When we released last month’s article titled - The Clock is Ticking for the Fed, we highlighted our concerns about the strikingly large downward revisions in prior months’ non-farm payroll reports. While markets were distracted by political noise surrounding weak jobs data, we maintained that the U.S. economy was faltering—and that hard data, as usual, was slow to reveal the sobering reality.

The most recent non-farm payroll numbers have reinforced our view. August non-farm payroll numbers rose by just 22,000, well below the consensus forecast of 75,000, and significantly weaker than July’s revised print of 79,000. Adding to that, the two-month payroll net revision June-July unsurprisingly saw further downward revisions of -21,000, reinforcing our view that labor market softness, is more entrenched than headline numbers suggest.

Bond Market Reaction

Despite growing signs of economic weakness, markets were slow to reflect the underlying data. Between the release dates of the past two payroll reports(dated 1 August and 5 September respectively), long-end U.S. Treasury yields remained elevated, even as rate cut expectations were priced in. Yields on 20- and 30-year Treasuries edged higher, reflecting persistent term premium and cautious investor sentiment, until the release of the August payroll report came in significantly weaker than expected.

Source: Bloomberg. 5th September 2025

Given the longer duration exposure of the long end of the curve—where 30-year Treasuries typically carry durations of around 18 to 20 years—price sensitivity to interest rate changes is significantly amplified. Investors overweight in long-duration assets would have seen outsized capital gains as yields declined, making them the biggest beneficiaries of Friday’s rally in long-dated Treasuries.

Consumer Fragility

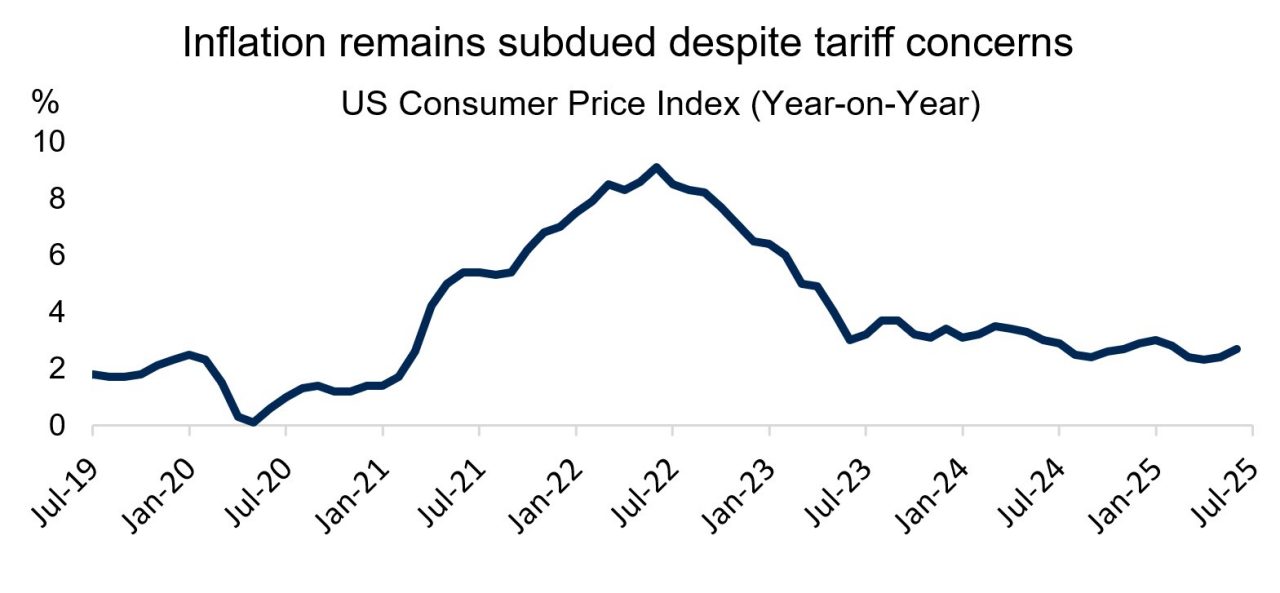

On the inflation front, we have yet to see a convincing spike from tariff-related pressures. More importantly, U.S. consumers are increasingly ill-equipped to absorb further price increases, especially after enduring the post-Covid inflation surge. We continue to expect the trade war would harm global growth more than inflation.

Source: Bloomberg. August 2025

Markets, from time to time, do get impacted by headline news or political narratives, but it is certainly worth remembering that fundamentals are equally, if not more important. With labor market softness deepening and consumer resilience waning, we believe the rally in Treasuries has room to run.

Source: First Sentier Investors, as of September 2025

Read our latest insights

Important information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Group believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither First Sentier Group, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material. The information herein is for information purposes only; it does not constitute investment advice and/or recommendation, and should not be used as the basis of any investment decision. Some of the funds mentioned herein are not authorised for offer/sale to the public in certain jurisdiction.

The value of investments and the income from them may go down as well as up and you may not get back your original investment. Past performance is not necessarily a guide to future performance. Please refer to the offering documents for details, including the risk factors. Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Group’s portfolios at a certain point in time, and the holdings may change over time.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of First Sentier Group. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of First Sentier Group. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited. First Sentier Group (registration number 53507290B), First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business names of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Group, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Group includes a number of entities in different jurisdictions.

To the extent permitted by law, MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Group

Get the right experience for you

Your location :  Singapore

Singapore

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom