This is a financial promotion for The First Sentier Global Listed Infrastructure Strategy. This information is for professional clients only in the EEA and elsewhere where lawful. Investing involves certain risks including:

- The value of investments and any income from them may go down as well as up and are not guaranteed. Investors may get back significantly less than the original amount invested.

- Currency risk: the Fund invests in assets which are denominated in other currencies; changes in exchange rates will affect the value of the Fund and could create losses. Currency control decisions made by governments could affect the value of the Fund's investments and could cause the Fund to defer or suspend redemptions of its shares.

- Single sector risk: investing in a single economic sector may be riskier than investing in a number of different sectors. Investing in a larger number of sectors helps to spread risk.

- Charges to capital risk: The fees and expenses may be charged against the capital property. Deducting expenses from capital reduces the potential for capital growth.

- Listed infrastructure risk: the infrastructure sector and the value of the Fund is particularly affected by factors such as natural disasters, operational disruption and national and local environmental laws.

Emerging market risk: Emerging markets tend to be more sensitive to economic and political conditions than developed markets. Other factors include greater liquidity risk, restrictions on investment or transfer of assets, failed/delayed settlement and difficulties valuing securities. For details of the firms issuing this information and any funds referred to, please see Terms and Conditions and Important Information.

For a full description of the terms of investment and the risks please see the Prospectus and Key Investor Information Document for each Fund.

If you are in any doubt as to the suitability of our funds for your investment needs, please seek investment advice.

The energy crisis in Europe has boosted global demand for LNG.

Global listed infrastructure companies pioneered the US LNG industry, investing US$50 billion since 2010.

The energy crisis is providing an opportunity for LNG to secure its role as a transition fuel.

With reliability and security of supply increasingly front of mind, US LNG exporters stand to gain market share, underpinning a further US$50 billion of investment over the next decade.

An increased need for natural gas infrastructure will also benefit the broader North American midstream sector.

The energy transition and the ongoing Russia-Ukraine war will accelerate global demand for Liquefied Natural Gas (LNG).

The mismatch between natural gas producing countries and demand regions, and the need to replace lost natural gas volumes previously sourced from Russia, should present numerous LNG-related investment opportunities for global listed infrastructure companies.

Global LNG markets

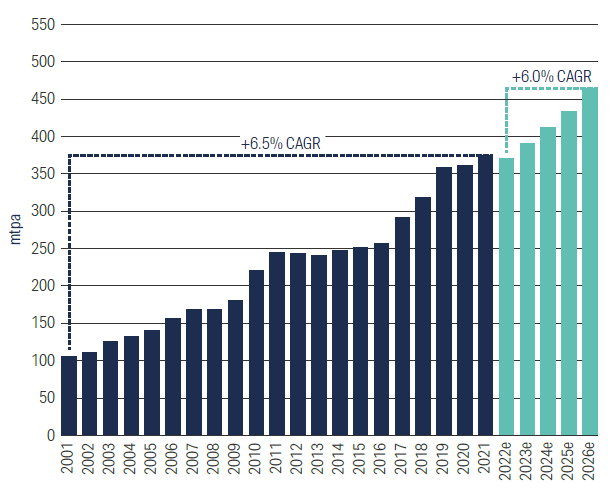

Over the past 20 years, the global LNG trade has increased by ~6.5% pa1. This growth has been driven by a larger share of the world’s population entering the middle class (ie higher demand from China’s urbanisation); along with climate change concerns that have seen coal generation being replaced by lower carbon2 and cheaper natural gas. By the end of 2021, there were 39 LNG- importing countries.

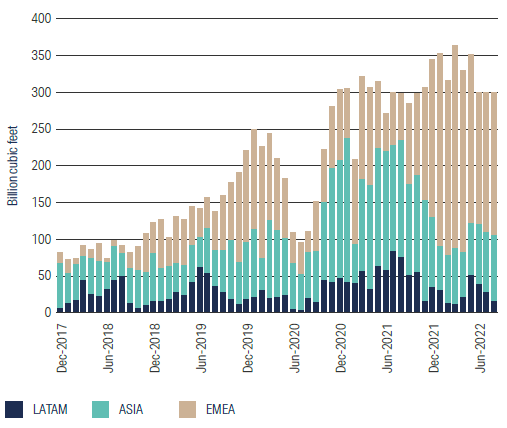

From here, we expect that LNG trade volumes will continue to grow, driven by additional European demand; an economic recovery in China once its stringent Zero Covid policies are lifted; and more countries (mostly in Asia) commissioning new LNG infrastructure.

Global LNG trade

Source: First Sentier Investors, BloombergNEF as at 30 September 2022 CAGR: Compound Annual Growth Rate

As demand for LNG has increased, so has the need for associated LNG storage and transportation infrastructure.

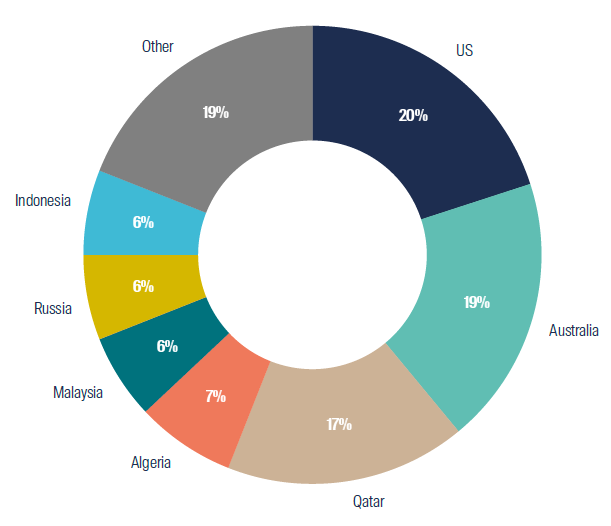

The existing global natural gas liquefaction (exporting) capacity3 stands at 464 mtpa4. The US owns the largest asset footprint, accounting for 20% of this total, followed by Australia and Qatar. More than 70% of US capacity is owned by global listed infrastructure companies. Market leaders in this space include Cheniere Energy, Sempra Energy, Dominion Energy and Kinder Morgan5.

Importantly, global listed infrastructure companies have pioneered US LNG exports by investing over US$50 billion into the US LNG infrastructure build-out since 2010.

LNG liquefaction (exporting) capacity per country

Source: First Sentier Investors, International Gas Union Global Gas Report 2022

A further 160mtpa of new liquefaction capacity is currently under construction or development, mostly in the US (42mtpa), Russia (34mtpa) and Qatar (32mtpa). Most of this capacity is expected to be commissioned by 2026/27. This growth is being driven by new and existing players, seeking to benefit from current high global LNG prices. These higher prices are driven by global market supply / demand dislocations. Although we do not expect all of these projects to proceed, the US has the benefit of:

- enormous natural gas resources

- deep/extensive capital markets to fund additional LNG capacity; and critically

- a proven track record of being a reliable and secure counterparty

Many of Russia’s planned capacity increases now appear unlikely to be completed, owing to the Western sanctions that have been imposed since its invasion of Ukraine. Australia may also struggle to increase its export capacity as a consequence of its domestic natural gas crises and historic cost over-runs. This means that the US will probably continue to hold the largest liquefaction footprint, increasing its market share to 21% by 2026, followed by Qatar and Australia with 17% and 15% respectively.

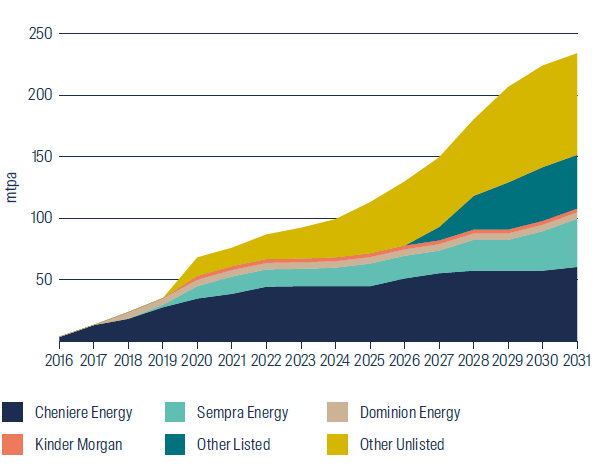

Additionally, a further ~100mtpa of LNG projects are being planned in the US alone. Although these planned developments may not all go ahead, the associated US$100 billion of capex that would be required provides a striking reminder of the huge size of the opportunity facing US companies operating in this sector.

Of this potential US$100 billion investment, almost US$60 billion is represented by projects being developed by global listed infrastructure companies. Therefore, we anticipate that listed infrastructure companies will remain a dominant segment of

this substantial market, accounting for more than 60% of US- based LNG liquefaction capacity into the future. The investment opportunity is enormous.

Listed infrastructure companies to maintain the largest market share of US LNG capacity (existing terminals, new capacity under construction and projects being planned)

Source: First Sentier Investors as at 30 September 2022

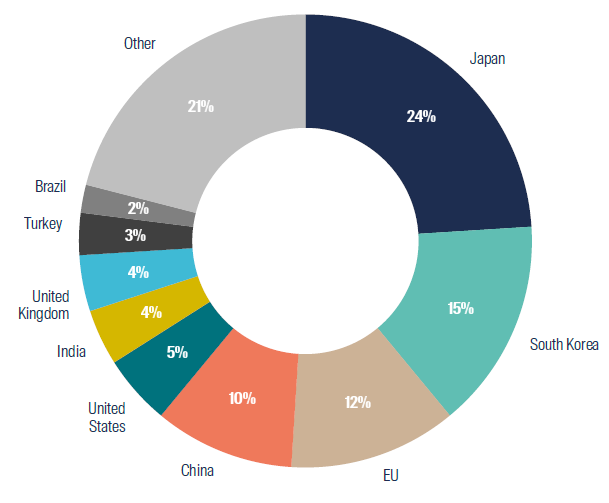

At 902mtpa, the global regasification (receiving) terminal capacity is almost twice as large as the world’s liquefaction capacity. Japan owns the largest capacity, followed by South Korea and China.

Interestingly, the US still has 40mtpa6 of regasification capacity. However these assets have a very low utilisation rate of ~5%, as the US has been an LNG exporter since 2017. Most US regasification (import) terminals have been converted to liquefaction (export) capacity in recent years, reflecting the shift in energy market dynamics and the lower investment intensity of reconverting existing import to export terminals.

LNG regasification (receiving) capacity per country

Source: First Sentier Investors, International Gas Union Global Gas Report 2022

The European energy crisis and the need for more LNG

Natural gas is a key component of the European energy matrix, accounting for ~24% of the continent’s energy supply7.

Importantly, natural gas is the marginal fuel for power generation in Europe, meaning that rising natural gas prices also drive electricity prices higher.

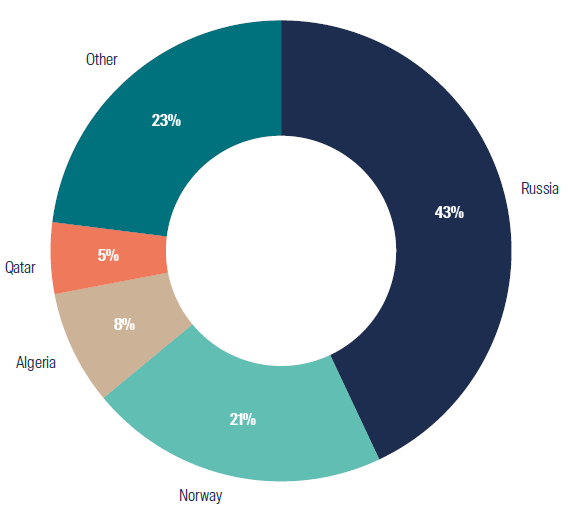

Before Russia’s invasion of Ukraine in February 2022, Europe sourced approximately 178 billion cubic meters (bcm) per year (or ~40% of its natural gas needs) from Russia. 160 bcm was imported via pipelines such as Nord Stream I, with a further 18 bcm arriving though Europe’s LNG regasification terminals.

% of share of Europe natural gas imports, end-2021

Source: First Sentier Investors as at 31 December 2021

Dwindling European natural gas reserves and a new-found resolve by European governments to reduce their dependence on Russian gas, along with Russian export cuts and pipeline disruptions8, have created significant opportunities for global LNG suppliers.

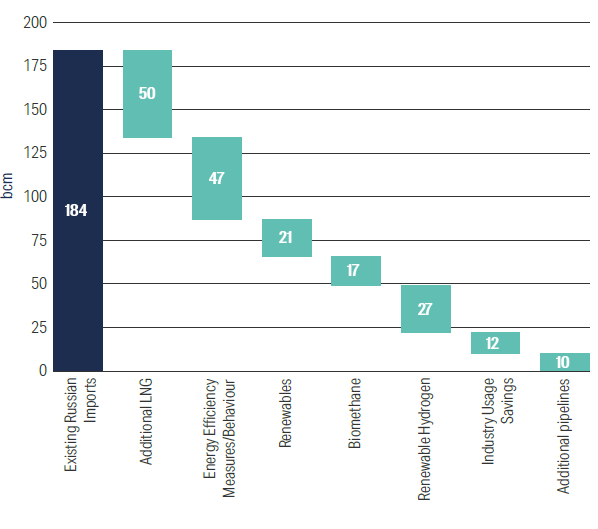

The European Commission (EC) has set out a plan to achieve full energy independence from Russia. This action plan, called REPowerEU, aims to reduce Russian natural gas dependency by 100bcm (or two thirds) by the end of 2022, while entirely eliminating Russian imports by 2027.

In order to replace these imports, the EC aims to:

- grow LNG imports by 50bcm (including existing and new import terminals)

- increase natural gas imports from non-Russian sources

- accelerate investment in renewables

- increase energy efficiency efforts and push for behavioural changes to reduce consumption

- grow biomethane supply; and

- expand its renewable hydrogen supply

REPowerEU – an action plan to reduce Russian natural gas imports

Source: First Sentier Investors, BloombergNEF as at 30 September 2022

The EC expects that investments totalling €300 billion will be needed to implement the REPowerEU plan.

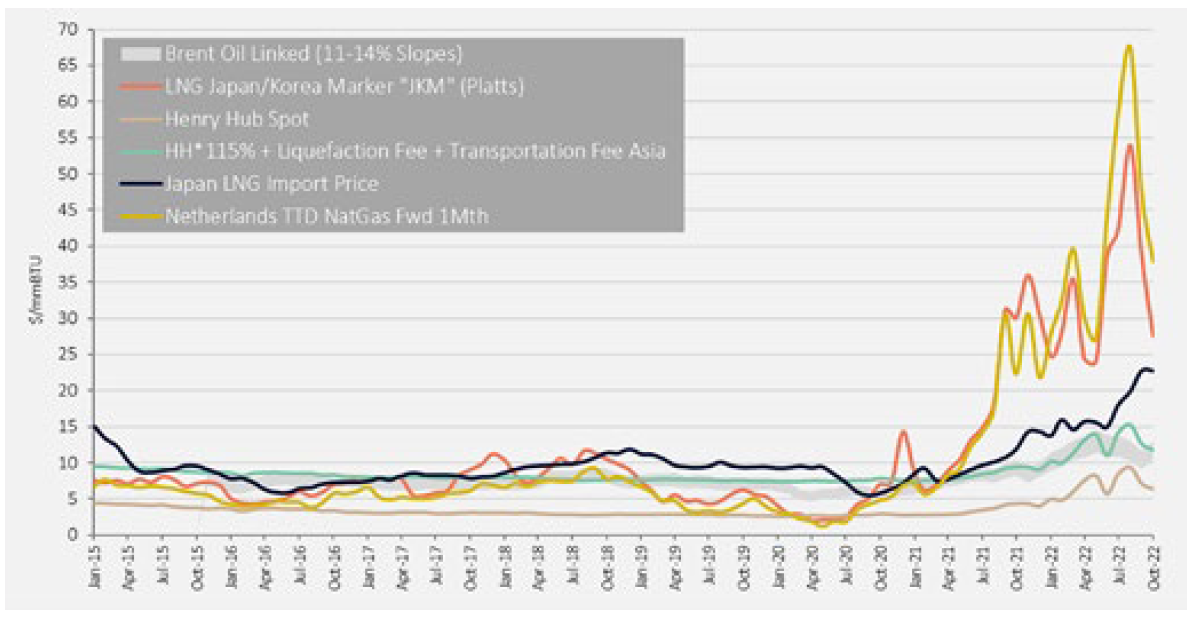

The curtailment of Russian natural gas exports to Europe pushed global LNG prices sharply higher

Source: First Sentier Investors, Bloomberg as at 31 October 2022

Europe already has 250bcm of LNG regasification capacity (equivalent to around 185mtpa). However, most of this capacity is located in Spain and the UK, with limited interconnectors to allow surplus natural gas to reach those regions that need it most, such as Germany, Italy and Central Europe.

Six new projects, with a total regasification capacity of 29bcm, are currently being built. Additionally, some countries are chartering or purchasing Floating Storage Regasification Units (FSRUs) for an additional capacity of almost 22bcm. These vessels can be deployed faster and become operational in a shorter timeframe than permanent importation facilities.

To replace 180bcm of Russian natural gas imports will be a herculean task. To put this into context, 180bcm is equivalent to ~130 mtpa of LNG. Currently, the US and Australia, the two countries that export the most LNG, have the capacity to export 93mtpa and 88mtpa, respectively. Therefore, in order to replace Russian imports, there is a need to “create” almost 1.5x the existing export capacity of one of those countries. Interestingly, in the short term, the weakness in the Chinese economy (due to Covid Zero policies and weakening exports due to a slowing global economy) has helped to meet Europe’s LNG demand, with some LNG cargoes being diverted from China to Europe. Nevertheless, in the long term, more LNG capacity will be required to meet Europe’s demand.

The US has substantially increased its LNG exports to Europe

Source: First Sentier Investors, US Energy Information Administration as at 31 August 2022

Contracts

Year to date, there has been an acceleration in LNG offtake agreements. These have reached 70mtpa so far this year, compared to 50mtpa in 2021. This is being driven by buyers racing to sign on long term contracts to secure supply in a rapidly tightening market. The tenor (or contract maturity term) has extended to almost 16 years on average, evidence that LNG suppliers need long term contracts to be able to secure the funding that is needed to build new liquefaction terminals.

Almost 70% of these new contracts have been executed with US-based LNG producers.

US listed LNG companies

Of particular interest to our team are three portfolio holdings that own and operate extensive US LNG export infrastructure assets; namely Cheniere Energy, Sempra Energy and Dominion Energy9. Another listed infrastructure company with a LNG footprint is Kinder Morgan.

Cheniere Energy is the largest independent US LNG producer, and the only listed pure-play LNG company in the world. It has been a portfolio holding since the second quarter of 2019. Originally a small company with a US LNG import (regasification) terminal, Cheniere foresaw over a decade ago that the nascent shale fracking boom would turn the US from an energy importer to a hydrocarbon exporter. Now with a total liquefaction capacity of 45mtpa, Cheniere alone accounts for almost half of the US’ existing LNG export capacity. The company has benefitted substantially from booming LNG prices, as part of its export volumes are sold on spot markets. This has enabled Cheniere to almost double its earnings guidance for 2022.

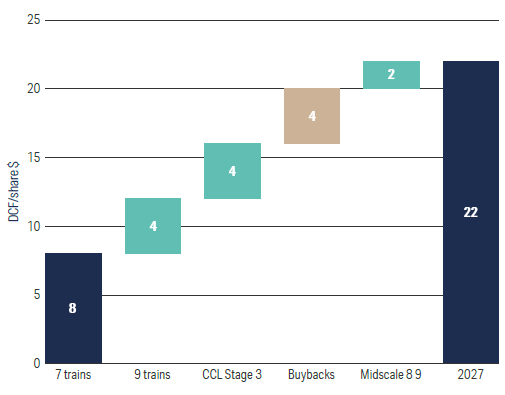

Cheniere earnings upgrades from LNG export demands

Source: First Sentier Investors, Cheniere Energy (top end of guidance range) as at 12 September 2022.

DCF: Distributable Cash Flow.

CCL: Corpus Christi Liquefaction

It has recently announced plans to expand one of its LNG sites by an additional 10mtpa, as well as developing a further 3.4mtpa. Given its large amount of available land, we expect Cheniere to further expand its capacity beyond 50mtpa.

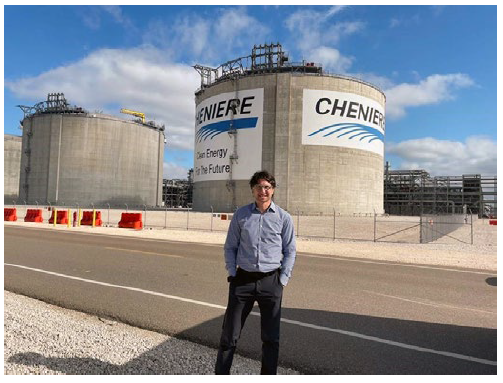

Cheniere’s Corpus Christi LNG export terminal

Site visit to Cheniere’s Corpus Christi assets (November 2022).

Sempra Energy is a regulated utility based in California, which also owns LNG assets in Texas with a total export capacity of 14mtpa. The company is currently building an additional LNG export project in Mexico with a capacity of 3.3mtpa, and has the opportunity to develop a further 21mtpa, including the likely expansion of Cameron LNG Phase 2 and greenfield project Port Arthur LNG.

Large-cap regulated utility Dominion Energy owns a stake in Cove Point LNG Terminal, which has 5mtpa of LNG export capacity in Maryland, on the US east coast. We believe all three companies are uniquely positioned to benefit as this substantial theme in global energy markets plays out.

Large-cap regulated utility Dominion Energy owns a stake in Cove Point LNG Terminal, which has 5mtpa of LNG export capacity in Maryland, on the US east coast. We believe all three companies are uniquely positioned to benefit as this substantial theme in global energy markets plays out.

Kinder Morgan is an energy midstream company whose assets include the Elba Liquefaction facility in Georgia, with a total capacity of 2.5mtpa. Interestingly, in September 2022, Kinder Morgan divested an equity stake in this facility for 13x EBITDA10, reflecting the strong fundamentals and appealing value proposition of this type of asset.

The Energy Midstream opportunity

The continuing development of the US LNG industry will also provide an ongoing growth driver to the broader energy midstream sector. Any new LNG terminals that are built will have to be supplied with natural gas. Therefore, new gathering, processing, transportation and storage capacities will need to be developed alongside LNG terminals.

Currently, the US produces around 100 billion cubic feet per day (bcf/d) of natural gas. If the entire 100mtpa of US LNG export capacity currently being developed goes ahead, this will probably increase US natural gas production volumes by more than 15%. Natural gas export volumes would increase from their current 10% to represent almost 20% of US production.

This would likely benefit listed infrastructure companies including Williams, TC Energy, Enbridge Inc., Kinder Morgan and DT Midstream.

Conclusion

We believe the global LNG industry will accelerate its expansion, driven by increasing European demand (to replace Russian imports) and the energy transition.

US-listed LNG players, developers of LNG capacity since the early 2010s, appear set to benefit from additional investment opportunities at attractive risk-adjusted rates of return. We anticipate more than US$50 billion of additional capex needs in this space over the next decade.

This will also expand investment opportunities for the rest of the energy midstream complex, as it moves to meet the additional appetite for natural gas exports.

Footnotes

- Source: BloombergNEF as at 30 September 2022.

- Natural Gas emits ~50% and ~30% less CO2 than coal and oil, respectively.

- Defined as nameplate capacity. Up to September 2022, the utilisation rate was 79%. Excludes projects under construction and/or development.

- Million tonnes per annum.

- For illustrative purposes only. Reference to the names of each company mentioned in this communication is merely for explaining the investment strategy, and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of First Sentier Investors.

- Most of the operating capacity is located in Puerto Rico.

- Petroleum products, renewables and nuclear energy account for 35%, 17% and 13%, respectively.

- In September 2022, the Nord Stream I pipeline connecting Russia to Germany suffered leaks and was shut down. Some Western European governments have mentioned “sabotage” as the reason for such leaks.

- The companies mentioned here represent a complete list of the stocks held by the portfolio as at 30 November 2022 that own or operate US LNG export facilities.

- Earnings before interest, taxes, depreciation and amortisation

Important Information

This material is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should conduct your own due diligence and consider your individual investment needs, objectives and financial situation and read the relevant offering documents for details including the risk factors disclosure. Any person who acts upon, or changes their investment position in reliance on, the information contained in these materials does so entirely at their own risk.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication but the information contained in the material may be subject to change thereafter without notice. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Investors.

Past performance is not indicative of future performance. All investment involves risks and the value of investments and the income from them may go down as well as up and you may not get back your original investment. Actual outcomes or results may differ materially from those discussed. Readers must not place undue reliance on forward-looking statements as there is no certainty that conditions current at the time of publication will continue.

References to specific securities (if any) are included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Any securities referenced may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

References to comparative benchmarks or indices (if any) are for illustrative and comparison purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities) that are different from the funds managed by First Sentier Investors.

Selling restrictions

Not all First Sentier Investors products are available in all jurisdictions.

This material is neither directed at nor intended to be accessed by persons resident in, or citizens of any country, or types or categories of individual where to allow such access would be unlawful or where it would require any registration, filing, application for any licence or approval or other steps to be taken by First Sentier Investors in order to comply with local laws or regulatory requirements in such country.

This material is intended for ‘professional clients’ (as defined by the UK Financial Conduct Authority, or under MiFID II), ‘wholesale clients’ (as defined under the Corporations Act 2001 (Cth) or Financial Markets Conduct Act 2013 (New Zealand) and ‘professional’ and ‘institutional’ investors as may be defined in the jurisdiction in which the material is received, including Hong Kong, Singapore, Japan, and the United States, and should not be relied upon by or be passed to other persons.

The First Sentier Investors funds referenced in these materials are not registered for sale in the United States and this document is not an offer for sale of funds to US persons (as such term is used in Regulation S promulgated under the 1933 Act). Fund-specific information has been provided to illustrate First Sentier Investors’ expertise in the strategy. Differences between fund-specific constraints or fees and those of a similarly managed mandate would affect performance results.

Selling restrictions

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Investors, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group (MUFG). Certain of our investment teams operate under the trading names FSSA Investment Managers, Stewart Investors and Realindex Investments, all of which are part of the First Sentier Investors group.

This material may not be copied or reproduced in whole or in part, and in any form or by any means circulated without the prior written consent of First Sentier Investors. We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311)

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188)

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Investors is a business name of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors (registration number 53236800B) is a business division of First Sentier Investors (Singapore).

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

- United States by First Sentier Investors (US) LLC, authorised and regulated by the Securities Exchange Commission (RIA 801-93167).

Other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Investors Group

Get the right experience for you

Your location :  Iceland

Iceland

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom