Trump’s second-term: Will inflation accelerate?

With Trump starting his second-term, concerns are resurfacing about the trajectory of inflation. Trump’s key campaign promises—deregulation, tariffs, and tax reforms—all signal a potentially more inflationary future. If inflation shows signs of spiraling out of control, it could challenge the Federal Reserve’s easing stance and broader economic stability.

While forecasting inflation remains inherently complex due to competing forces, we are cautiously optimistic. Given the already elevated levels of inflation, we do not anticipate a reacceleration, barring significant shocks to food or energy prices. Any further increases from current levels, however, could result in substantial market disruptions, potentially triggering a sell-off in risk assets.

A Look Back: The Drivers of Recent Inflation

Inflation surged as the global economy emerged from COVID-driven lockdowns. Supply chains seized up, unable to meet the surge in demand for goods, pushing prices upward.

Initially, many central bankers deemed the inflation spike "transitory," expecting it to subside as supply chains normalised. However, this assumption was upended by additional disruptions in early 2022, particularly due to the Russia-Ukraine war. Food and energy supply shortages exacerbated inflationary pressures, propelling U.S. headline inflation to a peak of 9%.

In response, the Fed embarked on aggressive monetary tightening, raising rates by 500 basis points between March 2022 and July 2023. This, combined with improved supply chain dynamics, helped cool goods inflation. However, core inflation remained stubbornly high, with the Consumer Price Index (CPI) tracking around 3% since August 2023.

Fed Policy Rate (%)

Source: Bloomberg, December 2024.

Sticky Components: What’s Keeping Inflation High?

A significant portion of the initial inflation surge was driven by non-core components, such as food and energy, which have since stabilised. However, core inflation—particularly in the services sector—has remained elevated. Core services account for roughly 60% of US CPI, with shelter1 being a substantial component.

Shelter Costs and Lagging Indicators

Contributions to US CPI, Year-on-Year YoY (%)

Source: Bloomberg, December 2024.

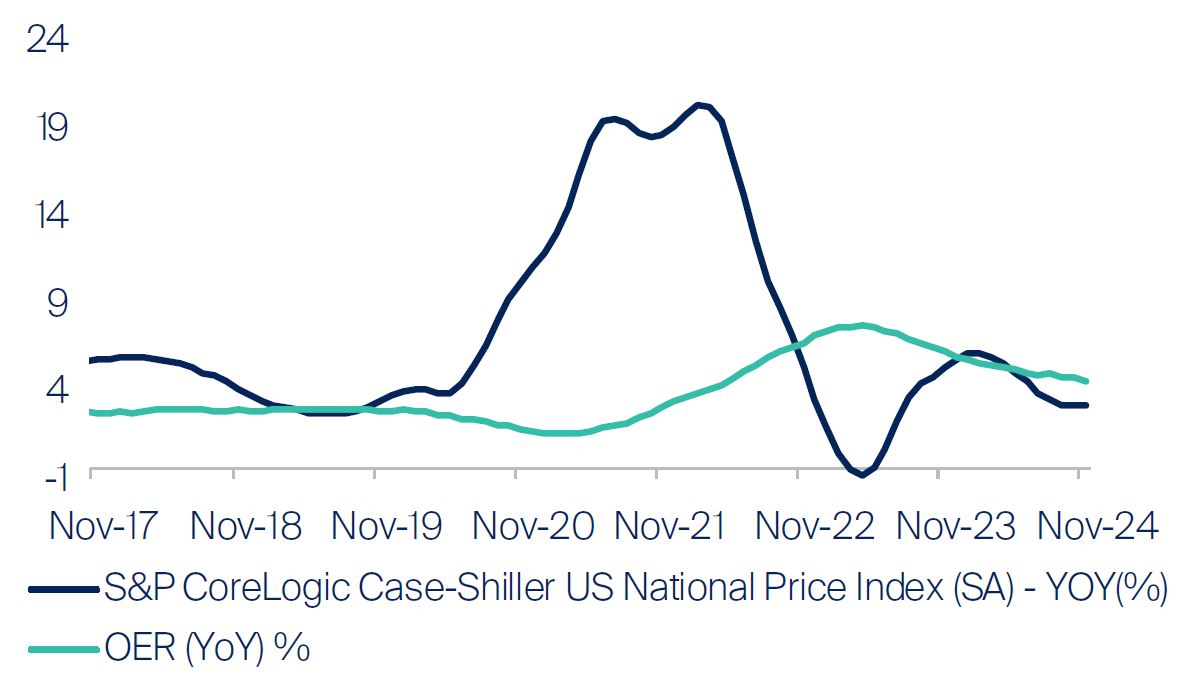

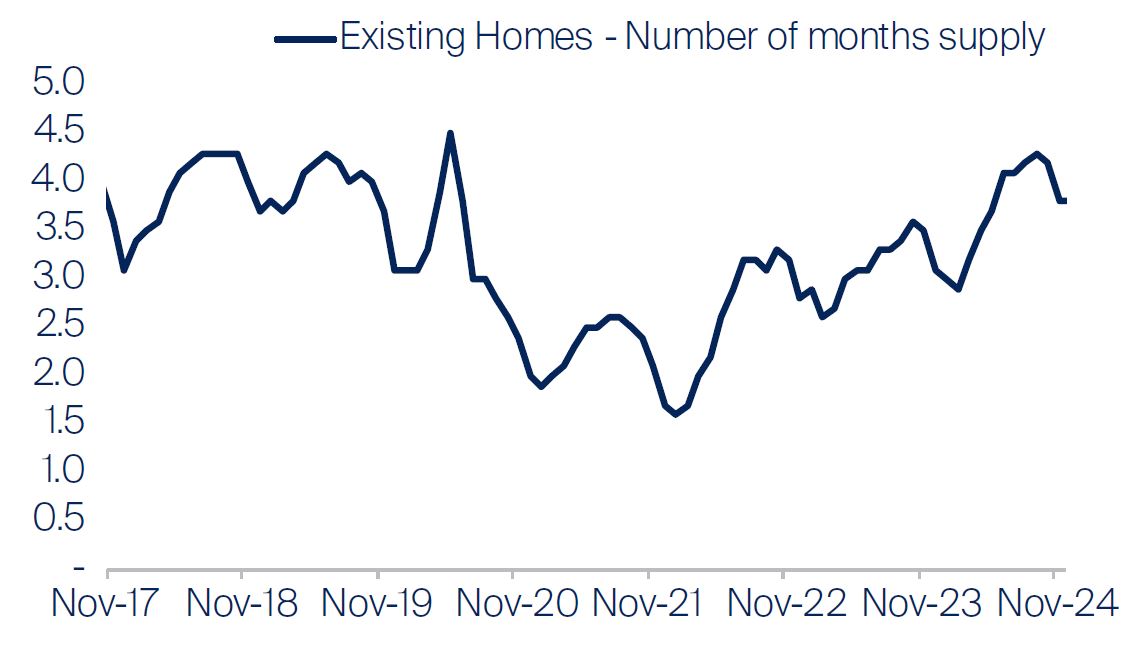

Further declines in shelter prices should pull inflation lower. Shelter, which includes the Owner’s Equivalent Rent (OER) metric, represents about 35% of the U.S. CPI. The OER, a survey-based measure, surged following post-COVID home price increases but has been slower to reflect the recent cooling of home price gains. Typically, the OER lags changes in home prices by approximately 14 months, and we expect the softening home market to come through in OER numbers.

Source: Bloomberg, October 2024.

High mortgage rates and limited new home construction post-COVID have exacerbated the demand-supply imbalance. Meanwhile, the rent component of shelter costs has remained elevated as post-COVID rental price increases continue to filter through the market.

Source: Bloomberg, November 2024.

Dampening Demand and Rising Unemployment

Lower consumer demand will also put a cap on further price increases. There is a limited runway for sustained consumer demand that is running on past savings As these savings dwindle, high prices are likely to weigh on future spending power, further tempering inflationary pressures. The increase in credit card delinquencies also suggest that consumer demand is in early stages of faltering, thus providing limited upside to how much higher prices can rise without breaking the economy.

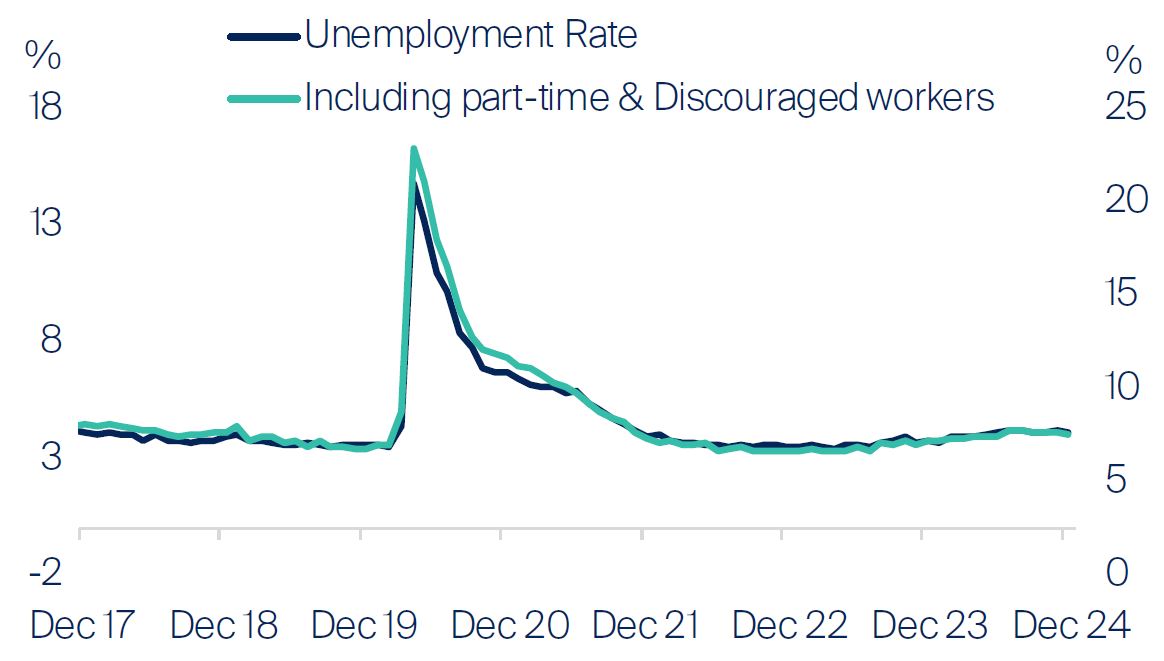

Additionally, unemployment rates have begun to creep higher, signaling emerging weaknesses in the labor market. As the Fed shifts its focus to labor market health, rising unemployment could amplify the effects of high living costs, even without additional inflationary pressures.

Source: Bloomberg, December 2024.

Source: Bloomberg, November 2024.

Implications for Asia: Growth Concerns and Divergence

In contrast to the U.S., Asian economies have enjoyed a relatively benign inflationary environment, allowing for a more tempered approach to monetary tightening. However, the region faces challenges from slowing global growth, particularly in export-oriented economies like Singapore, South Korea, and Taiwan. This slowdown stems not only from weaker Chinese demand but also from lackluster global consumption.

Despite these challenges, there are bright spots. Economies such as India, with strong domestic demand, are likely to outperform. Additionally, the ongoing tech upcycle offers resilience for certain Asian markets. As inflation moderates, we expect policy divergence among Asian central banks, with some easing rates alongside the Fed while others remain cautious.

Source: First Sentier Investors, January 2025

1 Shelter cost refers to the expenses associated with housing

Read our latest insights

Important Information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business divisions of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

Get the right experience for you

Your location :  Singapore

Singapore

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom