Introduction

- Electric utilities in the US are experiencing significant demand growth, driven by data centers and AI

- Investment is needed now: capital plans are increasing, driving subsequent earnings growth

- Precision Scheduled Railroading (PSR) is still alive! Optimise costs AND grow freight volumes

- Value on the table at Norfolk Southern (NSC) following its activist proxy battle

Welcome to the Tortured Infrastructure Department... Private markets continue to buy listed infrastructure assets and earnings forecasts continue to trend up. However, your authors remain tortured by unresponsive valuation multiples and a lack of sleep from too many flights (as well as inspired by Taylor Swift’s latest album The Tortured Poets Department).

We recently travelled through the US, meeting with 50 infrastructure management teams, regulators and customers in eight states from the utility, railroad, waste management, energy midstream and data center sectors. The insights from our respective trips, and implications for the team’s portfolios, are shared below.

Utilities

Key takeaways included:

- utilities are experiencing unprecedented load growth1

- data centers and Artificial Intelligence (AI) are prioritising speed to market over clean energy, leading to increased gas investment and delays to coal-fired power plant retirements, and

- higher load is leading to upward revisions to utility capital plans, driving upside risk to their current rate base2 and Earnings Per Share (EPS) growth expectations.

Load, baby, load!

After decades of flat electricity demand for US utilities, the industry is now seeing unprecedented demand as growth in data centers / AI, electrification, onshoring and electric vehicles outweighs energy efficiency gains. One utility executive stated: “Seeing all these customers wanting 24/7 load and willing to pay for it – it is every utility’s dream”.

This demand is only expected to accelerate as the AI rollout continues. On our trip, we visited a data center in Atlanta, Georgia, one of the five epicentres of the current data center boom. The employees we met there highlighted that the pace of leasing demand growth is “astounding”. All capacity currently under construction (425 megawatts / MW) is already sold out to 2027. In terms of how AI is boosting that demand, they said: “An average customer wants power density of 14-17 kilowatt-hours (kWh3). An AI customer now wants 70 kWh”. Effectively, a five-fold increase.

As data centers (and especially AI-focused data centers) expand their footprint throughout the US, upward pressure on utility load forecasts will continue, owing to the amount of power required for processing and cooling. The following chart from Minneapolisbased electric utility Xcel Energy highlights the extent of this load growth.

Xcel Energy's anticipated load growth from data centers

Source: Xcel Energy. Data as of 19 May 2024.

Data centers account for 4% of total US electric load today. Forecasts expect that to increase by 80-120%4, to eventually make up between 6% and 10% of total US electric load by 2030 - with risk to the upside.

The EPA5 vs AI

As this load demand increases, data center priorities have changed. One executive said: "Data centers used to ask for 24/7 power, clean energy and low prices …now they are just asking for 24/7 power". Attending the American Gas Association conference in California, one consistent message amongst utilities was that natural gas will continue to play an important role as more renewables come online, coal plants retire and competition for energy intensifies in the face of increased load. Natural gas represents a reliable source of backup power (especially with increased extreme weather events leading to power outages). It can also play a crucial role in meeting power needs during periods of peak demand.

Attending the American Gas Association conference in Palm Desert, CA

Source: First Sentier Investors May 2024.

This backdrop sets up a potential clash between the EPA / climate change goals and AI’s growing appetite for electricity. A utility executive said: “There is a significant amount of power [demand] coming and the administration is making it very difficult to build a new power plant”. The question of whether the US government is willing to slow down the implementation of AI in order to reach its climate goals remains open. Our sense is that the US has decided that being at the forefront of AI is a key priority to them, and that climate goals may have to shift or take a back seat to allow this to happen. As you can see in the following chart, our forecasts assume an increase in natural gas generation between now and 2040.

US electricity generation capacity (GWs)

Source: First Sentier Investors. Data as of 31 May 2024.

Upside risk to current forecasts

As noted earlier, load growth is putting upward pressure on utility load forecasts. This is being reflected in turn in the Integrated Resource Plans (IRPs)6 being filed by utilities. For example, in 2022 Georgia Power (a subsidiary of listed electric utility Southern Company) filed an IRP with forecast load growth of less than 400 MW between 2024 and 2031. In their 2023 IRP filing, the forecast load growth for the same period was 6,600MW (a 17 times greater increase).

These increases then flow through to utilities’ investment plans, ultimately expanding the regulated asset base upon which each utility is allowed to earn a return. For example, Pennsylvaniabased PPL Corp estimated that every new large data center requesting 1GW of power would require transmission grid upgrades costing at least US$50-150 million. For PPL, every US$125 million spent in this way equates to an additional 1% of EPS.

And the growth isn’t all being driven by new-build data centers. Southern Company’s CFO stated on the company’s Q1 2024 earnings call that energy sales to data centers increased by 12% compared to the prior year; three quarters of this increase came from existing data centers.

As today’s conversations with potential data center customers progress through to tomorrow’s signed deals and construction commencements, utilities will see their rate base and earnings growth profiles trend upwards. We believe that over the next 12 months we will see material uplifts to existing IRPs because of this. Our portfolios are well positioned to benefit, with exposure to electric utilities including NextEra Energy, Southern Company, Dominion Energy, Duke Energy, Xcel Energy, AES Corp, Alliant Energy and Evergy.

Regulation

On the trip, we met with utility regulators in Massachusetts (MA), Georgia (GA) and Illinois (IL). It was interesting to see how different states think about the holy trinity of energy – namely affordability, reliability and sustainability. GA is a pro-growth, business-friendly state. It takes a light-handed approach to regulation which emphasises reliability and affordability over sustainability. “We will roll out the red carpet for anyone that wants to do business in GA”. Regulators in GA are keen to work with utilities to enable data center-driven economic development in the state. “Data centers will do good in the state. They will be good corporate citizens; they will donate to charity and sponsor our baseball teams”. IL and MA are more focused on sustainability, with MA prioritising affordability and ensuring the utilities are not over-spending.

Visiting Georgia Power’s Experience Center in Atlanta, GA

Source: First Sentier Investors May 2024.

Railroads

On this trip we also met with Class I freight rail companies including Burlington Northern Santa Fe Railway (BNSF), Warren Buffett’s unlisted railroad in the Western US; various trucking companies; shippers; and representatives of the American Association of Railroads (AAR).

Three key takeaways were:

- Precision Scheduled Railroading (PSR) is still alive

- Norfolk Southern (NSC) has a huge amount of untapped value, regardless of the recent proxy outcome, and

- freight recovery expectations are now pushing into 2025, against an uncertain economic backdrop.

PSR is still alive

North American freight rail margins have declined in 9 of the last 10 quarters owing to muted volumes, negative labour productivity and persistent cost headwinds (inflation and labour). All three of these headwinds have recently started to turn into tailwinds, with expectations of sequential margin improvement in 2Q 2024 accelerating into the second half of the year. This represents a huge potential positive for rail valuations, given their historical correlation with margin improvement.

All Class I freight rail operators, except BNSF, believe that PSR is the right way to optimise existing assets. Following PSR principles allows railroads to increase efficiency and control costs, resulting in better service and safety levels and a higher network capacity, ultimately leading to top-line growth.

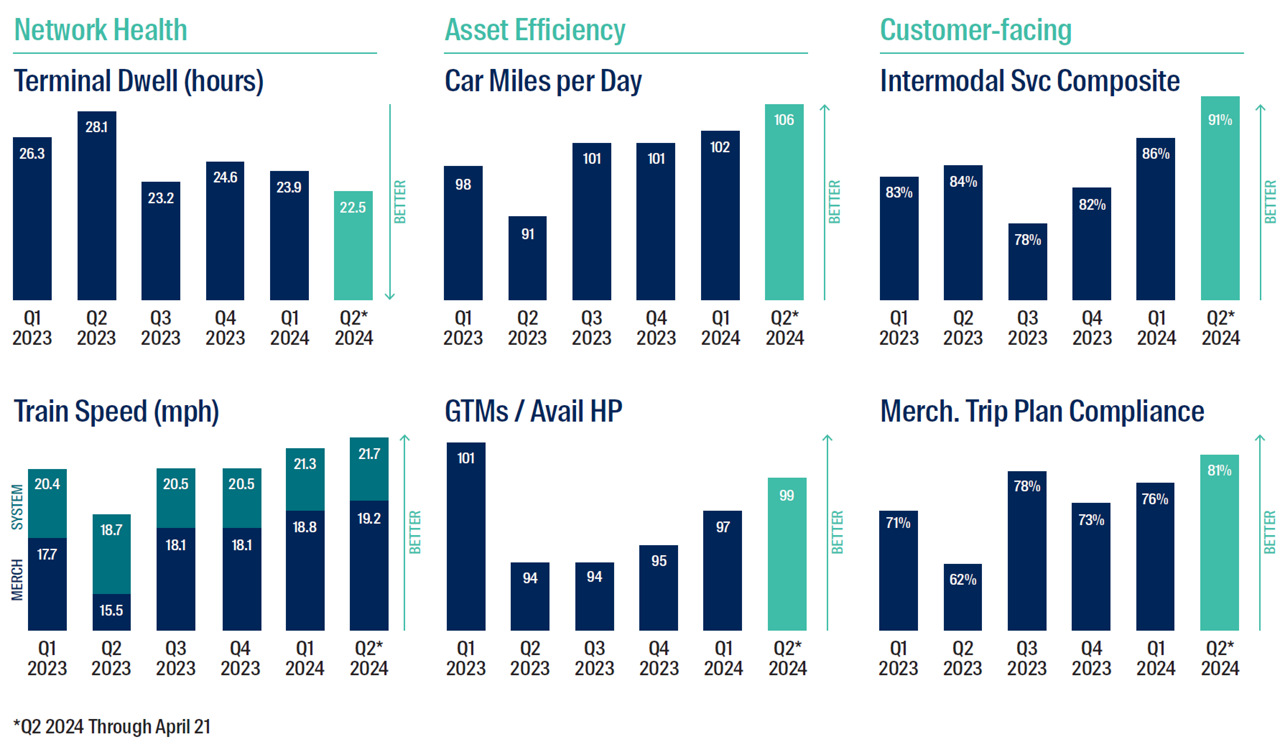

Consistently in our railroad meetings, management teams talked about velocity, cars online and terminal dwell – all service statistics that are improving and leading to OR7 improvement. The rails are more similar than they are different; if one can get to an OR of 57 (the best-in-class metric currently) then they all can.

Norfolk Southern improving service and cost metrics

Source: Norfolk Southern. Data as of 21 May 2024

Actions speak louder than words; recent changes in management remuneration frameworks show continued support for PSR. Margins had been removed from some of the rail companies’ targets. This year saw the re-introduction of this OR metric (something we support, although we also like to see ROIC8 and TSR9 in these targets too!). Margin improvement remains a key component of rail EPS growth, combined with inflation-plus pricing, volume growth and regular share buybacks. We believe these factors can drive an annual EPS growth rate of 10%+ over the next 5 years.

Norfolk Southern

This was the first time that we had heard from Norfolk Southern’s new Chief Operating Officer John Orr since the company’s proxy battle outcome on May 9th. Recent improvement in service metrics indicate that he is already making positive changes to the operating model. After a very public struggle with activist investor Ancora Holdings over the last three months, three of NSC’s 13 board members were ousted, including the Chair. Even though Ancora did not get the change in management that they proposed, this result sends a very clear message to the rest of the board, and the management team, that they now need to perform.

NSC is the last of the listed railroads to implement PSR. Its Operating Ratio, EPS growth and ROIC have consistently lagged those of its peers. Since 2019, costs have increased 12% and volumes are down 10% (the worst volume decline of all the rails) meaning they are using a much higher cost base to move lower volumes. Its “Purchased services and rents cost per 1000 GTM”10 was 22% higher in 2023 than that of its closest peer CSX Corp. NSC also has the worst service statistics and safety record in the industry. This equates to a margin gap compared to peers that is the largest we’ve ever seen.

Therein lies the opportunity. Looking forward, although NSC won the proxy fight, the pressure is now on them to deliver. If they succeed, then we believe its optimised earnings can be between 10% and 15% higher than the market currently expects. If they fail, then next year the likelihood of a management change is increased, and much-needed changes will be carried out by a new management team.

Either way, we believe that in three years we end up in the same place - with a better NSC than we have today, as it moves from industry laggard to industry average. As the firm executes on moving from a 70% OR (1Q 2024) to a 60% OR over the next 3 to 4 years (lower is better), and delivers on their plan of US$400 million of cost savings within the first 1 to 2 years, the stock can see both valuation multiple and earnings upgrades. NSC board members have recently been buying the stock too, indicating that they also see value at the company.

Railroad companies' 2023 Operating Ratio comparison

Source: Ancora Holdings. Data as of 15 April 2024

Economy still uncertain and trucking market remains weak

Exactly a year ago, in the depths of the freight recession, we attended a similar transportation conference. The trucking market did not sound any better this trip than it did then. Trucking companies are still talking about over-capacity in the market which, combined with weak domestic intermodal11 demand, is putting prices under pressure. Softer-than-expected 1Q 2024 data, muted seasonal freight trends and a weak volume outlook all seem to be pushing the freight recovery further out. It feels like the longest freight recession ever!

This matters most for the intermodal segment of the railroad companies. It affects both volumes and pricing, as railroads compete with trucking in this segment (15% discount to see conversions), especially in the Eastern half of the US.

In contrast to domestic intermodal, international intermodal is seeing huge growth off the lows of 2Q 2023. Port of LA/LB12 import volumes and rail international intermodal volumes are up by around 20% since then. This could be the result of some share shift from East Coast ports to the West Coast ahead of union negotiations. International intermodal is mostly transported by the rails, not the trucking companies. This is part of the reason for the huge disconnect between intermodal volumes of rail companies (for example BNSF) and trucking companies (for example JBHT).

Intermodal volumes growth comparison

Source: Company reports and websites, First Sentier Investors. Data as of 31 March 2024.

Overall the truck market recovery looks to be pushed into 2025, but when this very long cycle does turn, the Eastern railroads like NSC and CSX should see outsized benefits compared to the other railroads.

Water treatment plant asset tour, PA

The water industry in the US is currently going through significant change. For the first time in 27 years the US EPA has mandated new rules for PFAS13 maximum contaminant levels. Simply put, this is to ensure that drinking water is cleaner and safer. However, it takes time and significant investment to comply with these new standards.

On this trip we visited Essential Utilities’ largest water treatment plant in the US. This plant is located next to Pickering Creek Dam (see top left of the photo for the dam). It is one of 11 water treatment plants that Essential Utilities has in Pennsylvania. It can treat up to 55 million gallons of water per day (the equivalent of 3,000 swimming pools, for context!).

Essential Utilities' Pickering Creek Water Treatment Plant, PA

Source: First Sentier Investors May 2024.

Trip overview

During four weeks of combined travel we conducted four asset tours, met with regulators and staff from three state utility commissions and participated in over 50 research meetings. We came back more positive on portfolio holdings GFL Environmental, Norfolk Southern, Southern Company, Xcel Energy, Dominion Energy, NextEra Energy, AES Corp, Alliant Energy and Evergy. We are well positioned to benefit from utility industry dynamics, with upside risk to capital and growth forecasts. Additionally, portfolio holdings Norfolk Southern and GFL Environmental have scope to benefit from self-help and cost-out measures, regardless of what an uncertain US economy does in second half of 2024.

Key highlights from the trip included:

- Sophie – visiting the Wolf Creek nuclear plant in Kansas. Did you know it generates 18% of the state’s electricity?

- Jess – hard hat in Philadelphia. Did you know the US EPA was established by Republican President Richard Nixon in 1970? How times have changed...

- Sophie – eating cookies baked with a hydrogen oven (blended 20% hydrogen into their gas system) at the Hydrogen Home Pilot conducted by Sempra Energy. They tasted much better than regular cookies!

- Jess – in-person meetings with management driving greater conviction in the investment thesis of new portfolio holding GFL Environmental

The lowlights were:

- Sophie – landing in Kansas at 1am and starting the next day of meetings at 6am

- Jess – extreme weather events negatively impacting Q2 railroad volumes and our travel plans

- Sophie – increased electricity load leading to increased emissions in the years ahead...

- Jess – underwhelming size of takeover premium in Atlantica Sustainable Infrastructure offer from private infrastructure fund Energy Capital Partners

- Sophie – no sighting of Travis Kelce in Kansas City

1 Increase in power demand over time.

2 The assets by which a regulated utility provides an electric, gas or water service; and on which it is allowed to earn a rate of return.

3 A kilowatt-hour is the energy delivered by one kilowatt of power for one hour

4 Source: North American Electric Reliability Corp.

5 US Environmental Protection Agency

6 Plans submitted by regulated utilities to their respective regulators, setting out how they intend to meet the expected long-term growth of demand with minimal cost.

7 OR (Operating Ratio) is defined as operating expenses as a percentage of revenue and is a key metric for PSR.

8 Return on Invested Capital.9 Total Shareholder Return.

10 Cost per volume metric, where purchased services and rents includes the costs of services purchased including the costs of operating facilities and equipment rentals. GTMs is gross ton miles which is movement of one ton of train weight over one mile.

11 The transportation of freight via an intermodal container, using multiple modes of transportation (e.g. ship, aircraft, rail / truck), without handling the freight itself when changing modes.

12 Los Angeles/Long Beach.

13 13. Per-and polyfluorinated alkyl substances, also known as “forever chemicals”..

Company data obtained from company annual reports or other investor reports. Financial metrics and valuations are based on Bloomberg data. Data as of 31 May, 2024 unless otherwise noted. Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same.

Read our latest insights

Important information

This material is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should conduct your own due diligence and consider your individual investment needs, objectives and financial situation and read the relevant offering documents for details including the risk factors disclosure.

Any person who acts upon, or changes their investment position in reliance on, the information contained in these materials does so entirely at their own risk.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Investors.

Past performance is not indicative of future performance. All investment involves risks and the value of investments and the income from them may go down as well as up and you may not get back your original investment. Actual outcomes or results may differ materially from those discussed. Readers must not place undue reliance on forward-looking statements as there is no certainty that conditions current at the time of publication will continue.

References to specific securities (if any) are included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Any securities referenced may or may not form part of the holdings of First Sentier Investors' portfolios at a certain point in time, and the holdings may change over time.

References to comparative benchmarks or indices (if any) are for illustrative and comparison purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities) that are different from the funds managed by First Sentier Investors.

This document is not, and under no circumstances is to be construed as, an advertisement or a public offering of the fund in Canada. No securities commission or similar authority in Canada has reviewed or in any way passed upon this document or the merits of the fund described in this document, and any representation to the contrary is an offence.

Selling restrictions

Not all First Sentier Investors products are available in all jurisdictions.

This material is neither directed at nor intended to be accessed by persons resident in, or citizens of any country, or types or categories of individual where to allow such access would be unlawful or where it would require any registration, filing, application for any licence or approval or other steps to be taken by First Sentier Investors in order to comply with local laws or regulatory requirements in such country.

This material is intended for ‘professional clients’ (as defined by the UK Financial Conduct Authority, or under MiFID II), ‘wholesale clients’ (as defined under the Corporations Act 2001 (Cth) or Financial Markets Conduct Act 2013 (New Zealand) and ‘professional’ and ‘institutional’ investors as may be defined in the jurisdiction in which the material is received, including Hong Kong, Singapore, Japan, and the United States, and should not be relied upon by or be passed to other persons.

The First Sentier Investors funds referenced in these materials are not registered for sale in the United States and this document is not an offer for sale of funds to US persons (as such term is used in Regulation S promulgated under the 1933 Act). Fund-specific information has been provided to illustrate First Sentier Investors’ expertise in the strategy. Differences between fund-specific constraints or fees and those of a similarly managed mandate would affect performance results.

About First Sentier Investors

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Investors, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group (MUFG). Certain of our investment teams operate under the trading names FSSA Investment Managers, Stewart Investors and Realindex Investments, all of which are part of the First Sentier Investors group.

This material may not be copied or reproduced in whole or in part, and in any form or by any means circulated without the prior written consent of First Sentier Investors.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311)

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188)

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Investors, FSSA Investment Managers, Stewart Investors, Realindex Investments and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), Realindex Investments (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business divisions of First Sentier Investors (Singapore).

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

- United States by First Sentier Investors (US) LLC, authorised and regulated by the Securities Exchange Commission (RIA 801-93167)..

- Other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Investors Group

Get the right experience for you

Your location :  Netherlands

Netherlands

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom