Energy midstream – running with the bulls

We met many energy midstream management teams at an industry conference in West Palm Beach. Energy midstream remains in an earnings upgrade cycle as US energy exports accelerate while domestic demand remains robust. The key differences to this US energy cycle are:

- supply has been constrained as publically-listed E&P companies remain focused on free cash generation

- quantifying the degree to which the US industry will grow its market share globally at the expense of Russia is imprecise and

- midstream Balance Sheets are very healthy.

New investment is mostly occurring in the energy-friendly states of Texas and Louisiana while new pipelines in US northeast and Midwest remain politically challenged. Investment is most focused on Liquefied Natural Gas (LNG) export facilities, with listed infrastructure companies accounting for 70% of US LNG export capacity today. We expect both brownfield and greenfield LNG export projects to be developed over the next decade. In May 2022 alone, new LNG export agreements were signed with German, Polish, French, Malaysian and Korean off-takers. This export drive will also lead to additional midstream infrastructure investments that will be needed to feed the LNG facilities: gathering, processing, storage and transportation opportunities to abound. This will mainly occur in the cost-competitive, lightly regulated Permian and Haynesville basins. In addition, many firms are looking at net zero related investment opportunities, such as carbon capture and storage (CCS) and hydrogen facilities along the US Gulf Coast.

We believe the US has a global competitive advantage in hydrocarbons owing to its abundance of low cost reserves, large pool of skilled labour, access to cheap financial capital and a stable political / legal framework. This makes US energy midstream very well positioned to dominate European and Asian import needs over the next two decades as well as lead the next generation of net zero related projects.

Sempra’s Cameron LNG export terminal

Source: Sempra

Utilities & renewables – decarbonisation driving earnings

We met over 30 US utilities and renewable energy management teams at investment conferences in New York and Miami. Utilities are focused on accelerating resiliency, safety, transmission and renewable energy investment opportunities while navigating the challenges of solar supply chain disruptions and large customer bill increases during an election year.

The electrification of the US economy with carbon free energy is driving increased investment opportunities for the sector. This is translating into higher earnings growth rates for US electric utilities.

Over the last year we have seen many utilities increase Earnings Per Share (EPS) growth expectations from between 4% and 6% pa to between 5% and 7% pa1, including industry giants Southern Company, Duke Energy and Consolidated Edison2. This investment-driven higher earnings growth shows no sign of slowing down. Over the next 12 months we believe DTE Energy, WEC Energy, Eversource Energy, Entergy and Xcel Energy are all likely to increase their forecast growth rates.

The only area where we saw investment delays was in solar panels, owing to the Department of Commerce’s current Antidumping and Countervailing Duties investigation. This, combined with stretched global supply chains, is causing delays, deferrals and cost increases to solar related investments across the US. This in turn may delay the closure of coal plants owing to grid reliability issues – an outcome clearly at odds with the Biden administration’s climate goals.

Site tour of Entergy’s Waterford 3 nuclear plant

Source: First Sentier Investors

Lastly, a summer of discontent is arriving for US utility customers as they face bill increases of between 20% and 40%, mainly due to higher natural gas costs. The next step will be to see how many (and which) politicians take a populist approach to this issue, by attacking the utilities rather than the underlying geopolitical and supply side causes. We believe customer bill increases of this scale will heighten political and regulatory risk for US utilities. That said, the extent of interference should still be materially lower than the energy price caps and windfall profit taxes seen in Europe.

Railroads – pricing very strong vs mixed volume outlook

In Boston we met with railroads, the Surface Transportation Board (regulator), trucking companies and ports. The positive pricing environment was reinforced, with higher fuel and labour costs putting more pressure on trucks than on railroads. This is allowing railroads to more than cover their cost inflation, thus improving their competitive position relative to trucking.

Source: Company reports, First Sentier Investors

Data from the St. Louis Federal Reserve, illustrated in the following chart, also shows that the trucking sector is bearing the brunt of rising costs in the transportation sector.

Source: First Sentier Investors, Federal Reserve Bank of St. Louis. As at April 2022.

The railroad management teams we spoke to were all consistent in their message that demand is still outpacing supply and they expect strong second half volume growth of between 3% and 5%. This demand is not only consumer driven, but also reflects high commodity prices supporting volumes for grain, coal, potash and fertiliser. Haulage in these segments represents over half of railroads’ earnings. Although the railroads are confident about strong volumes in the second half of the year, financial markets (and we) are more cautious given a likely slowing economic growth rate as the year progresses.

The biggest feeders into US railroads are the Ports of Los Angeles (LA) / Long Beach, which together handle over 50% of all imports from Asia into the US. Management discussed how ports on the US West Coast are losing market share not just to Canada and Mexico, but also to the US East Coast ports. This structural trend is positive for eastern railroads (CSX and Norfolk Southern) but negative for western railroads (Union Pacific and BNSF).

Around 30% of the Port of LA’s volumes go direct to rail, to be transported to Chicago, Memphis and Dallas. Once rail service metrics improve, there will be renewed focus on growing this 30% direct to rail segment, to help improve congestion at the port. One train can take 300 trucks off the road. We left Boston with the belief that railroads are very well positioned to take market share from trucks over the next three to five years.

Waste management – greening of a dirty industry

We then spent a grueling couple of days in Las Vegas at Waste Expo 2022, meeting with the management teams of both privately owned and publicly listed waste management companies, as well as visiting landfill and recycling assets. Sentiment was positive as management teams described this as the best pricing environment they have ever seen for the industry. Companies were confident that positive pricing trends can accelerate into the second half of the year and into 2023. Companies are increasing prices at between 6% and 7%, comfortably offsetting their cost inflation of between 4% and 5%. While inflation remains an issue, these companies can pass price increases on to their customers due to inflation-linked contracts and a consolidated industry structure (i.e. regional oligopolies).

Volume growth (currently running at between 2% and 3% pa) is above the long-term trend due to COVID recovery, new business activity and bolt-on M&A activity. With waste management being an essential service, volumes are inelastic to price and relatively immune from the economic cycle. While volumes could slow in the second half of this year as the economy softens, this is not a material earnings driver for this sector.

Waste management companies are expanding the development of Renewable Natural Gas (RNG) and recycling projects. We expect these opportunities to become a larger part of their business mix going forward. Both activities have environmental benefits with landfill RNG being a carbon neutral energy source and recycling contributing towards a circular economy. As large generators of methane from their landfill assets, waste companies now have an opportunity to create an earnings stream by capturing this potent greenhouse gas. This is a customer-driven initiative, as the move towards net zero makes these landfill gas-to-energy assets more valuable. RNG and recycling centers are less capital intensive than traditional landfill assets, with attractive returns on invested capital.

Asset tour of recycling plant in Boston

Source: First Sentier Investors

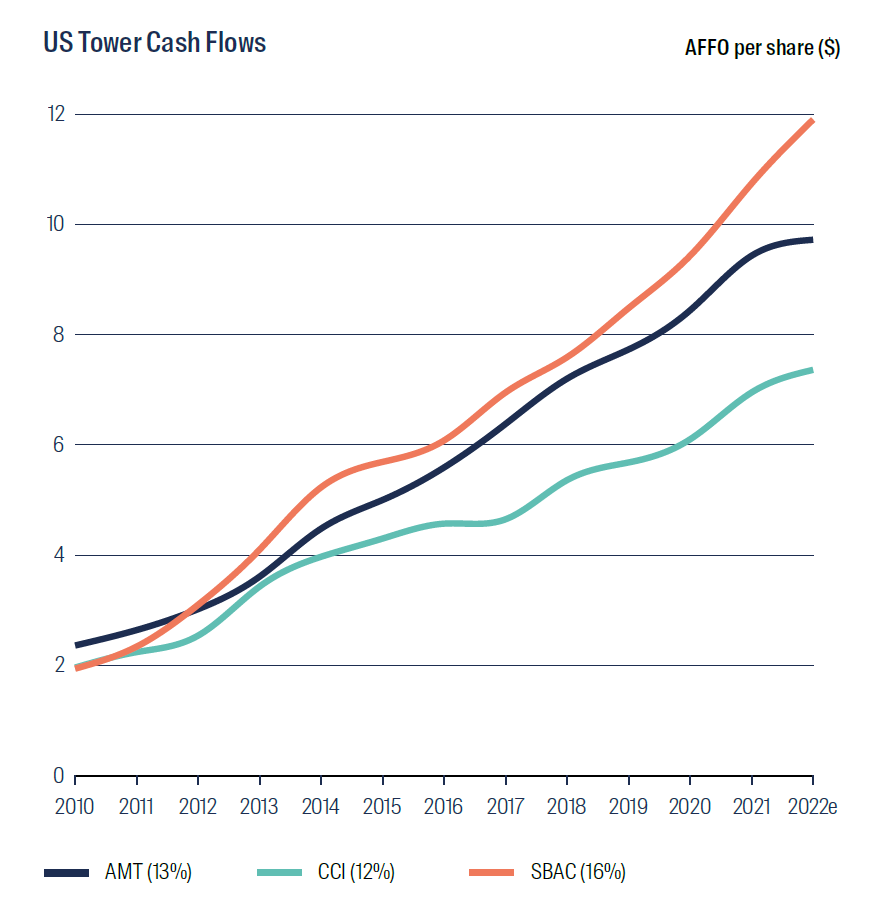

Wireless Towers – recession proof

We met US industry giants American Tower in Boston and SBA Communications in Boca Raton. Wireless tower telecom customers’ (Verizon, AT&T, T-Mobile and DISH) growth in network spending is being driven by higher video and data usage requiring higher network density, plus the accelerating rollout of 5G technology. Rates of spending growth varies by customer, with T-Mobile leading and AT&T lagging.

The rollout of 5G technology, contracted price increases of 3% pa, and improving tenants per tower should provide a robust non-cyclical revenue growth of ~6% pa over the next 3 to 5 years, partly offset by higher rates of customer churn. This, combined with 70% of operating costs being fixed or with price escalators of less than 3% pa, helps to protect profits from inflation.

Source: First Sentier Investors, company reports

Sustainability – new green growth opportunities

A common theme across all listed infrastructure sub-sectors we met with was a notable increase in investment opportunities related to sustainability, as US corporates are being encouraged by the investment community to improve their environmental credentials and decarbonisation efforts. For listed infrastructure, this is creating the next wave of investment opportunities, both in new areas like RNG, CCS and hydrogen; and via expanding opportunities for existing areas such as renewable energy, recycling and railroads.

Republic Services’ fully electric truck

Source: First Sentier Investors

In many meetings we heard corporate customers increasingly considering lower emissions as part of their infrastructure buying decisions. Examples included:

- railroads preferred to trucking competition due to lower carbon emissions,

- carbon free renewable Power Purchase Agreements,

- RNG blended into natural gas streams for utility or corporate use to reduce their carbon footprint,

- carbon neutral natural gas pipelines, and

- utilising electric trucks.

Source: DT Midstream

Conclusion

Listed infrastructure is well positioned to navigate the dual challenges of high inflation and slowing economic growth. Be it through regulated returns, regional oligopoly industry structures or contracted pricing, this asset class is successfully passing on inflation to the end customer and protecting earnings. This, combined with structural and sustainability-related investment opportunities, provide the asset class with earnings growth that is relatively inflation protected.

1 Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon First Sentier Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and First Sentier Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

2 For illustrative purposes only. Reference to the names of each company mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of First Sentier Investors.

Important Information

This material is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should consider, with the assistance of a financial advisor, your individual investment needs, objectives and financial situation.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material and we do not undertake to update it in future if circumstances change.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Investors.

About First Sentier Investors

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Investors, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group. Certain of our investment teams operate under the trading names FSSA Investment Managers, Stewart Investors and Realindex Investments, all of which are part of the First Sentier Investors group.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Limited, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311)

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188)

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Investors is a business name of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors (registration number 53236800B) is a business division of First Sentier Investors (Singapore).

- Japan by First Sentier Investors (Japan) Limited, authorised and regulated by the Financial Service Agency (Director of Kanto Local Finance Bureau (Registered Financial Institutions) No.2611)

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

- United States by First Sentier Investors (US) LLC, authorised and regulated by the Securities Exchange Commission (RIA 801-93167)

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Investors Group

Get the right experience for you

Your location :  New Zealand

New Zealand

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom