- The demand environment for toll roads and airports remains strong, with pent-up demand continuing to flow and resilience expected in a downturn.

- Operating leverage in toll roads should come to the fore as toll escalators linked to inflation more than offset rising costs.

- The sector is finding a pathway to decarbonise infrastructure through next-gen construction materials and techniques.

I have just returned from two weeks on the road visiting toll road and airport companies across Europe, Mexico and the US1. The mood throughout was one of cautious optimism, with both general economic activity and airport/toll road volumes proving more resilient than expected. It was clear that in the face of the rising cost of living, people are prioritising the opportunity to escape for a holiday. Whilst there are still very clear and apparent risks ahead for the global economy, it is positive to see the transport sector holding up well.

We continue to view toll roads favourably, owing to historic traffic resilience in a recession environment. Their light cost structure is providing strong operating leverage as inflation escalators are applied to tolls, and as volumes continue to surprise to the upside.

Within the airports sector, we prefer leisure-orientated airports with a strong network of airlines, particularly low cost carriers. These airlines are best positioned to lower fares in the face of potentially weakening demand later in 2023, providing support to traffic volumes if needed.

Figure 1: Madrid - touring Aena’s Madrid-Barajas Airport

Source: First Sentier Investors.

Sun and snow

Demand has remained strong across airports and toll roads globally, with little to no sign of deterioration in demand despite the uncertain economic outlook and significant cost of living pressures.

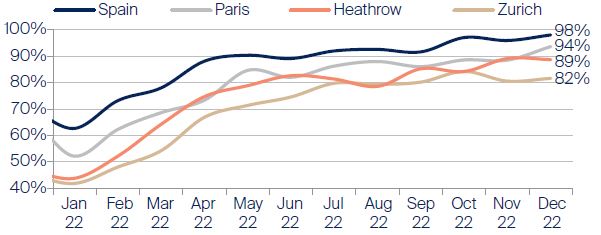

Figure 2: European passenger traffic vs. 2019

Source: Company data, First Sentier Investors as at 31 December 2022.

Significant increases in airfares have not slowed the recovery as many had anticipated, with keen demand continuing despite ticket pricing being up 10-25% compared to 2019 levels. These increases can be attributed to a combination of higher fuel costs and constrained capacity post-COVID. We anticipate that these factors will normalise over the next few years.

Figure 3: Airfares vs. 2019 pricing

US Airlines: pax. revenue per revenue seat mile, Europe/Mexico: ticket revenue per pax. Source: Company data, First Sentier Investors as at 31 December 2022.

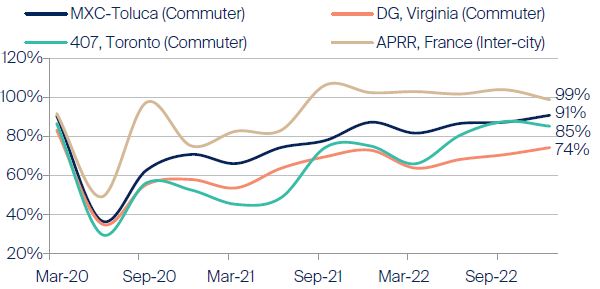

Toll roads have similarly seen resilient traffic flows, particularly those which handle inter-city rather than commuter traffic. During summer 2022, Vinci’s 3,200km Autoroutes du Sud de la France (ASF) road network in the southwest of France saw strong demand stemming from leisure travel to regional France as well as to Spain. More recently, the Autoroutes Paris-Rhin-Rhone (APRR) network in the southeast of France has seen strong demand from travel to the ski fields in the French Alps over winter.

Figure 4: Dallas - skipping the morning rush on a tour of Ferrovial’s Managed Lanes with management

Source: First Sentier Investors.

Low cost but flying high

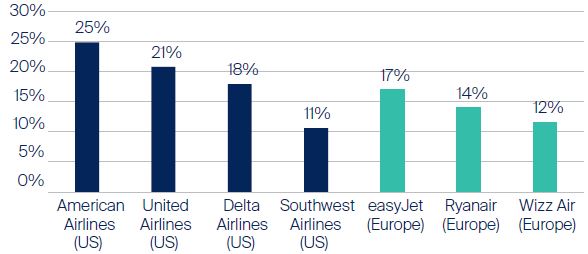

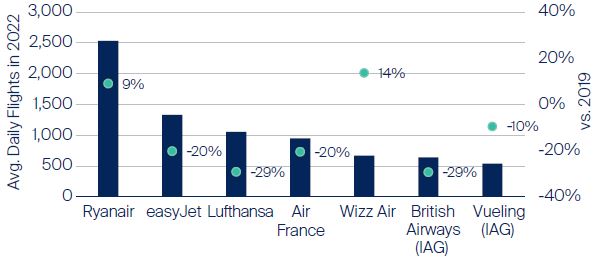

We believe there is a clear structural advantage in leisure- orientated airports that are supported by a strong network of low cost carrier (LCC) airlines. The strong growth trajectory of LCCs relative to other airlines was evident in the years leading up to the pandemic and has accelerated further during the recovery. The following chart illustrates the recovery rates of various European airlines in 2022.

Figure 5: A Low Cost Carrier (LCC) led recovery

Source: Company data & First Sentier Investors. Data as at 31 December 2022.

The term low cost carrier (LCC) refers to airlines that typically market more affordable unbundled or ‘no-frills’ airfares. Notable LCCs include Ryanair and easyJet in Europe, Southwest and Spirit Airlines in the US, and Volaris and Viva Aerobus in Mexico. Full service carriers (FSC) are airlines that offer a higher standard, bundled service (such as included baggage and food). Examples of FSCs are American and United Airlines in the US, Lufthansa and British Airways in Europe, and Aeroméxico in Mexico.

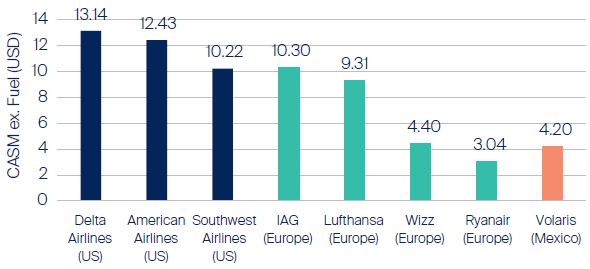

LCCs are structured to achieve extremely low operating costs per seat, providing maximum operating leverage for each additional seat sold. This structure, plus their robust balance sheets relative to FSCs, allows them to be more dynamic in their pricing to respond to changes in demand via what airlines call ‘fare stimulation’ (i.e. lowering prices).

Conversely, FSCs remain constrained by highly leveraged balance sheets (including COVID State Aid repayment obligations) and lower capacity growth owing to more limited fleet investment.

Figure 6: LCCs have significantly lower cost structures

IAG & Lufthansa based on USD exchange rate as at 30 September 2022.

Source: Company data, First Sentier Investors as at 30 September 2022.

For an airport, changes in ticket pricing have no impact on the landing/terminal charges they charge the airline, nor on the opportunity to extract retail spending from the passengers — essentially a win-win.

Aena, the operator of 46 airports in Spain, has an extremely strong collection of LCCs servicing its airports. 21% of 2022 traffic came from the benchmark LCC, Ryanair, while IAG’s low cost subsidiary Vueling and their Spanish subsidiary Iberia accounted for 17% and 12% of traffic respectively. We believe this fare stimulation capability bodes well for traffic in the event of an economic slowdown and pressure on disposable incomes, providing an element of protection on the downside for Aena.

Figure 7: Cancun - checking out the duty free at a very busy Cancun Airport with company management

Source: First Sentier Investors.

Inflation insulation

Higher inflation has been the key concern for investors over the course of 2022 and heading into 2023, with clear implications from both a macroeconomic perspective as well as the resulting pressure on operating costs. We remain positive on the inflation protection benefits of toll road operators. Inflation-linked tolling frameworks are providing protection from the operating and interest expense increases that are now flowing through from elevated inflation and the tightening of monetary policy throughout much of the world.

Figure 8: Texas – the busy control room at Ferrovial’s Texas Managed Lanes

Source: First Sentier Investors.

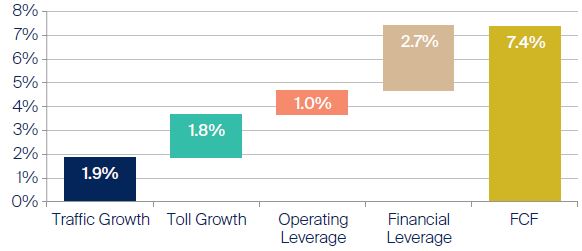

The following chart highlights the operating leverage benefits of toll roads, using the historical free cash flow (FCF)2 drivers at Vinci’s ASF toll road business in France. This emphasises how the fixed cost dilution (i.e. operating leverage) from toll and traffic growth contributed an additional 1% to the total 7.4% growth in FCF.

Figure 9: ASF free cash flow growth drivers (2004-19 CAGR3)

Source: Vinci/ASF, First Sentier Investors. Data as at 31 December 2022.

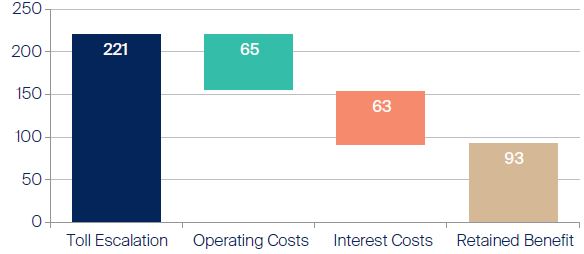

Whilst increasing interest rates will be a headwind, the fixed and long-dated debt of toll road balance sheets such as ASF’s provides protection from the increases in short-term rates. This allows the toll roads to generate additional free cash flow from toll increases in the near term, as illustrated below.

Figure 10: 2023 estimated ASF benefit (EUR Millions)

Source: Vinci/ASF, First Sentier Investors. Data as at 31 December 2022 & FSI estimates.

Low carbon construction

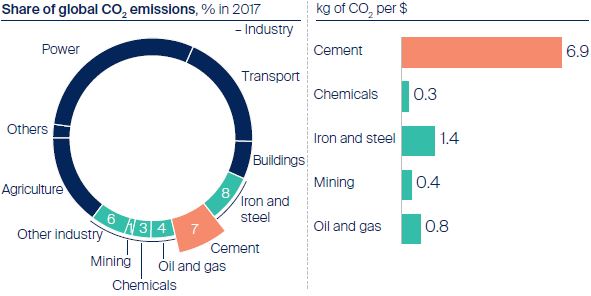

The most carbon intensive phase of the lifecycle of transport infrastructure is typically the construction phase, where projects require significant amounts of materials such as concrete, steel and bitumen. Recent meetings with the Environmental, Social and Governance (ESG) teams at toll road companies Vinci and Transurban have highlighted for me the progress that is being made on the pathway to decarbonise the construction process. The development of low-carbon, next generation construction materials is particularly noteworthy.

Figure 11: Sydney - Transurban’s new M4-M8 Link Tunnel

Source: First Sentier Investors.

Concrete accounts for 7%4 of the world’s greenhouse gas emissions, driven by the energy intensive process of creating the cement that binds the aggregate and sand together to create concrete. To decarbonise this process Vinci has worked to find a substitute for the main cement ingredient, clinker, using the residual slag from blast furnaces used in steel production. By substituting this ingredient Vinci has been able to produce concrete with 70% less CO2 emissions than traditional forms.

Figure12: Sources of CO2 emissions

Exhibit 1 from “Laying the foundation for zero-carbon cement’”, May 2020, McKinsey & Company, www.mckinsey.com. Copyright (c) 2022 McKinsey & Company. All rights reserved. Reprinted by permission.

Asphalt is another key material, used not only in the initial construction phase but also as part of ongoing maintenance, with both road and runway surfaces typically replaced every 10-15 years. Asphalt originates as a by-product of the oil refining process, a process that requires significant heat for the separation of the gasoline and asphalt components of the oil. Vinci has been working to increase the recyclability of existing asphalt pavements to limit its dependence on new bitumen production. This includes delivering the world’s first fully recycled road, with 1km of the A10 motorway in Northern France resurfaced using 100% recycled asphalt aggregates. This reduced emissions from the resurfacing works by 50%.

Asset Deep-Dive: Mexico City to Toluca Toll Road

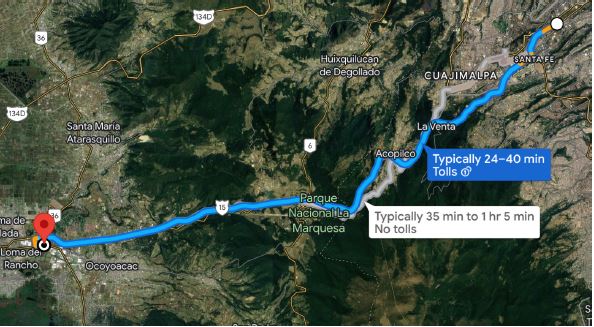

Mexican toll road company, PINFRA, owns and operates the Mexico to Toluca toll road via a 60-year concession ending in 2049. The 31km road serves as a key link between Mexico City’s key business district of Santa Fe and the urban centre of Toluca to the east. This is a very important asset for PINFRA, accounting for ~18% of the group’s earnings5.

Figure 13: Mexico City - touring PINFRA’s toll road to Toluca

Source: First Sentier Investors.

The road serves the large commuter population who live in the more affordable Toluca region and then commute to work or study in Mexico City. As a result, the road has a high share of light vehicles, which we estimate at ~85% of total traffic. The toll road saves ~30-40 minutes in typical morning and evening traffic relative to the free alternative (~25 mins vs. ~1 hour). The road surface is on par with any toll road I have visited around the world, providing a smoother driving experience for motorists relative to the aging free road.

Figure 14: A key link between for Mexico City

Source: Google Maps.

While the road has suffered from both a new competing road to the north as well as the impacts of work-from-home, the strong growth from people relocating to the region from Mexico City has offset some of these impacts. The asset also benefits from a variable concession end date, whereby the concession has a set 12% annualised real return cap. If this return is realised before 2049 the concession is returned to the grantor early. However, as a result of COVID impacts, the concession duration effectively extends owing to the lower returns during the period. The trade-off to this is that the returns are capped on the upside.

Figure 15: Toll road traffic recovery (vs. 2019 levels)

Source: Company data, First Sentier Investors as at 31 December 2022.

The road faces the prospect of competition from a new interurban train line that runs directly alongside and in some instances above the toll road. The 58km and 105bn peso ($5.4bn) rail project has faced significant delays (originally scheduled for completion in 2018) and cost escalation (+284%). We expect bus passengers who currently use the free road will switch to the train once it opens in 2024. This will likely lead to small traffic losses (~5%) owing to the secondary effect of there being less congestion on the free alternative route.

Figure 16: Slow progress on the Mexico City-Toluca train

Source: First Sentier Investors.

The Mexico City to Toluca toll road is a high quality asset, with capacity for continued traffic growth as the catchment area continues to grow around it. Fundamentally, we believe PINFRA is one of the most mispriced toll roads in our investment universe. The company offers strong growth potential and optionality from continued improvement and expansion of its road networks.

1 For illustrative purposes only. Not all of these companies are necessarily owned by First Sentier Investments. Any fund or stock mentioned in this presentation does not constitute any offer or inducement to enter into any investment activity nor is it a recommendation to purchase or sell any security.

2 The cash a company generates, less the cash outflows that support its operations and maintain its capital assets.

3 Compound Annual Growth Rate

4 McKinsey, May 2020

5 Earnings Before Interest Tax Depreciation and Amortisation

Source: Company data, First Sentier Investors, as of 31 January 2023.

Important information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors is a business name of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B) is a business division of First Sentier Investors (Singapore).

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Investors Group

Get the right experience for you

Your location :  Hong Kong

Hong Kong

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom