Beyond lip service: Progress in gender diverse leadership

Over the past two years, RQI Investors has created a comprehensive, proprietary database of gender diversity statistics for companies in the MSCI ACWI, an index of large- and mid-cap stocks across 23 developed and 25 emerging markets. The data spans more than a decade and reveals trends in gender diversity at both board and senior management levels.

RQI Investors has been using gender diversity data alongside other company performance metrics in its investment process. In 2022, it published a research report showing that gender diversity boosts company performance and has the potential to boost returns for investors.

Using the same database, RQI Investors has reviewed the progress of gender diversity over the past three years. Some of the insights are outlined below.

- The world’s 20 best-performing companies (in terms of gender diversity for leadership) had boards and senior management teams with female representation of between 50–60%. This is also true for Australia, where the most gender diverse boards and senior management teams had more than 50% women.

- Globally, the number of firms with more than 40% women on boards has almost doubled over three years (1/01/2020–31/12/2022) and risen by 25% for senior management in the same period. However, when we look at the raw numbers this still only equates to less than 10% of companies.

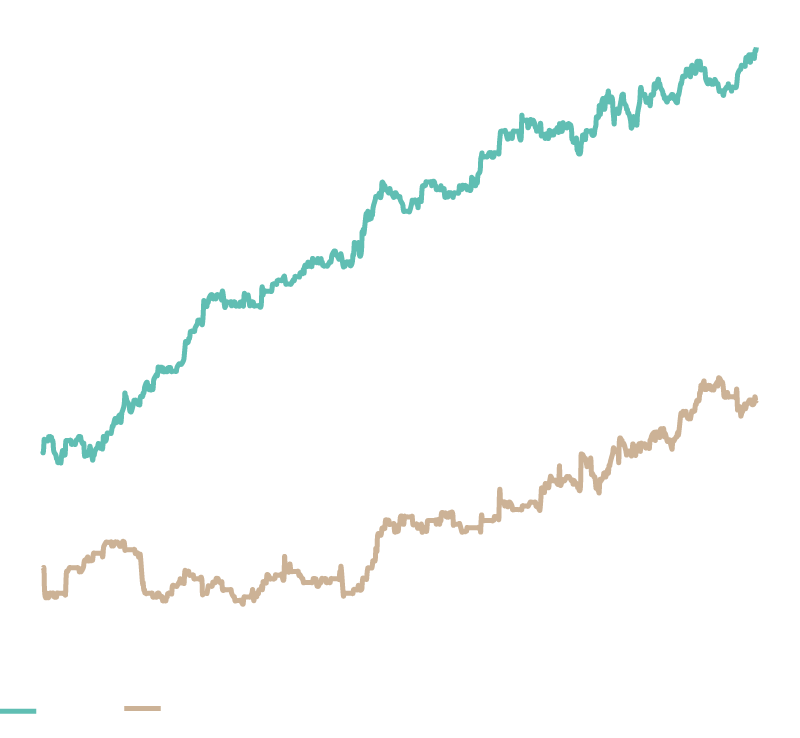

Figure 8. Number of Global (MSCI ACWI ex AU) firms with more than 40% female representation

Source: Factset, RQI Investors; data as at 31/12/22

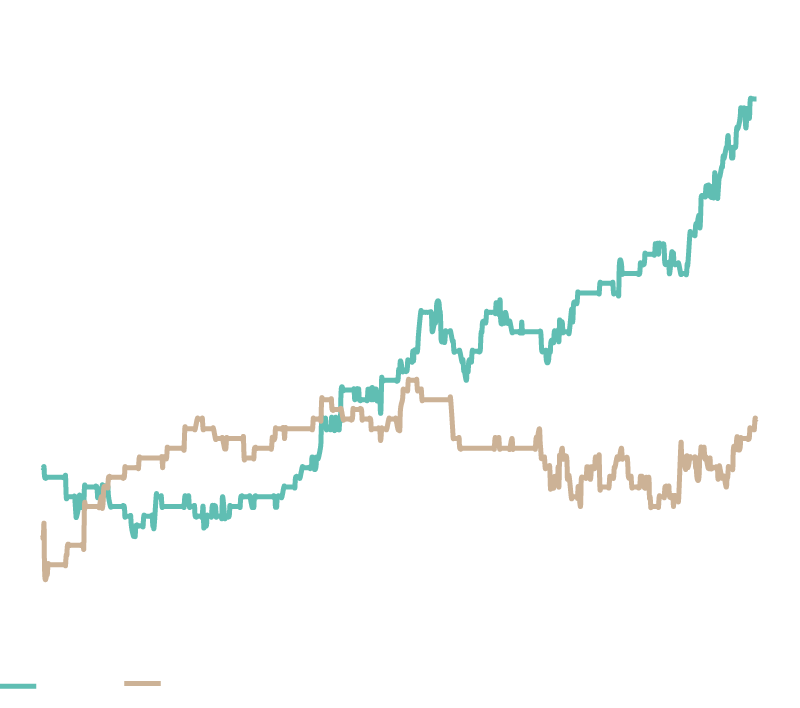

In the last 3 years within the ASX300, the number of firms with more than 40% women on the board has nearly doubled, while the increase in senior management has been more modest, growing by 25%. However, when we look at the raw totals, this still only equates to 81 and 48 companies respectively.

Figure 9. Number of ASX 300 firms with more than 40% female representation

Source: Factset, RQI Investors; data as at 31/12/22

The sectors with the larger increases within Australia have tended to be within the Materials and Financial sectors, whilst globally it has been the Financials, Industrials and Materials sectors. Globally the USA and China have led the larger increases in diversity in both the board and senior management.

Australian Small and Mid-Cap Companies

The Australian Small and Mid-Cap Companies team frequently discuss ESG issues with senior management and board members during the team’s extensive engagement with companies. The team seeks to ensure that management are aware of, and accountable for, the management of material ESG issues. These discussions contribute towards the team’s overall investment view and are an integral part of the team’s investment process.

As minority shareholders, it is pleasing to support ESG initiatives and witness improvements in the companies in which we invest. A mining company, which is a key holding in the mid-cap strategy, has steadily improved its ESG practices over several years, which the team has fully endorsed. For example, the mining company has improved its gender diversity across all levels of the organisation, resulting in the workforce now comprising almost 30% women, including more than 40% female representation in the senior executive team and the board. The company’s approach to ESG considerations has helped it become one of the leaders in the mining industry globally and it remains a core holding in the mid-cap strategy.

Challenges

We are currently exploring ways to assess more markers of diversity in companies.

If diversity can be summed up as ‘the things that make us different’, those things are often a combination of internal factors such as race, age, or sexual orientation, as well as external forces such as a person’s socioeconomic background or education. A diverse organisation will be comprised of people who have a range of different experiences, however, data on such factors is often limited, partly due to their personal nature.

FSI’s own Diversity Census, now in its second year, is a voluntary survey that seeks to capture these more nuanced differences. It allows us to be more transparent with clients and employees, as well as identify areas for improvement. We would like to see similar approaches in the companies we invest in, so that we can engage with them more meaningfully on this topic.

Get the right experience for you

Your location :  Luxembourg

Luxembourg

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom