- Leisure travellers are leading the Japanese passenger rail traffic recovery

- Pent up demand has resulted in increased spend per passenger in rail companies’ retail segments

- Decreasing energy demand represents a headwind to Japanese utilities’ growth outlook

- Capital return opportunities remain plentiful in Japan, in contrast to most other developed markets

Last quarter I visited infrastructure companies in Tokyo, Osaka and Nagoya. The trip included visits to ten corporate head offices and three site tours. This paper seeks to share some of the key findings from my meetings with Japanese passenger rail and utility companies.

Recovery in travel and retail spend

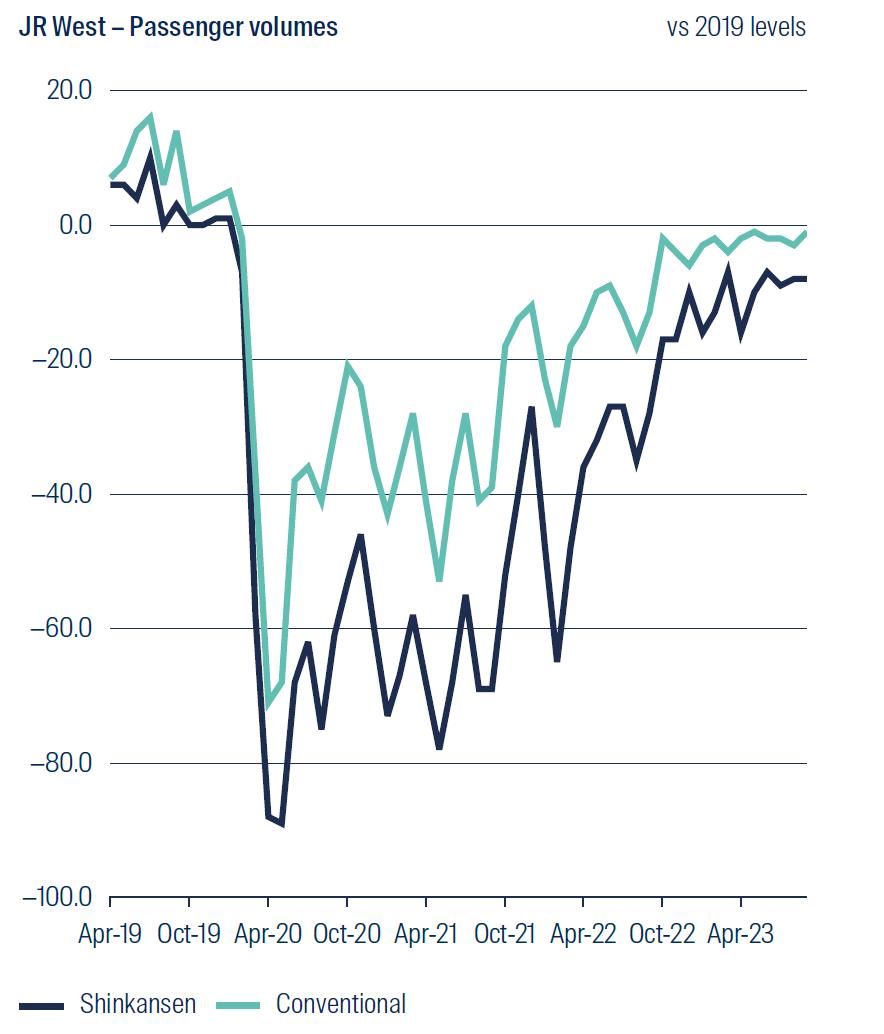

Traffic recovery remains the key upside risk for Japanese passenger rail (JR) companies. While Japan was one of the last countries to re-open its borders after COVID-19, travellers have quickly returned to both Shinkansen (bullet train) and Conventional (local) railways. Leisure demand has led the way, and has now surpassed pre-pandemic levels. Business travel volumes are still approximately 10% lower. The following chart illustrates JR West’s traffic recovery (note, Shinkansen has a higher mix of business passengers than Conventional).

Source: FSI, Company data.

Data as at 30 September 2023.

COVID-19 was downgraded by Japan from infectious disease status (requiring quarantine) in May 2023. Since then, business travel has increased as workers have begun to return to the office full time. We assume this recovery trend will continue throughout 2024.

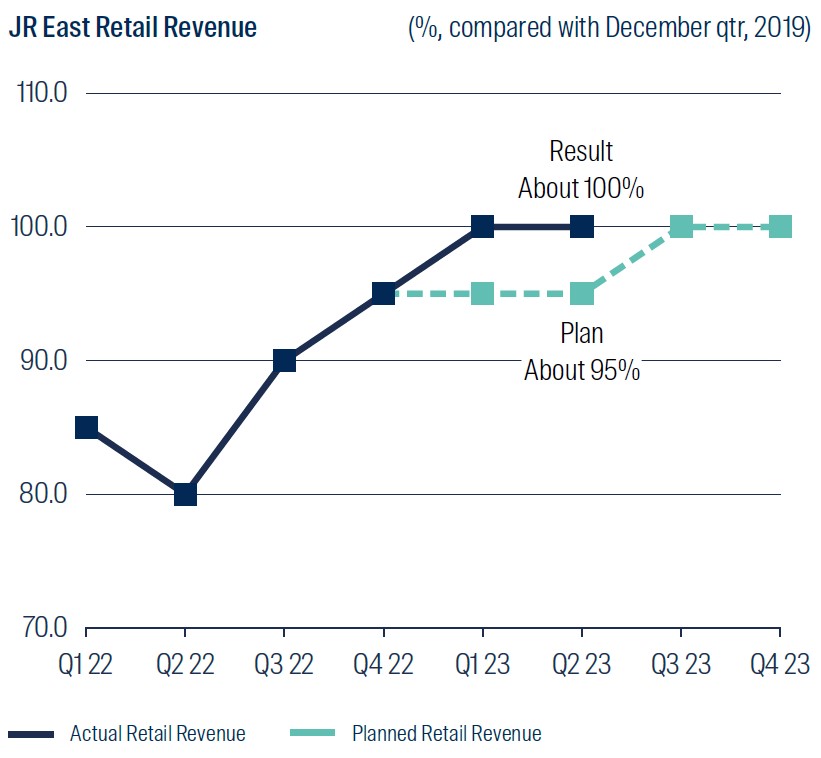

Retail spend per passenger has also recovered to above pre-pandemic levels, highlighting the pent up travel and spending demand present in Japan. Although passenger volumes for JR Central and JR East have not yet recovered to 2019 levels, retail revenue for both companies has already reached 2019 levels owing to increased spend per passenger. The following chart illustrates the recovery in JR East’s retail revenue over recent quarters.

Source: First Sentier Investors, company data and estimates.

Data as at 31 October 2023.

We expect that retail revenues will continue to grow; although pent-up demand may wane, the return of additional passengers over time is expected to make up for this.

Stations or cities?

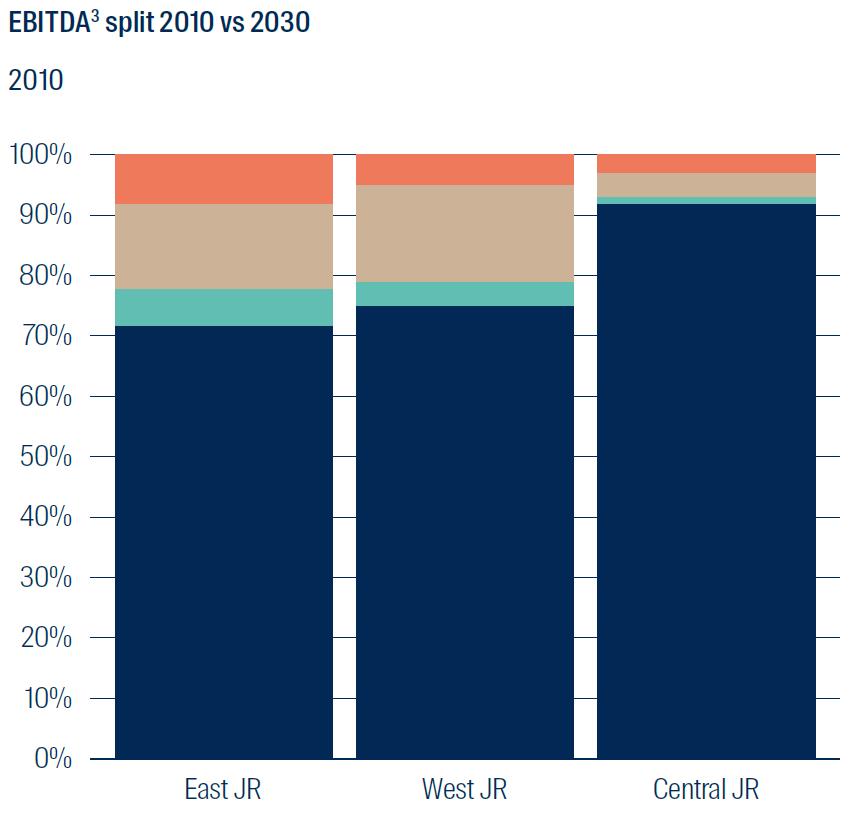

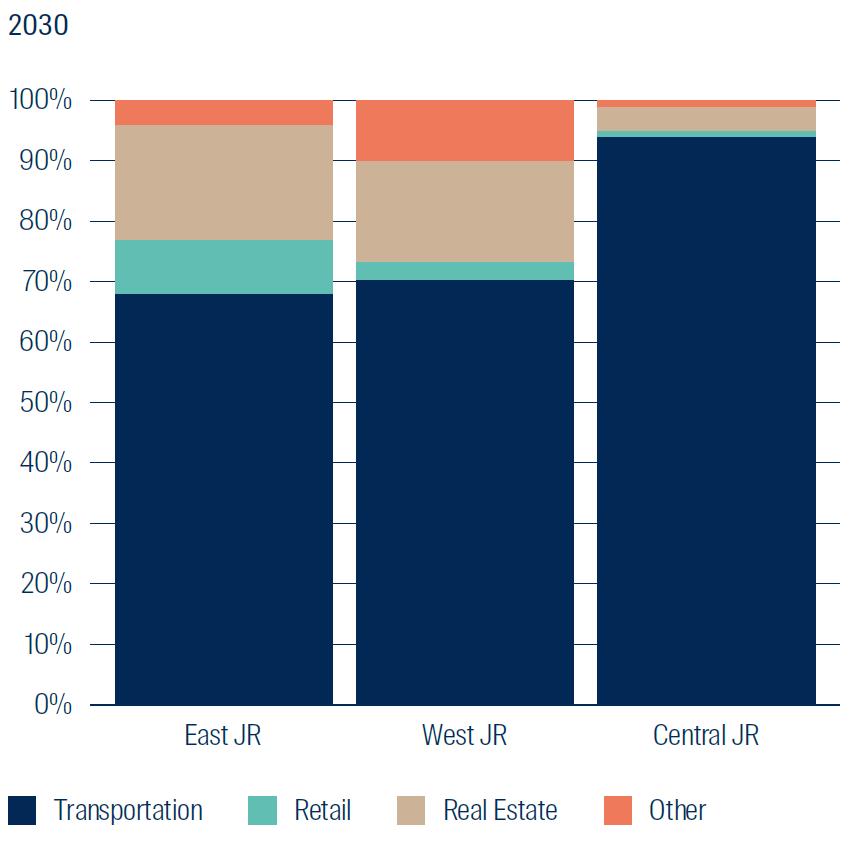

The Japanese rail companies are investing more into their retail and real estate businesses than ever before. For example, JR East estimate that by 2027 their revenue split will be 60% transportation and 40% other (ie real estate and retail). The company plans to target a 50/50 split after 2027. Over the next three years, JR West plans to allocate 60% of their growth capex1 towards real estate and city development, and only 20% to their transportation business2. We believe that this is likely to help offset the demographic challenges facing Japan; namely an ageing and declining population.

As the following charts illustrate, we expect that transportation will decrease as a proportion of the overall business for JR East and JR West, while real estate becomes more significant for both companies. JR Central remains the outlier, owing to its investment related to the “Maglev” or Chuo Shinkansen (a new Shinkansen route from Tokyo to Osaka that will travel 500km/hr and take 67 minutes).

Source: Company Data, FSI estimates.

Data as at 31 October 2023.

Even with the current 10% decline in business travel, the JRs have had the benefit of their revenues being diversified beyond the transportation business. For example, transportation revenue for JR West recovered to 86% of pre-COVID-19 levels in the June quarter of this year, while real estate revenue was 114%4. We assume transportation will reach 100% of pre-pandemic levels in Japan (as they have in other parts of the world) by March 2025. We think that continued investment in their real estate and retail segments are important to their growth outlook, and that doing so provides risk to the upside.

This is the point where the station meets the sky bridge to office and hotel buildings and escalators to the department stores.

Source: First Sentier Investors

For those visiting Japan, it is amazing to witness the scale of the railway stations and the synergies between the rail, real estate and retail businesses. When JR Central constructed the JR Gate Tower and JP Tower in 2017 (above their station in Nagoya), it transformed the city. When touring this, you can see first-hand the flow-through effect and synergies of connecting the four tower blocks through a pathway called the “sky street” on Level 15 of each of them. JR Central have created a hub. The bottom floor is the bus, train, taxi and Shinkansen terminal. Passengers must then travel up through department stores, retailers and restaurants in order to reach the “sky street” which connects the hotel and office lobbies of all 4 towers. Having this monopoly, has enabled JR Central to shift Nagoya’s downtown to above their station, where they will also eventually connect the “Maglev”.

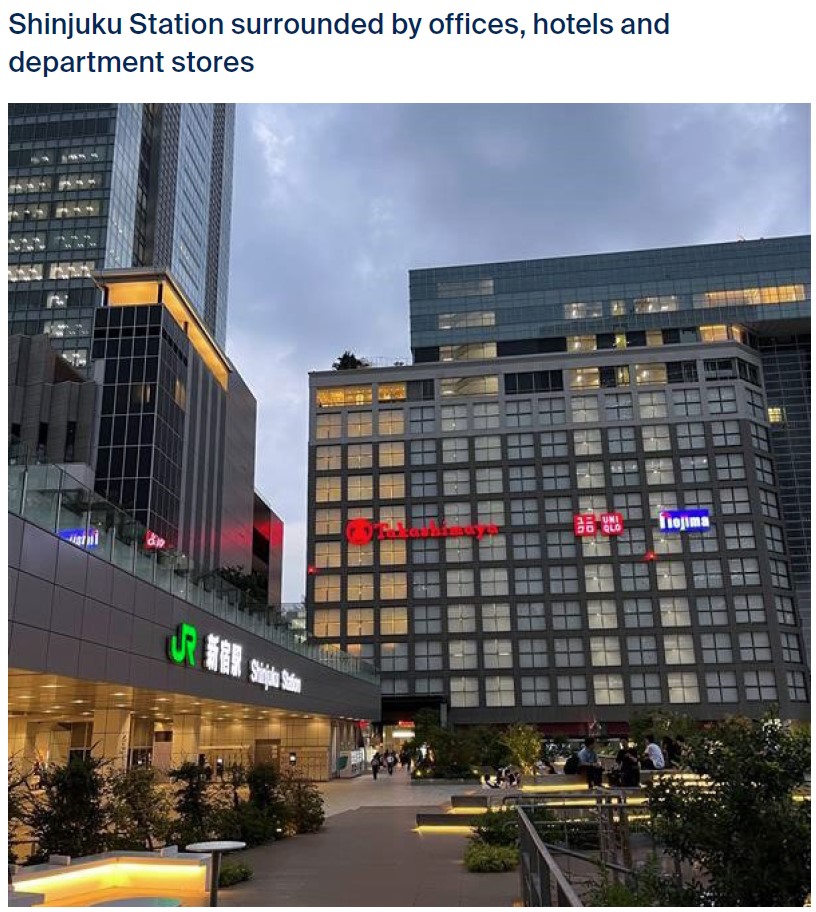

I also toured JR East’s new Miraina tower (a large scale, modern office building). The company has shifted the ticket gates of Shinjuku railway station to connect through to the lobby. This competitive advantage is something that cannot be replicated. We think by investing and developing office buildings, hotels and department stores, the JR companies will turn their stations into “hubs” that people travel to, not through.

Source: First Sentier Investors

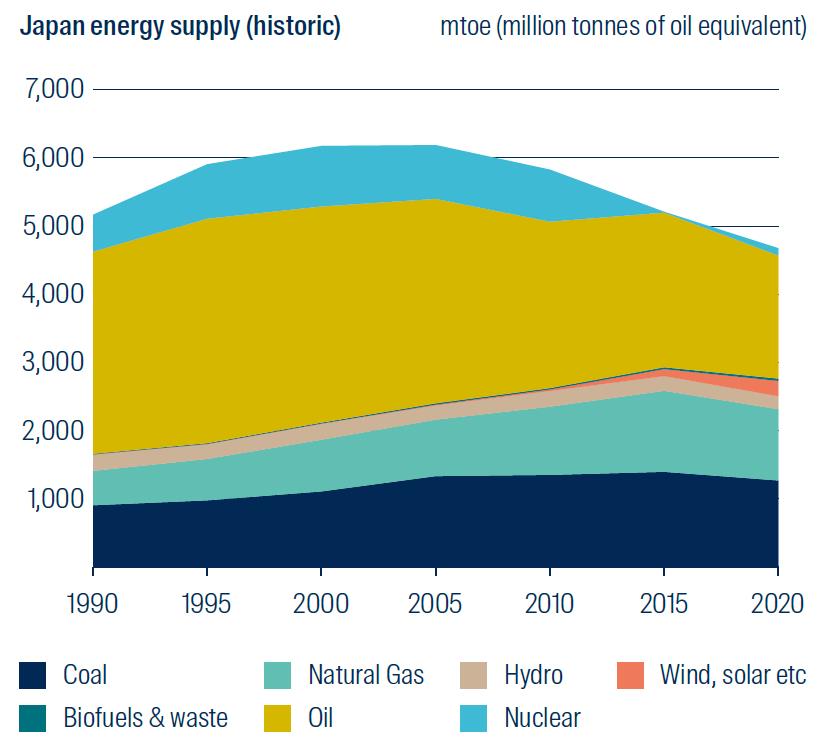

Utility demand and growth challenged

Similar to the Japanese rail companies, the country’s utilities are also experiencing challenges with growth. Unlike the rails however, they have the added headwind of decreasing demand. Every utility I visited attributed this to warmer weather, declining service territory populations, more efficient appliances, better insulated buildings and energy saving targets from the government. While warmer weather is usually negative for gas demand but positive for electricity demand, the positive impact is not enough to offset the other factors driving the decline in demand.

To compensate for this, Japan’s utility companies are seeking other avenues of growth. While you may expect their investment to be focused on domestic renewables such as solar and onshore wind, this market remains restricted by Japan’s challenging topography and limited space. The alternative low carbon energy sources – offshore wind and nuclear – both have their hurdles. The biggest obstacle to nuclear remains negative public sentiment and earthquake / tsunami risk, as seen with the 2011 Fukushima disaster. Prior to the earthquake in 2011, 30% of Japan’s energy needs were met by its 54 nuclear power plants. Today only 12 nuclear power plants have been restarted that make up around 8% of the energy mix today5.

Japan’s challenge with offshore wind is its deep coastal waters. This means that offshore wind farms would need to be floating rather than fixed to the sea bed, which comes with additional cost.

For these reasons, Japan’s utilities have selected different markets to invest in. For Tokyo Gas this includes US shale gas; Osaka Gas is exploring gas distribution in India; while Kansai Electric Power is investing in data centres. The list goes on. Though these investments may help their growth targets, they are diversifying away from their core strategies and geographies, which comes with its own risks.

Source: IEA

Net Zero by 2050?

When speaking about the Net Zero targets set by the government, Japanese utilities almost all said that the targets will be challenging to meet. The government’s current targets imply an energy mix of 30-40% nuclear and carbon capture and storage (CCS), and 50-60% renewables by 20506.

These targets seem optimistic; this amount of nuclear would need all existing plants to be restarted and new nuclear plants to be built. The necessary amount of CCS would require a substantial amount of space to be made available. Also, while nuclear plants are now being restarted and public sentiment is gradually warming to this, I expect there would be backlash if any new nuclear plants were proposed.

Capital management

Selected Japanese listed infrastructure firms have under-levered Balance Sheets, in a country with very low interest rates compared to the rest of the world. This backdrop enabled JR West to increase its dividend in late 2023, with further upside potential in 2024 and 2025. Osaka Gas recently announced its first share buyback since 2010, in a move that was broadly welcomed by shareholders. We have been advocating for Japanese companies to increase their dividend payout ratios, so this has been positive to see.

These increased capital return opportunities in Japanese infrastructure are in contrast to companies in the rest of the developed world which face higher interest expenses and increased equity needs.

1 A form of capital expenditure undertaken by a company in order to expand existing operations or to further its growth prospects.

2 Source: Company data, First Sentier Investors, as at 31 October 2023.

3 Earnings Before Interest Taxes Depreciation and Amortisation.

4 Source: Company data, First Sentier Investors, as at 31 October 2023.

5 Source: International Energy Agency as at 31 October 2023.

6 Source: JERA as at 31 October 2023.

Important Information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors, FSSA Investment Managers, Stewart Investors, Realindex Investments and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), Realindex Investments (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business divisions of First Sentier Investors (Singapore).

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

To the extent this material contains any measurements or data related to environmental, social and governance (ESG) factors, these measurements or data are estimates based on information sourced by the relevant investment team from third parties including portfolio companies and such information may ultimately prove to be inaccurate.

To the extent this material contains any ESG related commitments or targets, such commitments or targets are current as of the date of this publication. They have been formulated by the relevant First Sentier Investors (FSI) investment team in accordance with either internally developed proprietary frameworks or are otherwise, based on the Institutional Investors Group on Climate Change’s (IIGCC) Paris Aligned Investment Initiative framework. The commitments and targets are based on information and representations made to the relevant investment teams by portfolio companies (which may ultimately prove not be accurate), together with assumptions made by the relevant investment team in relation to future matters such as government policy implementation in ESG and other climate-related areas, enhanced future technology and the actions of portfolio companies (all of which are subject to change over time). As such, achievement of the commitments and targets set out [in this material / on this website] depend on the ongoing accuracy of such information and representations as well as the realisation of such future matters. FSI will report on progress made towards achieving these targets on an annual basis in its Climate Change Action Plan. The commitments and targets set out in this material are continuously reviewed by the relevant investment teams and subject to change without notice.

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

Get the right experience for you

Your location :  Singapore

Singapore

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom