- With travel restrictions lifted we were back on the road in the United States, conducting over 80 face-to-face meetings with listed infrastructure stakeholders in nine cities across seven states

- Energy midstream remains in an earnings upgrade cycle supported by geopolitical tensions and supplier discipline

- Utilities and renewables investment in decarbonisation and electrification is leading to higher EPS growth

- Railroad and waste companies are increasing prices to more than offset rising labour and fuel costs

- Listed infrastructure is well positioned to navigate a difficult environment of higher inflation and slower economic growth

We recently spent several weeks in the United States visiting listed infrastructure management teams, regulators, politicians, industry associations and conducting asset tours. The following paper provides an overview of our findings.

Energy midstream – running with the bulls

We met many energy midstream management teams at an industry conference in West Palm Beach. Energy midstream remains in an earnings upgrade cycle as US energy exports accelerate while domestic demand remains robust. The key differences to this US energy cycle are:

- supply has been constrained as publically-listed E&P companies remain focused on free cash generation;

- quantifying the degree to which the US industry will grow its market share globally at the expense of Russia is imprecise; and

- midstream balance sheets are very healthy.

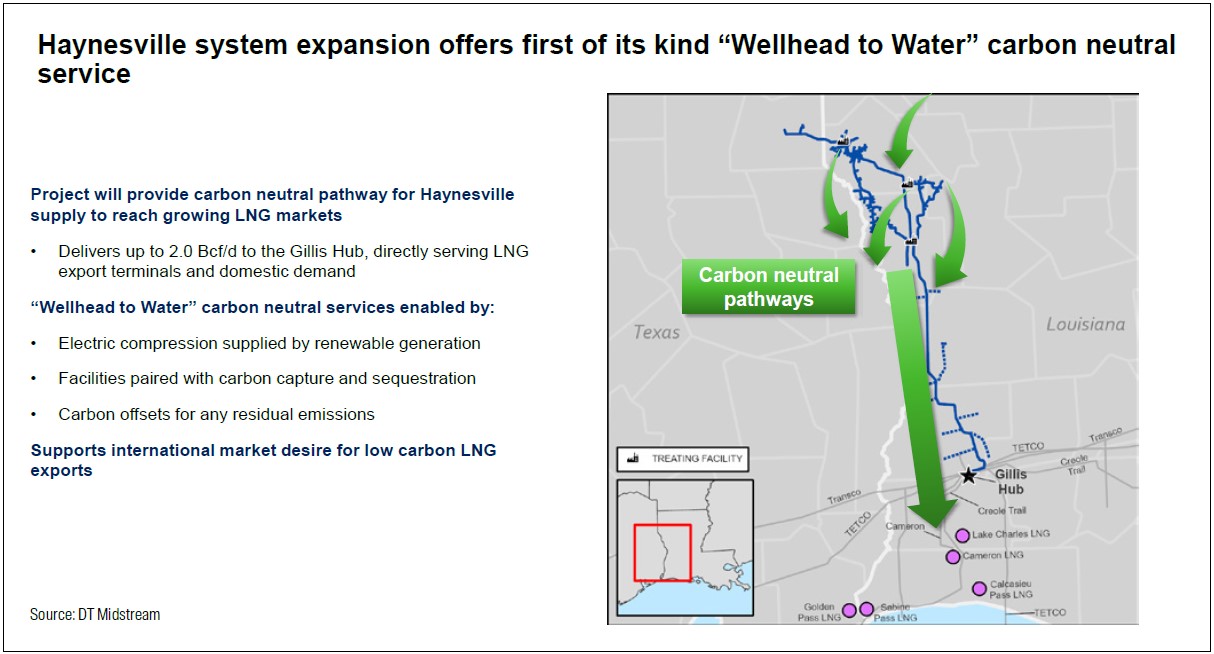

New investment is mostly occurring in the energy-friendly states of Texas and Louisiana while new pipelines in US Northeast and Midwest remain politically challenged. Investment is most focused on Liquefied Natural Gas (LNG) export facilities, with listed infrastructure companies accounting for 70% of US LNG export capacity today. We expect both brownfield and greenfield LNG export projects to be developed over the next decade. In May 2022 alone, new LNG export agreements were signed with German, Polish, French, Malaysian and Korean off‑takers. This export drive will also lead to additional midstream infrastructure investments that will be needed to feed the LNG facilities: gathering, processing, storage and transportation opportunities abound. This will mainly occur in the cost‑competitive, lightly regulated Permian and Haynesville basins. In addition, many firms are looking at net zero-related investment opportunities, such as carbon capture and storage (CCS) and hydrogen facilities along the US Gulf Coast.

We believe the US has a global competitive advantage in hydrocarbons owing to its abundance of low cost reserves, large pool of skilled labour, access to cheap financial capital and stable political/legal framework. This makes US energy midstream very well positioned to dominate European and Asian import needs over the next two decades as well as lead the next generation of net-zero related projects.

Sempra’s Cameron LNG export terminal

Utilities and renewables – decarbonisation driving earnings

We met over 30 US utilities and renewable energy management teams at investment conferences in New York and Miami. Utilities are focused on accelerating resiliency, safety, transmission and renewable energy investment opportunities while navigating the challenges of solar supply chain disruptions and large customer bill increases during an election year.

The electrification of the US economy with carbon free energy is driving increased investment opportunities for the sector. This is translating into higher earnings growth rates for US electric utilities.

Over the last year we have seen many utilities increase earnings per share (EPS) growth expectations from between 4% and 6% pa to between 5% and 7% pa1, including industry giants Southern Company, Duke Energy and Consolidated Edison2. This investment-driven higher earnings growth shows no sign of slowing down. Over the next 12 months we believe DTE Energy, WEC Energy, Eversource Energy, Entergy and Xcel Energy are all likely to increase their forecast growth rates.

The only area where we saw investment delays was in solar panels, owing to the Department of Commerce’s current antidumping and countervailing duties investigation. This, combined with stretched global supply chains, is causing delays, deferrals and cost increases to solar related investments across the US. This in turn may delay the closure of coal plants owing to grid reliability issues – an outcome clearly at odds with the Biden administration’s climate goals.

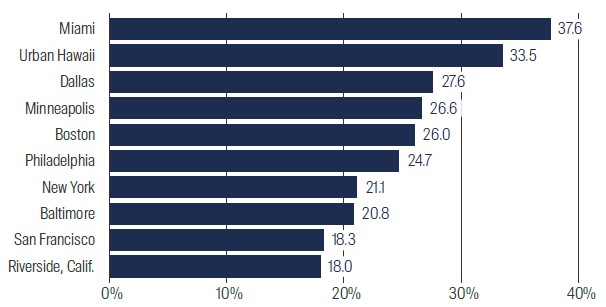

Site tour of Entergy’s Waterford 3 nuclear plant

Lastly, a summer of discontent is arriving for US utility customers as they face bill increases of between 20% and 40%, mainly due to higher natural gas costs. The next step will be to see how many (and which) politicians take a populist approach to this issue, by attacking the utilities rather than the underlying geopolitical and supply side causes. We believe customer bill increases of this scale will heighten political and regulatory risk for US utilities. That said, the extent of interference should still be materially lower than the energy price caps and windfall profit taxes seen in Europe.

Household energy inflation

Year over year change in April (%)

Source: US Bureau of Labor Statistics

Note: Household energy is defined as ‘energy items used for heating, cooling, lightling, cooking and other appliances and household equipment’

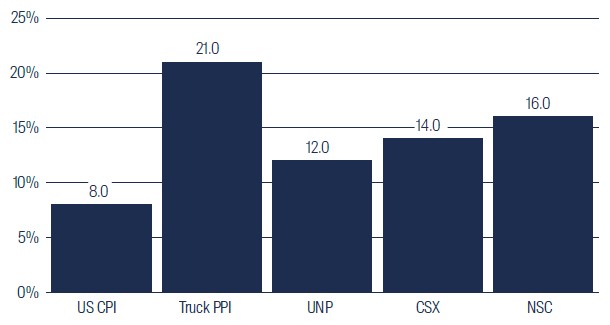

Railroads – pricing very strong vs mixed volume outlook

In Boston we met with railroads, the Surface Transportation Board (regulator), trucking companies and ports. The positive pricing environment was reinforced, with higher fuel and labour costs putting more pressure on trucks than on railroads. This is allowing railroads to more than cover their cost inflation, thus improving their competitive position relative to trucking.

Robust Q122 railroad pricing

Source: Company reports, First Sentier Investors

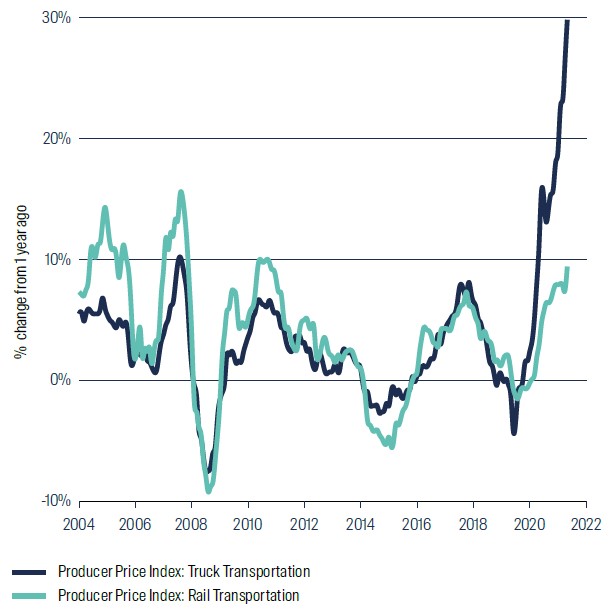

Data from the St. Louis Federal Reserve, illustrated in the following chart, also shows that the trucking sector is bearing the brunt of rising costs in the transportation sector.

Trucking costs spike vs rails

Source: First Sentier Investors, Fedeal Reserve Bank of St. Louis. As at April 2022

The railroad management teams we spoke to were consistent in their message that demand is still outpacing supply, and they expect strong second half volume growth of between 3% and 5%. This demand is not only consumer driven, but also reflects high commodity prices supporting volumes for grain, coal, potash and fertiliser. Haulage in these segments represents over half of railroads’ earnings. Although the railroads are confident about strong volumes in the second half of the year, financial markets (and we) are more cautious given a likely slowing economic growth rate as the year progresses.

The biggest feeders into US railroads are the Ports of Los Angeles (LA)/Long Beach, which together handle over 50% of all imports from Asia into the US. Management discussed how ports on the US West Coast are losing market share not just to Canada and Mexico, but also to the US East Coast ports. This structural trend is positive for eastern railroads (CSX and Norfolk Southern) but negative for western railroads (Union Pacific and BNSF).

Around 30% of the Port of LA’s volumes go direct to rail, to be transported to Chicago, Memphis and Dallas. Once rail service metrics improve, there will be renewed focus on growing this 30% direct to rail segment, to help improve congestion at the port. One train can take 300 trucks off the road. We left Boston with the belief that railroads are very well positioned to take market share from trucks over the next three to five years.

Waste management – greening of a dirty industry

We then spent a gruelling couple of days in Las Vegas at Waste Expo 2022, meeting with the management teams of both privately owned and publicly listed waste management companies, as well as visiting landfill and recycling assets. Sentiment was positive as management teams described this as the best pricing environment they have ever seen for the industry. Companies were confident that positive pricing trends can accelerate into the second half of the year and into 2023. Companies are increasing prices at between 6% and 7%, comfortably offsetting their cost inflation of between 4% and 5%. While inflation remains an issue, these companies can pass price increases on to their customers owing to inflation-linked contracts and a consolidated industry structure (i.e. regional oligopolies).

Volume growth (currently running at between 2% and 3% pa) is above the long-term trend due to COVID recovery, new business activity and bolt-on M&A activity. With waste management being an essential service, volumes are inelastic to price and relatively immune from the economic cycle. While volumes could slow in the second half of this year as the economy softens, this is not a material earnings driver for this sector.

Waste management companies are expanding the development of Renewable Natural Gas (RNG) and recycling projects.We expect these opportunities to become a larger part of their business mix going forward. Both activities have environmental benefits with landfill RNG being a carbon neutral energy source and recycling contributing towards a circular economy. As large generators of methane from their landfill assets, waste companies now have an opportunity to create an earnings stream by capturing this potent greenhouse gas. This is a customer-driven initiative, as the move towards net zero makes these landfill gas-to-energy assets more valuable. RNG and recycling centers are less capital intensive than traditional landfill assets, with attractive returns on invested capital.

Asset tour of recycling plant in Boston

Wireless Towers – recession proof

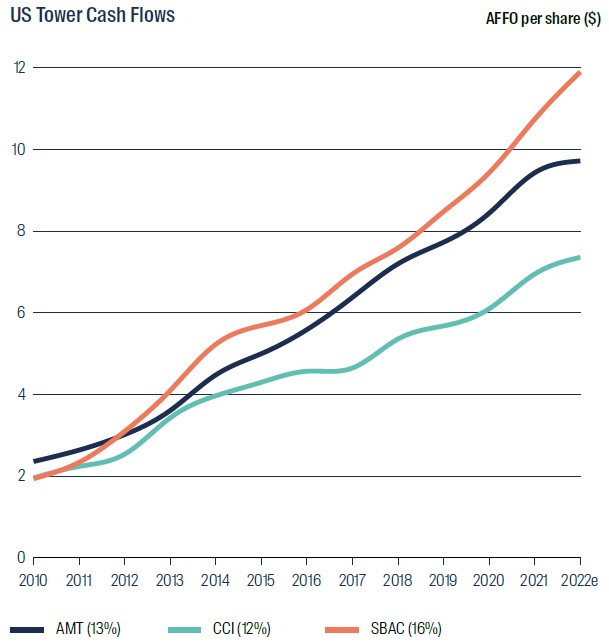

We met US industry giants American Tower in Boston and SBA Communications in Boca Raton. Wireless tower telecom customers’ (Verizon, AT&T, T-Mobile and DISH) growth in network spending is being driven by higher video and data usage requiring higher network density, plus the accelerating rollout of 5G technology. Rates of spending growth varies by customer, with T-Mobile leading and AT&T lagging.

The rollout of 5G technology, contracted price increases of 3% pa, and improving tenants per tower should provide a robust non-cyclical revenue growth of ~6% pa over the next 3 to 5 years, partly offset by higher rates of customer churn.

This, combined with 70% of operating costs being fixed or with price escalators of less than 3% pa, helps to protect profits from inflation.

Source: First Sentier Investors, company reports

Sustainability – new green growth opportunities

A common theme across all listed infrastructure sub-sectors we met with was a notable increase in investment opportunities related to sustainability, as US corporates are being encouraged by the investment community to improve their environmental credentials and decarbonisation efforts. For listed infrastructure, this is creating the next wave of investment opportunities, both in new areas like RNG, CCS and hydrogen; and via expanding opportunities for existing areas such as renewable energy, recycling and railroads.

Republic Services’ fully electric truck

In many meetings we heard corporate customers increasingly considering lower emissions as part of their infrastructure buying decisions. Examples included:

- Railroads preferred to trucking competition due to lower carbon emissions;

- Carbon free renewable Power Purchase Agreements;

- RNG blended into natural gas streams for utility or corporate use to reduce their carbon footprint;

- Carbon neutral natural gas pipelines; and

- Utilising electric trucks.

Conclusion

Listed infrastructure is well positioned to navigate the dual challenges of high inflation and slowing economic growth. Be it through regulated returns, regional oligopoly industry structures or contracted pricing, this asset class is successfully passing on inflation to the end customer and protecting earnings. This, combined with structural and sustainability-related investment opportunities, provide the asset class with earnings growth that is relatively inflation protected.

1 Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon First Sentier Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and First Sentier Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

2 For illustrative purposes only. Reference to the names of each company mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of First Sentier Investors.

Important Information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors is a business name of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B) is a business division of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

Get the right experience for you

Your location :  Hong Kong

Hong Kong

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom