- Electric Vehicles are coming, charging infrastructure is the real barrier

- EV a $US1.4 trillion opportunity for utilities as grids become more essential

- Responsible investors can accelerate EV uptake and the drive to net zero

First Sentier Investors recently presented at the Responsible Investment Association Australasia (RIAA) annual conference and hosted a design lab on how responsible investors can shape the future of Electric Vehicles (EV). This paper outlines the key challenges for EV acceptance, analyses the rollout of EV charging infrastructure around the world, and considers practical ideas for investors to super-charge the uptake of EV.

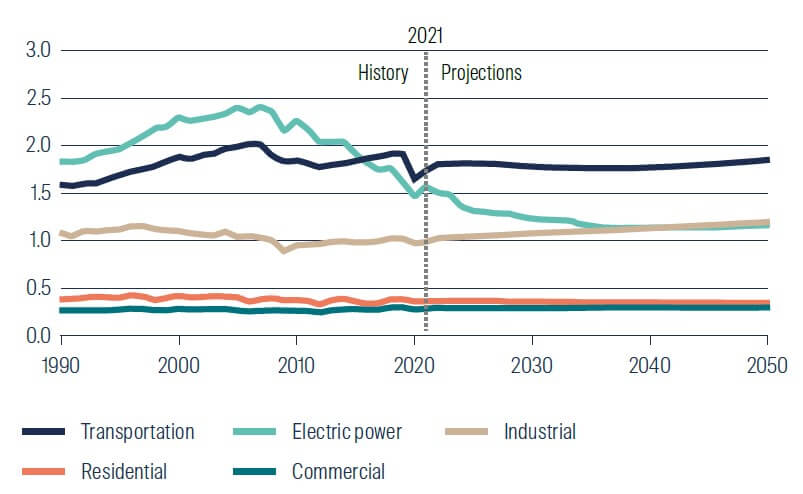

Transport is next focus for net zero

Staying on the path to net zero carbon emissions by 2050 is critical to limiting the impact of global warming. Utilities have made tremendous progress in reducing emissions from the power sector over the last decade, replacing finite energy from coal and gas with renewable energy from wind and solar. With this trend well entrenched, transport is now the largest contributor to carbon emissions in many countries.

With around 75%1 of transportation emissions coming from road vehicles, electrification of cars, trucks, vans, buses and motorcycles is the challenge and the opportunity over the next decade. Focus shifts to transport.

Energy-related CO2 emissions by sector (US) (billion metric tons)

Source: EIA Annual Energy Outlook 2022, First Sentier Investors

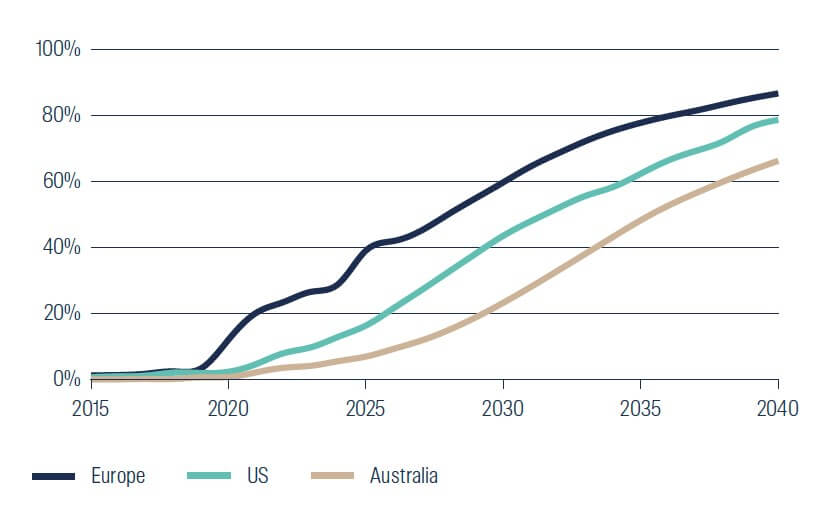

Electric vehicles are coming

Sales of passenger EV globally were 6.6m in 2021 up from 3.2m in 2020 and 2.1m in 2019, according to BloombergNEF (BNEF).2 The researcher estimates EV sales represented 9% of all passenger vehicle sales. Leading markets for EV sales included Germany (26%) and UK (21%).

Most governments around the world recognise the need to accelerate uptake of EV to address the climate impacts of transport. European policies have been particularly supportive with the region’s largest car manufacturer Volkswagen Group expecting electric vehicles to represent 70% of sales by 2030 and to stop selling internal combustion engines by 2035.3

EV share of passenger vehicle sales

Source: BNEF Long-Term Electric Vehicle Outlook 2022, First Sentier Investors

The scale and range of EV availability has been impacted by R&D lead times, COVID disruptions and supply chain constraints. Tesla has been leading the charge (Model 3 sold 470k units in 2021) but a new range of EV from established manufacturers will be available soon, including the best-selling vehicle in the US the Ford F-150. Momentum is building.

Audi e-tron GT

Ford F150 Lightning

Source: Audi, Ford

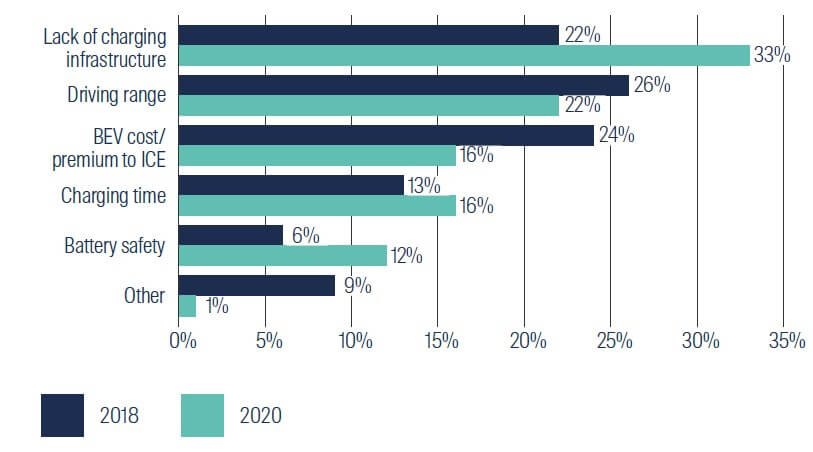

EV charging the real barrier

As the new range of EV hit the showroom floor, the real challenge begins. A Deloitte survey4 found that the number one barrier to EV adoption was a lack of charging infrastructure (33% of participants). If we add driving range (22%) and charging time (16%), then it could be argued more than 70% of the problem is about charging infrastructure.

Barriers to EV adoption (UK)

Source: Deloitte 2020 Global Auto Consumer Study, First Sentier Investors

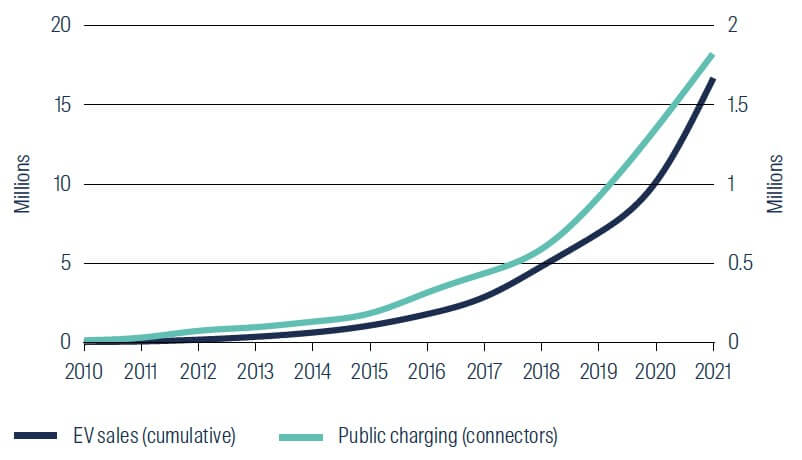

For the conversion to EV to be a positive experience for consumers, the rollout of charging infrastructure has to lead vehicle sales. While more than 80% of passenger EV charging is likely to be done at home, addressing the anxiety issues above will require a significant investment in public charging.

EV sales and public charging infrastructure (global)

Source: BNEF Long-Term Electric Vehicle Outlook 2022, First Sentier Investors

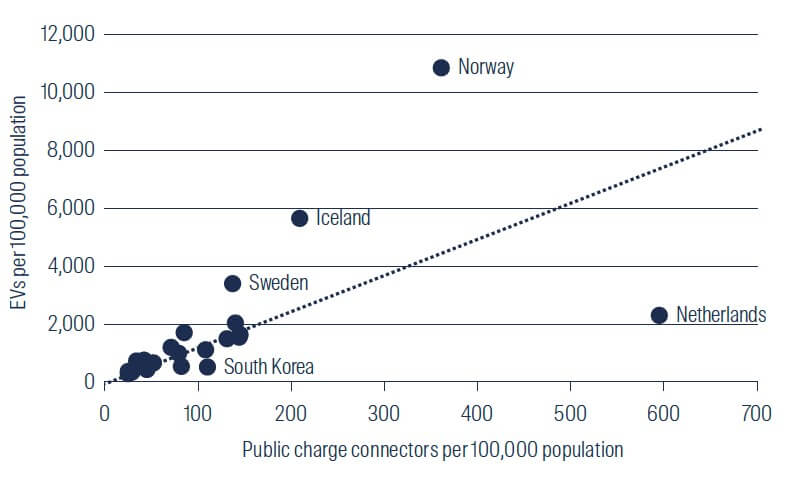

The global experience to date suggests a ratio of EV to public charger at 15:15. This ratio varies widely by country and should logically correlate with population density. Countries with high density like Netherlands, South Korea, China and Italy have ratios of less than 10:1. Populations with more detached housing like Germany, US, Sweden and Australia are likely to need less public charging with ratios at more than 20:1.

As the fleet of passenger EV expands, so too will the need for EV charging. BNEF estimates this investment opportunity could represent $US1.0–1.4 trillion over the next 20 years, roughly split evenly between private, public and commercial uses.6 We believe the opportunity is big.

EV public charging infrastructure by country

Source: BNEF, First Sentier Investors as at 31 December 2021

Finding the right business model

There are a number of ways to play the EV theme. Investing in EV vehicle and battery manufacturers like TSLA, BYD or CATL. Gaining exposure to key minerals like lithium, cobalt or nickel. However, manufacturers are likely to face significant competition over time while commodities could be a wild ride. In this report we focus directly on EV charging infrastructure.

A number of EV charging infrastructure companies listed in recent years – ChargePoint, EVgo, Allego, Wallbox, Blink Charging and Volta. The business models vary but may include the manufacture and sale of charging hardware, installation and maintenance of the hardware, a margin on electricity sales, and software for subscription-based access to charging networks.

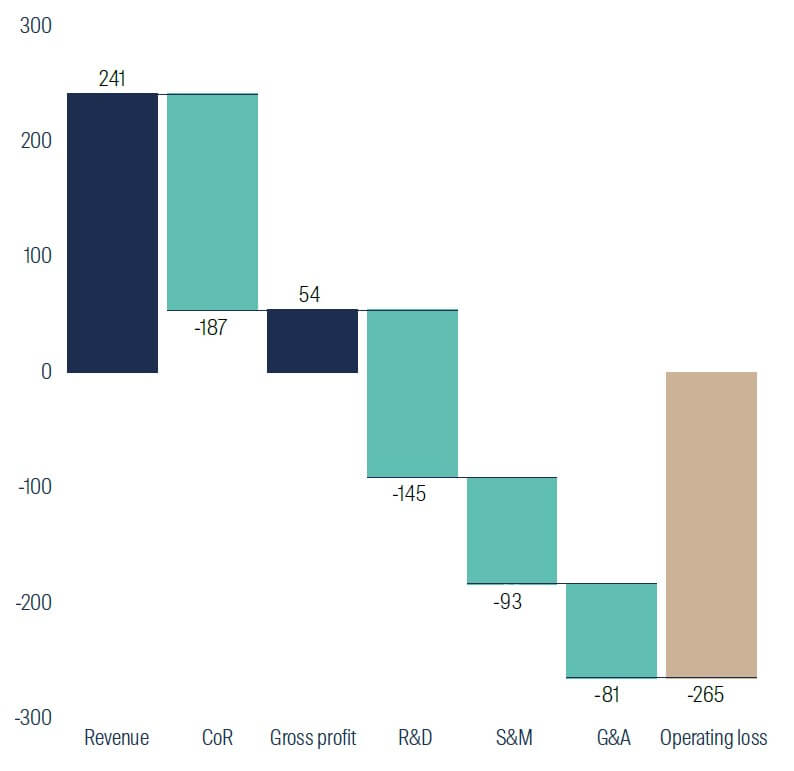

Initial excitement in the massive growth opportunity has been overwhelmed by the reality of heavy losses. Our analysis indicates that the business models deliver low gross margins, there are few barriers to entry, supply chain issues have delayed rollouts and the “land-grab” for charging sites is expensive. The financials of ChargePoint highlight the significant (mis) allocation of capital to research and development, sales and marketing, and general and administrative expenses.

ChargePoint operating loss waterfall ($m)

Source: ChargePoint, First Sentier Investors. Year ended 31 January 2022

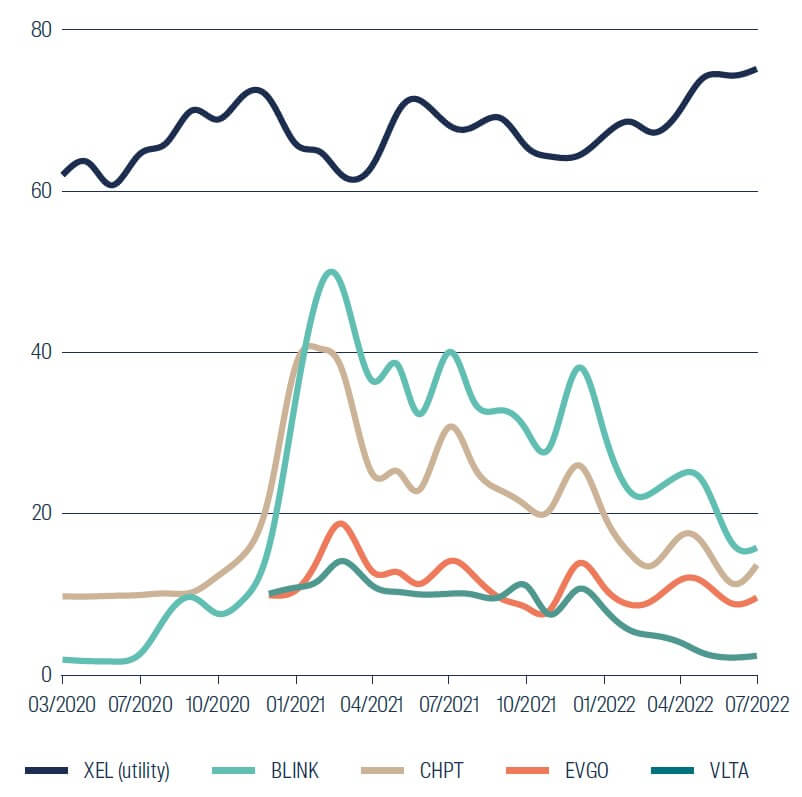

Stock price performance of the charging infrastructure companies has been dismal and investor capital would have been better invested in a regulated utility.

EV charging stock performance ($/share)

Source: Bloomberg, First Sentier Investors as at 31 May 2022

In our view, regulated utilities with electricity distribution networks represent a more compelling exposure to EV charging infrastructure. With the right policy and regulatory settings in place, utilities are well placed to deliver a coordinated rollout of a consistent product at a reasonable cost. By including the EV charging infrastructure rollout costs in the regulated rate base, along with the required distribution and transmission network upgrades, costs can be shared across the customer base. We believe utilities are the best play.

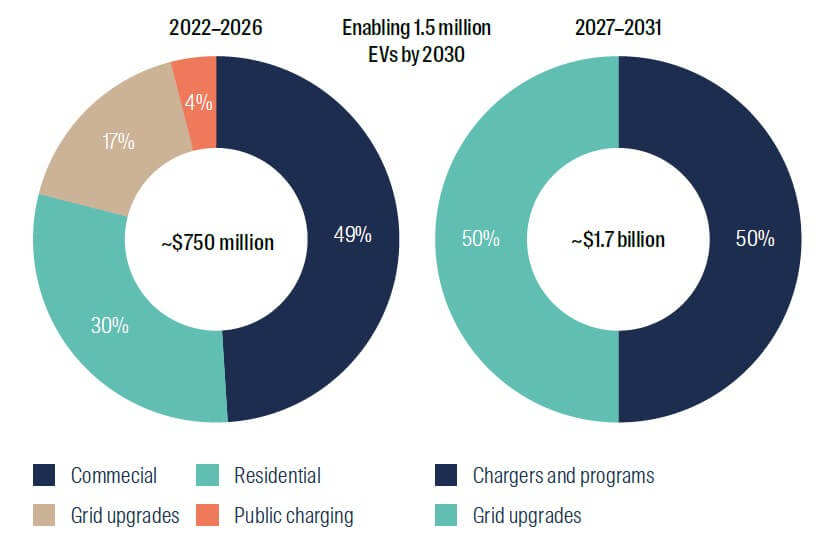

Xcel Energy provides a useful case study. Xcel owns electricity distribution networks in Minnesota, Colorado, Wisconsin and New Mexico with approved EV programs. The utilities intend to invest over $US2 billion over the next 10 years to enable 1.5m EV in their service territories. In current dollars that equates to around $US700 for charger equipment plus $US700 for installation for each customer.

Xcel Energy EV Infrastructure Plan

Source: Xcel Energy, First Sentier Investors

Residential

- Charger installs and services

- Rebates for vehicles and charger installs (rate based)

Commercial

- Charging equipment/installs for cities, schools and businesses

- EV purchase rebates (rate based)

Public

- Stations in major corridors and underserved communities

This capital investment will add to rate base growth, which in turn will add to earnings growth. Xcel is targeting 5–7% EPS growth which should be sustainable over the long-term.

Xcel is not alone. Across the US there are now 60 electric companies in 35 states or territories with regulatory approvals for EV programs7, including PG&E/Edison/Sempra in the west, ConEd/PSEG/Avangrid/Eversource in the north-east and Duke/NextEra in the south-east.

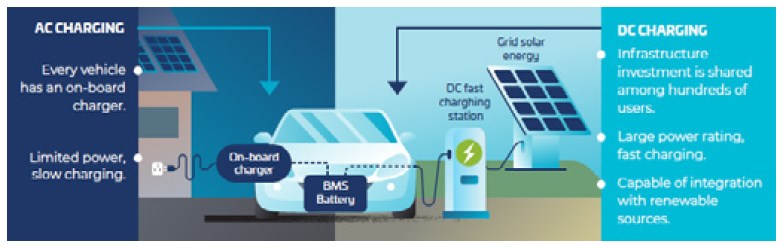

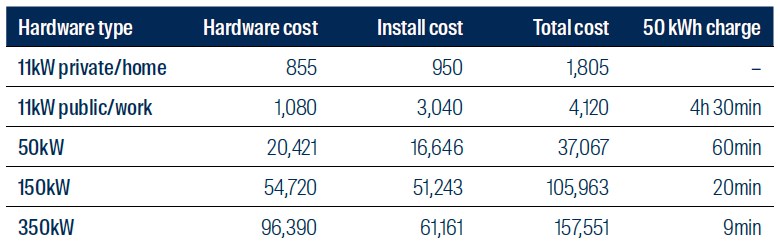

The investment opportunity could be materially higher if customers demand faster charging. While a home AC installation for overnight charging should price below $2,000, a fast DC charger that gets you back on the road in 20 minutes could cost more than $US100,000.

Type and cost of EV charging infrastructure

Hardware and installation cost assumptions in 2020 (US $)

Source: Electric Vehicle Council, BNEF, First Sentier Investors

EV charging will have secondary effects on utilities. EV will likely represent 10–20% of electricity load over the coming decades. Ten years ago there were fears that conservation/efficiency measures and distributed generation would render the grid redundant. Now the opposite is true, with electrification of transport and heating, datacentres and even bitcoin mining creating strong growth in volumes. The grid looks set to become even more essential.

Customers may also want to ensure that the electricity for EV charging is from renewable sources. We believe this will lead to additional investment in solar and wind generation and associated transmission lines.

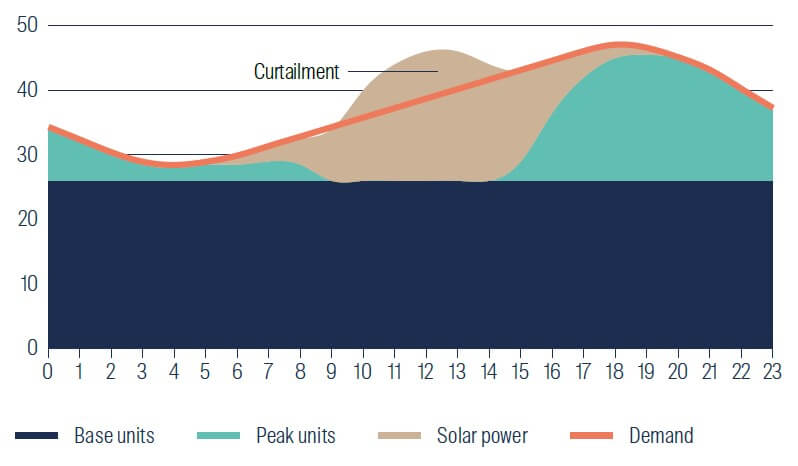

EV charging may also stimulate demand for smart grid solutions. A growing challenge for electricity grids is that renewable supply peaks during the middle of the day, whereas demand peaks in the evening. Significant development of solar capacity has resulted in summer days where power supply is well in excess of demand. Grids are forced to reject or curtail solar energy to maintain balance in the system.

Electricity demand/supply by time of day (TWh)

Source: First Sentier Investors. Simplified model

Most EV spend 80–90% of the time parked. Vehicle-to-grid (V2G) bi-directional charging could allow the EV fleet to act as a network of batteries, charging from the grid during the solar peak and releasing to the grid in the demand peak. V2G charging could (1) reduce renewable energy curtailment, (2) help grid operators manage peak demand and (3) offer a peak/off-peak price arbitrage. International Renewable Energy Agency (IRENA) estimates that V2G charging could reduce peak load by 4% and energy costs by 13%.

We believe EV charging is an enormous investment opportunity with numerous challenges. So how can Responsible Investors contribute to accelerating the uptake of EV? Below are a few ideas worth considering:

- Allocate investor capital towards electric utilities which have regulatory approval to rollout EV charging infrastructure

- Lobby energy regulators to include EV charging infrastructure plus associated electricity distribution and transmission network upgrades in the rate base to encourage investment. Multi stakeholder engagement with utilities, regulators and industry bodies could be a useful tool

- Real estate investors require minimum 1-in-5 vehicle parking spaces to be EV ready for new or re-developed office, commercial, housing projects

- Explore opportunities for toll road companies to develop EV fast charging and recreation areas on vacant land along suburban or intercity roads

- Challenge integrated oil companies to transform retail fuel sites into EV fast charging centres

- Allocate higher risk capital to supply chain solutions including rare metals mining, semi-conductors and battery manufacturing. Allocate capital to the manufacture of component parts such as semiconductors

- Allocate your personal capital to an EV

1 Source: International Energy Agency as at 31 December 2021.

2 Source: BloombergNEF Long-Term Electric Vehicle Outlook 2022.

3 Source: Volkswagen, May and June 2021.

4 Deloitte 2020 Global Auto Consumer Study.

5 Source: BloombergNEF Long-Term Electric Vehicle Outlook 2022.

6 Source: BloombergNEF Long-Term Electric Vehicle Outlook 2022.

7 Source: First Sentier Investors as at 31 May 2022.

Reference to the names of each company mentioned in this communication are for illustrative purposes only and are merely used for explaining the investment strategy. Any fund or stock mentioned in this presentation does not constitute any offer or inducement to enter into any investment activity nor is it a recommendation to purchase or sell any security.

Important Information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors is a business name of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B) is a business division of First Sentier Investors (Singapore).

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.© First Sentier Investors Group

Discover more

Get the right experience for you

Your location :  Hong Kong

Hong Kong

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom