The Asian credit market has recently seen a surge in convertible bond issuance, accompanied by strong double-digit returns year-to-date. This trend has drawn attention from both institutional and retail investors. But what exactly are convertible bonds, and why are they gaining traction?

In this first part of series, we break down the fundamentals of convertible bonds—a hybrid investment that blends the characteristics of both bonds and stocks. Our aim is to make this asset class more understandable for everyday investors.

Market Snapshot

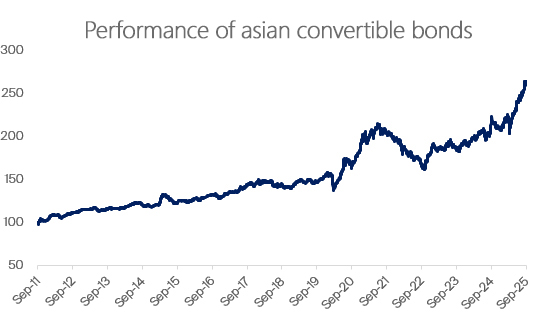

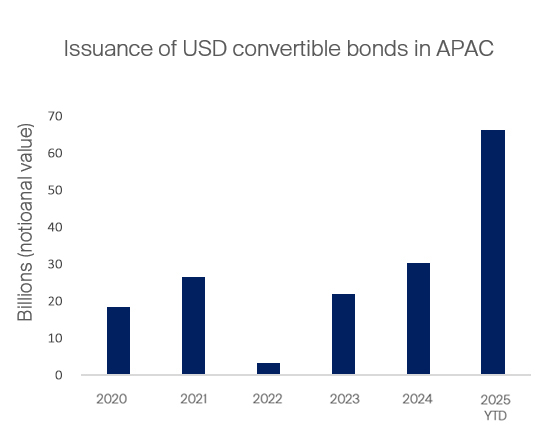

Asian convertible bonds have delivered impressive year-to-date performance, amid favorable market conditions, attracting strong investor interests. In 2025, convertible bond issuance has tripled compared to the average from 2020 to 2024, indicating growing demand from companies seeking flexible financing and investors looking for balanced risk-reward opportunities.

Nomalised with 9/30/2011 = 100

Source: Bloomberg, as of 30 September 2025. Reference index: Bloomberg APAC ex Jpn Convertibles Composite Total Return Unhedged USD

Source: Bloomberg, as of 27 October 2025

What Are Convertible Bonds?

Convertible bonds are hybrid instruments that combine features of both debt and equity. They are issued by companies to raise capital and typically offer fixed interest payments and a maturity date—just like traditional bonds. What sets them apart is the embedded option that allows investors to convert the bond into a predetermined number of shares of the issuing company. This conversion feature introduces equity-like upside potential to an otherwise fixed-income security.

Convertible Bonds vs. Traditional Bonds

Convertible bonds share several traits with plain vanilla bonds: they have a fixed maturity date, regular coupon payments, and an issuer obligation to repay principal. However, the key difference lies in the conversion option. This feature allows bondholders to convert their holdings into equity at a set price, offering the potential to benefit from rising share prices.

Because of this equity-linked upside, convertible bonds typically offer lower yields than comparable bullet bonds. Yet, during periods of market softness, convertibles may trade at more attractive valuations. This is because equity-sensitive investors may reduce exposure, creating opportunities for fixed income investors to capture higher yields relative to traditional bonds.

Convertible Bonds vs. Equity

For equity-focused investors, convertible bonds offer a more conservative way to gain exposure to stock markets. Each bond includes a conversion pricei, which represents the effective price per share at which the bond can be exchanged for equity.

If the company’s stock rises above this price, the investor can convert the bond and benefit from the upside. If the stock underperforms, the bondholder can simply hold the bond, continue receiving interest, and get their principal back at maturity—preserving capital.

This dual nature—participating in equity upside while protecting against downside—makes convertible bonds an attractive alternative to direct equity investments, especially in volatile markets.

Why Consider Convertible Bonds?

Convertible bonds offer a balanced investment profile: income generation through coupons, capital preservation in down markets, and growth potential via equity conversion.

Their valuation is influenced by both fixed inputs (like maturity and conversion price) and market-driven factors (such as stock performance and interest rate movements). Strategically allocating to convertibles during equity bull markets can enhance returns within a fixed income portfolio.

Importantly, convertible bonds are not just for sophisticated investors. Retail investors can also benefit from their risk-adjusted return potential, especially when seeking to diversify income portfolios with a growth tilt.

Final Thoughts

Convertible bonds represent a compelling middle ground between bonds and stocks. As more Asian companies tap into this flexible financing method, and as investors look for smarter ways to navigate market cycles, we believe convertible bonds will continue to play a valuable role in portfolio construction.

Coming Up in Part II: We’ll share insights into how we identify convertible bond opportunities across different market environments.

i Conversion Price = Par Value / Conversion Ratio. Conversion price represents the effective price per share at which the bond converts into equity. This is calculated by dividing the bond’s par value (typically USD 1,000) by its conversion ratio, which is the number of shares the bondholder receives upon conversion. For investors, the conversion price represents the cost of acquiring equity through the bond.

Read our latest insights

Important information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Group believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither First Sentier Group, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material. The information herein is for information purposes only; it does not constitute investment advice and/or recommendation, and should not be used as the basis of any investment decision. Some of the funds mentioned herein are not authorised for offer/sale to the public in certain jurisdiction.

The value of investments and the income from them may go down as well as up and you may not get back your original investment. Past performance is not necessarily a guide to future performance. Please refer to the offering documents for details, including the risk factors. Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Group’s portfolios at a certain point in time, and the holdings may change over time.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of First Sentier Group. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of First Sentier Group. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited. First Sentier Group (registration number 53507290B), First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business names of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Group, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Group includes a number of entities in different jurisdictions.

To the extent permitted by law, MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Group

Get the right experience for you

Your location :  Singapore

Singapore

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom