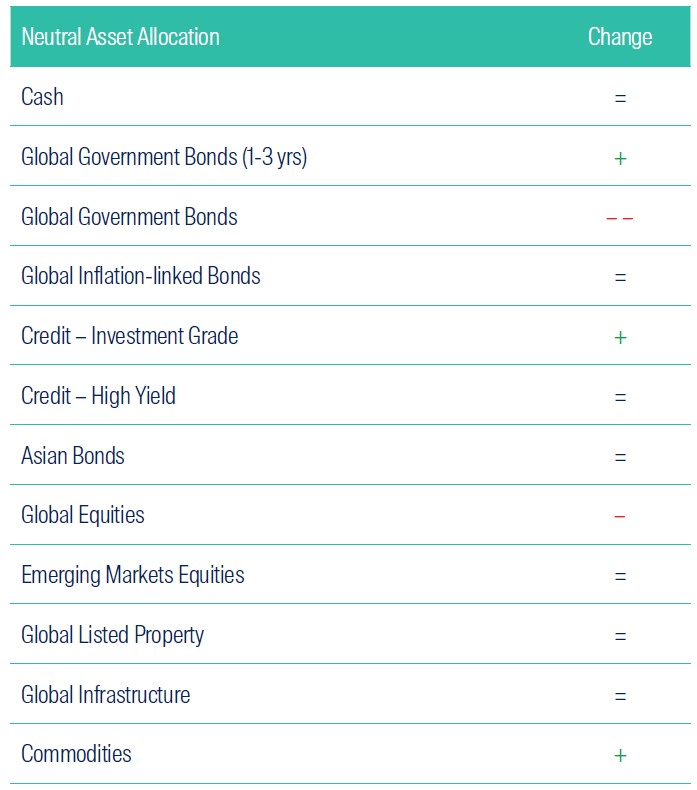

We recently reviewed the Neutral Asset Allocation (NAA) for our portfolios, an exercise that is undertaken twice a year. This note summarises the key drivers of investment markets over the most recent six month period and outlines the changes made to the NAA.

It has been more than 18 months since the Covid-19 pandemic first began and although economic growth continues to recover with unemployment rates falling in most regions, inflation concerns are rising. Vaccine hesitancy / shortages, supply chain disruptions, and the rapid spread of the Omicron strain are all impacting growth rates and creating volatility across financial markets. We continue to closely monitor the policies and announcements coming from both governments and central banks alike as they work toward a global recovery.

What exactly is the NAA review?

The first step in our investment process is to determine the economic outlook, both globally and for individual countries. Twice a year, we formally review existing assumptions and for each country determine the likely long-term values for inflation, risk free rates, long-term bond yields, and earnings growth.

Using current valuations as a starting point, these determinations enable us to calculate expected returns for various asset types globally. In turn, this helps inform the most appropriate mix of investments that have the highest likelihood of achieving our clients’ long-term objectives.

Source: First Sentier Investors as at 31 December 2021.

How do we determine the right mix of Neutral Asset Allocation (beta) and Dynamic Asset Allocation (alpha)?

Based on our economic assumptions and expected returns, we determine the likelihood of meeting the portfolio’s investment objective over the investment horizon as part of the NAA process. In the current low return environment, relying solely on the NAA in a constrained unlevered long-only approach will not be sufficient to meet the return objectives.

This is where we use our Dynamic Asset Allocation (DAA) process to factor in shorter-term market dynamics with the aim of delivering additional returns and abating portfolio risks such as tail events. By adding an uncorrelated return source (alpha) we can improve the portfolio’s likelihood of meeting the investment objective.

We consider current allocations when combining NAA and DAA, as the extent to which active management may be used is managed through the portfolio’s risk budget to avoid unwanted additional risks. We look at both the tracking error (and other risk metrics) and the expected return, in assessing the portfolio’s ability to meet its investment objective.

It is critical to have the flexibility to blend beta and alpha to be more dynamic and allow us to deliver our clients’ investment objectives, even in a lower return environment. As a highly experienced team with over two decades’ experience, we will continue to implement our established and methodical NAA process and then adjust positioning through the DAA process as opportunities arise, to ensure the highest possibility of achieving our clients’ target return.

Key Points

Overall, meaningful changes to the NAA have been made as our economic climate assumptions continue to evolve in response to the ongoing recovery from the Covid-19 crisis. We believe that although financial markets have stabilised from the sharper movements seen in 2020, there is still much risk to be mitigated. Our analysis suggests that most asset classes have slightly higher expected returns, driven by higher earnings and inflation.

- Volatility: Our volatility expectations across most asset classes have not materially changed, with the exception of Commodities and Property. They are both aligned with the reopening of economies globally as can be seen with the recent higher market movements over the last six months.

- Inflation: Early in 2021 we increased our inflation assumptions across all markets, along with higher cash rates and long-term bond yields to reflect the eventual tightening of central bank policy. These views have been retained in this review.

- Earnings: While earnings growth took a tumble over 2020, a pick up to more normalised earnings has already returned as Covid-19 vaccination rates have increased, allowing for the easing of lockdown measures.

- Asset Allocation: Portfolio positioning has focused on the balance between equities and bonds, with the intention to reduce the allocation to growth.

- Equities: We have decreased the allocation to global equities, predominantly driven off the back of higher relative valuations seen in global equities.

- Currencies: Rising rates will put pressure on equity valuations and with bonds less likely to provide diversification, we have retained part of the global equity exposures in foreign currencies.

- Fixed Income: Reducing allocations to equities does see a marginal increase to fixed income exposures which we have allocated to shorter-dated, rather than longer-dated bonds. This results in a lower overall portfolio duration which will reduce the portfolio’s sensitivity and risk to rising yields.

- Property and Infrastructure: Global property was introduced as a discreet allocation last year, due to its attractiveness from a valuation perspective relative to the strong and rapid rebound seen in equity markets more broadly. This review has seen a slight increase to participate in the global recovery as restrictions are eased. Exposure to Global Infrastructure has also been maintained.

- Commodities: We increased exposure to Commodities, which provides inflation linkages to hedge against the ongoing supply constraint issues in the near term, or sustained demand pressures from a growing global economy over the long term.

While market conditions still appear uncertain, this can also lead to opportunities. The risks presented by the current economic climate are always dealt with diligently and in line with our investment philosophy and process. We continue to strive to achieve our clients’ investment objectives while aiming to minimise drawdowns and preserve investor capital.

Is the Covid-19 recovery at risk of losing momentum?

From one Greek letter to another

Over the past six months, while the Delta variant of Covid-19 had gradually come under control, the rise and spread of the Omicron variant has proved to be even more contagious. The global economy has continued on its road to recovery, albeit a bumpy one, from the pandemic and its associated disruptions, with global equity markets rallying despite a pick-up in volatility, while bond yields remain volatile. After some easing of mobility restrictions earlier thanks to largely successful vaccination drives in most of the developed world, we are now seeing a reintroduction of lockdown measures globally to varying extents. This has added to inflationary pressures and ongoing global supply chain disruptions, which are already beginning to hinder economic indicators. In addition, many regions are still experiencing varying levels of vaccine hesitancy or shortage. While a ‘pandemic of the unvaccinated’ may continue for some time, this will result in an uneven recovery and will likely persist as a major theme over 2022 contributing to ongoing volatility.

Decline in quarterly GDP growth

In most major economies, Q3 GDP growth show a quarteron-quarter decline, most likely reflecting ongoing supply-side issues — US Q3 GDP growth is at 0.6% versus 1.6% in Q2, and 1.1% versus 5.4% respectively in the UK. Euro Area quarterly growth readings have been moderate, with the region expanding by 2.2% in the September quarter. According to Eurostat, this was supported by strong domestic demand and exports, but was weighed down by supply chain constraints.

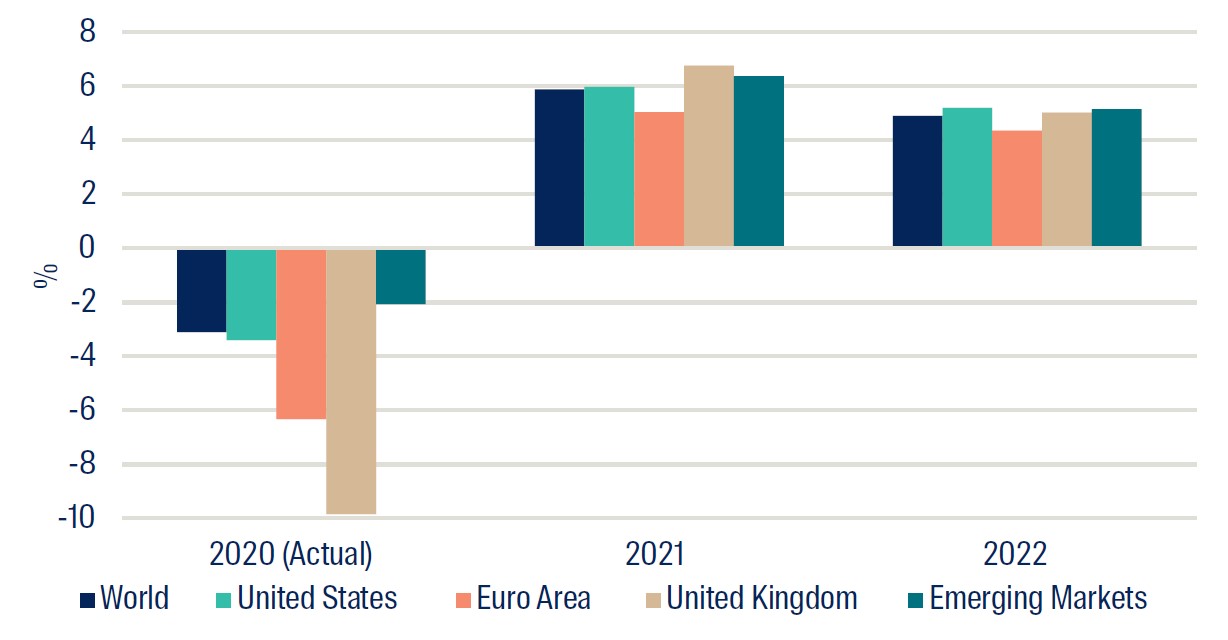

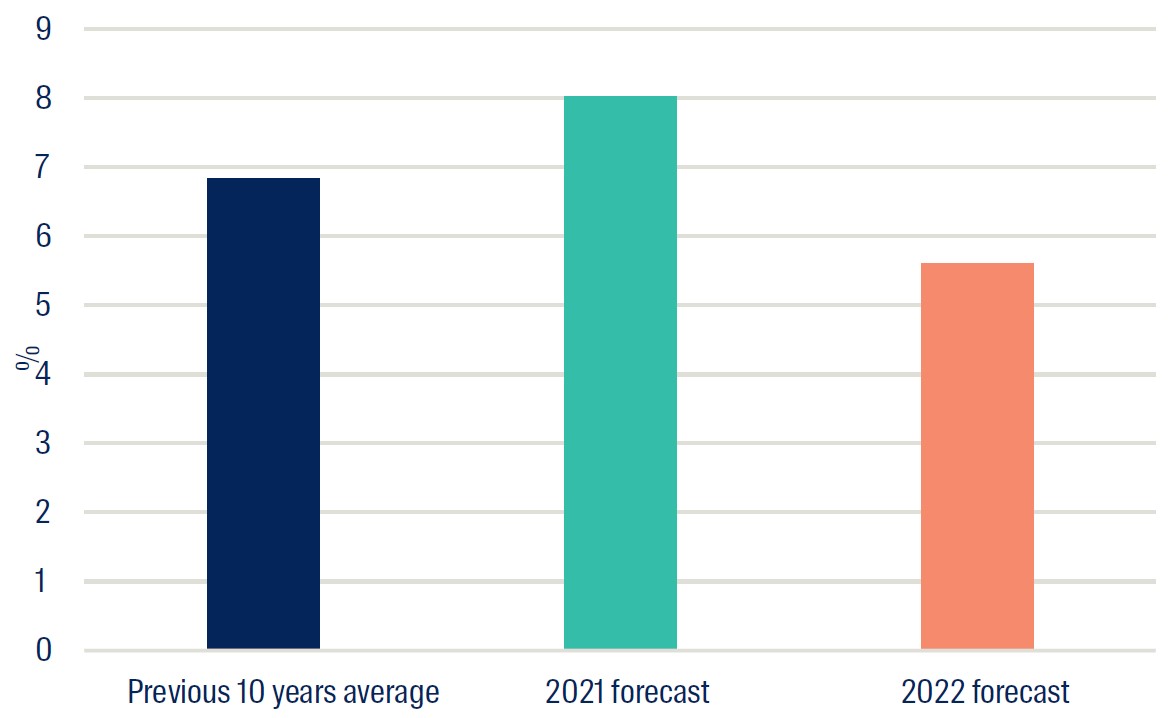

Figure 1: IMF Economic Growth Projections

Source: IMF as at 12 October 2021

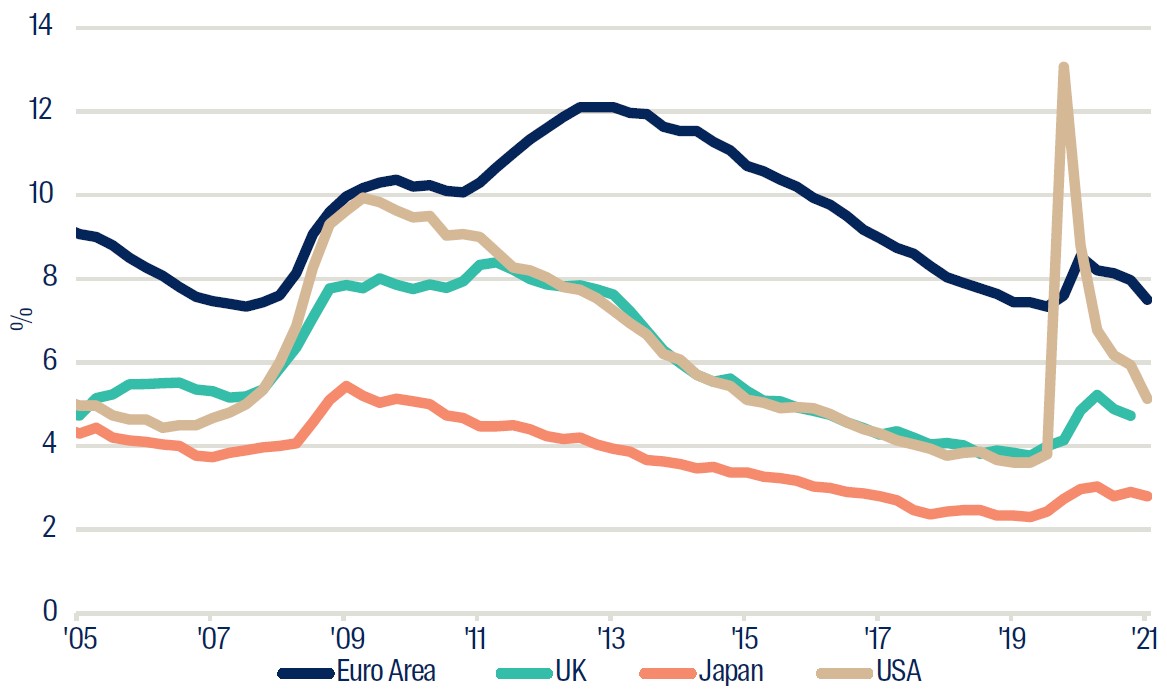

Labour shortage and mismatch

Although the removal of lockdown measures may allow people to return to work, a shortage in workers appears to be rippling through major markets. For example, there are signs in the US that even after the generous unemployment benefits have dried up, some are still choosing not to return to work. Instead, there is now a structural mismatch of skills and jobs. The rate of unemployment is falling, but the rate of participation is not moving proportionately. In turn, labour shortages are placing upward pressure on wages, only adding to higher-than-expected inflation concerns.

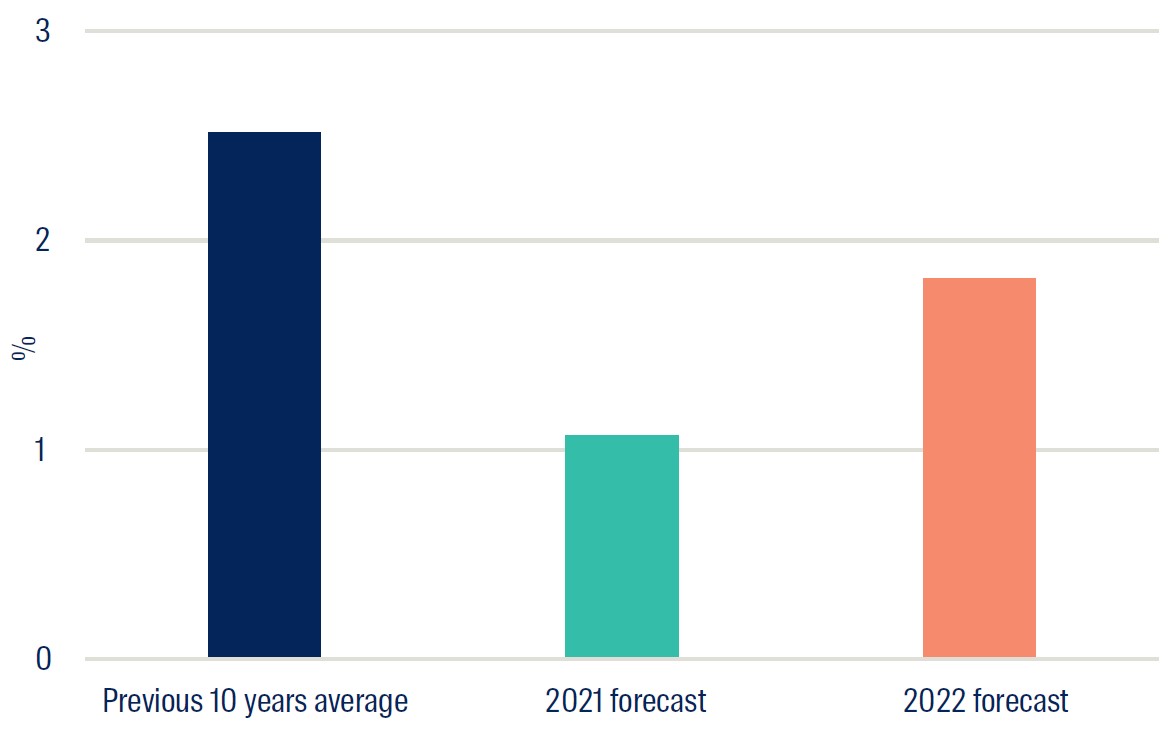

Figure 2: Unemployment

Source: OECD as at 31 December 2021

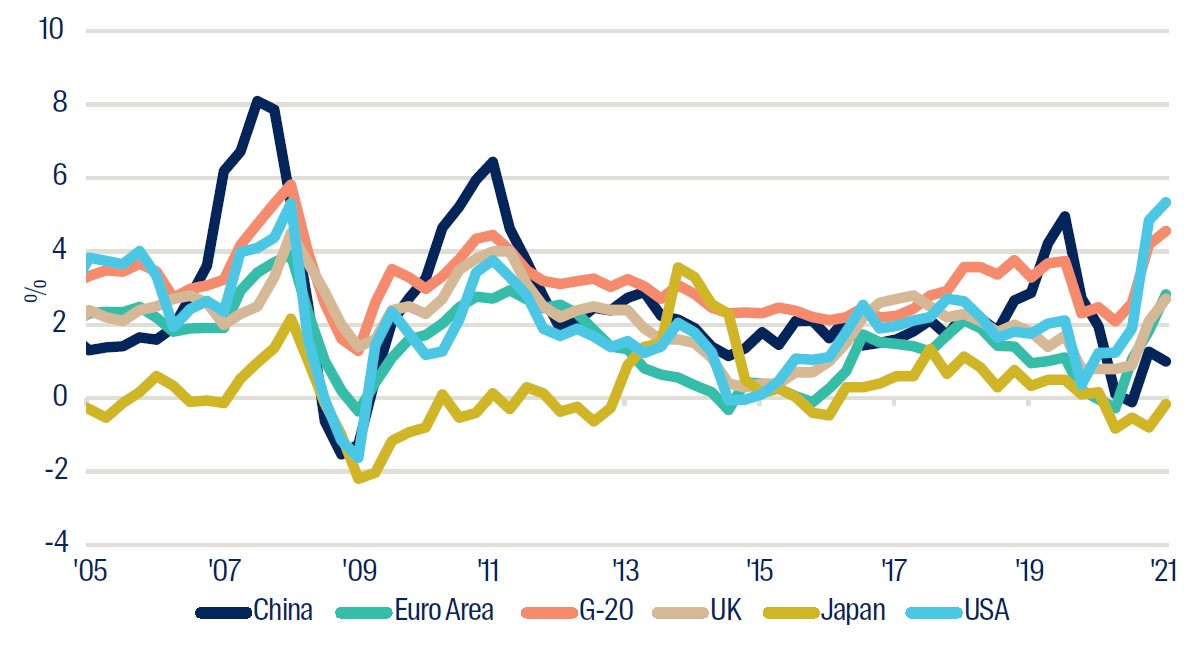

Is inflation becoming ‘persistently transitory’?

For most of 2021, policymakers have stuck to their ‘transitory’ narrative, but inflation readings are not falling into line quite yet. In the Euro area, inflation increased to 4.1% year-on-year in October, the highest since July 2008. While this could be partly attributed to pent-up demand after an extended lockdown, global supply chain distortions and the energy crisis are also contributing to rising prices. In fact, supply chain strains had been building up prior to the outbreak although this only accentuated the damage to global logistics networks. If protracted, this may indicate that higher-than-expected inflation may not be as transitory as policymakers proclaim, and these pressures are starting to bleed into consumer goods like food and energy.

Rising cost of inputs (shipping, energy, and wages)

At present, we have the added complexities such as the rising cost of shipping and soaring cost of energy. European gas prices, represented by the Dutch Natural Gas Futures Index, have increased by 377% over 2021. Although it has not yet hit the US as hard, gas prices have already risen by nearly 50% since the beginning of August and oil prices are trending higher. While energy, food, and the specific industries most impacted by supply chain disruptions (e.g. semiconductors) may see a reversion over the nearer term, wage increases are typically ‘sticky’ which means once wage inflation picks up due to labour shortage, it will likely persist. In other words, this ‘transitory’ spike in inflation may end up being uncomfortably high for a longer period of time, which would have major economic and financial market implications.

Figure 3: Inflation

Source: OECD as at 31 December 2021

Central bank reaction function

Tighten, or be tightened

It appears the great taper is underway and central bank are performing the ultimate balancing act by trying to keep loose policy while watching inflation become uncomfortably high. As the transitory narrative becomes harder to sell, rhetoric from policymakers has evolved. While central banks have indicated they are willing to let things ‘run hot’, it is evident now that rising inflation concerns are pushing some markets to rapidly bring forward tightening — or at least an end to the loosening. Many central banks have already started making such plans, and in some instances it appears that markets are beginning to lose patience — if policymakers’ guidance does not align with market conditions, then markets may price in tightening without them.

2022, the year of tapers and rate hikes

In the US, the Federal Open Market Committee (FOMC) announced at its November meeting that it will taper its asset purchases starting in November 2021, with expectations to finalise by June 2022. At the same time, Federal Reserve Chair Jerome Powell stressed that increases to the official interest rate were not up for consideration yet. Even so, consensus forecasts still suggest the Federal Funds rate will increase in 2022, albeit with a shift to September from June due to the slower pace of asset purchase tapering. The FOMC indicated that separating the asset purchase and interest rate decisions is an effort to prevent a repeat of 2013’s ‘taper tantrum’. Similarly, inflation pressures have pushed Bank of England officials to increase rates for the first time in three years, from the historic low of 0.1% to 0.25% in December 2021, sooner than originally expected.

Turbulent times in China

Several headlines have been emerging from China, as recent government policies appear to be disrupting certain sectors. While the country has eked out positive GDP growth readings in 2021, the momentum and size has been limited compared to history. To start with, China has had some of the harshest lockdown with their zero-Covid strategy. While this approach has moderated slightly with improving vaccination rates, the growing Omicron outbreak has triggered localised lockdown measures, which could hamper the nation’s full recovery if the spread continues or if measures are enduring.

More coal please

China was not immune to the global energy crisis either. In September, government officials had advised state-owned energy companies to secure energy supplies “at all costs”. As some residential areas faced blackouts, some regions were advised to restrict power to the industrial sector, which did not bode well for production activity and growth.

Regulatory crackdowns on tech giants

China made headlines for a government ‘crackdown’ on tech giants. While the focus was initially on Alibaba and its founder Jack Ma, Beijing proceeded to crack down on over 30 companies in its thriving tech sector. Prior to this, regulation on China’s tech sector was perceived to be relatively loose, which helped fuel its rapid growth. Since then, the regulator has intervened and blocked mergers, and these extreme policy swings have left investors wary.

Evergrande contagion in the real estate sector

The Evergrande debt crisis certainly raised some alarms in September. Evergrande is one of China’s largest real estate developers, but in recent years, the company’s level of debt has ballooned, raising investor alarm about cash flow issues, with the risk of default. After struggling for months to reduce its indebtedness, Evergrande finally defaulted on its bond repayments in December 2021. The real concern that ate away at investor risk sentiment was the risk of contagion through the country’s huge real estate sector, home prices as well as the economy. This has had a negative impact on economic activity, demonstrated by subdued purchasing managers’ index (PMI) readings coupled with the growing risk of ‘stagflation’ characteristics.

Figure 4: China - GDP Growth

Source: OECD, IMF as at 31 December 2021

Figure 5: China - Inflation

Source: OECD, IMF as at 31 December 2021

Outlook

In this bumpy road to global economic recovery, concerns around supply shortages, inflation and easing of monetary policy have been rising. Lockdown measures globally continue to tighten and ease in response to the evolving pandemic situation, though most populations grow increasingly fatigued. While Asia and emerging markets had lagged behind, rising vaccination rates are enabling mobility to improve and economies to increasingly reopen.

More hikes to rein in inflation

Towards the end of 2021, rhetoric around rising interest rates evolved from the ‘transitory’ inflation expectations — policymakers are keeping a close eye on inflation, and markets are starting to price this in. While unemployment has seen a recent improvement, the dip in participation has pushed wage growth higher. The Bank of England indicated that consumer price inflation could reach 5%, partly owing to the sharp increase in energy prices. If so, it would seem likely that a policy response would occur sooner rather than later. Similarly in the US, with supply disruptions likely to persist, some investors are anticipating two or three interest rate hikes in 2022.

Opportunities at hand, but not without considerable risks

Economic growth remains robust, despite a loss of momentum across some European nations. In most developed countries that have made significant vaccination progress, flash PMIs have been showing improvements. Despite supply constraints, consumer demand continues to see a significant uplift. While the Q3 earnings season has demonstrated that equities may have further to run, growing inflation signals a rising yield environment on the horizon which could induce investor caution. This may place pressure on equity valuations, but solid corporate balance sheets and substantial pent-up demand will remain supportive. The flexibility of objective-based strategies allows us to mitigate these risks relative to a static benchmarked asset allocation.

Important information

The information contained within this document is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. Neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this document.

This document has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this document without obtaining specific professional advice. The information in this document may not be reproduced in whole or in part or circulated without the prior consent of FSI. This document shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

In Hong Kong, this document is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this document is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors is a business name of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B) is a business division of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

Get the right experience for you

Your location :  Singapore

Singapore

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom