Net Zero initiatives are gathering pace. While moves to decarbonise the world’s economy are reducing the need for some infrastructure assets, they are underpinning strong structural growth for others.

This paper looks at the likely implications that these changes hold for the global listed infrastructure asset class.

We also describe how our investment approach aims to understand and assess the associated risks and opportunities, as we seek to harness them to benefit investors.

The United Nations 2015 Paris Agreement on climate change aims to limit the average global temperature increase to ‘well below 2° Celsius’. Achieving this means reducing carbon emissions to Net Zero (i.e. balancing the man-made greenhouse gases being added to the atmosphere with the amount being removed) in the second half of the 21st century.

Net Zero efforts are gathering positive momentum to meet this challenge. In June 2019, the UK set into law a target of being Net Zero by 2050 – the first major economy to do so. Several other European countries, along with Japan, South Korea and China have since set legally binding, mid-century, Net Zero targets. The European Commission plans to mobilise up to US$1 trillion to help make Europe climate neutral by 2050. After a four-year hiatus, the US is also ready to work towards making its economy carbon neutral by 2050.

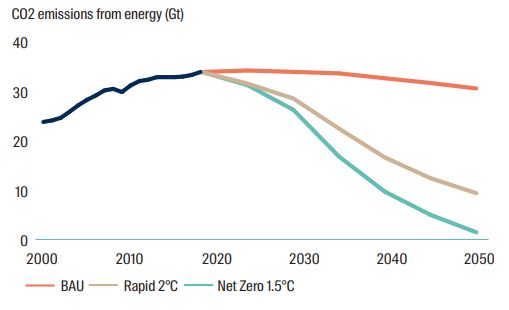

BP’s Energy Outlook 2020 considers these and other forces that are likely to shape the global energy system over coming decades, as moves to decarbonise drive large-scale changes. While at this stage we are all estimating what Net Zero might look like, BP has provided a useful set of scenarios against which we can compare our own analysis. Figure 1 illustrates the critical importance of hitting Net Zero targets.

Figure 1: CO2 emissions from energy & global energy demand

Source: First Sentier Investors, BP Energy Outlook as of 30 September 2020.

‘BAU – Business as usual’

Our forecasts are broadly consistent with the Net Zero or 1.5°C scenarios set out in the rest of this paper. We anticipate a sharp decline in coal usage, both for power generation, and later for other industrial processes. We expect a structural decline in oil demand of between 3% and 6% per year. We are more optimistic on the prospects for natural gas. Given the high cost and complexity of hydro or nuclear power, we believe the role of gas as a transition fuel should support continued growth until around 2030, to be followed by a structural decline of between 2% and 3% per year. We also anticipate continued strong growth in renewables. These assumptions, and their potential impact on global listed infrastructure, are discussed in more detail below.

Implications for listed infrastructure

It is hard to overstate the scale of the implications that these developments have for the global listed infrastructure opportunity set. The two largest sources of carbon are the electricity and transportation sectors. The consumption of fossil fuels by utilities to generate electricity accounts for between 30% and 40% of the world’s carbon emissions. Transportation (primarily cars and trucks) accounts for a further 15% to 20% of global emissions.

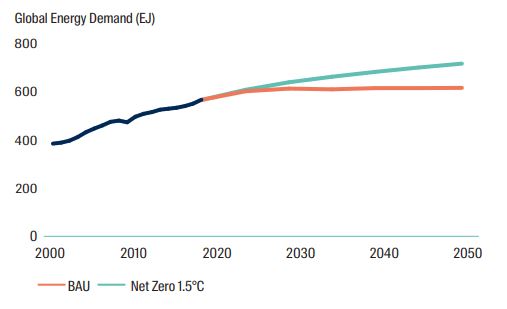

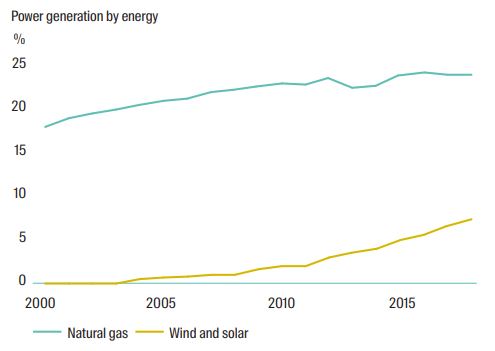

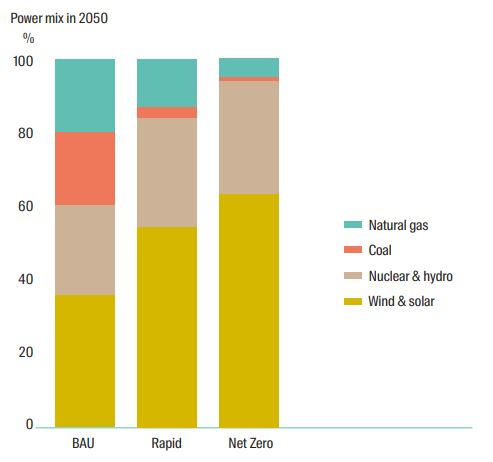

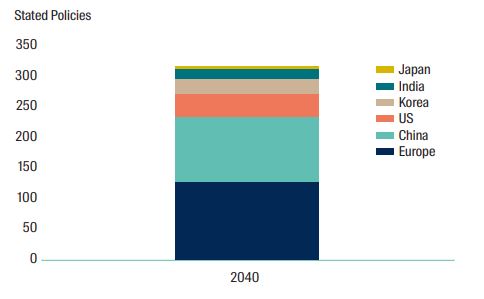

The changes required from these industries during the transition to a Net Zero world will bring some stranded asset risk – but also present substantial growth opportunities. Foremost amongst the sectors under threat, energy infrastructure faces an environment where oil demand may have already peaked. Volume levels for North American oil pipelines may now be in structural decline, albeit with some residual demand likely from the petro-chemical and aviation industries. Over the medium term, we expect that thermal coal will be eliminated from power generation (see Figure 2); followed later by the steel industry finding a replacement for metallurgical coal. These changes will affect utilities with generation capability, as well as freight rail companies with coal haulage segments.

Figure 2: Energy mix in 2050 – elimination of coal

Source: First Sentier Investors, BP Energy Outlook as of 30 September 2020.

Electric utilities

More positively, the large-scale replacement of conventional power stations with cheaper renewables will present substantial capex opportunities for many electric utilities over coming years. In the US, regulated utilities are typically allowed to recover costs and (importantly) earn a return on capital expenditure. Renewables build-out should therefore provide a steady source of earnings growth over long time frames, particularly for bigger utilities which benefit from economies of scale.

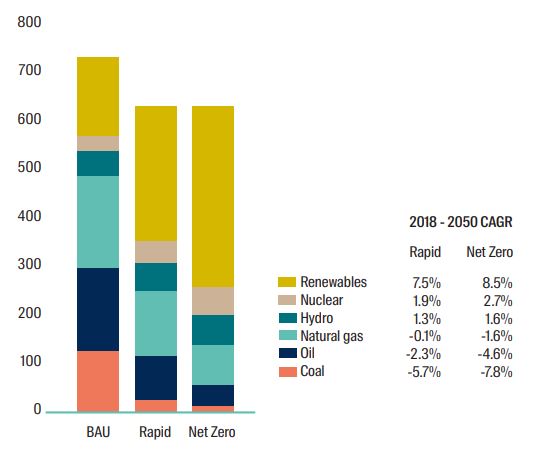

The process is already well under way. Cheap wind and solar power is being rolled out to replace uneconomic coal plants. Existing transmission grids are being expanded in order to connect new solar and wind farms with population centres where the energy is needed. The next leg of growth in wind and solar build-out is likely to be sparked by advances in battery storage technology (where cost curves are on a sharp downward trajectory) to combat renewables’ intermittency. Electric vehicles volumes reaching critical mass, likely later this decade or early in the next, will drive further material increases in electricity demand and further renewables build-out.

Figure 3: Growth of renewables in the energy mix

Source: First Sentier Investors, BP Energy Outlook as of 30 September 2020.

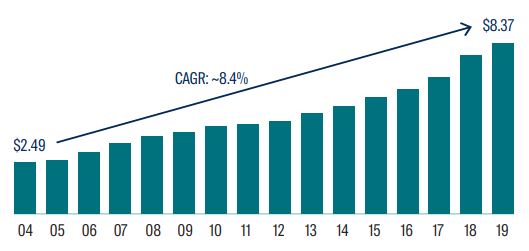

In the US, first-movers such as NextEra Energy (see Figure 4) and Xcel Energy are now being followed by other utilities seeking to reduce exposure to competitive power markets and achieve a more predictable earnings profile. Virginia’s Dominion Energy agreed in July 2020 to sell its natural gas transportation and storage assets; and has announced plans to invest up to US$43 billion in wind, solar and storage projects over the next 15 years. In the same month, Public Service Enterprise Group unveiled plans to sell its fossil fuel power plants and focus on earning regulated returns by helping its home state of New Jersey meet its clean energy goals, through grid modernization and investment in batteries and renewables. CenterPoint Energy, Entergy, Exelon and FirstEnergy are either already making material changes to move in this direction, or have firm plans to do so.

Figure 4: NextEra Energy – adjusted earnings per share

Source: NextEra Energy as of 31 December 2019.

Europe’s utility giants including Iberdrola (Spain), Enel (Italy), RWE (Germany), Ørsted (Denmark) and SSE (UK) have all announced plans to invest billions of dollars annually over coming years to develop and operate wind, solar and battery facilities. SSE provides a case study in positive change. Through plant closures, asset divestments and renewables investment the company has transformed from a traditional, fossil-fuel heavy, integrated utility to focus on regulated electricity networks and renewables. SSE is on-track to reduce carbon intensity by 60% and treble renewable energy output by 2030.

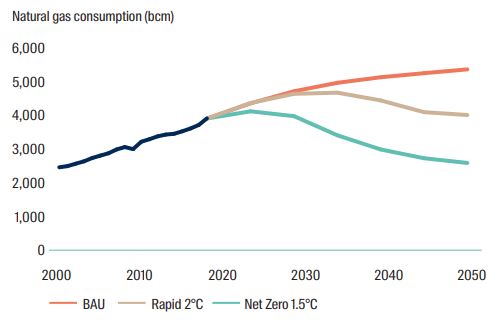

Complementing these changes, natural gas (see Figure 5) is likely to remain a key transition fuel with continued growth over the next decade. Gas-fired power plants can supply energy quickly at times of high demand. They provide a flexible way to mitigate renewables’ intermittency until battery storage technology catches up, at which point we expect a long-term decline in demand will begin. Even then, some countries (Japan) or regions (US northeast) will rely in part on natural gas, owing to a lack of renewable resources. Other sources of reliable power – nuclear and hydro projects – remain expensive and usually require large government subsidies. Natural gas is a sensible way to ‘keep the lights on and the bills low’.

Figure 5: Natural gas consumption to 2050 (bcm)

Source: First Sentier Investors, BP Energy Outlook as of 30 September 2020.

Big oil

A further indication of the structural nature of this shift is illustrated by the way that many of the world’s largest oil companies – while not part of the listed infrastructure opportunity set – are progressively positioning themselves for this energy transition. On the face of it, growing competition from large, well-resourced entities including BP, Royal Dutch Shell and Total could represent a competitive threat.

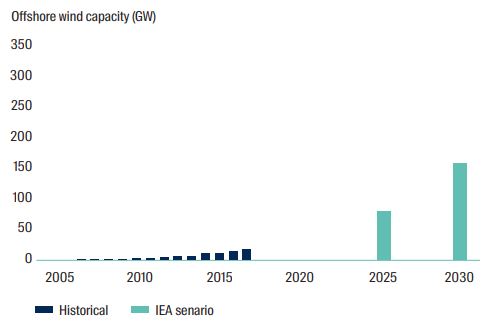

However, we believe on balance that this is good news for established operators in this space. Given their existing skill-set, we expect Big Oil to focus on large-scale, complex projects like offshore wind and hydrogen facilities. Capital investment will drive down unit costs and reinforce the economics for hard-to-abate industries. Further, oil majors may be willing buyers of existing projects from utilities – at premium valuation multiples. Pilot programs and joint ventures with utilities could also evolve into big M&A deals over time.

Figure 6: Global growth in offshore wind capacity (GW)

Source: First Sentier Investors, IEA reports as of 30 September 2020.

ESG considerations for investors

Our team has always believed that Environmental, Social and Governance (ESG) factors are significant performance drivers for infrastructure companies. We seek to reflect this in the way we invest. Rather than being used as a screening tool, ESG considerations are fully incorporated into our investment process, in order to consistently identify and understand the risks and opportunities. ESG-related criteria we consider include Environmental, Social, Governance, Board, Alignment of Interests, and Disruption. All else being equal, we would need to see additional potential upside in order to invest (if at all) in stocks with weakness in these areas.

We believe that our responsibility as active investors – and the most effective way to drive positive change – is to consistently engage on these issues with the companies we analyse and invest in. Regular company meetings, both with management teams and a range of stakeholders, competitors and suppliers provide us with insights into the direction a company is taking in relation to ESG issues. In addition, we believe that the development of datasets and benchmarks such as the GLIO/GRESB ESG Index series will help investors and companies better understand issues to be addressed and the importance of public disclosure and transparency. These tools combined will also allow us to hold a company accountable to its targets and to encourage additional action.

This emphasis in our approach has proven valuable in the light of recent developments. From an Environmental perspective, it is clear that companies moving towards Net Zero can benefit from a rich source of long term, low risk earnings growth.

While less immediately obvious, Net Zero also has important Social and Governance implications. On the Social side, it is important for infrastructure companies to consider all stakeholders – staff, community, customers, suppliers and regulators – if they want to maximise long-term returns to shareholders. Infrastructure companies operate from privileged positions.

This often comes with the expectation that they will do the right thing by the society they are serving, rather than pursuing profits at any cost. Mounting public support for action on climate change means that companies are increasingly expected to demonstrate that they are part of the solution. Failure to do so can lead to questions over the company’s social licence to operate, or result in to sub-optimal regulatory outcomes.

From a Governance point of view, company boards have a fiduciary duty to address this issue. Net Zero has direct implications for stranded asset risk, as well as regulatory risk and political risk – key considerations for infrastructure companies and investors. And this is before factoring in the opportunity cost of not getting involved. To be part of this change, to raise earnings growth rates from 4% to 6% or 8% per annum, and to re-rate from a discount to a premium stock, utilities cannot afford to ignore Net Zero, and they must move quickly.

Conclusion

Net Zero represents a structural shift that is fundamentally changing the global listed infrastructure universe. Detailed analysis of ESG factors can help investors navigate this fundamental shift in the investment landscape. Net Zero assumptions are reflected in our team’s thinking, company research, scenario analysis and portfolio construction decisions. Any change of this scale comes with some level of risk. Pleasingly, as we go through this process, we also see substantial opportunities for companies taking a responsible approach.

While we consider climate change and the resulting build-out of renewables to be the most material ESG-related topic for listed infrastructure currently, sustainability is much broader than this. Self-driving vehicles, increasing urbanisation and advances in big data are all likely to have serious implications for the asset class. It is important to factor ESG considerations into all of these themes. Doing so is not just a risk mitigator – it can also be a substantial source of positive investment returns.

Important Information

This material is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should conduct your own due diligence and consider your individual investment needs, objectives and financial situation and read the relevant offering documents for details including the risk factors disclosure. Any person who acts upon, or changes their investment position in reliance on, the information contained in these materials does so entirely at their own risk.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication but the information contained in the material may be subject to change thereafter without notice. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Investors.

Past performance is not indicative of future performance. All investment involves risks and the value of investments and the income from them may go down as well as up and you may not get back your original investment. Actual outcomes or results may differ materially from those discussed. Readers must not place undue reliance on forward-looking statements as there is no certainty that conditions current at the time of publication will continue.

References to specific securities (if any) are included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Any securities referenced may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

References to comparative benchmarks or indices (if any) are for illustrative and comparison purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities) that are different from the funds managed by First Sentier Investors.

Selling restrictions

Not all First Sentier Investors products are available in all jurisdictions.

This material is neither directed at nor intended to be accessed by persons resident in, or citizens of any country, or types or categories of individual where to allow such access would be unlawful or where it would require any registration, filing, application for any licence or approval or other steps to be taken by First Sentier Investors in order to comply with local laws or regulatory requirements in such country.

This material is intended for ‘professional clients’ (as defined by the UK Financial Conduct Authority, or under MiFID II), ‘wholesale clients’ (as defined under the Corporations Act 2001 (Cth) or Financial Markets Conduct Act 2013 (New Zealand) and ‘professional’ and ‘institutional’ investors as may be defined in the jurisdiction in which the material is received, including Hong Kong, Singapore and the United States, and should not be relied upon by or be passed to other persons.

The First Sentier Investors funds referenced in these materials are not registered for sale in the United States and this document is not an offer for sale of funds to US persons (as such term is used in Regulation S promulgated under the 1933 Act). Fund-specific information has been provided to illustrate First Sentier Investors’ expertise in the strategy. Differences between fund-specific constraints or fees and those of a similarly managed mandate would affect performance results.

About First Sentier Investors

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Investors, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group (MUFG). Certain of our investment teams operate under the trading names FSSA Investment Managers, Stewart Investors and Realindex Investments, all of which are part of the First Sentier Investors group.

This material may not be copied or reproduced in whole or in part, and in any form or by any means circulated without the prior written consent of First Sentier Investors.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Limited, authorised and regulated in Australia bythe Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311)

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Investors is a business name of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors (registration number 53236800B) is a business division of First Sentier Investors (Singapore).

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Investors Group

Get the right experience for you

Your location :  Singapore

Singapore

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom