Listen to the episode

RQI Investors Real Insights: Lessons from the Quant Winter

In this episode we explore RQI Investors' latest research “Lessons from the Quant Winter”, a comprehensive report that examines the challenging period from 2018 to 2020 when quant strategies faced significant headwinds. We unpack the causes behind this underperformance, the impact on markets (especially in Australia and other developed economies), and the surprising rebound post-COVID. We explore the intersection of human expertise and advanced technology, brought to life through an AI-generated voice.

Summary

The quant winter was a two‑year period from 2018 to 2020 when quant funds underperformed. This was largely a Developed Markets effect, with Australia also affected, and Emerging Markets showed a different profile (shorter and sharper).

The main culprit was Value, which performed poorly (and progressively worse) as the period went on. Other factors like Growth and Momentum – which usually compensate for Value underperformance – and Low Volatility did not. Quality performed relatively well.

The “why” is not clear. Low inflation and the growth of big tech from about 2015 are certainly contributors, but the lack of performance of Growth and Momentum is still a puzzle.

By using a perfect forecast or “oracle” approach, we see that it would have been difficult to position a quant factor model any differently.

The last few years have shown strong quant factor performance and have raised questions of whether a quant winter could recur. We believe this period is more of a recovery from the winter than a precursor to another factor drought.

A value story

What became known as the quant winter was a period of a little over two years, from early 2018 to mid-2020. Nomura, in a private research note, found that only 15% of quant funds beat their benchmarks in 2018 and 2019.1

Could it happen again? A recent bounce back in performance has raised this question.

We look at factor performance during this period and whether we would have done anything differently if we had known in advance of this period.

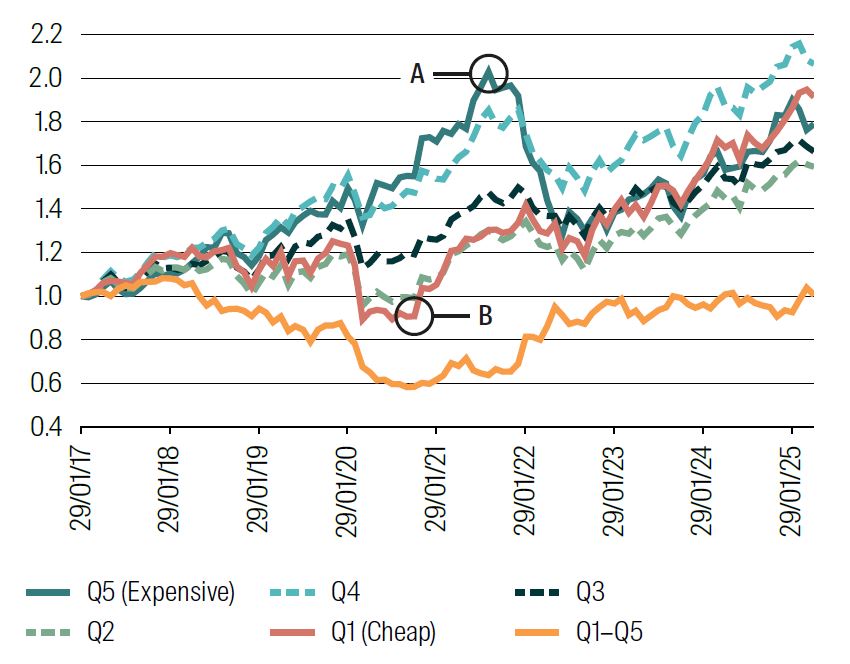

We find that the main driver of this poor performance was the Value factor. The orange line on Chart 1 below shows the performance of Value from 1 Jan 2017 to 1 May 2025. It fell sharply from about early 2018 until mid‑2020, when it rebounded. The best Value stocks (Q1, red line) were flat until early 2020, when their performance fell and then sharply rose (point B).

The most expensive stocks (Q5, dark green line) ran very strongly until late 2021, when they fell sharply (point A).

Chart 1: Performance of Value quintiles (measured as EY_NTM)

1 Jan 2017 to 1 May 2025.

Source: RQI Investors, MSCI, 2025.

1 See for example https://www.ft.com/content/8666e64a-357f-11ea-a6d3-9a26f8c3cba4

Potential causes?

Isolating a single cause of the quant winter is probably impossible. At first blush there are a number of possible explanations which, in combination, led to this period of factor underperformance.

Below we list some likely culprits.

1. Growth and valuation multiple expansion of big US tech

In our opinion, this is the main driver of the underperformance of Value during this period. The growth in the largest stocks in the US has been dramatic since about 2015, as we saw in our recent paper on Market Concentration.1

The weight of the top 10 names in MSCI World steadily increased from about 10% in 2015 to more than 25% by late 2024, and these stocks trade at much higher multiples than the market, with the spread widening very sharply, from late 2018.

2. Crowding of factors or increased correlation through quant fund growth

Factor crowding has been a problem in the past, with the GFC being the prime example, where many quant fund returns were highly correlated and negative during the market sell‑off.

The correlation of Value with other factors was highly variable and not increasing as crowding would suggest. We do see Value becoming much less negatively correlated with Momentum and Growth at the start of the quant winter, before reverting. Quality and Growth correlation also varied sharply over the period, although is positive overall.

3. Academic data mining/overfitting

The idea here is that quant investor models closely followed the publication of academic research papers, and that academic research has had poor performance out of sample, either due to overfitting in sample or seeing the idea priced out immediately. We dispute this: (a) quant funds do not blindly adopt these newly released ideas directly into their models, (b) it is the behaviour of more standard or generic factors that seem to be at the heart of the quant winter, and (c) the behaviour of these factors is not uniform, and so does not point to a central all‑encompassing factor driver like research overfitting.

4. Low interest rates and inflation

Characteristics of the approximately 10 years between the GFC and Covid were low interest rates and low inflation. We already know that this led to a period which provided strong support for Growth as a style, evidenced by the underperformance of the Value style for most that period.2 In some ways, government or political policy encouraged a type of Growth bubble and supported the dramatic emergence of the tech giants.

5. Natural cyclicality in quant factors?

Different types of quant factors work at different stages of the economic cycle. There are also examples of “seasonality” rather than cyclicality. (for example, momentum in Australia tends to work especially well in June and then badly in July, due to tax loss selling and then repurchase).

Detectable quant behaviour can be attached to certain market regimes, but we could not call it cyclicality. Its contribution to the quant winter was probably very muted.

1 Walsh, D, RQI Investors, 2025, Extreme concentration and its implications for equity investors. https://www.firstsentierinvestors.com.au/au/en/institutional/insights/latest-insights/extreme-concentration-and-its-implications-for-equity-investors.html

2 Artificially low interest rates provide a stimulus for Growth as long dated cash flows are inflated in Present Value calculations.

A second-rate oracle

How should we have been positioned if we wanted to avoid underperformance during this period? In other words, if we have access to an oracle, who could tell us what was about to happen, how would we act? What would pay off?

We propose a second‑rate oracle, rather than a first‑rate all‑ seeing oracle. This second‑rate oracle can only tell us in which quintile of future returns a stock belongs today. For example, by visiting our second‑rate oracle we will get to know today if stock ABC will be in the top quintile of returns in (say) 12 months’ time. Our obvious investment strategy is then to go long quintile 1 and short quintile 5.1

What are the characteristics of the stocks in these quintiles?

This helps us pose the entirely hypothetical question – how would we be positioned (that is, what factor exposures would we have) to capture the return spread between best value and most expensive (Q1–Q5)?2 Our universe is again MSCI World ex Australia.

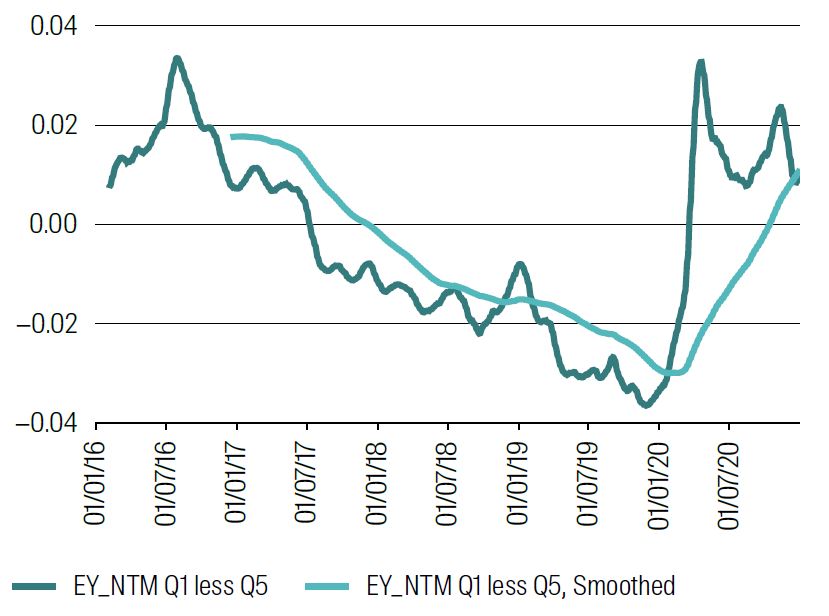

Chart 2 plots the optimal positioning during the quant winter period – from the start of Jan 2016 to the end of Dec 2020.3 Recall that each point in the chart is the Value tilt that will maximise returns over the next 250 days.

We see the essence of the quant winter here. At the beginning of 2016, we would want to hold a positively tilted Value portfolio to get the best return over the following 250 days. But this tilt rapidly declined, went negative and remained strongly negative for the quant winter period. In other words, we would want to tilt aggressively away from Value for perhaps two years to take advantage of our oracle’s knowledge of the future, and that tilt became stronger as the period went on. This tilt only rebounded back to value during late 2020.

Chart 2: Value exposure in oracle quintile spread Q1–Q5

1 Jan 2016 to 1 Jan 2021.

Smoothing is via 25 day and 250 day rolling averages.

Source: RQI Investors, MSCI, 2025

1 Note the convention that Q1 is good value and Q5 is expensive.

2 This is not a ground-breaking idea, but it does quantify the potential benefits (or losses) and shows the time varying exposure required to achieve those benefits.

3 We start one year earlier than in the first paper to allow us to calculate a 250-day future window and to see the runup to the quant winter.

Is another quant winter likely?

We would say this is very unlikely as the circumstances which led to it were very unusual both in scale and confluence.

Value significantly underperformed due to a combination of low interest rates (supporting growth) and an apparent generational step change in technology, which is highly concentrated in a few stocks. Quality (measured as ROE) paid off, but it was expensive. Momentum did not pay off – the move may have been too concentrated. Growth did not pay off because it was not growth in earnings but a growth in multiples that was behind it. In summary, the set of circumstances leading to this period was unusual and seems to have a low probability of being repeated.

We would make two recommendations to help mitigate the impact of future signal vacuums like this. They seem obvious in hindsight but are critical to a high‑quality quant process.

- Avoid overuse of generic quant factors and diversify your inputs.

- Diversify the output factor exposures through better portfolio construction.

Recovery

In the first two chapters, we looked at the origins of what became known as the quant winter, how it played out and what might have caused it. We also looked at how we might have been positioned (theoretically only) if we had known something of this in advance.

In this final chapter, we look at the period from the end of this quant winter to today (actually, end of April 2025), which has been a time of strong quant alpha performance, perhaps stronger than we might have expected. Is this an unusual period, or is it a snapback of the alpha drag we have seen, or something else? To try to answer these questions, we look to contemporaneous factor returns and their correlations.

We title this chapter “Recovery” rather than something like “Quant Spring” quite deliberately, as we want to avoid this interpretation that quant is somehow seasonal.

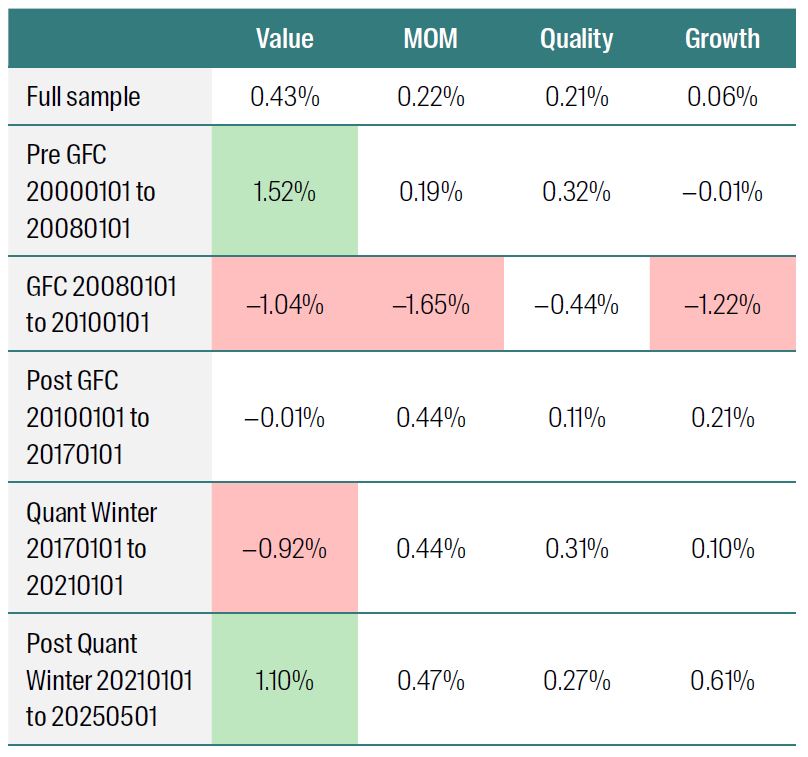

Table 1 summarises our results. We see that this recovery period for each factor is no stronger than other periods in the past, except perhaps for the growth factor. This is almost certainly due to ongoing performance of tech. Less common is seeing Value, Momentum and Growth all performing at the same time. Unusually, Quality has been positive but lower than in the past, suggesting that the strong return to earnings growth has been at the expense of ROE.

Table 1: Average monthly Q1–Q5 return spreads for each factor at different periods

Source: RQI Investors, MSCI, 2025

Read our latest insights

Important Information

This material is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should consider, with the assistance of a financial advisor, your individual investment needs, objectives and financial situation.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material and we do not undertake to update it in future if circumstances change.

To the extent this material contains any expression of opinion or forward‑looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Group.

About First Sentier Group

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Group, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group. Certain of our investment teams operate under the trading names AlbaCore Capital Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners, all of which are part of the First Sentier Group. RQI branded strategies, investment products and services are not available in Germany.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

• Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311)

• European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188)

• Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong.First Sentier Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the businessnames of First Sentier Investors (Hong Kong) Limited.

• Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Group (registration number 53507290B), First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business names of First Sentier Investors (Singapore).

• United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

• United States by First Sentier Investors (US) LLC, registered with the Securities Exchange Commission (SEC# 801‑93167)

• other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Group 2025

Get the right experience for you

Your location :  United States

United States

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom