This is a financial promotion for The First Sentier Multi-Asset Strategy. This information is for professional clients only in the EEA and elsewhere where lawful. Investing involves certain risks including:

The value of investments and any income from them may go down as well as up and are not guaranteed. Investors may get back significantly less than the original amount invested.

Currency risk: the Fund invests in assets which are denominated in other currencies; changes in exchange rates will affect the value of the Fund and could create losses. Currency control decisions made by governments could affect the value of the Fund's investments and could cause the Fund to defer or suspend redemptions of its shares.

Emerging market risk: Emerging markets tend to be more sensitive to economic and political conditions than developed markets. Other factors include greater liquidity risk, restrictions on investment or transfer of assets, failed/delayed settlement and difficulties valuing securities.

Derivative risk: derivatives are sensitive to changes in the value of the underlying asset(s) and/or the level of the rate(s) from which they derive their value. A small movement in the value of the assets or rates may result in gains or losses that are greater than the amount the Fund has invested in derivative transactions, which may have a significant impact on the value of the Fund.

Credit risk: the issuers of bonds or similar investments that the Fund buys may get into financial difficulty and may not pay income or repay capital to the Fund when due.

Interest rate risk: bond prices have an inverse relationship with interest rates such that when interest rates rise, bonds may fall in value. Rising interest rates may cause the value of your investment to fall.

Charges to capital risk: The fees and expenses may be charged against the capital property. Deducting expenses from capital reduces the potential for capital growth

For a full description of the terms of investment and the risks please see the Prospectus and Key Investor Information Document for each Fund.

If you are in any doubt as to the suitability of our funds for your investment needs, please seek investment advice.

First Sentier Investors is a global fund manager with experience across a range of asset classes and specialist investment sectors. We are stewards of assets managed on behalf of institutional investors, pension funds, wholesale distributors, investment platforms, financial advisers and their clients worldwide.

This paper outlines the Responsible Investing (RI) approach for the Multi-Asset Solutions (MAS) team. It explores the considerations undertaken when developing our approach. The paper should give prospective clients and consultants an understanding of the RI activities undertaken on our client’s behalf.

In the MAS team, our RI approach is integrated in the investment process of our objective-based funds and can be incorporated into bespoke mandates.

Our RI approach incorporates:

– An extensive list of ethical screens, based on 9 themes

– ESG as a return driver

– ESG Proxy Voting

– ESG Engagement

About First Sentier Investors

Our purpose is to deliver sustainable investment success for the benefit of our clients, employees, society and our shareholder and our vision is to be a provider of world-leading investment expertise and client solutions, led by our responsible investment principles and based on our core values: Care, Openness, Collaboration and Dedication.

First Sentier Investors was an early adopter of United Nationssupported Principles for Responsible Investment (PRI). For over a decade we have produced and distributed our formal governance, strategy, policies and implementation committees across our global business, recognising that the responsible approach of individual investment teams would be unique and develop at a different pace.

Each year, along with our 2,127 asset management peers, we are assessed as to how well we are applying responsible investment principles across and within our business. In the 2020 assessment, we performed very strongly, gaining the maximum score A+ in 7 of the 8 categories and A in the eighth.

First Sentier Investors is also a member of the Responsible Investment Association Australasia (RIAA). In the 2020 benchmarking our firm was ranked in the top quartile against 44 industry peers.

The Multi-Asset Solutions team approach

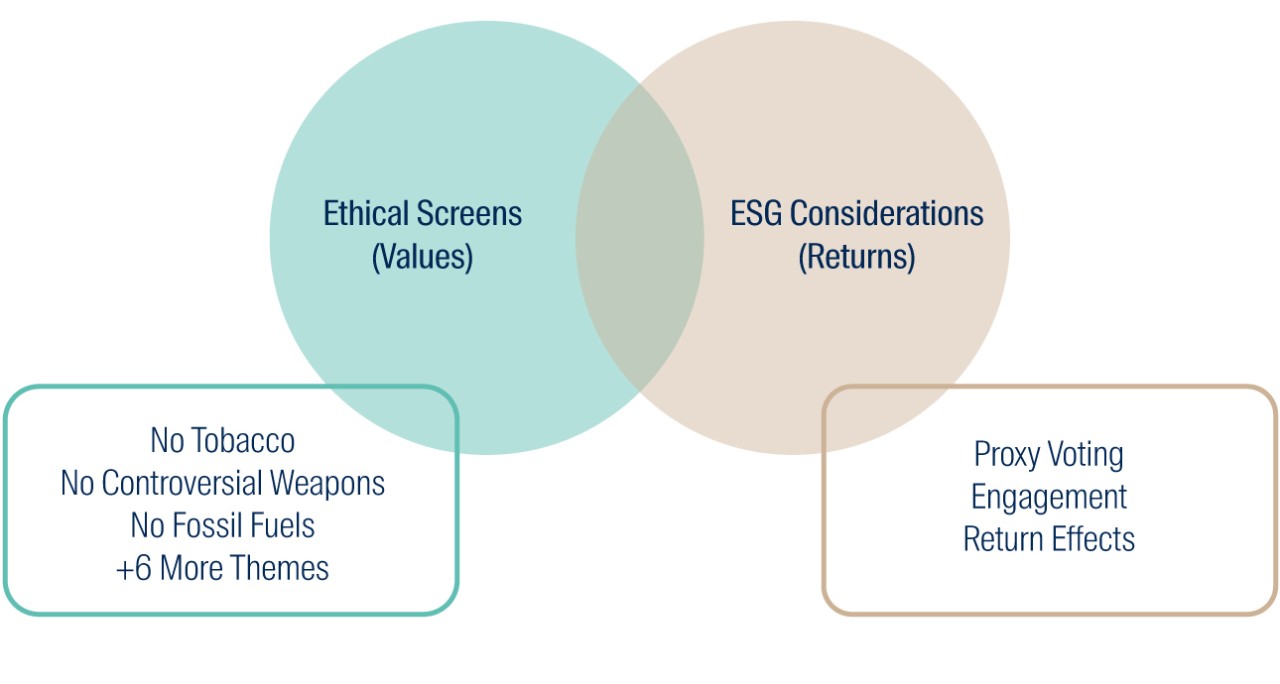

For the MAS team, the activities associated with RI fall into two groups:

1. Ethical Screens: A values-based approach to decisionmaking. We consider whether to invest in a company based on an ethical framework, regardless of the return outlook. In the multi asset context this also extends to bonds and commodities.

2. ESG Considerations: Environmental, Social and Corporate Governance (ESG) considerations are primarily concerned with the assets held in the portfolio as a return driver. Research has shown that ESG considerations are a positive driver of long term performance. We also undertake engagement and proxy voting with the companies we hold in the portfolio, in order to drive particular behaviours.

These two activities may overlap at times. For example, we may seek to screen out companies with poor ESG practices to enhance returns, or exclude companies because of ethical reasons, which also have poor future return expectations, e.g. companies with fossil fuels exposure.

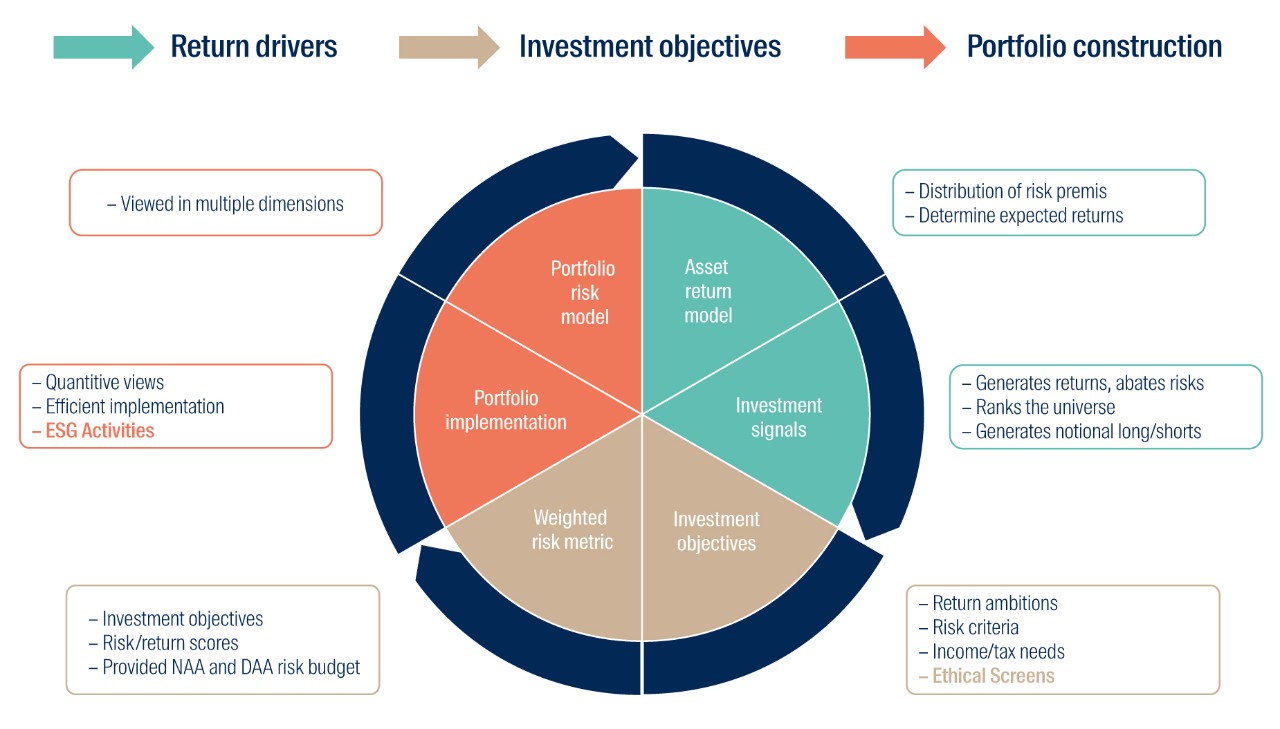

These activities are integrated within our investment process – both when we set our longer-term Neutral Asset Allocation (NAA)1 and our shorter term Dynamic Asset Allocation (DAA)2.

1 Refer to our website for our paper on Strategic asset allocation

2 Refer to our website for our paper on Dynamic asset allocation

When we develop a neutral asset allocation using long term assumptions of return, risk and correlations between asset classes, we model the effect of both ESG considerations and ethical screens, to ensure the baskets of securities we use are expected to be within modelling parameters.

Divestment

Divestment often refers to the use of exclusions or ethical screens, and the decision not to hold particular assets because of ethical reasons. As the MAS team has the capability to build complete portfolios from the ground up, at the individual securityclevel, we have a large amount of flexibility in screening out assets.

In our objective-based portfolios we have already divested assets based on particular themes, outlined on page 3. When building tailored investment solutions for clients we incorporate their ethical considerations when we are defining the investment objectives.

The theory of divestment

Capitalism and markets can be thought of as a system of voting, people vote with their money. When people buy something, it’s a vote in the market saying this product is something that is desirable. It signals to producers to keep producing that thing or potentially produce more of it. Conversely, when people don’t buy a product, it signals to producers to reduce or even stop producing that item. The point is that purchase choices act like votes in the economy, directing the production of goods and services.

Companies raise money (either debt3 or equity4 ) and invest it in order to produce goods and services. If more investors are willing to supply money to a particular company, the cost of capital5 will reduce. Conversely, if people are less willing to supply capital to a company, then their cost of capital will increase. There is some debate around the effect this has, but it’s about choice as people do not want their investment vote to go to companies that do not align with their values.

Screens in the equity asset class

We have divested companies based on the 9 themes on page 3, as they do not align with our purpose and beliefs. Theoretically, under a purely ESG investment framework, once the long term social implications (cost of regulation) are priced into the share price, and the stock is cheap enough, an ESG-conscious manager can still buy the stock. However, under an ‘ethical exclusions’ investment approach like ours, we still will not buy it.

3 Borrow money from investors

4 To issue a stake in the company to investors

5 The cost for the company to obtain funds from investors, either through issuing debt and/or equity

The below table outlines our rules for screening within each theme.

* Defined by Sustainalytics as the degree to which company value is at risk, driven by the transition to a low-carbon economy.

As of 2020, the combination of the above screens could remove between 30% and 55% of the companies in the major indexes. This works out to be about 30-40% of the market capitalisation weight and a tracking error in the range of 1.5% to 3%.

Fossil fuels divestment example:

We accept the science of climate change and support the global transition to net zero emissions in line with the goals of the Paris Agreement. As investors, we understand this will impact different assets in different ways, both in relation to their contribution to climate change in the form of greenhouse gas emissions, but also their exposure to changes occurring in the physical environment and changes occurring in the regulatory and operating environment. We report in line with the Task Force for Climate-Related Financial Disclosure’s recommendations and encourage the companies that we invest in to do the same. The key elements of the FSI Responsible Investment Strategy directly related to climate change are set out in our Climate Change Statement, available on our website.

Our decision to divest from direct fossil fuel assets in our objective-based portfolios was only made after robust analysis. The chart below shows the tracking error and carbon footprint reductions of various approaches we examined before confirming our current approach.

In the below analysis, we looked at the number of stocks excluded from the MSCI All Country World Index (ACWI) as a percentage. Secondly, we measured tracking error* to ensure it fits within our portfolio construction process. Then we examined the relative reductions of the carbon emissions from the portfolios, both current and potential emissions from reserves#. The reserves are important for assessing the stranded asset7 risk, if the world transitions to renewable energy, these assets may become worthless.

The analysis started with the first three from the left, exclusions sets from the left side of the chart, from which we implemented some simple exclusions to set a baseline. The Energy and Utilities sectors are excluded because they have the largest carbon footprints according to research by MSCI. This research which showed the Utilities sector was the largest consumer of fossil fuels currently, but the Energy sector had the largest potential consumption of fossil fuels (i.e. fossil fuels not yet extracted from the ground).

The next three indexes were constructed by MSCI (shown with ‘MSCI’ in the headings) by removing companies with higher carbon footprints. Each index excluded a different number of companies, then used multiple approaches to reweight the stocks within the portfolio, in order to reduce the tracking error with respect to the traditional ACWI index.

In the final three (on the right) we looked at baskets of stocks created using the ‘Carbon Risk’ data provided by Sustainalytics8. We excluded stocks with carbon risk related to their operations and carbon risk related to their products (two separate data points). We excluded companies based on Sustainalytics’ classification of carbon risk levels, beginning by only removing companies with a severe level of risk, and then progressively removed more categories such as High and Medium levels of carbon risk.

In our portfolios we use the approach on the far right excluding companies that have Severe, High and Medium carbon risk.

Effect of exclusions on MSCI All Country World Index

*Tracking Error calculated using Bloomberg Risk Model (Global), with index holdings snapshot as at 19/6/2020.

#Carbon emission data produced by MSCI, total emissions per company. Each basket was then reweighted relative to the MSCI ACWI benchmark.

7 Stranded assets are investments that are not able to meet a viable economic return and which are likely to see their economic life curtailed due to a combination of technology, regulatory and/or market changes.

8 Sustainalytics is a company that rates the sustainability of listed companies based on their environmental, social and corporate governance (ESG) performance.

Screens in the fixed income asset class

Our screens are consistent across asset classes: if we exclude the equity holdings of a company, we would also screen out the bonds9 issued by that company. In addition to bonds issued by companies, we also consider government bonds, issued by countries as clients may wish to exclude bonds issued by particular nations.

Green Bonds are bonds issued to fund a specific project or initiative, designed to have a positive and measurable impact. Because the money is used to finance a specific activity, they are assessed on a case-by-case basis, as clients will normally allow investment in Green Bonds from a company that may otherwise be screened out.

Screens in the commodity asset class

If the screen is based on a theme, such as avoiding companies which are dependent on fossil fuels, then it makes sense that fossil fuels themselves are avoided. We screen out Crude Oil and other Energy commodities. We also screen out Livestock commodity futures10 as part of our Animal Welfare theme.

Did you know the average barrel of oil is estimated to emit around 430 kg of CO2 (EPA 2018).

The MAS team has the capability to build custom commodity benchmarks using return forecasts from the commodity sectors, Energy, Agricultural, Livestock, Precious Metals, and Industrial Metals. We then tailor the commodity basket to achieve the desired level of risk, return and correlation to other asset classes such as equity.

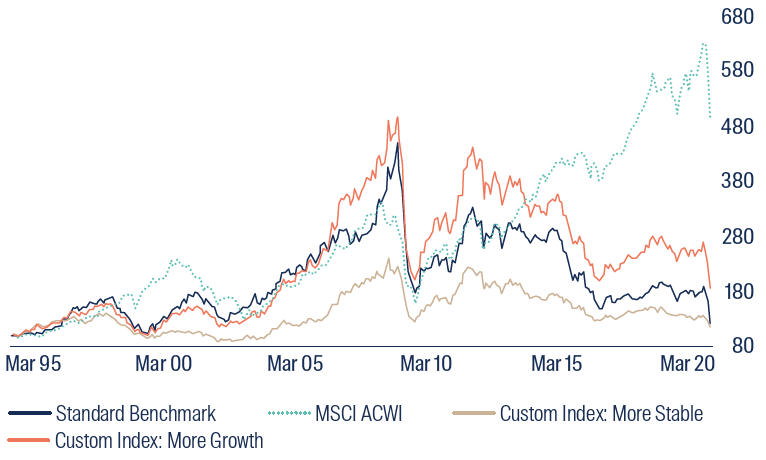

The chart below shows a back test for two custom commodity indexes relative to the standard Reuters CRB commodity benchmark and the MSCI ACWI index. While the custom indexes have similar expected returns&, the ‘More Stable’ index has lower volatility and lower correlation to equity, whereas the ‘More Growth’ index has higher volatility and correlation to equity.

Historical Index Performance

& Return expectations from the April 2020 Neutral Asset Allocation review for the Real Return Fund

Details of specific exclusions: All energy commodities are excluded: Crude Oil WTI, Gasoline RBOB NY, No 2 Heating Oil NY, Natural Gas, Gas Oil, and Crude Oil Brent

All livestock commodities are excluded: Live Cattle, Feeder Cattle, and Lean Hog

9 Debt issued in order to raise capital.

10 Futures contracts that follow the fluctuation in livestock prices, such as Live Cattle, Feeder Cattle, and Lean Hogs

11 The exact definitions differ, but usually include weapons manufacturers, gambling, tobacco, alcohol, and sex-related industries.

12 E.g. Salaber (2007); Fabozzi et al. (2008); Hong and Kacperczyk (2009); Statman and Glushkov (2009).

Screen on ESG score, the overlap between screens and ESG considerations

In the next section, ‘The literature’, we show that ESG factors can lead to higher risk-adjusted returns over the long term. In our investment process, we extract this return driver through screening out companies with poor ESG scores.

In the tables below, we compare the effect of different approaches on tracking error. The first basket in the table is MSCI ESG Screened – a MSCI-produced index which removes companies with the poorest ESG scores. The second basket was created using Sustainalytics data, removing companies that are categorised as having severe ESG Risk. The third basket was also created with Sustainalytics, based on Controversy categories, removing companies that have severe or high controversy risk, either currently or in their outlook.

ESG as a return driver

We believe ESG factors, constitute sources of long term risk and return. By incorporating responsible investments directly into our investment practices, we seek to enhance the quality of our investment process.

The literature

The finance literature as it relates to ESG has focused heavily on so-called ‘sin stocks’, or equities in industries that are considered off-limits.11 Until recently, scholars considered sin stocks to have a risk premium that results in higher historical returns.12 This made sense in theory, as any exclusions shrink the investment universe and constrain the portfolio. We would expect a constrained portfolio to have worse risk-adjusted returns than an unconstrained one, all things being equal. We would also expect higher returns for sin stocks through the following mechanism:

Fewer investors in sin stocks due to investor preferences for sustainable companies and higher risk (e.g. litigation) ➞ higher cost of capital for those firms ➞ higher expected returns.

As Asness (2017) says, this is exactly what we would want, as it discourages undesirable firms and industries, and promotes sustainable companies via lower cost of funding for them. However, recent research (Adamsson and Hoepher 2015; Blitz and Fabozzi 2018) found that the ‘sin stock anomaly’ – disappears when controlling for Fama and French (2015) factors: size, value, momentum, profitability and investments. Lobe and Walkshäusl (2016) also found that sin stocks did not outperform a portfolio of socially responsible stocks (which includes nuclear energy stocks). Firms with good ESG scores elicit lower stock volatility on dividend announcements, as they are already transparent and committed to higher ethical standards with fewer agency problems (Kim et al. 2014; Glegg et al. 2018). Finally, reversing the literature’s earlier consensus, Owen and Temasvary (2018) found that having more women on bank boards is value-enhancing, an example of the mispricing of diversity.

The newest financial literature aligns with our world view, ESG factors can help generate superior risk-adjusted returns over the long-run, as we believe ESG risks and externalities are mispriced in the market. As such, the academic literature has moved on from the idea of giving up returns for a more sustainable portfolio.

ESG engagement

Engaging in an active dialogue with the companies or entities that we invest in is an important activity as it provides a key opportunity to improve our understanding of their businesses, and monitor material business issues including strategy, capital allocation and financials as well as their approach to environmental, social and governance matters, and enables us to influence them to improve these practices.

Engagement and modern slavery risks

Human rights is a complex issue attracting increasing levels of scrutiny and which can affect multiple asset classes. Corporations have legal, moral and commercial responsibilities to respect human rights and manage the human rights impacts of their operations. They are not only expected to meet their human rights responsibilities, but may face reputational, legal or other consequences if they fail to do so. As an investor in these businesses on behalf of our clients, it is imperative that we fully understand the risks and seek to mitigate them.

Engagement is our main tool for inciting change in relation to Modern Slavery. To this end, we have partnered with Sustainalytics to provide engagement services on this theme. As multi asset investors we normally operate at the asset class level rather than the individual stock level. Partnering with Sustainalytics gives us the opportunity to add our voice to many other voices encouraging companies to understand and reduce the risks associated with Modern Slavery within their supply chains.

Sustainalytics has a targets based engagement process, which is focussed on getting companies to commit to and achieve measurable outcomes. The engagement includes letters, direct company meetings, client campaigns, voting and will generally escalate over a two year period. If these efforts fail, they can recommend clients divest from a specific company.

ESG proxy voting

We believe proxy voting is an important investor right and responsibility and should be exercised wherever possible. In addition, the ability to vote strengthens our position when engaging with investee companies and supports the stewardship of our clients’ investments. Voting rights (along with other rights attached to shares, for example pre-emption rights) are a valuable asset which should be managed with the same care and diligence as other assets on behalf of our clients.

FSI obtains recommendations from a selection of proxy voting advisers (currently Glass Lewis and Ownership Matters); however, our investment teams retain full control of their voting decisions. More information on our proxy voting approach can be provided.

We have elected to use Glass Lewis’ ESG voting advice policy, and the below chart shows the voting difference between the standard approach and the ESG approach^. While Glass Lewis votes on the merits of each resolution, you can see the net effect of ESG voting is more likely to vote in favour of shareholder resolutions and against management resolutions.

Standard vs ESG voting approaches

^It shows the voting for 13,157 resolutions during the 6 months to the end of October 2019.

Our view on shorting

Shorting tends to be an important tool in the multi asset context to manage risk, and in our long/short portfolios it is actually a return driver. We typically short derivatives such as index futures, index options, interest rate swaps and currency forwards.

We believe that shorting can increase the cost of capital for a company: it is almost akin to a ‘no’ vote rather than just not voting for something. It works on the same principle as the theory of divestment discussed earlier in the paper, reducing the amount of capital available to a company.

Some investors have ethical objections to shorting certain assets like shares or bonds. This is normally due to the perception of profiting from other people’s economic loss. We can create tailored investment objectives that do not include shorting assets.

How we implement the screens

Each year, our objective-based funds have two Neutral Asset Allocation reviews, where we update the allocations of the physical holdings of the portfolio. During this process we also rebalance the baskets of direct physical assets. During this rebalance we apply the ethical screens and would divest any new companies (stocks and bonds) which have issues. We also rebalance the baskets of commodity futures, again applying the screens for Fossil Fuels and Animal Welfare.

Within our Dynamic Asset Allocation process, we rebalance the portfolio weekly. The DAA process uses cross asset signals, which include commodities. We exclude commodities related to Fossil Fuels and Animal Welfare from the signal construction and design.

Limitations of multi asset investing and ethical screens

We typically hold long equity index derivatives as part of our DAA investment process. This is an issue as stocks that we may otherwise screen out still receive the economic benefit if they are constituents of an index, i.e. diminishes the effect of divestment. Over time the weight of these problematic stocks within an index should reduce as more asset managers divest for ethical reasons. In the interim we can design tailored investment portfolios that avoid long equity index futures.

Summary

We have explored our RI approach and the considerations undertaken when developing our methodology. In the MAS team, our RI approach is integrated in the investment process of our objective based funds and can be incorporated into bespoke mandates. Our RI methodology can be tailored to address many ESG and Ethical Themes.

Glossary

Long – A long position is to purchase a security or derivative, with the expectation that it will rise in value.

Short – A short position is to sell a security or derivative, with the expectation that it will lower in value. A covered short would then see the seller repurchase the security or derivative at the new lower price.

Derivatives – A financial security that is derived from, or reliant upon, an underlying asset or group of assets. The contract is between two or more parties, and the price is derived from price fluctuations in the underlying asset.

Index futures – futures contracts entered in today, to buy or sell a financial index at a future date. These futures contracts are used to speculate in the price direction of an index.

Index options – A financial derivative which provides the right (but not obligation) to buy or sell the value of an underlying index at the stated exercise price. No actual securities are bought or sold and are always cash-settled.

Interest rate swaps – a forward contract in which one stream of future interest payments is exchanged for another based on a specified principal amount. These usually involve the exchange of a fixed interest rate for a floating rate, or vice versa, to reduce or increase exposure to fluctuations in interest rates, or to obtain a marginally lower interest rate than would have been possible without the swap.

Currency forwards – a binding contract in the foreign exchange market that locks in the exchange rate for the purchase or sale of a currency on a future date.

References

Acemoglu, D., Johnson, S., Robinson, J.A., 2001. The Colonial Origins of Comparative Development: An Empirical Investigation. American Economic Review 91, 1369–1401.

Asness, C.S., 2017. Virtue is its Own Reward: Or, One Man’s Ceiling is Another Man’s Floor. AQR Perspectives.

Blitz, D., Fabozzi, F.J., 2017. Sin Stocks Revisited: Resolving the Sin Stock Anomaly. The Journal of Portfolio Management 44, 105–111.

Desclée, A., Hyman, J., Polbennikov, S., Dynkin, L., 2016. Sustainable investing and bond returns. Impact Series, Impact Series 40.

El Ghoul, S., Guedhami, O., Kwok, C.C.Y., Mishra, D.R., 2010. Does Corporate Social Responsibility Affect the Cost of Capital? (SSRN Scholarly Paper No. ID 1546755). Social Science Research Network, Rochester, NY.

Fabozzi, F.J., Ma, K.C., Oliphant, B.J., 2008. Sin Stock Returns. Journal of Portfolio Management; New York 35, 82-94,8.

Fama, E.F., French, K.R., 2015. A five-factor asset pricing model. Journal of Financial Economics 116, 1–22.

Gartenberg, C.M., Prat, A., Serafeim, G., 2016. Corporate Purpose and Financial Performance (SSRN Scholarly Paper No. ID 2840005). Social Science Research Network, Rochester, NY.

Glegg, C., Harris, O., Ngo, T., 2018. Corporate social responsibility and the wealth gains from dividend increases. Review of Financial Economics 36, 149–166.

Adamsson, H., Hoepner, A.G.F., 2015. The ‘Price of Sin’ Aversion: Ivory Tower Illusion or Real Investable Alpha? (SSRN Scholarly Paper No. ID 2659098). Social Science Research Network, Rochester, NY.

Hong, H., Kacperczyk, M., 2009. The price of sin: The effects of social norms on markets. Journal of Financial Economics 93, 15–36.

Kim, Y., Li, H., Li, S., 2014. Corporate social responsibility and stock price crash risk. Journal of Banking & Finance 43, 1–13. Lobe, S., Walkshäusl, C., 2016. Vice versus virtue investing around the world. Rev Manag Sci 10, 303–344.

North, D.C., 1986. The New Institutional Economics. Journal of Institutional and Theoretical Economics (JITE) / Zeitschrift für die gesamte Staatswissenschaft 142, 230–237.

Owen, A.L., Temesvary, J., 2018. The performance effects of gender diversity on bank boards. Journal of Banking & Finance 90, 50–63.

Salaber, J., 2007. The Determinants of Sin Stock Returns: Evidence on the European Market. Working paper.

Statman, M., Glushkov, D., 2009. The Wages of Social Responsibility. Financial Analysts Journal 65, 33–46.

Keynes, The General Theory of Employment, Interest and Money, 1936

Smith, The Theory of Moral Sentiments, 1759

Layton, Roger A, 2007 . “Marketing Systems—A Core Macromarketing Concept”. Journal of Macromarketing. 27 (3): 227–242. doi:10.1177/0276146707302836. ISSN 0276-1467.

Swanson, Jacinda, 2007. “The Economy and Its Relation to Politics: Robert Dahl, Neoclassical Economics, and Democracy”. Polity. 39 (2): 208–233. doi:10.1057/palgrave.polity.2300055. ISSN 0032-3497. JSTOR 4500273.

Icons sourced from the Noun Project. https://thenounproject.com/

Important Information

This document has been prepared for informational purposes only and is only intended to provide a summary of the subject matter covered. It does not purport to be comprehensive or to give advice. The views expressed are the views of the writer at the time of issue and may change over time. This is not an offer document and does not constitute an offer, invitation or investment recommendation to distribute or purchase securities, shares, units or other interests or to enter into an investment agreement. No person should rely on the content and/or act on the basis of any material contained in this document.

This document is confidential and must not be copied, reproduced, circulated or transmitted, in whole or in part, and in any form or by any means without our prior written consent. The information contained within this document has been obtained from sources that we believe to be reliable and accurate at the time of issue but no representation or warranty, express or implied, is made as to the fairness, accuracy, or completeness of the information. We do not accept any liability whatsoever for any loss arising directly or indirectly from any use of this document.

References to “we” or “us” are references to First Sentier Investors a member of MUFG, a global financial group. First Sentier Investors includes a number of entities in different jurisdictions. MUFG and its subsidiaries do not guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk including loss of income and capital invested.

If this document relates to an investment strategy which is available for investment via a UK UCITS but not an EU UCITS fund then that strategy will only be available to EU/EEA investors via a segregated mandate account.

In the United Kingdom, issued by First Sentier Investors (UK) Funds Limited which is authorised and regulated in the UK by the Financial Conduct Authority (registration number 143359). Registered office Finsbury Circus House, 15 Finsbury Circus, London, EC2M 7EB number 2294743. In the EEA, issued by First Sentier Investors (Ireland) Limited which is authorised and regulated in Ireland by the Central Bank of Ireland (registered number C182306) in connection with the activity of receiving and transmitting orders. Registered office: 70 Sir John Rogerson’s Quay, Dublin 2, Ireland number 629188. Outside the UK and the EEA, issued by First Sentier Investors International IM Limited which is authorised and regulated in the UK by the Financial Conduct Authority (registered number 122512). Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB number SCO79063.

Copyright © (2021) First Sentier Investors

All rights reserved.

Get the right experience for you

Your location :  Sweden

Sweden

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom