Building on Part 1: How Do Convertible Bonds Work?, where we explored the fundamental mechanics of convertible bonds, we now share how convertible bonds can be strategically deployed across different market cycles.

Convertible bonds combine features of bonds and equities. They offer downside protection like bonds and upside potential like stocks. While issuance often rises during strong equity markets, convertible bonds can offer trading opportunities across varying market conditions - if used strategically. Their hybrid nature make them a versatile tool for alpha generation.

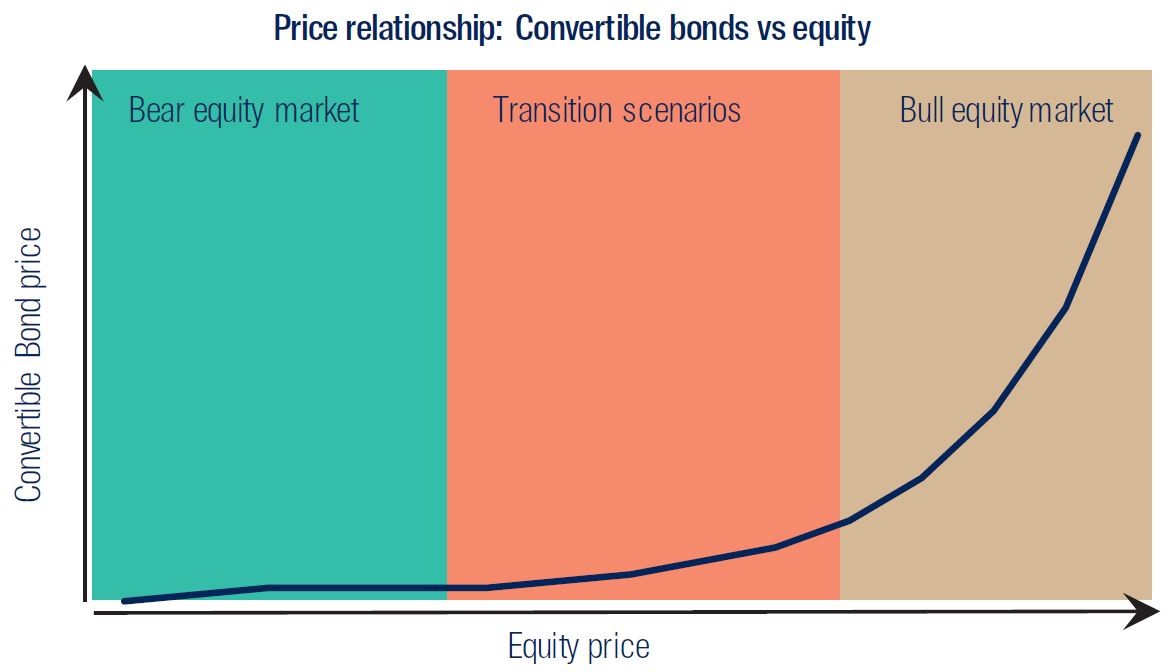

Through the lens of a bond investor, we look at three broad market scenarios: bear equity markets, transition scenarios, and bull equity markets. The relationship between a convertible bond’s price and its underlying equity can be visualized as a convex curve—providing equity-linked upside while cushioning downside risk.

Price relationship of Convertible Bond and its corresponding equity, for illustrative purpose.

Source: First Sentier Investors

Bear Equity Market: Focus on Credit Fundamentals

When equity markets fall, we focus on the issuer’s credit quality and the bond’s ability to repay principal and interest. In these periods, equity investors often avoid convertibles because of high premiums. This reduced demand in convertible bonds from equity investors may lead to more attractive prices for bond investors. Yields on convertibles may exceed those of similar straight bonds, offering attractive income during periods of bear market volatility.

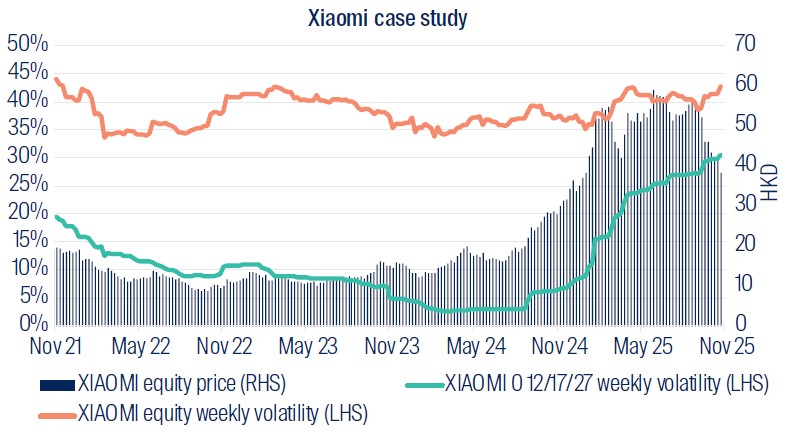

Convertible bonds tend to exhibit significantly lower volatility compared to their underlying equities, particularly during bear market conditions.

Source: Bloomberg, First Sentier Investors as of 30 November 2025.

For example, we purchased XIAOMI 0.000 17-DEC-2027 back in late 2023, a year when the Hang Seng Index returned -14% for the calendar year. This 0% coupon, non-rated bond was priced below par at 89 with a yield1 of 5.94% at time of purchase, which providing an attractive yield on par with its longer dated comparable bullet bond, XIAOMI 3 ⅜ 04/29/30 Corp, which yielded 5.93%. Xiaomi was rated Baa2/BBB at time of purchase, so we saw this as a fundamentally sound bond offering attractive income, with a “free” equity option until the bond’s puttable date of December 2025. In late 2024, Xiaomi’s bonds rallied above par, turning its previously ‘free’ convertibility option into positive value. We eventually sold this bond in 3Q 2024 for a profit of 12% as market sentiment and the company’s business cycle turned positive.

Transition Scenarios: Tactical Positioning Matters

Markets rarely move in a straight line. During periods of uncertain market sentiment, tactical trading within defined risk limits becomes essential. Convertible bonds, with their lower volatility compared to equities, provide opportunities to capture alpha in these conditions. Excluding default scenarios, we see potential for alpha by trading convertible bonds when their yields are lower than comparable bullet bonds, yet still offer a degree of downside protection.

As an example, we invested in YGCZCH 3.500 03-OCT-2029 in December 2024 at 99, slightly below its par value of 100. We chose this bond for its respectable yield of 4.09%, compared to its similar bullet bond YGCZCH 2028 which yielded 4.95%. Given the still uncertain equity environment, YGCZCH’s respectable yield made this a name that we were comfortable to hold for the medium term, while remaining well positioning for potential upside should the industry cycle turn and equity rally take place.

We also invested in WUXAPP 0.000 19-OCT-2025 in December 2024 at 99, with a yield of 1.3%, which was considerably lower than JACI’s average yield. At the time of purchase, the Hang Seng Index was showing signs of emerging from a prolonged bear market. This gave us a strong conviction that this bond could benefit from equity-driven upside if the recovery continued into 2025. Ahead of the bond’s maturity in October 2025, we sold it in June, achieving an absolute return of 7.3% over a holding period of approximately six months.

Next up…

Stay tuned for Part 3, where we extend our narrative to address convertible bond trading during bullish equity markets and how we optimize upside participation while managing risk.

1 Yield to put was used, given that the bond came with a puttable option.

Read our latest insights

Important information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Group believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither First Sentier Group, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material. The information herein is for information purposes only; it does not constitute investment advice and/or recommendation, and should not be used as the basis of any investment decision. Some of the funds mentioned herein are not authorised for offer/sale to the public in certain jurisdiction.

The value of investments and the income from them may go down as well as up and you may not get back your original investment. Past performance is not necessarily a guide to future performance. Please refer to the offering documents for details, including the risk factors. Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Group’s portfolios at a certain point in time, and the holdings may change over time.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of First Sentier Group. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of First Sentier Group. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited. First Sentier Group (registration number 53507290B), First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business names of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Group, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Group includes a number of entities in different jurisdictions.

To the extent permitted by law, MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Group

Get the right experience for you

Your location :  Singapore

Singapore

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom