15 May 2025: RQI Investors, an Australian-based global quantitative manager within the First Sentier Investors group, that manages US$15.4bn1, today launches a UCITS vehicle of its successful Global Value strategy2 available to UK, European, Singaporean and Canadian investors.

The RQI Investors’ Global Value Fund is the latest vehicle of RQI Investors’ flagship Global Value Strategy; first launched in 2008, it collectively manages in excess of US$6.5bn3 (as at 31 March 2025)4. RQI Investors Global Value Strategy has delivered top quartile performance versus Value peers (both quants and stock pickers) outperforming the median global value managers in Nasdaq eVestment database5, by 3.6% p.a., 2.5% p.a, 1.6% p.a. and 1.3% p.a. over the last three, five, seven and ten years respectively.6

RQI Investors’ Chief Executive, Andrew Francis said: “This is an exciting development for RQI Investors, the company’s first investment vehicle outside of Australia as we seek to grow our highly successful business internationally. The Global Value strategy has an impressive 16-year track record, is highly regarded by global asset consultants and has excellent Australian based research house ratings. In addition, its track record is excellent versus value peers and Value indices.

“The Global Value strategy is systematic, removing the issues of key person risk, is value-titled and contrarian in its approach. It has a higher yield and lower valuations than the market cap index, providing strong diversification benefits from index investing. It captures the value cycle whilst avoiding the pitfalls of value investing – that is, avoiding Value traps and stocks that are cheap for a reason. Its fees are highly competitive versus other active managers and the outcomes have been top quartile over ten years versus value peers.”

“The new vehicle is being seeded with US$50m; US$20m from a Family Office, with a further US$30m co-investment from RQI Investors’ parent company, First Sentier Investors. To achieve this scale of seed investment from a Family Office is a huge endorsement of RQI Investors’ strategy and team, as is the confidence demonstrated by First Sentier Investors in matching the investment.”

The RQI Investors Global Value Strategy is globally managed by Dr. Joanna Nash, Dr. Ron Guido, and Dr Wang Chun Wei and Head of Investments, Dr David Walsh, each of whom have been with RQI Investors for approximately five years, and with over 15 years of financial service experience.

Head of Investments at RQI Investors, Dr David Walsh, said: “We’re very pleased to be bringing the RQI Investors Global Value Strategy to new investors; the UCITS fund is well-placed to take advantage of the current market dynamics, where US-led concentration looms large.”

Appendix 1: Discrete Five-Year Performance of RQI Global Value Strategy Composite in US$

| Date | Composite Gross return | Composite Net return | Benchmark return |

|---|---|---|---|

| 31 Mar 2025 | 10.31% | 9.65% | 7.31% |

| 31 Mar 2024 | 26.32% | 25.56% | 23.42% |

| 31 Mar 2023 | -3.26% | -3.84% | -7.40% |

| 31 Mar 2022 | 8.07% | 7.43% | 7.15% |

| 31 Mar 2021 | 61.79% | 60.82% | 54.36% |

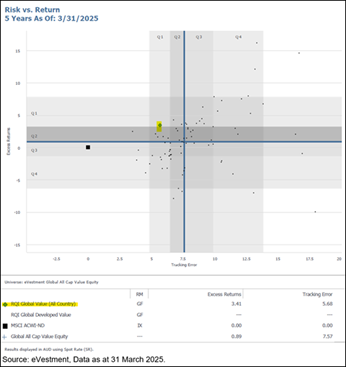

Appendix 2: Performance of RQI Global Value Strategy vs other global value managers, as per Nasdaq eVestment database, to 31 March 2025

Appendix 3: RQI Global Value vs. risk adjusted returns versus benchmark and peers sit in the top quartiles as at 31 March 2025 from Nasdaq eVestment Report

Footnotes

[1] Source: FSI Australia, (as at 31 March 2025)

[2] The UCITS is within First Sentier Investors Global Umbrella Fund plc, an Irish domiciled fund.

[3] Including both segregated mandates and funds.

[4] See Appendix 1

[5] See Appendix 2

[6] See Appendix 3

About RQI Investors

RQI Investors is part of the First Sentier Investors group and manages US$15.4 billion (as at 31st March 2025) in Australian, global and emerging market shares across its Diversified Alpha and Value strategies. Established in 2008, RQI Investors is an Australian-based active quantitative equities investor that delivers investment performance by combining the best investment ideas with its unique blend of people, insights, research, portfolio construction and risk management.

Important information

This press release is intended for information only, aimed solely at the media and should not be further distributed to individual and/or corporate investors, and financial advisers and/or distributors. The information included within this document and any supplemental documentation provided should not be copied, reproduced or redistributed without the prior written consent of First Sentier Investors.

This document has been prepared for general informational purposes. It does not purport to be comprehensive or to give advice. This is not an offer document and does not constitute an offer or invitation or investment recommendation to distribute or purchase securities, shares, units or other interests or to enter into an investment agreement.

The information contained within this document has been obtained from sources that we believe to be reliable and accurate at the time of issue but no representation or warranty, express or implied, is made as to the fairness, accuracy, or completeness of the information.

Get the right experience for you

Your location :  Spain

Spain

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom