We recently reviewed the Neutral Asset Allocation (NAA) for our portfolios, an exercise that is undertaken twice a year. This note summarises the key drivers of investment markets over the most recent six-month period and outlines the changes made to the NAA.

For some time the world has been grappling with the fallout of the Covid-19 pandemic — the impact on society, on economic growth, inflation and mobility — but the outbreak of war in Ukraine in late February and the ongoing conflict has resulted in even greater insecurity and market instability. Since our last NAA review, we have been closely monitoring the tightening of fiscal policy measures by major central banks, rapidly rising inflation, continued supply-chain disruptions and, of course, the broader implications of the conflict in Ukraine.

Our return expectations for major asset classes have evolved and the changes to our NAA are summarised in the table below.

What exactly is the NAA review?

The first step in our investment process is to determine the economic outlook, both globally and for individual countries. Twice a year, we formally review existing assumptions and determine the likely long-term values for inflation, risk free rates, long-term bond yields, and earnings growth.

Using current valuations as a starting point, these determinations enable us to calculate expected returns for various asset types globally. In turn, this helps inform the most appropriate mix of investments (NAA) that have the highest likelihood of achieving our clients’ long-term objectives.

Source: First Sentier Investors as at 31 May 2022. Asset classes that have zero allocation have been greyed out.

How do we determine the right mix of Neutral Asset Allocation (beta) and Dynamic Asset Allocation (alpha)?

Based on our economic assumptions and expected returns, we determine the likelihood of meeting the portfolio’s investment objective over the investment horizon as part of the NAA process. In the current low return environment, relying solely on the NAA in a constrained unlevered long-only approach will not be sufficient to meet the return objectives.

This is where we use our Dynamic Asset Allocation (DAA) process to factor in shorter-term market dynamics with the aim of delivering additional returns and abating portfolio risks such as tail events. By adding an uncorrelated return source (alpha) we can improve the portfolio’s likelihood of meeting the investment objective.

We consider current allocations when combining NAA and DAA, as the extent to which active management may be used is managed through the portfolio’s risk budget to avoid unwanted additional risks. We look at both the tracking error (and other risk metrics) and the expected return, in assessing the portfolio’s ability to meet its investment objective.

It is critical to have the flexibility to blend beta and alpha to be more dynamic and allow us to deliver our clients’ investment objectives, even in a lower return environment. We believe our investment process and philosophy provides our clients the highest possibility of achieving their investment objectives and expect the DAA process to be of paramount importance given the current outlook for major asset classes. As a highly experienced team, the Multi-Asset Solutions team will continue to implement the Fund’s established and methodical NAA investment process and then adjust positioning through the DAA process as opportunities arise.

Key Points

Overall, meaningful changes to the Neutral Asset Allocation have been made. Our economic climate assumptions continue to evolve in response to the ongoing recovery from the Covid-19 crisis, against the backdrop of high inflation and rising interest rates. Additionally, the war in Ukraine has escalated geopolitical tensions, providing additional uncertainty.

- Volatility: In a rising interest rate environment, both fixed income and equity returns have experienced an uptick in volatility. Our analysis suggests that most asset classes have slightly higher expected returns, driven by higher earnings and inflation.

- Inflation: In 2021, we increased our inflation assumptions across all markets and anticipated higher cash rates and long-term bond yields. We have further adjusted several countries’ inflation, and cash rates, higher again in 2022.

- Earnings: As Covid-19 vaccination rates increased and lockdown measures eased, corporate earnings picked up to more normalised levels.

- Asset Allocation: Portfolio positioning has focused on the balance between equities and bonds, with a reduction to interest rate sensitivity.

- Equities: We have decreased the global equity allocation, in favour of a reallocation to commodities which provides diversification in the current environment of elevated equity volatility.

- Currencies: We expect that rising rates will put pressure on equity valuations so to provide diversification, half of the Fund’s global equity exposure and the full property and infrastructure exposure is currently unhedged.

- Fixed Income: We have decreased the total allocation to global bonds and investment grade credit, in favour of a reallocation to commodities.

- Property and Infrastructure: We increased the allocation in 2021, and maintained the exposure in this review, to participate more meaningfully in the recovery as global mobility restrictions ease further.

- Commodities: The commodities allocation has increased, to provide inflation linkages to the ongoing supply constraint issues in the near term, and sustained demand pressures from a growing global economy over the longer term. For diversification, this exposure has expanded to include precious metals, industrial metals, and agricultural commodities.

While market conditions remain uncertain, a pick-up in volatility can present opportunities that can be exploited through the DAA process. We continue to strive to achieve our clients’ investment objectives while aiming to minimise drawdowns and preserve investor capital.

New Disruptions to the Economic Recovery

After two long years of lockdowns, multiple Covid-19 variants, overwhelmed hospitals, and general uncertainty, the rollout of effective vaccines and an increase in herd immunity was finally pointing toward a return to ‘normal’.

We Want You! (To Work)

Many people that had lost work during the lockdowns have returned to work, as consumer sentiment and economic activity were beginning to recover. Demand for labour as industries have reopened has been so substantial that there is now a shortage of workers in some sectors with some people not returning to the jobs they held before, or at least not for the same wages and conditions. Alongside the supply-chain disruptions, this increase in wages is further adding to the concerns of persistently high inflation. Overall, many economies have seen this significant increase in inflation; after a long period of ultra-loose fiscal and monetary policy measures, there will be a lot of focus on how policymakers wind these back.

Unexpected Attacks on Many Fronts

On top of these pressures, Russia’s invasion of Ukraine has prompted significant uncertainty throughout Europe, and placed additional strain on energy prices. Pandemic-related supply-chain bottlenecks are lingering, particularly as China’s ‘zero–Covid’ policy has weighed on economic activity in the country as the Omicron variant spread. Harsh lockdown measures are still a usable lever for Chinese authorities, with large cities like Shanghai — as well as several key manufacturing hubs — being shut down for April and May. Industrial production and exports have been hampered, adversely affecting supply chains globally.

Cloudy with a Chance of Contractions

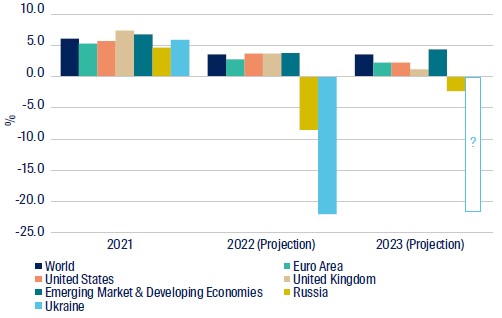

While the economic recovery from the Covid-19 pandemic was progressing, this unanticipated development has clouded the outlook and has sent consumer sentiment in key regions moving lower again. Unsurprisingly, given the current state of the world, the International Monetary Fund’s (IMF) growth projections made in January 2022 downgraded in April. According to the IMF, global growth is now projected to slow to 3.6% in 2022, compared to a previous forecast of 4.4%. In particular, both Ukraine and Russia are expected to experience sizable economic contractions over the year. The destruction of infrastructure, the displacement of people and the loss of life seem likely to impact Ukraine for an extended period. Meanwhile, Russia has started to feel the effects of economic sanctions, the severance of trade ties and diminishment of confidence.1

Chart 1: IMF Economic Growth Projections

Source: International Monetary Fund – April 2022 World Economic Outlook

Ukraine War

On 24 February 2022, news broke that Russian forces had invaded Ukraine. The impact of the conflict is not bound by the borders of Ukraine; while Ukraine is most directly impacted, the negative effects have spread throughout Europe and, to some extent, the rest of the world. Millions of Ukrainians have been displaced from their homes, with many ending up in neighbouring eastern European nations such as Poland, Romania, Moldova and Hungary. This will only add to the growing pressures these regions are already facing.

The Gas is Not Enough

As Russia is a major exporter of oil and gas, the geopolitical tensions have caused a surge in commodity prices. While this is not the only driver of the recent uptick in inflationary pressure, it has certainly exacerbated existing pricing pressures. The reliance on Russian commodities has been a particular focal point after Germany decided to halt the Nordstream 2 gas pipeline project, designed to transport Russian gas directly to Germany. More broadly, EU members are discussing reducing reliance on Russian commodities. While the outcome remains to be seen, there has already been some confrontation — Russia has halted gas supplies to Poland and Bulgaria in April, and Finland, Denmark, Germany and the Netherlands in late May to early June, for failing to pay in ruble. We expect that there will be a myriad of additional risks from the conflict across financial markets and market function, inside and out of Russia.

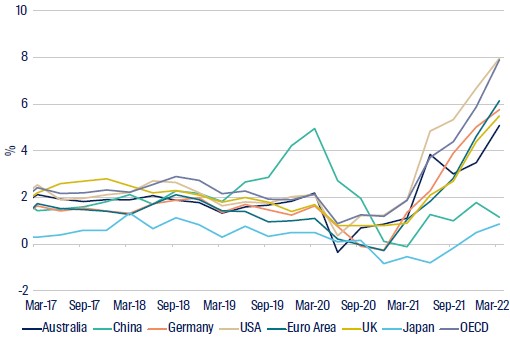

Inflation

While most of the rhetoric from policymakers in 2021 tried to soothe markets with the ‘transitory’ inflation story, each subsequent inflation reading has continued to suggest otherwise. As illustrated in Chart 2, inflation across most major markets has been on the rise. Finally, the tune has changed and central bankers have started to consider options to combat the surging costs of living. In the United States, the annual inflation rate accelerated to 8.5% in March2, the highest in more than 40 years. Inflation moderated only slightly in April, to an annual rate of 8.3%. The conflict in Ukraine, in particular, has pushed crude oil prices upward; as fuel oil prices rose more than 70% in February alone. Food prices have also risen by 8.8% on an annual basis, the most since May 1981. Some forecasters expect March to represent a peak in inflation, but with the war in Ukraine unlikely to end soon, prices could remain volatile for some time. Similarly, according to Eurostat, the annual inflation reading for the Euro Area surged to an all-time high of 7.4% in both March and April. Considering the current environment, this was in line with expectations. The current CPI rate is more than three times the European Central Bank’s (ECB) 2% target. The sanctions imposed on Russia are continuing to exert upward pressure on fuel and natural gas prices in the region; according to the IMF’s April 2022 world economic outlook, elevated inflation is expected to persist for a while to come.

Chart 2: Inflation rates of major economies

Source: OECD as at 11 May 2022. Annual inflation for the period 31 March 2017 to 31 March 2022.

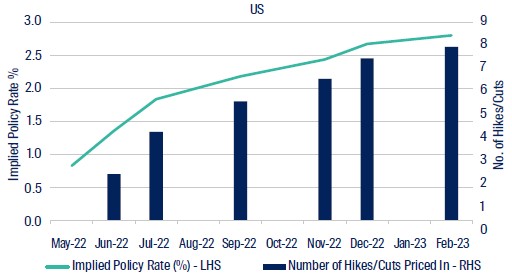

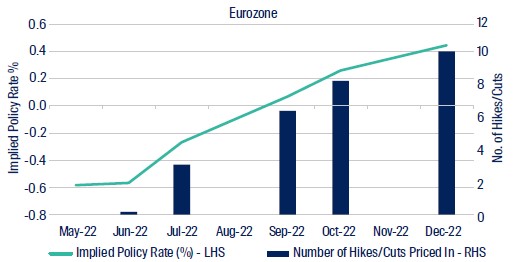

‘Licence to Hike’ – Policy Tightening Begins

In response to the upward movement in inflation, some central banks have started tightening monetary policy settings. Chart 3 below captures the number of interest rate hikes expected across the Eurozone and in the US, against the implied policy rate. The Bank of England was the first key bank to move, raising rates at its December 2021 meeting. Base rates were increased again in February and March, and again in early May. In the US, the Federal Reserve Bank (the ‘Fed’) increased the Federal Funds Rate by 0.25 percentage points to between 0.25% and 0.50% in March 2022, and by a further 0.50 percentage points in May. During the press conference in May, policymakers advised that further increases will occur if warranted, and at the March meeting there was a median of seven increases over 2022. With two hikes already implemented, Chart 3 below from Bloomberg’s World Interest Rate Probability function shows the expectations for another five hikes to come this calendar year. In Europe, the ECB President confirmed the tapering of the Pandemic Emergency Purchase Programme would finish in June, with the asset purchase programme to conclude in the third quarter of 2022. Subsequently an interest rate hike might be required if inflation remains elevated.

Chart 3: Number of interest rate hikes priced in

Source: Bloomberg World Interest Rate Probability as at 23 May 2022.

Proceed with Caution

While taming inflation is an important objective, there will likely be other implications of these policy changes. The Covid-19 pandemic led to a substantial increase in debt levels around the world3. With inflation already sitting at persistently high levels, the hiking of interest rates will place additional strains on budgets. As fiscal consolidation plays out, public budgets will need to balance the needs for social and other notable expenditures, such as defence. Without a successful transition from the elongated period of loose fiscal policy measures, confidence could further erode. Such sentiment could prompt capital outflows, particularly from emerging markets and encourage a debt crisis. Additionally, if advanced economies were to become more aggressive with their monetary policy adjustments, this could drive a further correction of asset prices.

Rising Bond Yields Spell Pressure for Returns

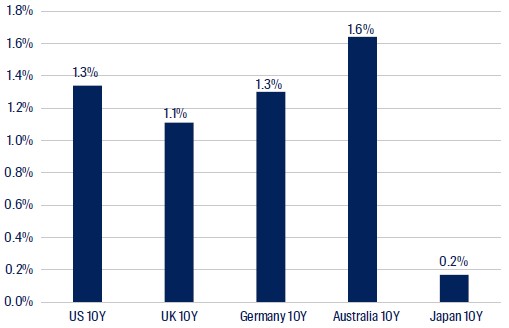

After several years of ultra-low interest rates and bond yields, the rising rate environment has already proved detrimental to fixed income returns. These unfavourable returns are not necessarily surprising; interest rates had been sitting close to zero for quite some time and always seemed likely to rise at some point. In the first four months of 2022, 10-year US Treasury yields rose 1.42%, to 2.93%. Over the same period, German 10-year bund yields rose 1.11%. This was a particularly notable move given bund yields had spent 30 months in negative territory, before rising back above zero at the end of January. As illustrated in Chart 4, government bond yields have risen significantly, after many years of trending downward. Due to the relationship between bond yields and interest rates, yields could continue to rise in the current environment where central banks appear committed to dampening inflation through higher interest rates. In turn, this could exert pressure on fixed income returns. Following the previous and recent NAA reviews, we shifted away from longer-dated sovereign bond markets to shorter duration exposure.

Chart 4: Change in benchmark 10-year government bond yields over 2022

Source: Bloomberg as at 31 May 2022, period 31 December 2021 to 31 May 2022.

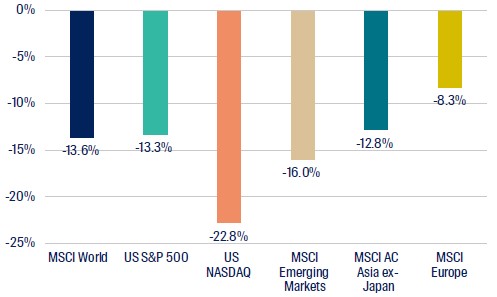

Equities, Especially Technology, Have Been Challenged

The calendar year to date has also been unkind to equity markets. This is partly due to the Ukraine war, rising interest rates, and high inflation that is creating a volatile environment for company valuations. The technology sector, particularly in the US, has delivered lacklustre returns over the past few months, followed by a particularly bad earnings season. Major global indices have experienced declines in the calendar year to date, with the tech-heavy US NASDAQ Index being the worst performer. Supply-chain disruptions, rising borrowing costs, as well as the lingering effects of the Covid-19 pandemic are likely to present ongoing challenges for equities.

Chart 5: Global equity market returns over 2022

Source: Bloomberg as at 31 May 2022, period 31 December 2021 to 31 May 2022.

Outlook

Having seen a sharp increase in volatility in the year to date, our outlook for financial markets remains cautious. Showing no signs of easing, the war in Ukraine continues to erode investor sentiment and is putting pressure on energy prices, exacerbating the rising costs of living. The global economy remains relatively resilient, although the Ukraine war is expected to slow the rate of growth. Global corporate earnings have been stronger than expected, but the removal of the fiscal and monetary tailwinds will reveal whether deeper issues have been masked. Labour markets have improved markedly, while the rising cost of living is placing additional pressure on wage inflation.

More Hikes on the Horizon

As other economic indicators continue to improve, central bank officials and monetary policy settings are in sharp focus, as policymakers consider how to best combat the persistently high inflation levels lingering across most major economies. Multiple interest rate hikes are anticipated across most major markets before the end of the year. In the US, for example, the Fed has made a strong commitment to 0.50% hikes in the Federal Funds Rate after at least the next two meetings. In Europe, while the ECB has yet to imply an interest rate hike in the near term, the ongoing conflict in Ukraine and the associated price pressures have prompted investors to price in the probability of as many as four rate hikes in the remainder of 2022.

China’s Zero-Covid Policy Hurting Economy

While the focus in Europe is highly revolved around the war in Ukraine, Covid-19 outbreaks continue to wreak havoc in China. The spread of the virus appeared to be under control for much of the past two years, but authorities now appear to be struggling under their ‘zero-Covid’ policy. Market sentiment has deteriorated after Shanghai spent all of April and May in lockdown. In fact, it appears China’s official 5.5% GDP growth target for 2022 may be difficult to achieve given subdued economic activity levels.

It’s a Balancing Act between Risk and Return

Bond yields continue to rise, although longer-term expectations remain within historically low ranges. A key risk is that a stagflation regime persists after the current supply-chain issues have been resolved through the entirety of 2022 and beyond. The rising yield environment continues to drive some caution among investors and is exerting downward pressure on equity valuations. Although corporate balance sheets remain solid and there is still an enormous level of pent-up demand in economies following lockdowns, investors are wondering whether this will be sufficient to support current valuations. We have adopted a cautious approach and began reducing the equity weight in our portfolios in January 2022, having previously introduced protection in October 2021 in recognition of these broad-based risks. With rates still close to all-time lows and with persistently high inflation, the risks are to the upside in interest rates. Thankfully, the flexibility of our objective-based strategies allows us to mitigate these risks, and we will continue to rebalance the portfolio as opportunities present themselves over the coming months.

1 International Monetary Fund – April 2022 World Economic Outlook

2 US Bureau of Labor Statistics

3 International Monetary Fund – April 2022 World Economic Outlook

Important information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors is a business name of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B) is a business division of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

Get the right experience for you

Your location :  Singapore

Singapore

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom