Mergers and acquisitions activity within the global listed infrastructure asset class has been strong in 2025 and looks set to continue.

Transactions have been driven by industry consolidation, private market acquisitions of public market assets and low‑cost funding opportunities for listed companies.

We estimate that these M&A transactions were carried out at an average premium of 43% to the undisturbed share price/valuation, rewarding global listed infrastructure investors.

Mergers and acquisitions (M&A) activity in the global listed infrastructure asset class has been strong in 2025. This has been driven by three major themes:

- industry consolidation

- private market acquisitions of public market assets, and

- low‑cost funding opportunities for global listed infrastructure companies.

This paper reviews each of these themes in detail, analyses the premiums paid and discusses the outlook for M&A in the global listed infrastructure sector as we move into 2026.

Industry consolidation

The first major M&A theme for global listed infrastructure in 2025 has been industry consolidation. This has been led by Union Pacific’s $72 billion1 takeover offer for Norfolk Southern at a 25% premium to its undisturbed share price.2 This transaction will create the first transcontinental railroad in the US, delivering faster transit times, single‑line freight service, reliability improvements, increased asset utilisation and greater velocity as well as cost efficiencies. We believe there is a high probability of government approval, given the current administration’s pro‑business stance and the merger’s alignment with “America First” politics.

Union Pacific and Norfolk Southern networks

Source: Union Pacific as at September 2025

Increasing investment needs within the electricity utility sector have been a catalyst for several M&A transactions. US utilities Black Hills Corp and NorthWestern Energy recently announced a merger to create a $7.8 billion utility with higher earnings growth potential (the Earnings Per Share compound annual growth rate is forecast to increase from 4–6% to 5–7%). The transaction will also make it easier for the combined entity to meet the data centre‑driven demand for electricity currently seen in the US Mid‑Continent.

US natural gas utility Spire Inc has recently acquired Nashville’s gas utility for $2.5 billion (at 1.8x rate base or 24x Price/ Earnings [P/E]) from Duke Energy. This transaction is among a growing trend of utilities with both electric and natural gas assets divesting their gas utilities to focus on the higher growth, electric segments of their business.

In the airports space, Brazilian infrastructure conglomerate Motiva Infraestrutura de Mobilidade is in the final stages of divesting its portfolio of 20 Latin American airports for around $2 billion. The most likely acquirers of these assets are existing global listed infrastructure airport operators from both Europe and Mexico.

In China, natural gas utility ENN Energy received a takeover bid from its parent company, ENN Natural Gas. This bid was priced at a 51% premium to its stock price. This transaction was driven by a continued weak operating environment, which forced the parent company to simplify its corporate structure, increase the integration of its different business segments and rationalise costs.

Lower energy prices and a slower growth outlook for Natural Gas Liquids (NGLs) have seen North American energy midstream companies Keyera, Kinder Morgan and ONEOK Inc each acquire assets that will help them to rationalise, optimise and consolidate their existing energy transportation and storage footprints.

Private market acquisitions

The second major M&A theme of 2025 for global listed infrastructure has been private market investors acquiring public companies (or their assets).

The year started with Canadian pension fund CDPQ bidding $2.1 billion for Innergex Renewable Energy’s portfolio of hydro, wind, solar and BESS assets in Canada, US, France and Chile. The acquisition price was at a 58% premium to the listed market or ~11.8x EV/EBITDA3. This transaction occurred as listed markets aggressively sold off renewable energy assets, following the election of President Trump.

In March, Blackstone Infrastructure made a $6.5 billion bid for US electric utility TXNM Energy at a 23% premium to its share price. This equated to multiples of 1.7x rate base or 18x P/E. TXNM believes that this bid fairly recognised the value of its existing business, and that a private market owner would be better able to finance its significant future capital investment program.

In July, TIL Group (a consortium consisting of BlackRock’s Global Infrastructure Partners, GIC and MSC) acquired the Altamira port in Mexico from listed toll road operator PINFRA for $800 million. The price equates to around 20x EV/EBITDA; a significant premium to listed market valuations of between 6x and 10x.

Port of Altamira – Mexico

Source: Mexico Business News as at September 2025

Late July saw US listed digital infrastructure company Crown Castle sell its fibre and small cells businesses to EQT (and related companies) for $8.5 billion. This sale price was at the lower end of market expectations of $8 billion to $10 billion. These assets have been serial underperformers with Crown Castle unable to achieve attractive investment returns.

Also in July, Bloomberg reported that US renewable energy developer AES Corp was “exploring strategic options including a potential sale” after it had received takeover interest from large investment firms. Nothing has progressed publicly since. However, we believe there is a reasonable probability that AES Corp will either divest assets to private market participants, or accept a “take‑private” bid, given the decline in renewable energy developers’ share prices over the last 12 months.

In August, private equity firm KKR signed a non‑binding letter of intent with Californian‑based utility Sempra to increase its stake (currently 20%) in Sempra Infrastructure, its Liquefied Natural Gas (LNG) business segment. Financial markets generally expect KKR to pay around 12–13x EV/EBITDA, which is a 20–30% premium over comparable listed LNG companies like Cheniere Energy. The benefits to Sempra from this transaction would be to reduce the conglomerate discount in its share price, improve its credit quality, reduce business risk and achieve price discovery on these complex, long‑dated assets.

August also saw mobile tower company SBA Communications sell its portfolio of 500 Canadian cell towers to CVC DIF for around $320 million. This equated to an adjusted funds from operations (AFFO) multiple of “mid‑to‑upper twenties”, a strong outcome.

Low‑cost financing options

The third major M&A theme for global listed infrastructure in 2025 has been low‑cost financing options. The capital‑intensive nature of infrastructure means companies need to raise new equity to fund new investments. A rough rule of thumb is that between 30 and 40 cents of new equity is needed for every extra $1 of investment. As investment needs have increased – particularly related to rising electricity demand – global listed infrastructure companies have sought to divest assets or non‑core minority shareholdings to fund the equity portion of their expanded investment plans. The high prices achieved by these sales provide the selling companies with a lower cost of financing than would have been achieved by issuing new equity to the market.

January saw American Electric Power (AEP) divest a 20% shareholding in part of its electric transmission business to KKR and Canadian pension plan PSP Investments for $2.8 billion. This price represents a very healthy 2.3x rate base, or 33x PE. In the same month Eversource Energy announced the sale of its water utility for $2.4 billion, which equates to 1.7x rate base.

AEP electric transmission assets

Source: Transmission Hub as at September 2025

In May, US electric and gas utility CenterPoint Energy announced it was starting the sale process for its Ohio natural gas utility. These proceeds will to be used to fund future investment into higher growth, higher return and low risk electric assets in Texas.

In August, US electric utility Duke Energy announced it was selling a 20% stake in its Florida subsidiary to Brookfield’s Super‑Core Infrastructure strategy for $6 billion. The price achieved was a very strong 2x rate base, or 29x private equity (PE).

All four of these asset sales were carried out to assist with the financing of large and growing investment plans. Quite simply: divesting assets at prices above your current share price provides a lower cost of capital, which in turn benefits customers and shareholders.

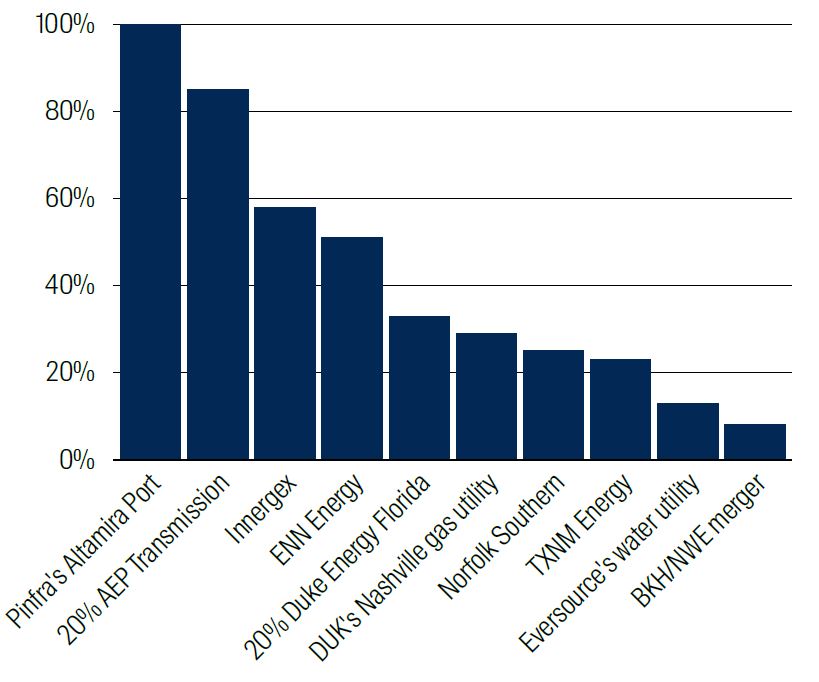

M&A premiums paid for global listed infrastructure

The below chart illustrates the premiums at which these M&A transactions have been carried out, relative to our estimate of the respective undisturbed, listed market valuations. The average premium to listed market valuations in 2025 has been 43%. However, the range of outcomes has been wide, from very high premiums for PINFRA’s Altamira port and AEP’s electric transmission assets to a low premium (almost a merger‑of‑equals) between Black Hills Corp and Northwestern Energy.

M&A premium paid to listed market valuations

Source: First Sentier Investors and company reports as at Sep 2025

The M&A outlook going into 2026

Optimistic financial markets, a pro‑business US administration, strong demand for infrastructure assets and increased financing needs for global listed infrastructure investment programs all point towards a robust M&A market moving into 2026.

First, we expect progress in already‑announced deals:

- Brazil’s Motiva to successfully conclude the sale of its portfolio of 20 airports by year‑end

- KKR to acquire a 30% plus stake in Sempra’s LNG division and

- CenterPoint Energy to achieve a strong price for its Ohio natural gas LDC in either the December quarter of 2025 or early in 2026.

Second, we expect industry consolidation M&A to accelerate as smaller electric utilities struggle to finance significantly higher capital investment needs and electric utilities seek to divest non‑core gas utilities. We also expect that BNSF Railway will follow Union Pacific to create a transcontinental railroad by acquiring CSX Corp (albeit this could be a 2027 event).

Third, we anticipate that mispricing in public markets will continue to create opportunities for private market M&A transactions. Areas of public market pricing pessimism around renewable energy (AES Corp, XPLR Infrastructure, Portland General Electric), toll roads (Atlas Arteria, Motiva, PINFRA) and passenger rail (Getlink) in particular, create potential for these events through 2026. We would also note that BlackRock’s October 2024 acquisition of Global Infrastructure Partners (GIP) is likely to ramp up private market fundraising, with listed markets likely to provide many of the infrastructure assets for this new mega infrastructure fund manager. We expect this will be met with a competitive response from fellow mega managers Blackstone, Brookfield, KKR and Macquarie.

Sempra Infrastructure’s Cameron LNG Export Terminal

Source: Sempra as at September 2025

What we haven’t yet seen in 2025 is M&A centred around corporate restructurings ie transactions seeking to unlock trapped assets or to remove conglomerate discounts within global listed infrastructure companies.

We believe property assets are ignored and trapped inside several global listed infrastructure firms including East Japan Railway, West Japan Railway, Zurich Airport and Tokyo Gas. Indian airports are ignored or lowly valued in Groupe ADP and Zurich Airport. UGI Corp is a US natural gas conglomerate which trades at a discount to our estimate of intrinsic value, owing to its eclectic mix of gas utilities, energy midstream, propane and Renewable Natural Gas (RNG). We believe that some of the above‑mentioned restructuring opportunities will be actioned over the next 18 months, creating more focused companies which are easier to value and are then likely to trade at higher multiples – to the benefit of customers, employees and shareholders.

Conclusion

M&A activity within the global listed infrastructure asset class has been robust throughout 2025. This has been driven by industry consolidation, private market acquisitions and low‑cost financing options. The average M&A premium paid in these transactions has been 43% above our estimate of listed market valuations.

As we move towards 2026, we expect these themes to continue with the potential for the emergence of a fourth driver, namely corporate restructurings. In general, we believe M&A within the global listed infrastructure asset class provides positive outcomes for all stakeholders – customers, regulators, employees and shareholders.

Source: Bloomberg, First Sentier Investors, company data, as of September 2025

1 All figures in USD unless otherwise stated.

2 The takeover price represents a 44% premium to Norfolk Southern’s share price before the publication of an article in Trains magazine where Union Pacific discussed the potential for railroad M&A.

3 Enterprise Value/Earnings Before Interest, Taxes, Depreciation and Amortisation

Read our latest insights

Important Information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Group believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither First Sentier Group, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material. The information herein is for information purposes only; it does not constitute investment advice and/or recommendation, and should not be used as the basis of any investment decision. Some of the funds mentioned herein are not authorised for offer/sale to the public in certain jurisdiction.

The value of investments and the income from them may go down as well as up and you may not get back your original investment. Past performance is not necessarily a guide to future performance. Please refer to the offering documents for details, including the risk factors. Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Group’s portfolios at a certain point in time, and the holdings may change over time.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of First Sentier Group. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of First Sentier Group. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited. First Sentier Group (registration number 53507290B), First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business names of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Group, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Group includes a number of entities in different jurisdictions.

To the extent permitted by law, MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Group

Get the right experience for you

Your location :  Hong Kong

Hong Kong

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom