With two consecutive Bureau of Labor Statistics employment reports missing, investors have turned to private-sector data and corporate announcements for guidance. The picture that has emerged thus far confirms fears: (1) the weakening trend in the labour market over the past year has been gathering momentum, and (2) this trend may persist longer than anticipated. Against this weakening economic backdrop, however, the Federal Reserve has held back on the pace of rate cuts, having cut rates only twice in the later part of 2025, citing concerns that tariff-related cost pass-through could still push inflation higher.

We expect to see more reports reinforcing the weakening trend in economic fundamentals, deepening the cautious outlook we have maintained since the start of the year.

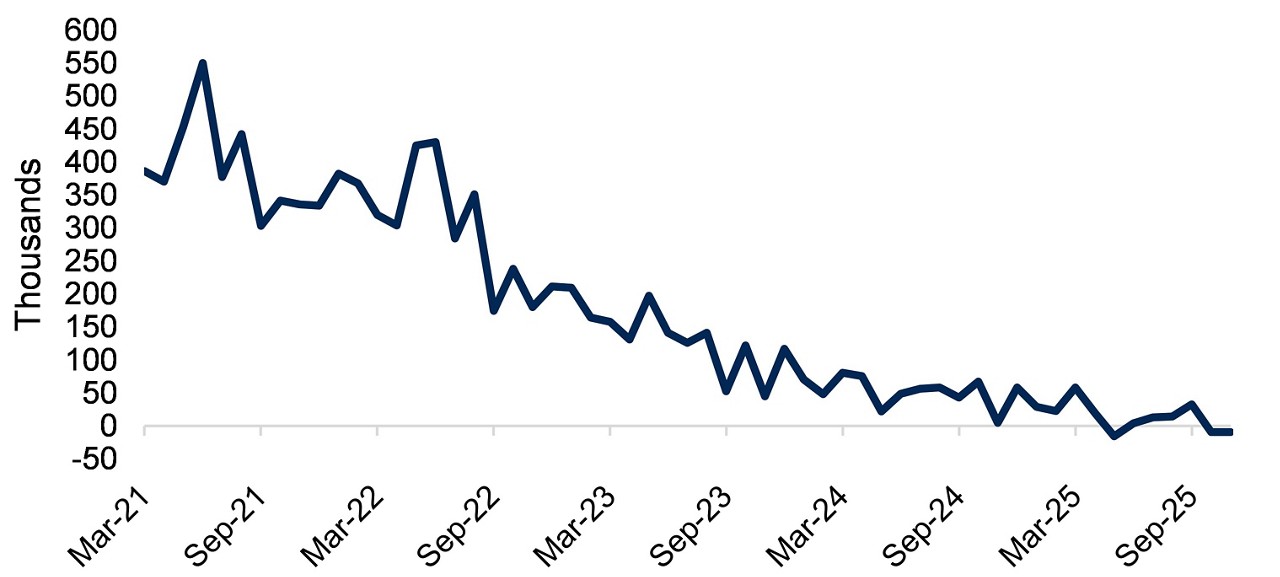

October Layoffs

Source: Challenger, Gray & Christmas, Bloomberg, as of 31 October 2025.

Outplacement firm Challenger, Gray & Christmas shared concerning news on the pace of job cuts in October – the highest number of October layoffs since 2003, with technology and warehousing jobs leading the cuts.

Jobs added

Source: Revelio Public Labor Statistics, as of 31 October 2025.

The Revelio Labs job report, aggregating public and private sector jobs, has shown a falling trend in overall payroll employment, with the public sector being the larger drag.

Recent job layoff announcements from major employers across widespread industries —including Amazon, UPS, and IBM—underscore the fragility of US consumer resilience. With hiring stagnating and layoffs accelerating, labour market deterioration appears entrenched.

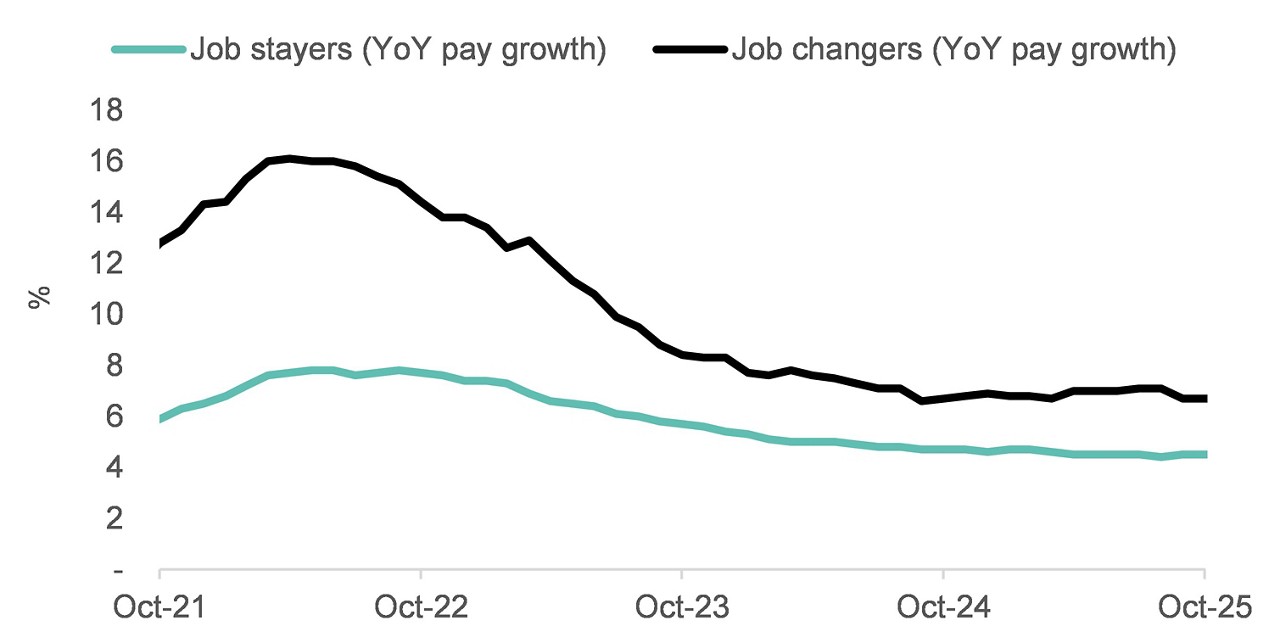

For those still employed, wage growth is slowing, particularly among job changers—a key segment that typically drives income gains during expansions. This adds to the broader loss of momentum in household purchasing power.

Source: ADP research, Bloomberg. As of 31 October 2025.

In the meantime, consistent with our views earlier in 2025, inflation has remained subdued, not accelerating as many had feared. One of the largest components of inflation—shelter costs—has continued to trend lower, help to anchor overall price levels at manageable rates. As the year draws to a close, we believe the strain on household finances has yet to fully surface, particularly when viewed through headline consumer spending data. One reason is that an increasing share of spending is driven by the wealthiest households. The affluent are shouldering an even greater proportion of U.S. consumption compared to prior years, masking underlying weakness among lower-income segments.

No doubt, the Federal Reserve’s recent rate cuts reflect a heightened focus on weaker labour market dynamics. However, beyond just “softening employment numbers,” a holistic view of the data points to mounting stress on lower- to middle-class consumers, who represent the largest part of the US population and rely on steady paychecks and sustainable employment. As such, the weakness lurking in the real economy is graver than data alone portrays.

We watch the days ahead for potential market weakness and volatility, and remind ourselves of the need to remain disciplined in our portfolios—staying selective, focused on quality, and cautious in stretched areas of the market.

Read our latest insights

Important Information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Group believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither First Sentier Group, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material. The information herein is for information purposes only; it does not constitute investment advice and/or recommendation, and should not be used as the basis of any investment decision. Some of the funds mentioned herein are not authorised for offer/sale to the public in certain jurisdiction.

The value of investments and the income from them may go down as well as up and you may not get back your original investment. Past performance is not necessarily a guide to future performance. Please refer to the offering documents for details, including the risk factors. Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Group’s portfolios at a certain point in time, and the holdings may change over time.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of First Sentier Group. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of First Sentier Group. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited. First Sentier Group (registration number 53507290B), First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business names of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Group, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Group includes a number of entities in different jurisdictions.

To the extent permitted by law, MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Group

Get the right experience for you

Your location :  Singapore

Singapore

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom