When First Sentier Investors updated our responsible investment (RI) policy two years ago, we knew it wouldn’t be a ‘set and forget’ task. The policy includes a mechanism to be reviewed at least every two years - but two years is a long time in the ESG world, and our latest review led to a number of important updates to the policy and its underlying approach.

The background

In 2020, First Sentier Investors undertook a comprehensive review of our existing policy suite and developed a single policy which built on and improved our approach, the Global Responsible Investment and Stewardship Principles and Policy (“the policy”).

The document articulates our approach to RI and what it means to us, and includes a set of guiding principles for investment team members as well as specific commitments in relation to ESG integration, corporate engagement, proxy voting and investment screens. Through this policy we communicate our approach to systemic issues such as climate change, natural capital and biodiversity, human rights and modern slavery, and diversity.

The policy was approved by the RI Steering Group in April 2020 following extensive consultation with the ESG Impacts Committee and other stakeholders in the business, and we felt proud that what we had achieved was market leading.

The rationale for change

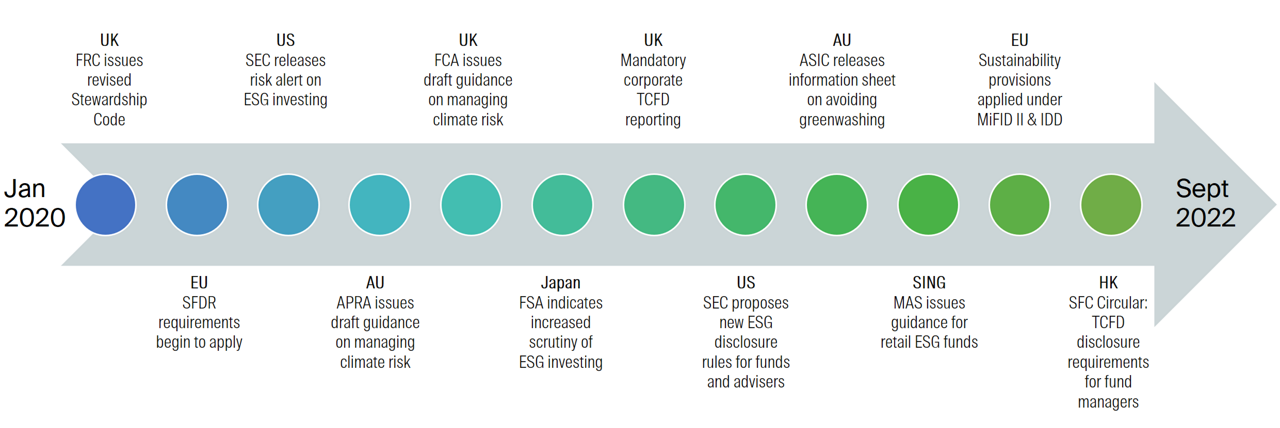

The pace of regulatory change in ESG investment has been rapid, and we have seen different focuses and requirements in different countries. Stewardship codes and industry frameworks have evolved. There has been a strong focus on preventing greenwashing, and at the same time, investors have taken further steps to quantify and measure the contribution they are making to sustainable development.

Figure 1: Regulatory Change Timeline, Source: FSI, July 2022

For this reason, when we began the process of updating our policy in early 2021, we decided to make significant changes rather than cosmetic ones.

What has changed?

As part of this process we tried to answer the question: ‘what makes a good RI policy?’.

We also identified that there was a lot of positive RI activity, but some of it was not documented or codified. As such, we found that we needed to get really clear on topics including:

- Our methods of engagement: engagement means different things to different people, and we wanted to be clear about the expectation for meaningful, ongoing engagement.

- How engagement is prioritised: given the varying nature of the asset classes we manage, the geographies in which they operate and the size of our holdings, this looks different for different teams, but we wanted to be clear on the factors that are taken into account when prioritising and determining the scope of engagement activities.

- What standards (regulations, codes and guidance) we were implementing: there is a growing list of standards that relate to and inform our RI activities, which we felt was important to recognise.

- Remuneration of investment team members: integrating ESG risks and opportunities into the investment process has been integrated (either implicitly or explicitly) into our remuneration framework for some time, but we are trying to be more transparent about this.

- How we monitor companies on an ongoing basis for ESG risks and opportunities: as we mentioned, nothing about RI is ‘set and forget’, especially the risks and opportunities faced by the companies we invest in, and we felt we needed to be explicit about this.

The outcome

At the end of the process, we had mapped out a framework of what we think best practice looks like. This thinking is captured below.

RI policy components

What does best practice look like?

Scope

Covers all investment professionals, as well as other departments as relevant.

Regulatory requirements or industry codes

References relevant regulatory requirements or industry codes the firm is subject to or seeks to comply with.

Governance

| Organisational structure & oversight | References the key governance structures, including reporting lines and in respect of committees, membership, responsibilities and meeting frequencies. |

| Resourcing & training | Outlines what RI training is provided and to whom. |

| Conflicts of interest | Comprehensively outlines the approach to managing conflicts of interest. |

Policy principles

| ESG considerations | Defines and identifies the approach to identifying ESG risks and opportunities and systemic ESG issues. |

| Position statements | States the firm’s position on key ESG issues of concern. |

ESG integration

| General approach | Included under ‘What RI & Stewardship means to us’ section |

| Exclusions | Articulates a framework for when and why the firm will introduce exclusions, and clearly explains any current exclusions. A list of excluded stocks meeting these requirements should be made publicly available. |

Active ownership

| General approach | Included under ‘What RI & Stewardship means to us’ section |

| Engagement | References:

|

| Voting | References:

|

| Policy advocacy and collaboration | Articulates the position on policy advocacy and industry collaboration, when the firm will engage and on what topics. |

| Monitoring and reporting | Articulates how progress will be monitored and reported in a structured & comprehensive way. |

| Transparency | Provides detail of transparency related commitments, including details of reporting and how often it is updated/provided. |

| Oversight | Provides detail on any oversight of the processes outlined above. |

| Remuneration | Clearly articulates the link between ESG and remuneration, how this applies and to whom. |

| Review | Has a minimum review period of 2 years, which in reality may not be often enough when there are changes in the market. |

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM), which forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. This material is intended to provide general information to ‘wholesale clients’ (as defined in the Financial Markets Conduct Act 2013) only. It is not intended and may not be provided or passed on to individuals who qualify as ‘retail clients’ (as defined in the Financial Markets Conduct Act 2013). This material does not take into account the objectives, financial situation or needs of any particular person or institution.

Any opinions expressed in this material are the opinions of the individual author at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individual authors within First Sentier Investors.

To the extent permitted by law, no liability is accepted by MUFG, FSI AIM nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that FSI AIM believes to be accurate and reliable, however neither MUFG, FSI AIM nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI AIM.

Any performance information is gross performance and does not take into account any ongoing fees. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Investors

All rights reserved.

Get the right experience for you

Your location :  New Zealand

New Zealand

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom