supportive of freight rail and energy midstream1; airport demand is being boosted by demographic trends

We see deep value in non-US infrastructure assets in 2025

2024 was a good year for global listed infrastructure. Strong earnings for energy midstream and a step-change in the earnings growth outlook for utilities helped the asset class to shrug off rising bond yields and political uncertainty.

Despite roughly flat returns from fixed income in 2024, infrastructure almost kept up with equities2. This is an outstanding outcome for the asset class.

The following paper looks ahead at the opportunities and potential risks that global listed infrastructure may face in 2025.

Powering the future: a utilities super-cycle

The prospects for utilities in 2025 are clearly positive. Regulated US utilities delivered robust sales, capital expenditure (capex) and earnings growth during the first nine months of 2024, with momentum building as the year progressed.

Demand for electricity in developed markets – roughly flat for decades owing to declining heavy industry and greater energy efficiency – is starting to grow again.

This growth is being driven by robust economic growth and technological advances – notably demand from data centres, which are both growing in number and consuming more power, in order to meet the energy intensive requirements of Artificial Intelligence (AI). EPRI3 estimates that by 2030, data centres could consume up to 9% of US electricity, up from 4% of total load in 2023. Industrial onshoring and the replacement of conventional with electric vehicles (EVs) are expected to further add to demand in the medium term.

As a result, utilities in the US and elsewhere are evolving from an energy transition (fossil fuels replaced by renewables) towards an “all-of-the-above” approach to power generation, with the renewables build-out continuing alongside the construction of additional natural gas power plants, extensions to coal and nuclear power plant service lives, and nuclear power plant re-starts.

While the technology is not yet proven, technological advances in nuclear power, notably in Small Modular Reactors (SMRs) hold out the promise of a cheaper, simpler route to nuclear, as discussed in the team’s recent paper, available here.

FSI site visit to Dominion Energy’s North Anna SMR site

Source: First Sentier Investors, September 2024.

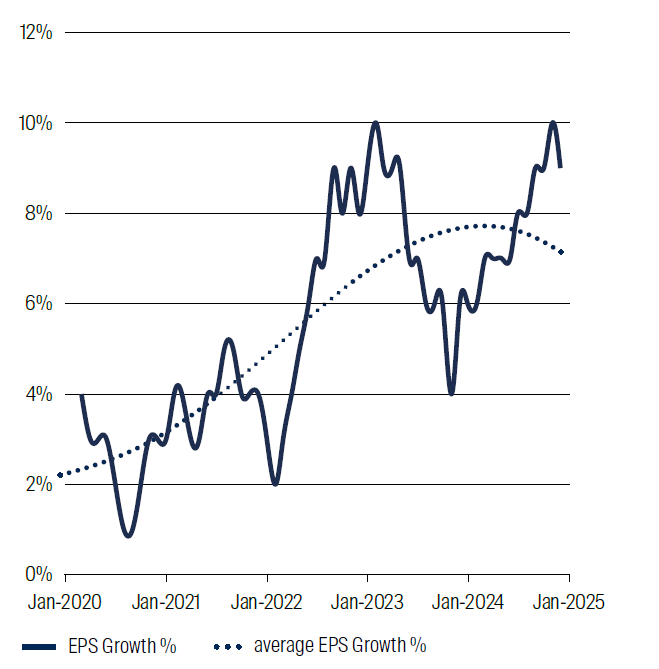

Under the regulatory frameworks of most utilities, capex upgrades support rate base4 growth, which leads over time to Earnings Per Share (EPS) growth. The unprecedented demand growth described above is expected to provide ample opportunity for utilities to obtain regulatory approval to spend more capex, underpinning healthy earnings growth over time. We see no signs of this theme easing and expect it to continue through 2025 and well beyond.

In addition to demand growth, we also see reduced regulatory risk in this environment. As regulators grasp the urgency of additional investment by utilities, they are more likely to approve requests to spend capex that may previously have been subject to challenge or denied altogether.

As a result, we believe that US utilities’ long term annual earnings growth rate will increase materially, from a range of between 4% and 6% to a range of between 5% and 8%. While European peers have not yet shown the ability to benefit from this theme to the same extent, we ultimately expect this theme to provide a tailwind to the earnings of operators on both sides of the Atlantic.

Resilience spending – investing to maintain and enhance the reliability of utility operations in the face of extreme weather events, natural disasters, and growing cyber threats – is also expected to grow. Already accounting for around 30%5 of US electric utility transmission and distribution spend, this represents an additional area of capex growth, and therefore rate base and earnings growth, within the utilities space.

The following chart illustrates how US utilities earnings growth is already picking up as a result of these drivers.

US utilities earnings per share growth

Source: Bloomberg, First Sentier Investors as at 30 November 2024.

US utilities may not be immune from the political uncertainty in 2025 discussed later in this paper. The likely repeal of parts of the Inflation Reduction Act (IRA)6 may cause uncertainty for renewables developers and regulated utilities with substantial renewable segments in the US over the next 12 months. However, the backdrop of growing electricity demand and the fact that to date around 75% of IRA-related benefits have flowed to Republican states7, should help to dampen the extent of changes made in this area.

Transport infrastructure: reaping a demographic dividend

Airport passenger volumes held up unexpectedly well in 2024. Additional demand came from retiring baby boomers with money to spend, and from a Gen Z cohort prioritising experiences over a globally expensive housing market. This may be the beginning of a structural theme, fuelled by the oldest and youngest generations. We expect travel demand and passenger volumes to remain robust in 2025, providing a tailwind to airport stocks.

Favoured names within this space include French-listed Vinci, Swiss operator Flughafen Zurich and Mexican peer GAP. Vinci is an infrastructure concession and construction company with a fast-growing airports segment. With over 70 airports across 14 countries in the UK, Europe, Asia and the Americas, Vinci is now one of the world’s largest airport operators.

Flughafen Zurich, which owns and operates Switzerland’s largest airport, looks set to see traffic volumes recover to pre-pandemic levels in 2025. The development of property assets in recent years, and the growth potential associated with its position of developer and concessionaire of Noida International Airport, Delhi offer scope for its valuation multiples to comfortably exceed its pre-2019 range.

GAP’s airports, which service a diversified mix of business and leisure passengers, are registering healthy passenger growth reflecting Mexico’s growing middle class and the conversion of bus passengers to air travel.

A holding in China’s Beijing Airport is well placed to benefit from any uplift in outbound Chinese tourism; while Japan’s efforts to make the country a higher priority destination for international travellers should provide a tailwind to Japan Airport Terminal, owner and operator of the terminals at Tokyo’s Haneda Airport.

Passenger rail stocks tend to benefit from similar drivers. Examples include Channel Tunnel operator Getlink, whose Eurostar service competes with ferries crossing the English Channel; and Japanese passenger rail company West Japan Railway, which services the culturally rich Kansai region of Japan – a popular region for tourists visiting Japan.

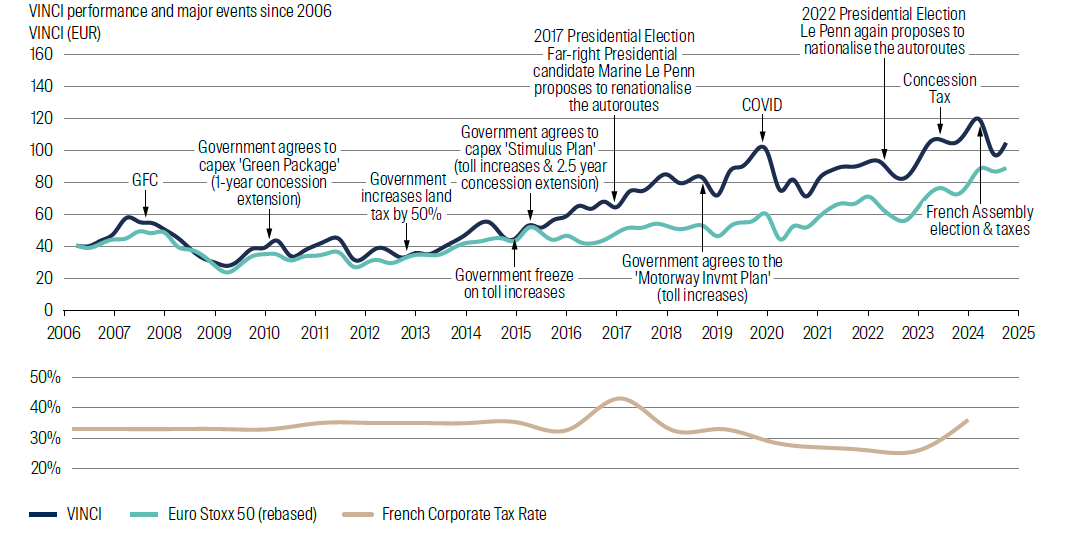

Toll roads faced a challenging 2024, as political risk weighed on the sector. The New South Wales Independent Toll Review report raised concerns for changes to the tolling structure that applies to Transurban’s network of Sydney toll roads; while the prospect of higher French taxes overshadowed French operators including Vinci, whose assets include substantial French toll road concessions. Accordingly, over the course of the year, the toll road sector traded down to what we regard as being very appealing valuation multiples.

However, experience tells us that while political noise affects the toll road sector periodically, earnings – and therefore share prices – have tended to shrug these off and maintain a steady upward trajectory over longer time frames. The sector has a strong track record of protecting the economic value of their road network concessions and the tolling frameworks that apply.

This resilience is illustrated by the following chart which shows how Vinci’s has risen (and outperformed the broader European market) despite a steady stream of taxation and toll-related government measures.

Political noise is nothing new

Source: First Sentier Investors, Bloomberg as at 30 September 2024.

We expect this will present an opportunity for investors in 2025. While multiples have declined, the sector’s fundamentals have remained robust. Inflation-linked toll increases have had little impact on demand. High operating leverage (i.e. largely fixed costs as sales increase) is proving supportive of earnings growth. Improvements made to toll road networks in recent years provide scope for further growth in traffic volumes.

Asset class performance in 2024 was characterised by marked differentials in performance between US and non-US infrastructure companies. Partly, this was simply a reflection of very strong fundamentals in the US. But we also believe that non-US infrastructure companies have been unfairly left behind. This now creates an opportunity in toll roads and airports (many of which are listed in Europe, Asia and Latin America rather than the US), as well as in select Emerging Market infrastructure stocks.

Trumped

While the US election outcomes are behind us, the announcement of Trump policies will likely remain a key driver of markets in the coming months. Election campaign rhetoric, the strength of the win and unconventional administrative appointments suggest the scale and pace of change is likely to be more significant than in the past.

Policy changes are likely to have material impacts on issues relevant for infrastructure investors ranging from global trade and currencies, inflation and interest rates to AI and cryptocurrency, renewables and nuclear.

For example, Trump’s win is likely to result in lower corporate taxes, reduced government regulation and increased onshoring. His administration is likely to have a pro-business, pro-energy, pro-economic growth agenda. We believe these are all positive earnings and share price drivers for the US energy midstream, freight railroads and waste management sectors.

On the other hand, a cut in the corporate tax rate, which Trump proposed reducing during his campaign from 21% to 15%8, would be less beneficial to listed infrastructure than it would be to general equities, given that utilities and towers treat tax as a pass-through.

More broadly, the potential for tariff increases on imports, further tax cuts and lower immigration (deportation) are likely to be inflationary – which could in turn push bond yields higher.

This may present a short-term headwind for infrastructure valuations, particularly more leveraged sectors like towers and utilities. However, we remain confident that the regulation and contracts in place will allow the asset class to recover inflation impacts in the medium term and serve as a meaningful inflation hedge for client portfolios.

Drill baby drill – too much of a good thing?

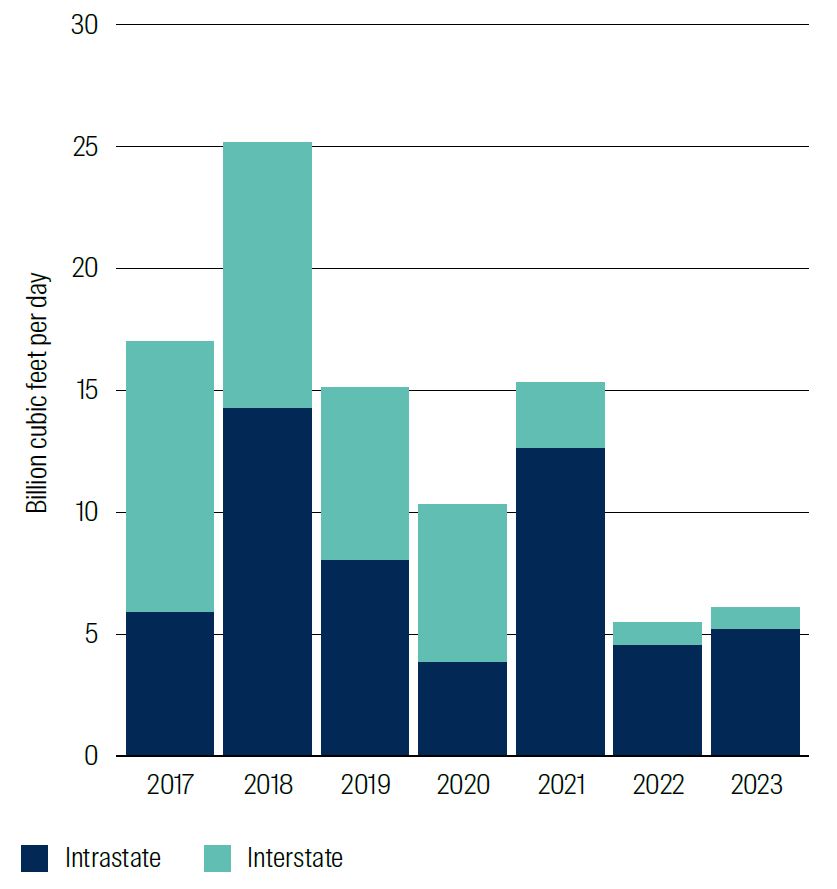

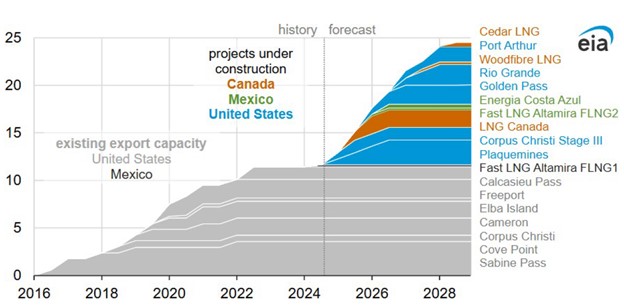

Energy midstream has been the key beneficiary of the election outcome to date. It is likely that constraints to explore, produce, transport and export hydrocarbons will be eased. The decline in pipeline approvals under the previous administration (illustrated in the following chart) will be reversed and the freeze on Liquefied Natural Gas (LNG) export licenses (illustrated in the chart overleaf) will be lifted.

US natural gas pipeline capacity additions have declined in recent years

Source: US Energy Information Agency as at 20 March 2024.

Note: Interstate pipelines are pipelines that cross state and international borders and are regulated by the Federal Energy Regulatory Commission. Intrastate pipelines are pipelines within a state that do not cross state borders and are regulated by a state agency. Intrastate capacity additions also include projects associated with interstate pipelines that do not cross state borders.

North America LNG export capacity climbing steadily – but flat in 2023-4

Billion cubic feet per day

Source: US Energy Information Agency as at 3 September 2024.

We remain positive on natural gas (and Natural Gas Liquids) as increased supply is likely to be met by increased demand from domestic manufacturing, power generation to firm intermittent renewables, power for data centers/AI/cryptocurrency and LNG exports.

Forecast decline for gasoline, diesel and aviation fuel also gets pushed to the right. Subsidies for EVs are probably removed. The combination of lower domestic subsidies and higher international tariffs probably leaves Elon Musk and Tesla in a stronger competitive position than GM or Chinese peer BYD. EV subsidies are most utilised in California – the home of Harris and Newsom. If you don’t think it’s personal, you haven’t been paying attention.

While these volume trends would clearly be positive for energy midstream stocks, we would caution that energy is not a one-way bet. A de-escalation of conflicts in Ukraine and the Middle East could take tension out of energy markets. Russian gas could return to Europe. Higher US production volumes could force a response from Saudi Arabia/OPEC to maintain market share. Trump may be delighted to see gasoline prices falling, supporting consumer sentiment and spending, and reducing headline inflation. A volume-driven rally could turn into a price-driven slump.

Back on track

North American freight railroads, the most economically sensitive assets that the portfolio owns, have endured a challenging few years. Weak industrial volumes have been amplified by coal plant closures. Tense union negotiations have resulted in material cost impacts. Poor service outcomes have encouraged increased regulatory scrutiny.

Having cut costs during the lean years, these companies are now primed to benefit from a pro-growth US agenda and resulting acceleration in US GDP and hence freight haulage volumes. The onshoring of domestic manufacturing should stimulate new demand for freight haulage. Coal plant closures may be pushed out, with lighter Environmental Protection Agency regulations and increased power demand. Railroads should have less regulatory oversight and more confidence to run a flexible labour force. Share buybacks could also ramp up as the fear of political reprisal diminishes.

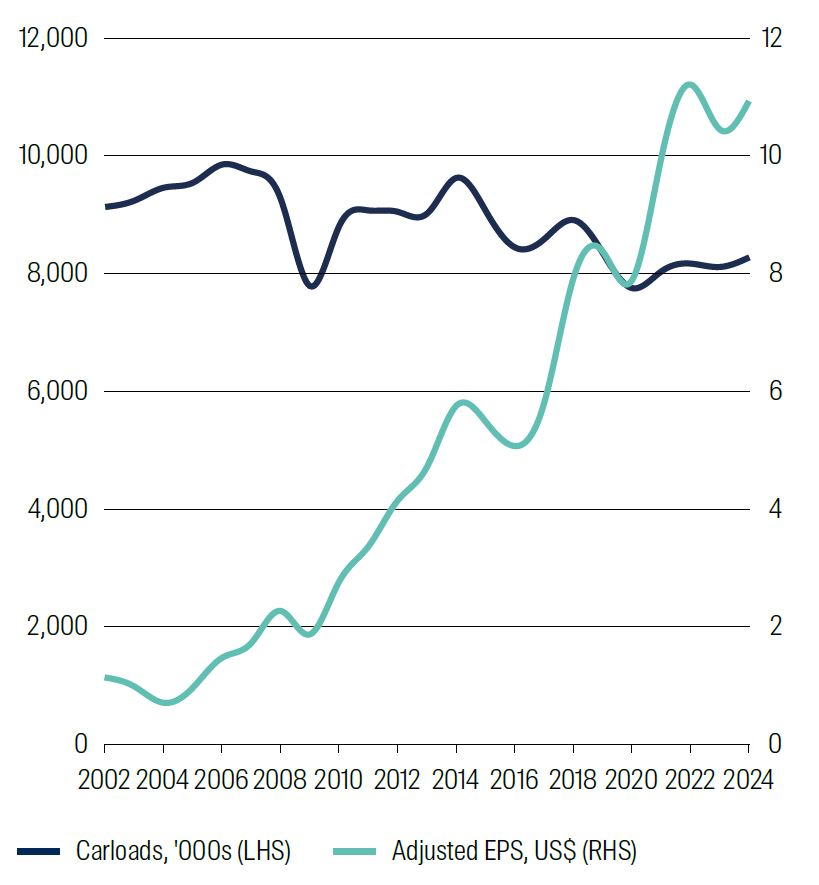

Our confidence in this sector is also based on its long-standing ability to deliver robust EPS growth, even against a backdrop of flat or declining freight haulage volumes. This is illustrated in the following chart, which compares Union Pacific’s carloads with earnings over time.

Union Pacific carloads and adjusted Earnings Per Share (US$)

Source: First Sentier Investors, Union Pacific. Data as at 30 September 2024.

We favour east coast railroads (Norfolk Southern, CSX Corp) that should benefit most. A significant increase in US import tariffs would negatively affect international intermodal volumes for west coast railroads (Union Pacific, BNSF Railway) – a segment which represents almost 20% of Union Pacific’s revenue. Other countries may then respond with tariffs of their own on US exports of agriculture and minerals, which could impact a further 25% revenue segment.

Canadian railroads (Canadian National Railway, Canadian Pacific Kansas City) would benefit far less from higher US economic activity levels. They could also be exposed to tariffs between the US and Canada/Mexico – an option that Trump appears to favour.

Return to centre

2024 was a big year for elections which created uncertainty for investors. While not always the case, most election outcomes highlighted the risk for parties that stray too far to the left or right. The pushback against government overreach, unsustainable deficits and illegal immigration is becoming more apparent. Eventually the silent majority will find its voice.

If and when the US dramatically raises tariffs on Chinese imports, there will need to be a measured response. We could expect a large currency devaluation and more significant fiscal and monetary stimulus. The sharp rally in China stocks in September 2024 highlighted the value in this market if the authorities get serious.

In France, Macron introduced new taxes on large companies and transport concessions to assuage the left and provide a temporary boost to the budget. But you can’t tax your way to greatness. We expect the concessions tax to be challenged in court and, as in previous instances, some value to be returned to companies.

In the UK the water companies became a political punching bag. They were easy targets given every household pays a water bill, sewerage leaks make good headlines and big corporates (such as unlisted operator Thames Water) were seen to be lining their own pockets rather than the pipelines. But the reality is the UK desperately needs private capital to invest in ageing infrastructure and deliver on green ambitions. Global capital is more liquid than water. If the UK does not provide adequate returns with greater certainty, then that capital will continue to flow to other markets.

Also coming in 2025, Canada and Germany are set to hold elections in the year ahead. We view the expected outcome – the replacement of left-wing incumbents by centre-right parties who are likely to foster a more business-friendly environment – as being a likely positive for infrastructure companies in both countries.

Conclusion

During an eventful 2024, global listed infrastructure delivered strong positive returns to investors, and most of the upside in a rising equity market environment9. These gains were partly a recovery from a challenging 2023 and were, in many cases, accompanied by earnings upgrades. As a result, even after the share price gains of the past 12 months, most global listed infrastructure sectors are still trading at a discount to the broader market as they head into 2025.

Asset class fundamentals are robust. Business models are in better shape, and the growth outlook for the asset class is currently stronger, than at any point that we have seen over the past 17 years.

While this has been reflected in the performance of many US-listed infrastructure stocks this year, non-US infrastructure stocks have lagged significantly and are now trading at deep value. We believe this creates a significant value opportunity for 2025.

While the incoming Trump administration adds an extra level of unpredictability to financial markets, we expect asset class earnings to remain supported by long term structural drivers.

We believe healthy balance sheets, steady demand for essential service provision and appealing dividend yields should provide downside protection in the event of a market downturn.

Global Listed Infrastructure

Infrastructure powers the world we live in – and when it comes to on-the-ground research, our team can be found on site

Investing in global listed infrastructure can offer inflation-protected income and steady capital growth from real assets delivering essential services. We search for best-in-class assets worldwide with high barriers to entry, structural growth and pricing power.

Source: First Sentier Investors, Bloomberg, company reports as of 30 November 2024.

1 Energy Midstream refers to the middle segment of the energy supply chain, specifically focusing on the transportation, storage, and wholesale marketing of crude oil, natural gas, and refined petroleum products.

2 Based on returns in USD to 30 November 2024.

3 The Electric Power Research Institute

4 Rate base is the term used to describe the value of property on which a US utility is permitted to earn a specified rate of return, in accordance with rules set by its regulator.

5 Source: Edison Electric Institute as at 31 December 2023.

6 The 2022 Inflation Reduction Act (IRA) was a significant piece of Biden legislation which includes providing tax credits and incentives for the development and deployment of renewable energy projects. President-elect Trump has expressed scepticism towards the IRA.

7 Source: E2 as at 14 August 2024.

8 Source: The Brookings Institution as at 21 November 2024.

9 Based on returns in USD to 30 November 2024.

Read our latest insights

Important Information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business divisions of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

Get the right experience for you

Your location :  Singapore

Singapore

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom