This is a financial promotion for The First Sentier Global Property Securities Strategy. This information is for professional clients only in the UK and elsewhere where lawful. Investing involves certain risks including:

- The value of investments and any income from them may go down as well as up and are not guaranteed. Investors may get back significantly less than the original amount invested.

- Currency risk: Changes in exchange rates will affect the value of assets which are denominated in other currencies.

- Single sector risk: Investing in a single sector may be riskier than investing in a number of different sectors. Investing in a larger number of sectors helps spread risk.

- Single country / specific region risk: Investing in a single country or specific region may be riskier than investing in a number of different countries or regions. Investing in a larger number of countries or regions helps spread risk.

- Charges to capital risk: The fees and expenses may be charged against the capital property. Deducting expenses from capital reduces the potential for capital growth.

- Property securities risk: Investments are made in the shares of companies that are involved in property (like real estate investment trusts) rather than property itself. The value of these investments may fluctuate more than actual property.

- Emerging market risk: Emerging markets may not provide the same level of investor protection as a developed market; they may involve a higher risk than investing in developed markets.

For details of the FCA authorised firms issuing this information and any funds referred to, please see Terms and Conditions and Important Information below

For a full description of the terms of investment and the risks please see the Prospectus and Key Investor Information Document for each Fund.

If you are in any doubt as to the suitability of our funds for your investment needs, please seek investment advice.

“Stabilising the climate will require strong, rapid, and sustained reductions in greenhouse gas emissions, and reaching net zero CO2 emissions.”

These words come from the latest Intergovernmental Panel on Climate Change (IPCC) Report1, released in August 2021. It paints an alarming picture of global warming and encourages swift action. Given that the global real estate sector creates one-third of global greenhouse gas emissions2, it is crucial that asset owners and investors take a proactive approach to reducing the carbon footprint of the properties we live, work and invest in.

At First Sentier Investors, the Global Property Securities team is taking a proactive approach to decarbonising our portfolio of Real Estate Investment Trusts (REITs) by setting a net zero emissions target. The REIT sector’s total assets are valued at over US$2 trillion3, and as some of the largest landlords in the world, they have clear duty of care to help fight climate change.

We have undertaken extensive analysis of our REIT portfolio using sophisticated models, developed in-house, and we are allocating our capital to landlords who are committed to emissions reduction. In this way, we believe real estate investors can play an important part in addressing climate change.

Three pathways to a low-carbon future

Our net zero analysis covers five areas:

1. Operational carbon

2. Embodied carbon

3. On-site energy generation

4. Procurement of renewable energy

5. Carbon offsets

Below, we discuss how each element will play a role in reaching the target of net zero carbon emissions for the portfolio.

Operational carbon

Operational carbon comes from completed buildings, and is generated from activities such as lighting, cooling, heating and running appliances.

Our operational carbon analysis includes forecasts on all owned real estate based on company information and our own assumptions. We forecast operational efficiency gains from development, redevelopment and maintenance capex programmes.

In order to reduce operational carbon emissions, modernisation is key. The newer a building is, the more efficient it is. On average, a new building is up to 55% more carbon efficient4.

Asset owners have a number of levers available to reduce their operational carbon footprint:

– Replacement: a knockdown-rebuild generally has the greatest impact on operational emissions, as efficiency can be built into the design and using the latest technologies. However, the building process does generate higher embodied carbon (explained below).

– Redevelopment: retaining the shell of a building but extensively renovating it can reduce the emissions associated with demolition and building. However, it generally doesn’t provide the same scope to embed efficiencies as a full redesign and rebuild.

– Modernisation: ongoing improvements such as overhauling HVAC systems5 Heating, ventilation, and air conditioning, replacing lighting, or installing solar panels can significantly reduce a building’s emissions. In many cases, it can also be achieved within existing capex maintenance budgets, which landlords set at an average of 5% of rent6.

There are two things landlords need in order undertake these improvements: access to capital and access to green building expertise. Investors need to be supportive of the former, and the property industry needs to continue fostering the latter, in order to successfully decarbonise the sector.

Embodied carbon

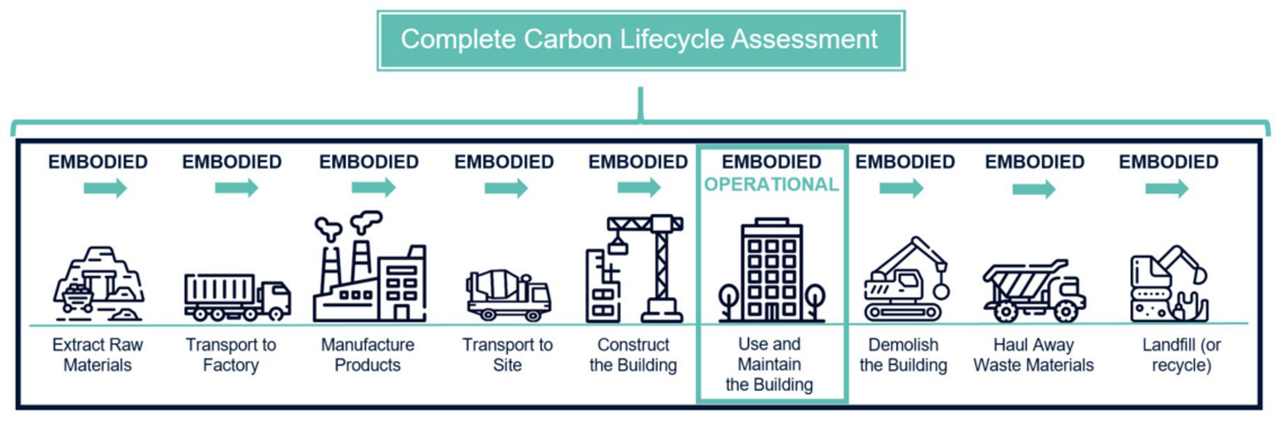

This relates primarily to the start and end of life of the assets, from demolition to construction, as outlined in Diagram 1 below. This is a critical part of the carbon puzzle: it’s estimated that 74% of total emissions from new buildings between 2020 and 2030 will be from embodied carbon7.

Diagram 1. Embodied carbon lifecycle

In our analysis, we take into account the embodied carbon of any building, with assumptions shared up and down the supply chain. Landlords are also increasingly accounting for the cost to the environment and including the carbon output into their project feasibility planning.

On-site energy generation

Buildings are conducive to on-site energy generation, particularly solar. Photovoltaic cells costs have fallen in recent years, and where a building’s surface area has the appropriate orientation, installing solar panel systems can deliver compelling economic returns while also reducing emissions.

Procuring renewable energy

Retail electricity providers are becoming more sophisticated in offering negotiated renewable energy procurement contracts with large energy users such as REIT owners. As a result, relative costs have fallen in many countries and renewable energy uptake has increased among building owners. This user-driven demand, from large energy customers, is leading to significant amounts of capital being invested in large-scale renewable energy generation.

Carbon offset

It’s not realistic for buildings to eliminate their emissions altogether – in the short-term at least. In an ideal future, we will see fully electrified buildings fed from a 100% renewable energy grid.

At the moment, however, carbon offsets play an important role in reaching net zero. Investment in outsourced carbon offset schemes, such as land and forest regeneration projects, have significant long-term benefits for the environment.

Some real estate owners are going even further, making direct investments in projects such as renewable energy generation, and holding them on their balance sheets.

Regardless of how they choose to offset their carbon, landlords need to ensure they are proactively accounting for the environmental costs of their assets in a clear and transparent way.

The road ahead

As the global population approaches 10 billion, the world’s building stock will likely need to double in size8. This means that the property sector has a significant responsibility for reducing greenhouse gas emissions – but that also means it has a huge opportunity.

Responsible investment considerations have been fully ingrained into our investment process for over a decade. We take our custodianship role very seriously and will seek to influence environmental, social and governance outcomes wherever we can.

Now, decarbonisation is the most urgent and important challenge we have as investors. By understanding how our portfolio impacts the climate, and engaging with REIT owners to drive positive change, we believe we can make a difference.

1 https://www.ipcc.ch/2021/08/09/ar6-wg1-20210809-pr/

2 Source: World GBC - Advancing Net Zero – Asia Pacific Embodied Carbon Primer, Sept 2020

3 Source: FSI, August 2021

4 Source: FSI, August 2021

5 Heating, ventilation, and air conditioning

6 Source: FSI, August 2021

7 Source: World GBC - Advancing Net Zero – Asia Pacific Embodied Carbon Primer, Sept 2020

8 World GBC - Bringing Embodied Carbon Upfront, Sept 2020

Important Information

This document has been prepared for informational purposes only and is only intended to provide a summary of the subject matter covered. It does not purport to be comprehensive or to give advice. The views expressed are the views of the writer at the time of issue and may change over time. This is not an offer document and does not constitute an offer, invitation or investment recommendation to distribute or purchase securities, shares, units or other interests or to enter into an investment agreement. No person should rely on the content and/or act on the basis of any material contained in this document.

This document is confidential and must not be copied, reproduced, circulated or transmitted, in whole or in part, and in any form or by any means without our prior written consent. The information contained within this document has been obtained from sources that we believe to be reliable and accurate at the time of issue but no representation or warranty, express or implied, is made as to the fairness, accuracy, or completeness of the information. We do not accept any liability whatsoever for any loss arising directly or indirectly from any use of this document.

References to “we” or “us” are references to First Sentier Investors a member of MUFG, a global financial group. First Sentier Investors includes a number of entities in different jurisdictions. MUFG and its subsidiaries do not guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk including loss of income and capital invested.

If this document relates to an investment strategy which is available for investment via a UK UCITS but not an EU UCITS fund then that strategy will only be available to EU/EEA investors via a segregated mandate account.

In the United Kingdom, issued by First Sentier Investors (UK) Funds Limited which is authorised and regulated in the UK by the Financial Conduct Authority (registration number 143359). Registered office Finsbury Circus House, 15 Finsbury Circus, London, EC2M 7EB number 2294743. In the EEA, issued by First Sentier Investors (Ireland) Limited which is authorised and regulated in Ireland by the Central Bank of Ireland (registered number C182306) in connection with the activity of receiving and transmitting orders. Registered office: 70 Sir John Rogerson’s Quay, Dublin 2, Ireland number 629188. Outside the UK and the EEA, issued by First Sentier Investors International IM Limited which is authorised and regulated in the UK by the Financial Conduct Authority (registered number 122512). Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB number SCO79063.

Copyright © (2021) First Sentier Investors

All rights reserved.

MAR000832_0821_EMEA

Get the right experience for you

Your location :  Switzerland

Switzerland

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom