FSSA Investment Managers

- Our capabilities

- FSSA Investment Managers

- Approach to responsible investment

Approach to responsible investment

Stewardship and ESG integration

We are responsible investors and have integrated ESG analysis and company engagement into the investment process. We believe that relevant ESG factors highlight the sustainability of a company’s earnings and could generate a significant impact on investment performance.

We believe quality companies with better ESG credentials will generally merit a higher valuation multiple; conversely, weaker companies may warrant a discount. By evaluating ESG factors, we can assess what might significantly improve or indeed destroy the investment case in terms of future valuations.

On the other side of the equation, being responsible investors means that we are responsible owners. We consider every company meeting as an opportunity to engage with management and we take our ownership responsibilities seriously. We engage extensively with companies to share best practice and influence behaviour on material issues.

| Countries visited in 2022 | China, Hong Kong, Australia, Egypt, United Arab Emirates, Germany, Indonesia, India, Japan, Singapore, Taiwan, Mexico, United Kingdom, United States |

| Number of meetings | 1558 |

Climate change statement

At FSSA, we have always believed that sustainability challenges and opportunities are a core part of investment fundamentals and can have an outsized impact on a company’s returns. We actively seek to invest in businesses whose sustainable practices and products are able to meet the world’s changing expectations.

This matters to us because as long-term investors, we expect that companies will have to bear the costs of meeting these challenges over the course of our ownership.

Key climate-related risks in our portfolios

Many of the countries we invest in are particularly vulnerable to climate-related risks given their geography and economic sensitivity. Therefore, we expect that every company we invest in will be exposed to some form of climate risk. Specifically, we have large exposures to financial services and consumer staples companies in our portfolios. To assess climate risk in the finance sector, we focus on lending practices and the impact this has on climate change. For consumer staples, the most material environmental topics are raw material use, water management and plastics pollution.

Climate risks – including those related to the transition to low-carbon economies, the physical impacts of climate change, reputational concerns, and regulatory and legal requirements – are all interconnected issues. Of these, we consider transition risks and physical risks to be the most significant to our portfolio and those that we can address directly with companies.

Transition risks are growing in consideration as companies think through the societal and economic shifts toward a low-carbon future. We see them as immediate challenges to address. Whilst our direct exposure to fossil fuels, agriculture and mining is minimal, we acknowledge that these businesses form a meaningful part of our investee companies’ supply chains. We therefore consider these risks from a top-down industry perspective as well as from a bottom-up, company-by-company point of view.

Physical risks refer to the impacts of a changing and volatile climate on existing business practices. As such, we believe this affects all companies – either through their primary business activities or their supply chains and distribution activities.

Beyond these two primary risks, companies also face more stringent regulatory and legal risks, which increases the risk of reputational damage. The governments of countries in which we invest have begun to implement penalties for non-compliance. We fully expect these risks to increase over time.

How we identify these risks

We identify climate-related risks throughout the research process, from the initial company assessment to the ongoing monitoring and review. We believe the most effective way to identify risks is through regular engagement with company management. This also provides us with an opportunity to assess other “soft factors” and determine whether a company’s efforts to manage climate risks are genuine.

To evaluate a company’s climate-related risks and opportunities and to prepare for these conversations with management, we review company disclosures and note the adherence to the Task Force on Climate-Related Financial Disclosures (TCFD). We also review data from third-party providers such as ISS and MSCI to provide us with a company’s historical carbon intensity and scope 1 and scope 2 emissions. Additionally, we use Sustainalytics and RepRisk, among others, to alert us of significant recent events and controversies. These findings are used to augment our engagement with companies.

Throughout the engagement process we identify areas where companies could improve and offer external resources that may assist in the process. For example, we encourage companies to utilise established frameworks like TCFD and the Science-Based Targets initiative (SBTi) to report on climate-related disclosure and targets.

We do not, at this stage, conduct separate scenario analyses as it relies heavily on unknowable assumptions, particularly around scope 3 emissions.

How we manage these risks

We manage climate-related risks from both a holistic portfolio perspective and in a bottom-up manner.

From a portfolio perspective, we conduct fund-level sustainability reviews with environmental and social indicators to identify the outliers and laggards, which then focuses our engagement efforts. Specific to climate risks, we review total carbon emissions, trends in emissions intensity, quality of disclosure and alignment to SBTi. We launched a decarbonisation process in 2021 with an assessment of how our holdings were positioned, how they performed at that point in time, and their plans for the future. With our engagement-led process, we started with an assessment of our largest positions, with the aim of driving multi-year emissions reductions. The lowest performing companies in our initial review have been prioritised for more pressing engagement.

From a bottom-up perspective, we integrate climate considerations throughout the research process. With every potential investment, we consider the business model and its exposure to climate-related risks, and decide whether we are comfortable with the level of risk the company faces. Assessing the quality of management is a critical component of our investment process. We look for signs that there is a long-term owner/manager who is passionate about climate issues – or is incentivised to care about this multi-decade challenge.

We may further express our views through votes on company proposals. Whilst we subscribe to proxy voting services such as Glass Lewis and Ownership Matters as a guide, the ultimate decision on how we cast our proxy votes lies with the respective investment analyst.

Our funds tend to have significantly lower carbon intensity than their respective benchmarks. However, we believe this data is best viewed as an output of our investment philosophy, which is centred on assessing the quality of companies holistically rather than selecting only those that perform well on this metric. We are hopeful that as the broader corporate world decarbonises, the gap between the benchmark and our portfolios will gradually close – and improve together.

Our targets

Our efforts to decarbonise are focused on reducing the total carbon emissions of our holdings. Rather than selling our carbon-intensive assets or buying companies that rely on an abundance of offsets, we seek to encourage an aggressive reduction in greenhouse gas (GHG) emissions among our investee companies, as is necessary to contribute to a real world reduction. We place less emphasis on grand-gesture statements and more on action and evidence.

We launched our decarbonisation process in 2021 with an assessment of how our holdings were positioned, how they performed at that point in time, and their plans for the future. While we plan to engage with all of our companies on this topic, we started with the most urgent – our largest positions in regional and country portfolios and those in carbon-intensive sectors covering 75% of FSSA’s total assets under management (AUM).

Our assessment is based heavily on the “net zero alignment maturity scale” from the Net Zero Investment Framework Implementation Guide (NZIFIG) produced by the Institutional Investors Group on Climate Change. Each portfolio company has been assigned to one of four tiers ranging from leader to laggard. The nuance in our tiers provides flexibility around a company’s direction of travel, resource constraints and purposefulness, which we think is essential in an emerging market context.

| FSSA tier | FSSA definition | NZIFIG maturity scale | Differences |

|---|---|---|---|

| Tier 0 | Not applicable | Achieving net zero | FSSA does not define this tier level. Companies achieving net zero are included in the Tier 1 definition. |

| Tier 1 | “Leader” is defined as either achieving net zero with current emissions intensity performance at, or close to, net zero emissions; or those aligned to net zero with adequate emissions reduction performance over three or more years | Aligned to a net zero pathway | FSSA includes both those that are achieving net zero or those aligned to net zero in this category. NZIFIG only considers those with current intensity emissions at or close to net zero to be achieving net zero or aligned. NZIFIG recommends checking the proportion of green revenue and if there are relevant increases over time as part of the company's decarbonisation plan. FSSA does not include this criteria. |

| Tier 2 | “Committed” is defined as aligning with short-, medium- or long-term goals (but not all), and disclosure of scope 1 and 2 emissions data for two or more years (with an option to include material scope 3 emissions data) | Aligning towards a net zero pathway | NZIFIG recommends checking the proportion of green revenue and if there are relevant increases over time as part of the company's decarbonisation plan. FSSA does not include this criteria. FSSA checks for any combination of scope 1, 2 or material scope 3 emissions reduction targets, defines adequate progress over two or more years, and how the business model may contribute to decarbonisation or how it may be structurally challenged. NZIFIG does not state progress over a specific timeframe. |

| Tier 3 | “Laggard, Planning” is defined as committed to aligning towards a net zero pathway with the intention to set clear targets, and disclosure of scope 1 and 2 emissions data for at least one year, but with little to no progress over time | Committed to aligning | NZIFIG specifies having a long-term goal to achieve net zero by 2050. FSSA checks for a clear foundation to set a target and will engage on this. FSSA checks for disclosure of scope 1 and 2 emissions for at least one year and any progress over that period, as well as how the business model may contribute to decarbonisation or how it may be structurally challenged. NZIFIG recommends transition plan methodologies with a progress timeframe defined according to the target(s) set. |

| Tier 4 | “Laggard, Needs Support” is defined as not aligned and may have the intention to set targets but with no time frames or metrics defined. These companies have poor disclosures leading to the inability to measure progress and their business models may be structurally challenged due to a reliance on carbon intensive resources. | Not aligned | NZIFIG designates this scale for all other companies. FSSA checks for level of disclosure, the intention to set a target, history of environmental malpractice, and how the business model may contribute to decarbonisation or how it may be structurally challenge. NZIFIG does not include this criteria. |

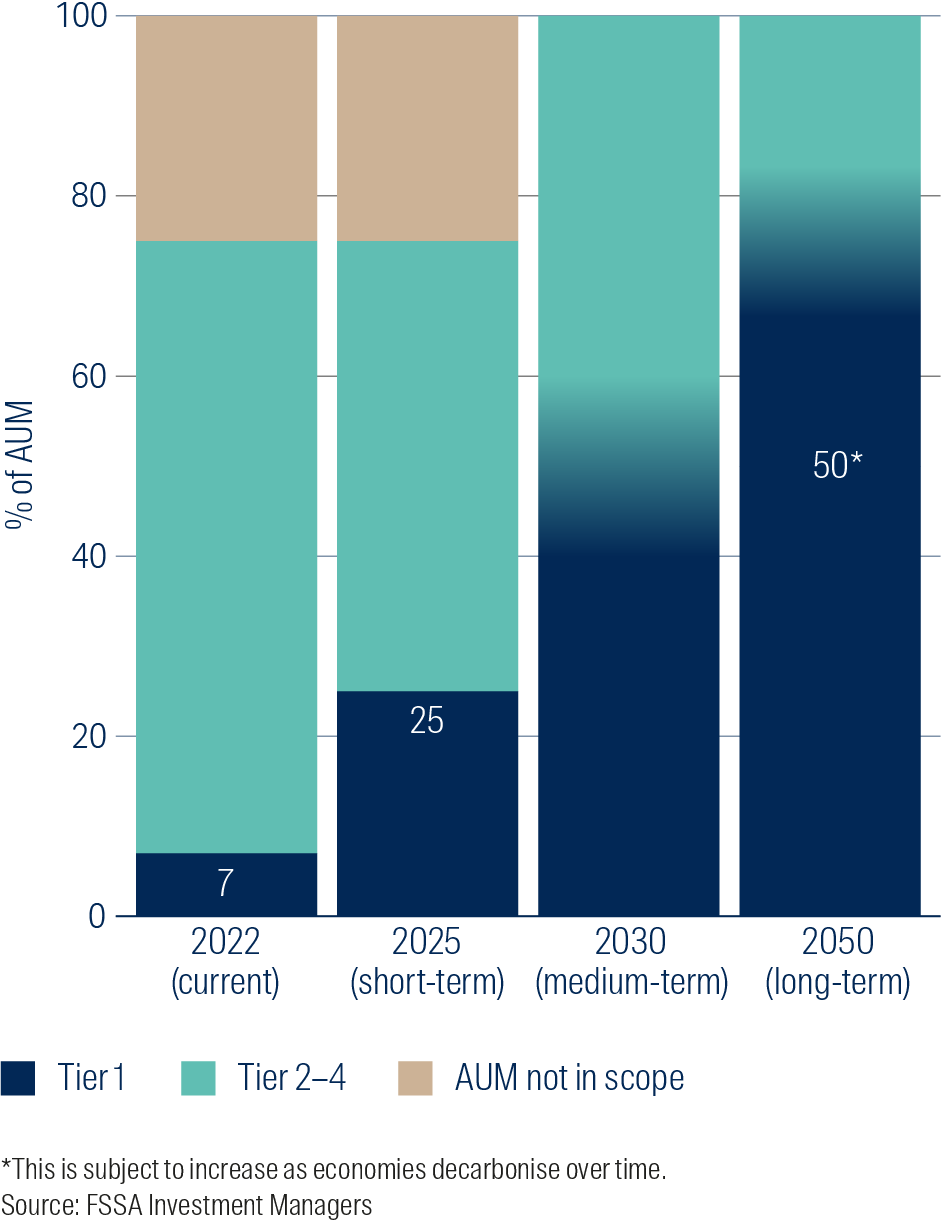

We have set targets to achieve by 2025, 2030 and 2050. With every passing year, we aim to increase the number of assessed companies graduating into Tier 1. We will report on the progress annually, then provide a detailed report in 2025 and every five years thereafter.

By 2025, we aim for 25% of assessed AUM to be assigned to Tier 1, aligned to net zero by 2050.

We will engage with all companies under assessment to meet 100% disclosure of scope 1 and scope 2 emissions by 2025, and encourage the alignment of targets to the Science Based Targets initiative (SBTi). We recognise that companies in our portfolio are subject to different timeframes (i.e., carbon neutrality by 2060 for China and by 2070 for India). We expect our holdings to align with the IPCC's recommendation of limiting global warming to below 1.5° Celsius and to reach net zero emissions by 2050.

By 2030, we aim to increase the percentage of AUM assigned to Tier 1, aligned to net zero by 2050, from the initial 25%.

Rather than penalise companies that are less advanced towards their net zero goals or those in hard to abate sectors, we aim to make and measure progress by supporting companies in this effort. We will achieve this through frequent engagement with company management to move towards genuine reductions and meaningful targets.

We are initially committing 50% of our AUM to be aligned to achieving net zero in 2050 (assigned to Tier 1), with an aim to increase the portion of AUM towards 100% as economies gradually decarbonise.

Case studies

We believe that a strong commitment to stewardship is an essential component of a strong approach to responsible investment, and that embedding responsible investment into the core of our investment activities is in the best long-term interests of our clients. For more than a decade we have systematically and progressively improved our practices and processes across our investment capabilities globally.

Proxy voting

Proxy voting history by type of resolution

The table below contains the proxy voting history for the team by issue type. The chart provides the same information for FY2023.

Voting independence

The chart below shows the number of times the team has voted against management recommendations, proxy advisors' recommendations, or against both. The purpose of this table is to show the independent judgement which is applied by the team when making voting decisions.

Proxy voting by region

The chart below shows the number of times the team voted in each region and the percentage of votes against management recommendations, against our proxy advisors' recommendation, or against both. The purpose of this table is to show the regional difference in voting patterns and governance concerns.

Proxy voting information is as at 31/12/2023

Source: First Sentier Investors / CGI Glass Lewis

Learn more

Disclaimer

Any targets (including, but not limited to, the net zero targets) on this webpage are based on (i) available information and representations made to First Sentier Investors by third parties, including, but not limited to, portfolio companies; and (ii) assumptions made in relation to future matters such as the implementation of government policy in climate-related areas, enhanced future technology and the actions of portfolio companies. Such information and representations may ultimately prove to be inaccurate and such future matters may not ultimately be realised. As such, First Sentier Investors cannot guarantee the achievement of these targets. These targets are subject to ongoing review and may change without notice.

Any ESG related commitments, are current as at the date of publication and have been formulated by the relevant investment team in accordance with either internally developed proprietary frameworks or are otherwise based on the Institutional Investors Group on Climate Change (IIGCC) Paris Aligned Investment Initiative framework. The commitments are based on information and representations made to the relevant investment teams by portfolio companies (which may ultimately prove not be accurate), together with assumptions made by the relevant investment team in relation to future matters such as government policy implementation in ESG and other climate-related areas, enhanced future technology and the actions of portfolio companies (all of which are subject to change over time). As such, achievement of these commitments depend on the ongoing accuracy of such information and representations as well as the realisation of such future matters. Any ESG related commitments are continuously reviewed by the relevant investment teams and subject to change without notice.

To the extent this material contains any measurements or data related to ESG factors, these measurements or data are estimates based on information sourced by the relevant investment team from third parties including portfolio companies and such information may ultimately prove to be inaccurate.

Keep up to date with our latest research and developments on social media, or subscribe to our email newsletter

First Sentier Investors became a Certified B Corporation in November 2022 with a score = 107.2, noting that the passing score is 80. Please visit the B Corp Directory to view our report and for additional information regarding the assessment process.

Copyright © First Sentier Investors (Australia) Services Pty Ltd 2026, (part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc MUFG.)

In the EU: This is a marketing communication. The fund(s) mentioned here may or may not be registered for marketing to investors in your location. If registered, marketing may cease or be terminated in accordance with the terms of the EU Cross Border Distribution Framework. Copies of the prospectus (in English and German) and key investor information documents in English, German, French, Danish, Spanish, Swedish, Italian, Dutch, Icelandic and Norwegian, along with a summary of investors' rights are available free of charge at firstsentierinvestors.com

Get the right experience for you

Your location :  Italy

Italy

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom