We recently reviewed the Neutral Asset Allocation (NAA) for our portfolios, an exercise that is undertaken twice a year. This note summarises the key drivers of investment markets over the most recent six month period and outlines the changes made to the NAA.

Just as a recovery from the Covid-19 pandemic lockdowns appeared to be an optimistic turning point, financial market volatility has intensified across all asset classes, exacerbated by rising inflation, interest rate hikes and a deteriorating growth outlook.

We have continued to closely monitor these themes since our last NAA review and have adjusted our allocations accordingly, as reflected in the below table.

What exactly is the NAA review?

The first step in our investment process is to determine the economic outlook, both globally and for individual countries. Twice a year, we formally review existing assumptions and determine the likely long-term values for inflation, risk free rates, long-term bond yields, and earnings growth.

Using current valuations as a starting point, these determinations enable us to calculate expected returns for various asset types globally. In turn, this helps inform the most appropriate mix of investments (NAA) that have the highest likelihood of achieving our clients’ long-term objectives.

How do we determine the right mix of Neutral Asset Allocation (NAA or beta) and Dynamic Asset Allocation (DAA or alpha)?

Based on our assumptions for the economic climate, and our expected returns, we can determine the likelihood of meeting the portfolio’s objectives over the investment horizon. It is becoming increasingly likely that relying solely on the NAA in a constrained long only, unlevered environment will not be sufficient to meet the return objectives.

This is where we use our DAA process, which takes shorterterm market dynamics into account and aims to deliver additional returns, as well as mitigate portfolio risks. By adding an uncorrelated return source (alpha) we can improve the likelihood of meeting the investment objective.

We consider current allocations when combining NAA and DAA, as the extent to which active management may be used is managed through the portfolio’s risk budget to avoid unwanted additional risks. We look at both the tracking error (as well as other risk metrics) and the expected return, in assessing the portfolio’s ability to meet its investment objective.

In the current low return environment, it is critical to have the flexibility to blend beta and alpha to deliver our clients’ investment objectives. We believe our investment process and philosophy provides our clients the highest possibility of obtaining a real return and expect the DAA process to be of paramount importance given the current outlook for major asset classes. As a highly experienced team with over two decades of experience, the Multi-Asset Solutions team will continue to implement our established and methodical NAA investment process and adjust positioning through the DAA process as opportunities arise.

Key Points from our Neutral Asset Allocation Review

Overall, we have made meaningful changes to the Neutral Asset Allocation. Our economic climate assumptions continue to evolve in response to the ongoing recovery from the Covid-19 pandemic, the implications of the conflict in Ukraine (particularly for Europe), the elevated levels of inflation and the impact of tightening monetary policy.

- Volatility: In a rising interest rate environment, both fixed income and equity returns have experienced an increase in volatility. Our analysis suggests that most asset classes have slightly higher expected returns, driven predominantly by higher interest rates. Our volatility expectations have not changed meaningfully.

- Inflation: Across the last three reviews, we have adjusted our inflation assumptions higher across all markets and anticipate higher interest rates and long-term bond yields to combat this. While the rate of interest rate hikes appears to be slowing, ultimately they are expected to rise further and short-term bonds offer a similar yield without the term premium risks.

- Earnings: The reduction in Covid-19 lockdown measures has been positive for corporate earnings however, increasing costs of living and borrowing costs can be a concern for companies.

- Asset Allocation: On a high level, we have reallocated a portion from global equities to global fixed income given that the rising rate environment has allowed fixed income assets to regain some of their attractiveness, including an increase in expected yields, compared to our previous review.

- Cash and fixed income: We have increased the neutral allocation to both cash and short-term global government bonds (1-3 years) given more attractive yields. Besides that, we have also increased our allocation to global high yield and introduced a new allocation to emerging market bonds, and these increases have been supported by removing our allocation to global investment grade bonds.

- Equities: We have decreased the global equity allocation to partially fund the increase in the overall fixed income allocation. We have also reintroduced a small allocation to Global Emerging Market equities to provide additional diversification.

- Currencies: Rising rates will put pressure on equity valuations and to provide diversification, all of the global equity exposure is currently unhedged.

- Commodities: The commodities allocation remains diversified to include both precious metals and agricultural commodities, as well as industrial metals. These exposures provide inflation linkages to the ongoing supply constraint issues in the near term, and sustained demand pressures from a growing global economy over the longer term.

While current market conditions remain uncertain, the presence of volatility can present opportunities to be exploited through the Dynamic Asset Allocation (DAA) process. We continue to strive to achieve our clients’ investment objectives while aiming to minimise drawdowns and preserve investor capital.

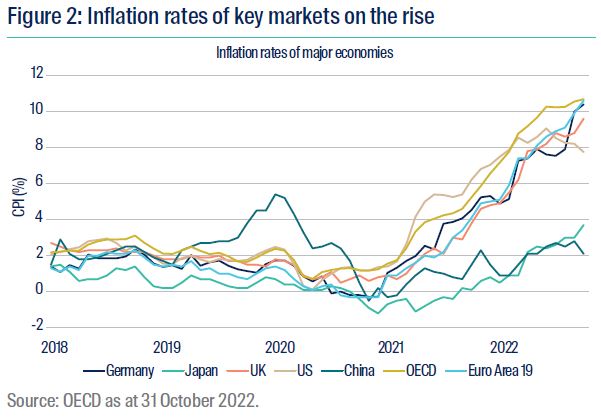

Central bankers continue the fight against inflation

It has been no secret that inflation has been a hot topic in 2022 across most major markets. While the Covid-19 pandemic related disruptions and the associated pent-up demand were initially to blame for the rising costs of living, the transitory narrative from central bank officials quickly changed tune when it became evident that without action, these pressures would likely linger. Beyond the recovery from the pandemic, the conflict in Ukraine has also contributed to these indicators rising. The European energy crisis — a by-product of the conflict in Ukraine — has seen the cost of energy in both Europe and the UK become a heavy burden. As we have seen, however, this problem is not unique to Europe.

Some signs of success, but it’s not enough

US inflation rose at an annual pace of 7.7% for the year to October 2022 and had been rising quickly for most of the year, reaching an annual pace of 9.1% in June before starting to trend lower. While fortunately this change in direction may signal that the work of central bankers in quantitative tightening has started to have its desired effect, these readings are still significantly above the US Federal Reserve’s target of 2%.

While investor speculation suggests that the peak inflation rate for the US has passed, the same case is not yet evident in Europe and the UK. While increasing cash rates is driving caution among some investors, central bankers still appear committed to monetary policy tightening in order to regain control.

Where to from here?

Higher income for fixed income assets, but duration risk is a trade-off

Widespread volatility was a feature of global markets this year, we expect this to continue in 2023 and bring ongoing dispersion of returns and greater investment opportunities. In particular, we note that higher interest rates can be beneficial for fixed income and corporate bond investors through higher income. Having said that, we also recognise the prospect of increased exposure to duration in a rising rate environment can erode some of the attractiveness of this asset. In corporate debt markets, defaults are increasing from historically low levels and are expected to reach long term averages, with Europe and emerging markets leading the way.

Attractive valuations against a backdrop of heightened volatility

Meanwhile, repricing in equity markets in recent months is leading to pockets of valuation opportunities emerging. However, these opportunities need to be considered in the context of ongoing volatility and the potential for deteriorating economic conditions. Global markets have seen selloffs and while valuations are more attractive than they were at this time last year, we are taking a cautious approach into 2023 and hold a slight underweight position to equities relative to our neutral view.

Emerging market equities underperformed, but are more attractive now

Year to date, emerging market equities have underperformed developed, weighed down by higher inflation, financial conditions and a strong US dollar. More specifically, China’s ongoing zero-Covid policy continues to drag on economic growth and although there seem to be signs of this strategy coming to an end, how exactly this will play out remains unclear. Despite uncertainties relating to Chinese Covid-19 policies, valuations in these markets appear more attractive in a historical sense, and so we have sought further diversification within equities by reintroducing a small allocation to emerging markets. We are retaining some currency exposures from global equity allocations to provide diversification in a risk off scenario but will review this regularly as currency divergence is increasing relative to recent years.

Central banks expected to continue tightening, albeit to a smaller extent

We expect central banks to continue to implement quantitative tightening measures, including increasing interest rates in 2023 — albeit in smaller increments than in 2022 — as evidence of inflation remains but continues to plateau. While tightening has exerted downward pressure on equity valuations, corporate balance sheets have so far remained solid.

Recession clouds loom, seek shelter with flexible strategies and risk management

Recession warnings have been gaining momentum, particularly as the US 2-year and 10-year yield curve spent a large portion of the year inverted — a phenomenon often viewed as a recessionary indicator. Nonetheless, most recent macroeconomic data releases have not been as dire and so we remain cautiously optimistic going into the new year. Thankfully, the flexibility of our objective-based strategies allows us to mitigate these risks and balance short-term dynamics with longer-term views, particularly relative to a static benchmarked approach to asset allocation.

Important information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors is a business name of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B) is a business division of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

Get the right experience for you

Your location :  Singapore

Singapore

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom