Please read the following important information for First Sentier Asian Quality Bond Fund

• The Fund invests primarily in debt securities of governments or quasi-government organization in Asia and/or issuers organised, headquartered or having their primary business operations in Asia.

• The Fund’s investments may be concentrated in a single, small number of countries or specific region which may have higher volatility or greater loss of capital than more diversified portfolios.

• The Fund invests in emerging markets which may have increased risks than developed markets including liquidity risk, currency risk/control, political and economic uncertainties, high degree of volatility, settlement risk and custody risk.

• The Fund invests in sovereign debt securities which are exposed to political, social and economic risks. The Fund may also expose to RMB currency and conversion risk.

• The Fund invests in debts or fixed income securities which may be subject to credit, interest rate, currency and credit rating reliability risks which would negatively affect its value. Investment grade securities may be subject to risk of being downgraded and the value of the Fund may be adversely affected. The Fund may invest in below investment grade, unrated debt securities which exposes to greater volatility risk, default risk and price changes due to change in the issuer's creditworthiness.

• The Fund may use FDIs for efficient portfolio management purposes, which may subject the Fund to additional liquidity, valuation, counterparty and over the counter transaction risks.

• For certain share classes, the Fund may at its discretion pay dividend out of capital or pay fees and expenses out of capital to increase distributable income and effectively a distribution out of capital. This amounts to a return or withdrawal of your original investment or from any capital gains attributable to that, and may result in an immediate decrease of NAV per share.

• It is possible that a part or entire value of your investment could be lost. You should not base your investment decision solely on this document. Please read the offering document including risk factors for details.

A monthly review and outlook of the Asian Quality Bond market.

Market review - as at May 2025

It was a positive month for risk assets, despite ongoing macroeconomic uncertainties. The Federal Reserve kept interest rates unchanged, and the minutes from the Federal Open Market Committee (FOMC) indicated a cautious approach to future policy decisions. The impact of tariffs has yet to be reflected in economic data, and the markets shrugged off Moody’s downgrade of the US sovereign rating from Aaa to Aa1.

The yield on the 10-year US Treasury ended the month at 4.4%, up by 24 basis points. The yield curve steepened, particularly at the long end, while the spread between 2-year and 10-year Treasuries remained relatively stable at 50 basis points, narrowing by 6 basis points.

As macroeconomic uncertainty diminished, credit spreads experienced a relief rally, returning to levels seen before April’s sell-off. Investment Grade (IG) USD Asian bond spreads tightened by 15 basis points to 118 basis points. Despite higher US Treasury yields partially eroding total returns, total IG credit returns remained respectable at 0.11%.

It was a mixed bag of news for Investment Grade (IG) USD Asian bonds, but positive sentiments largely prevailed. Share prices of Chinese technology companies recovered Liberation Day losses as tariffs were delayed and China unveiled more supportive monetary easing measures. In credit fundamentals, a divergence in earnings emerged. Meituan and JD both achieved strong earnings in Q1 2025, despite rivalry concerns between the two companies’ food delivery lines. Alibaba achieved decent growth and stable earning margins, but the performance of its cloud business lagged behind market expectations. Indian IG corporates generally achieved decent earnings growth in Q4 FY25 across digital, retail, ports, and energy distribution businesses. Adani Ports announced the issuance of INR 50bn in NCDs to the Life Insurance Corporation of India, extending the corporate’s overall maturities by 1.4 years. The company mentioned that they would use the proceeds to repurchase dollar bonds. The Adani curve saw a 2-4 point increase in its bond prices over the month.

In Asia Investment Grade Sovereigns, Indonesia’s Sovereign Wealth Fund, Danantara, continued to explore options to raise debt but faced disappointing news as Ray Dalio declined to join its board as an advisor.

Primary issuance volumes trended close to April levels, with an increase in issuances from quasi-sovereigns. PT Pertamina Hulu Energi, a subsidiary of Indonesia’s PT Pertamina, priced its debut bond, a USD 1 billion 5-year tenure, which was well received by the primary market.

Fund positioning

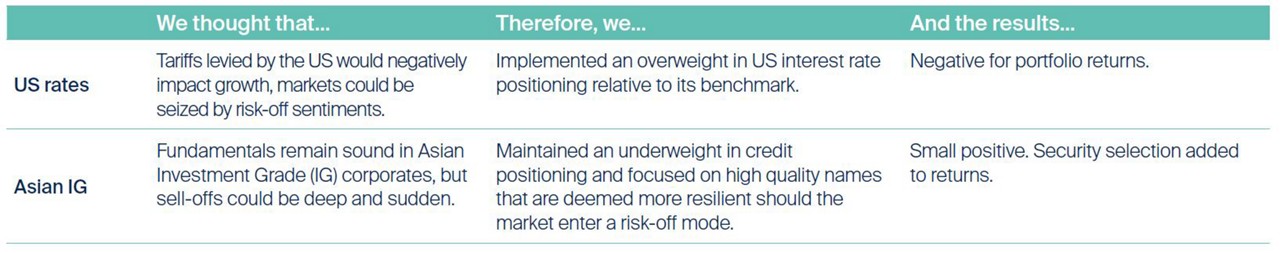

The Fund maintained an overweight in US rates in anticipation of a weakening macro backdrop, while maintaining a defensive stance in credit positioning. Small local currency allocations were maintained as diversifiers to a bearish dollar view.

Performance review

On a net-of-fees basis, the First Sentier Asian Quality Bond Fund returned -0.50% in May, underperforming its benchmark by -0.61%.

An underweight positioning in credit spreads was positive for performance, but the portfolio’s overweight in US rates detracted from returns. Local rates and currency exposure was flat for returns.

Source : Company data, First Sentier Investors, as of end of May 2025

Read our latest insights

Important Information

Investment involves risks, past performance is not a guide to future performance. Refer to the offering documents of the respective funds for details, including risk factors. The information contained within this material has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy or completeness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this. It does not constitute investment advice and should not be used as the basis of any investment decision, nor should it be treated as a recommendation for any investment. The information in this material may not be edited and/or reproduced in whole or in part without the prior consent of FSI.

This material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission in Hong Kong. First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of FSI’s portfolios at a certain point in time, and the holdings may change over time.

First Sentier Investors (Hong Kong) Limited is part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

To the extent permitted by law, MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Investors Group

Get the right experience for you

Your location :  Hong Kong

Hong Kong

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom