Infrastructure is at an inflection point. Different markets are emerging from COVID-19 at their own pace, while long-term challenges like decarbonisation are more urgent than ever. In a recent client update, our Global Listed Infrastructure team shared their predictions for the sector, summarised in the four points below.

1. The valuation gap is closing

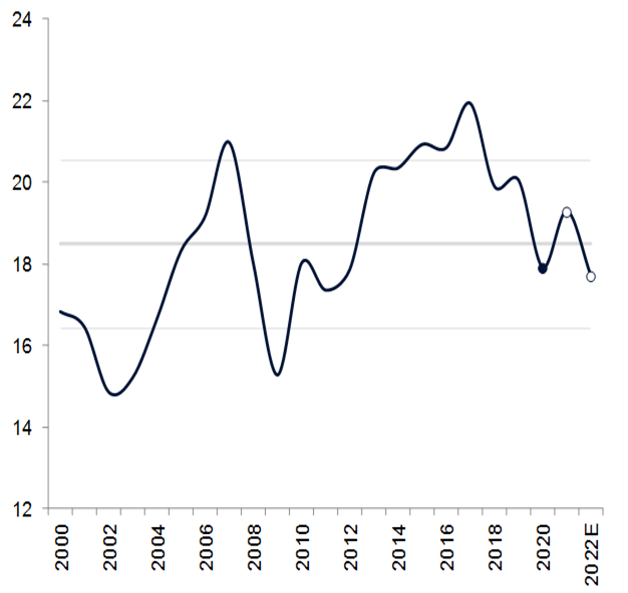

The past 18 months have been particularly challenging for global listed infrastructure. 2020 was only the second time in the past 15 years that the asset class underperformed both global equities and bonds over a calendar year. We believe that a lot of risks, such as rising interest rates, have now been priced in. There is now a compelling valuation gap, although we don’t expect it to last.

Valuations are now close to or below their long term historic averages. Balance sheets are in good shape and debt has been locked in at very attractive interest rates. Our view is that the asset class is well positioned to provide investors with income and steady earnings growth for many years to come.

Chart 1: Price/Earnings for Global Infrastructure

Simple average of 250 stocks in universe

Source: Bloomberg, First Sentier Investors, May 2021

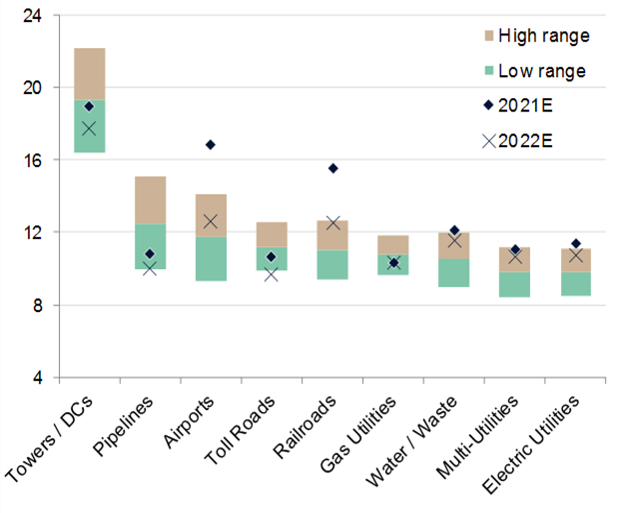

Chart 2: Value Range by Sector - EV/EBITDA x

Annual data from 2000 to 2022E

Source: First Sentier Investors, May 2021

2. There is a roadmap for transport recovery

We expect freight rail and toll roads to lead us out of this pandemic, based on haulage and traffic volumes. Next on our list would be airports, especially those with large exposures to domestic and leisure travel. When borders open up properly around the world, we can look forward to long haul business travel coming back, as well as a rebound in passenger rail volumes.

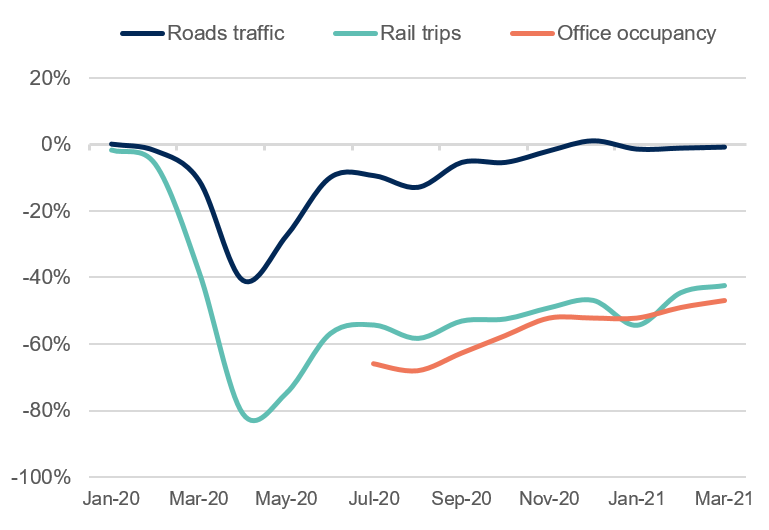

Some countries have returned to ‘normal life’ more quickly than others, and data from these regions suggest what the post-vaccine world might look like. Using Sydney as an example, the data on road volumes, rail passenger numbers and office occupancy rates show that once lockdowns end, toll road volumes quickly rebound.

While the effect of working-from-home (WFH) roughly halved office occupancy, it hasn't materially affected toll roads. This is due to several factors: some occupations simply can’t be done remotely, such as construction; there's been a shift away from rail towards private vehicles, as people avoid crowds; and there's been a modest tailwind from increased e-commerce and online shopping. Overall, toll road volumes have been very resilient in the face of the pandemic.

Chart 3: Toll road volumes

Transurban, Transport NSW, Property Council of Australia and First Sentier Investors

Data as at May 2021

3. There’s no need to fear rising inflation

There's no doubt that low interest rates have been a tailwind for income producing assets like infrastructure. Now expectations have started to shift towards higher interest rates, given the generous stimulus measures and strong economic recovery. It's understandable that investors may see that as a headwind, but in our view, it's important to look at what's really driving that interest rate increase.

If it's being driven by higher inflation, we think infrastructure assets are well positioned. Most concession agreements are long-term contracts that allow owners to pass inflation through to the end customer. In fact, we estimate that more than 70 per cent of our investable universe has the ability to pass through inflation.

But even in sectors where we don't necessarily have that explicit link – and freight rail is a good example – factors like high barriers to entry give companies good pricing power. In the case of freight rail, we've seen prices increasing on average by around 2-4 per cent per annum1.

4. There is a decade-by-decade path to Net Zero Emissions

The first decade is more of what we are already seeing in developed countries: the decarbonisation of the power generation sector. That includes replacing old, inefficient coal plants with renewable energy, and innovations in battery technology that will make renewables competitive with the gas system.

The second decade is about the electrification of transport, which is the largest emitter of carbon in today’s world. Infrastructure providers can achieve this through investment in transmission and distribution assets, pulling energy to centrally located hubs that charging stations can connect to. That will require further investment in renewables, and in transmission and distribution technology.

The 2040s will be focused on tackling those hard-to-abate sectors through step changes in technology. Essentially, we will leave the hardest challenges until last. That includes reducing the cost curves of things like green hydrogen and sustainable aviation fuels. Almost all the strategies to reach net zero require infrastructure investment, so as investors, we have an important role to play in addressing climate change.

1 Union Pacific Railway has been able to achieve average price increases of around 4% per annum since 2013. Source: company data

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (Author). The Author forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for the Author is available from First Sentier Investors on its website.

This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. Any opinions expressed in this material are the opinions of the Author only and are subject to change without notice. Such opinions are not a recommendation to hold, purchase or sell a particular financial product and may not include all of the information needed to make an investment decision in relation to such a financial product.

To the extent permitted by law, no liability is accepted by MUFG, the Author nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that the Author believes to be accurate and reliable, however neither the Author, MUFG, nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of the Author.

Get the right experience for you

Your location :  New Zealand

New Zealand

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom