American Listed Infrastructure (ALI) has seen a significant increase in Merger and Acquisition (M&A) activity. Private market and foreign corporate buyers are paying premiums of 25% to listed markets, often for non-controlling stakes. This M&A illustrates the intrinsic value available to investors in the ALI asset class. We expect M&A will continue for a number of years. This will deleverage balance sheets, reduce equity needs and recycle capital from non-core to core activities, thereby raising the quality of the ALI asset class.

Merger and Acquisition (M&A) activity in the American Listed Infrastructure (ALI) asset class has accelerated sharply over the past nine months as the world awakens from the COVID recession.

We believe the ALI asset class has many positive investment characteristics, and offers investors the potential of attractive risk-adjusted returns. The United States (US) infrastructure market offers, in our opinion, attractive returns on capital deployed. These returns are protected by listed infrastructure assets typically exhibiting higher barriers to entry and strong pricing power.

This market offers the ability to significantly increase capital deployed from the replacement of aged infrastructure and large structural growth opportunities1. This potential for attractive returns and robust growth occurs in a low risk environment (pro-market, business friendly operating setting, light-handed regulatory regimes, and strong property rights), with the tailwinds of robust economic and population growth.

These above mentioned factors, combined with low interest rates, high corporate confidence and attractive listed market valuations for infrastructure, have resulted in a spate of M&A activity in the ALI asset class. We would classify the buyers of these ALI assets as belonging to one of three broad categories:

(1) Private market investors

(2) Foreign corporates attracted to the US market, and

(3) US companies involved in corporate restructuring or industry consolidation.

The following paper explores each of these three categories and looks at future potential M&A opportunities within ALI.

Private market investors

The largest buyers of ALI assets over the past nine months have been private market investors including pension funds, sovereign wealth funds and private market (unlisted) infrastructure funds. These private market players are from the US, Canada and Asia-Pacific.

In December 2020, Transurban announced it had sold a 50% shareholding in its Greater Washington Area toll roads to a consortium of Australian and Canadian pension funds for $2.8 billion. This was followed in January 2021 when Singapore’s sovereign wealth fund, GIC, acquired a 20% stake in Duke Energy’s Indiana electric utility for $2 billion. In February 2021, Kinder Morgan and Brookfield Infrastructure Partners sold a 25% stake in their jointly owned Natural Gas Pipeline Company of America (NGPL) to ArcLight Capital Partners for $0.8 billion.

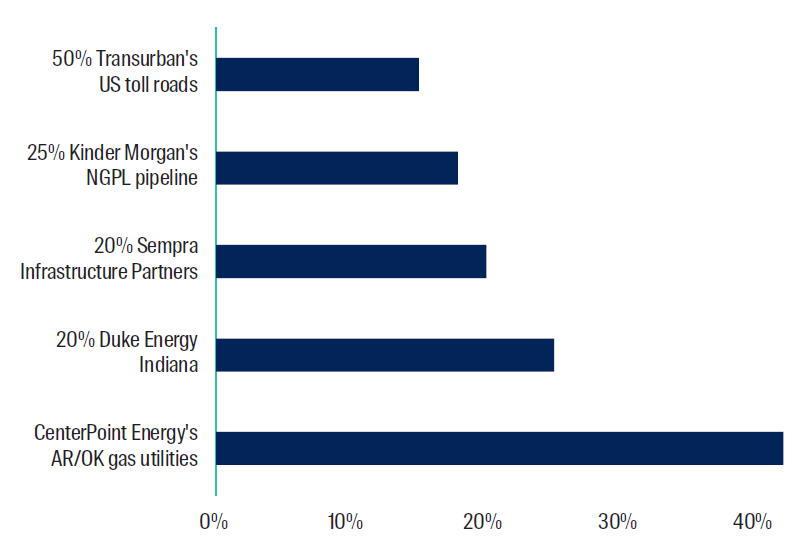

In early April 2021 Sempra Energy sold a 20% shareholding in its Sempra Infrastructure Partners (SIP)2 division for $3.4 billion to alternative asset management giant KKR. Late April saw CenterPoint Energy sell its Arkansas and Oklahoma natural gas utilities to Summit Utilities (owned by JP Morgan Infrastructure) for the monster price of $1.7 billion. This equated to 2.5x rate base or 38x earnings! There were 17 bidders for this asset. Public Service Enterprise Group sold its 467MW solar generation portfolio to US private infrastructure firm LS Power in May 2020. The transaction price was not disclosed. Private market investors often defend takeover multiples on the grounds of paying a control premium. However, four of these six acquisitions were for non-controlling stakes, with three of the six being relatively small minority positions. We estimate these private market buyers paid an average premium of 24% to listed market valuations.

Premium paid relative to listed market valuation

Source: Company announcements, First Sentier Investors estimates

These transactions added value for ALI shareholders by reducing these companies’ cost of capital, and avoiding dilutive equity issuances. They have also provided supportive data points, confirming valuations well above those ascribed by listed markets to these assets.

Foreign corporates

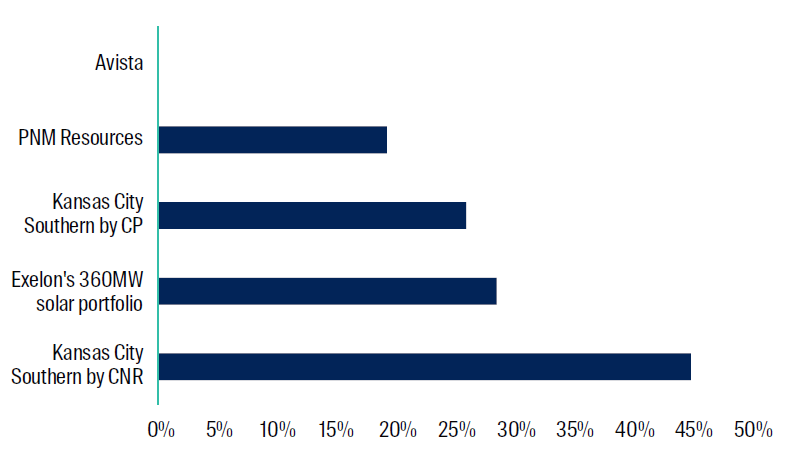

The second group of buyers of ALI assets over the last nine months has been foreign corporates. These acquirers are attracted to ALI’s strong renewable energy resources, robust economic growth and large investment opportunities which are generally not available in their home markets. In October 2020, renewables-rich electric utility, PNM Resources, agreed to be acquired by Spanish-based global clean energy giant Iberdrola for $8 billion.

The Public Sector Pension Investment Board of Canada (PSP) disclosed in November 2020 that it had built a stake in US electric and gas utility Avista Corp. In February 2021 PSP disclosed that it had increased this stake to 7.5%. This buying activity has contributed to strong outperformance of Avista Corp’s share price over this time period.

US electric and gas utility Exelon Corp divested its 360MW solar generation portfolio in December 2020 to Canadian based real assets manager, Brookfield. The sale price was $0.8 billion or $2,250/kW. March 2021 saw US railroad Kansas City Southern receive a takeover bid from Canadian Pacific Railway, which was swiftly followed in April by an even higher bid from Canadian National Railway. These two Canadian railroads are attempting to create a truly integrated North American railroad system linking Canada, the US and Mexico.

These five acquisitions demonstrate the value of ALI assets to foreign companies. We estimate these buyers paid an average premium to listed market prices of 24% (or 30% if you exclude the Avista Corp transaction, which was acquired on-market).

Premium paid relative to listed market valuation3

Source: Company announcements

Each of these five transactions have resulted in positive share price performances for ALI companies. Suits on the ground research at Kansas City Southern

Source: First Sentier Investors

US corporate restructuring and industry consolidation

The third group of buyers of ALI assets over the last nine months has been US corporates seeking to restructure their existing businesses or to consolidate an industry. These M&A transactions are motivated by the prospect of improving operational efficiencies, enhancing new revenue opportunities, streamlining existing businesses and lowering companies’ cost of capital.

In January 2021, UGI Corp (UGI) acquired West Virginia-based Mountaineer Gas Company for $0.5 billion. January also saw electric and gas utilities CenterPoint Energy and OGE Corp divest their stakes in ENABLE Midstream Partners (ENABLE) to Energy Transfer (ET) for ~$2.5 billion. This corporate restructuring simplified and focused both utilities while ET can integrate the ENABLE pipeline system into its network and extract operating synergies.

February saw UGI acquire the Pine Run natural gas gathering pipeline system from PennEnergy Resources for $0.2 billion. UGI will integrate this pipeline system into its existing assets in the Marcellus Shale. This transaction is an example of exploration and production companies restructuring themselves to focus on their core business and divesting their infrastructure assets to focused players like UGI.

In March 2021, US electric utility PPL Corp (PPL) acquired the Narragansett Electric Company in Rhode Island for $3.8 billion. We believe PPL will be able to reduce costs, improve operations and develop better regulatory relationships than the existing foreign owner, who has a poor track record in the US market. These corporate restructuring and industry consolidation M&A transactions all led to strong share price performances for the ALI companies involved.

Potential future M&A opportunities

While the last nine months have been a busy M&A period for ALI, we do not expect things to slow down for the remainder of 2021. We believe M&A will remain at elevated levels in the ALI space due to:

(1) low interest rates

(2) high levels of corporate confidence

(3) multiple willing sellers of assets

(4) many foreign corporates eager to expand into the US infrastructure market

(5) large amounts of unallocated private market infrastructure capital and

(6) the discount to intrinsic value the ALI asset class continues to trade at.

On the willing sellers, we believe US utilities American Electric Power, FirstEnergy, NiSource, Entergy and Exelon Corp are exploring the potential sale of stakes in various subsidiary companies. Likewise we view energy midstream companies as sellers of minority stakes in different assets, given the material pricing disconnect between public and private markets.

On the willing buyers, many global listed infrastructure firms, including but not limited to Ørsted, ENEL, SSE plc, APA Group, Vinci, Atlantia, Tokyo Gas and Osaka Gas have stated corporate strategies to expand into the US market. With the exception of offshore wind, these expansions are almost always via M&A rather than greenfield investment.

Conclusion

The ALI asset class has many highly attractive attributes and continues to trade at a large discount to what private market, foreign and US corporates are prepared to pay. While the last nine months have seen significant amounts of M&A in this space we believe more activity will occur throughout 2021. We believe investing directly in the ALI asset class provides investors with attractive risk adjusted returns at prices well below valuation levels being paid by multiple sets of diverse acquirers from around the globe.

Overseas buyer liked renewables rich PNM Resources

Source: Company Sustainability Portal March 2020.

1 Structural growth investment opportunities include renewable energy, electrification of transportation, mobile communications, reducing urban congestion, data centers, recycling and intermodal freight rail.

2 This division consists of the Cameron LNG Export facility in the US and Mexican natural gas pipelines, LNG and renewable energy assets. For illustrative purposes only. Reference to the names of each company mentioned in this communication is merely for explaining the investment strategy, and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of First Sentier Investors.

3 Premiums are disclosed in companies’ press releases on day of announcement. PNM Resources and Canadian Pacific are based on 30-day VWAP, Canadian National is based on premium to close of day before Canadian Pacific’s announcement. For Exelon’s solar assets, we estimate the listed market valuation of solar at $1,750/kw.

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (Author). The Author forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for the Author is available from First Sentier Investors on its website.

This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. Any opinions expressed in this material are the opinions of the Author only and are subject to change without notice. Such opinions are not a recommendation to hold, purchase or sell a particular financial product and may not include all of the information needed to make an investment decision in relation to such a financial product.

To the extent permitted by law, no liability is accepted by MUFG, the Author nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that the Author believes to be accurate and reliable, however neither the Author, MUFG, nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of the Author.

Get the right experience for you

Your location :  New Zealand

New Zealand

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom