We believe bond market demand in Asia represents an opportunity for fixed income investors. There are many factors driving this positivity; Asia’s strong growth outlook relative to other parts of the world, its demographics, the diversification within the universe of issuers and compared volatility and returns with other fixed income markets. As we look towards a post-Covid world, what case can be made for investing in Asia USD Investment Grade Credit?

Stability

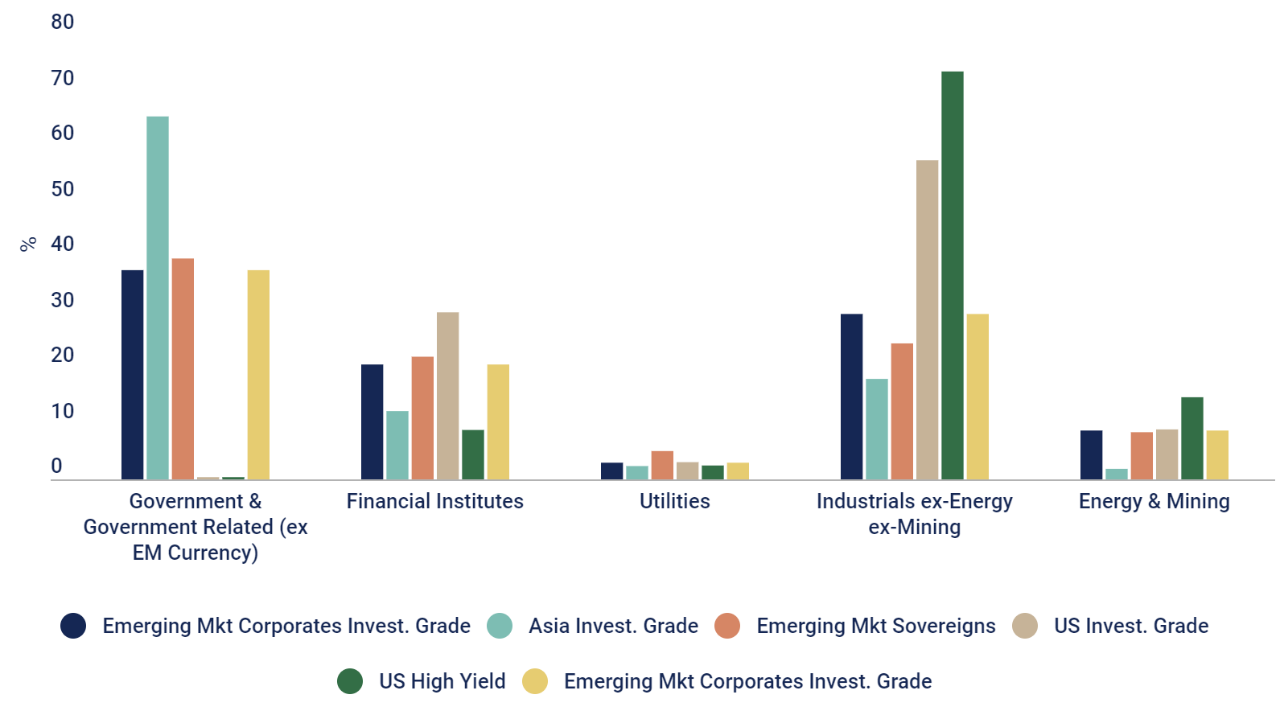

In 2017, we assessed the volatility of returns for Asian fixed income, comparing to US investment grade. The research showed that as the market has continued to mature, the volatility profile continues to mirror that of the US investment grade credit. Stepping into 2020, this relationship is set to continue and in our assessment, it is driven by several key factors. Firstly, the type of issuers that dominate, and hence make the largest part of benchmarks, are government related / state-owned enterprises. Chart1 shows that for Asia USD investment grade credit, it has the highest market value. Given the government ownership, these companies are inherently less risky than general corporates.

Chart 1. Market value (%) by industry

Source: Bloomberg, JPMorgan, FSI as at 31 Aug 2020

We do not believe in treating them all the same or placing all of our trust in the ownership structure. Each issuer has the same level of scrutiny as any corporate and we seek to invest in those stateowned enterprises we feel are the best in this sector. Equally important to note are two additional trends. Firstly, developed market investment grade benchmarks are typically dominated by financial institutions, due to their needs for capital. Asia has less financials in the benchmark relative to peers such as US investment grade. The dominant issuers within this sector in Asia are the high quality financial institutions from Singapore, China and Hong Kong. The second trend that was noted in our 2017 research was that Asian investors were buying Asia. This trend continues with approximately 75% of new issues being invested in by Asia based investors. Finally when we look at the dominant issuers for the industrials we see high profile, well capitalised, profitable global names that represent diversity and exposure to the growth story of Asia.

Returns

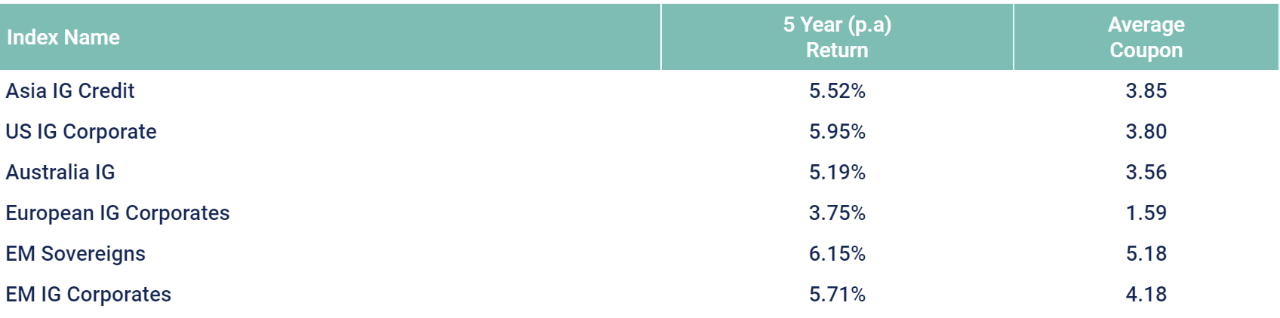

The return profile of Asian investment grade when compared to other fixed income markets remains robust and more importantly offers yield. In today’s COVID-19 heavily impacted world where Central Banks in developed markets have slashed interest rates to zero or near zero, Asia is still able to offer yield. Given the stability mentioned earlier, we believe this translates to an acceptable risk/ return profile for investors as shown per Chart 2.

Source: Bloomberg, FSI as of 30 Sep 2020

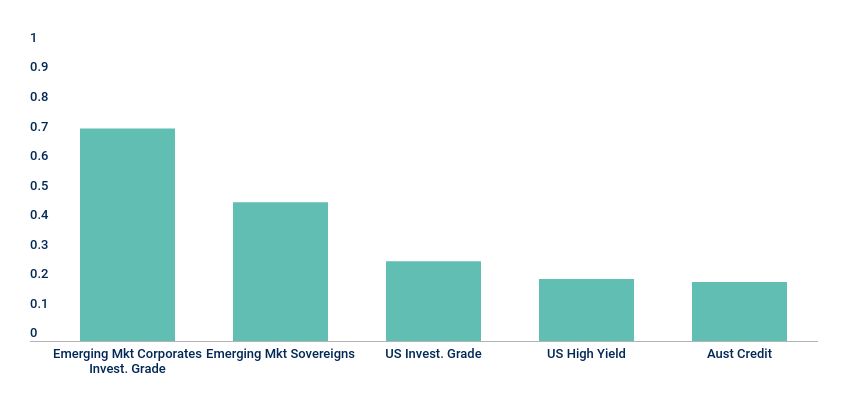

Additionally, we considered how Asia USD investment grade credit could fit within portfolios for global investors, considering return correlations to other fixed income markets. Unsurprisingly Asia USD investment grade credit has a high correlation to Emerging Markets corporates, yet not as high as we instinctively thought. Against global credit constituents, namely US Investment Grade, Emerging Markets Sovereigns, High Yield and Australian Credit, the correlation of returns for these fixed income markets are very low due to the constituents of the benchmark. We attribute this to the dominance of state-owned enterprises, lower allocation to financial, limited energy and mining exposure (a sector that has been volatile in 2020 due to global growth and oil price uncertainty).

Chart 2. Return correlation with Asia investment grade

Source: Bloomberg, FSI as at 31 August 2020

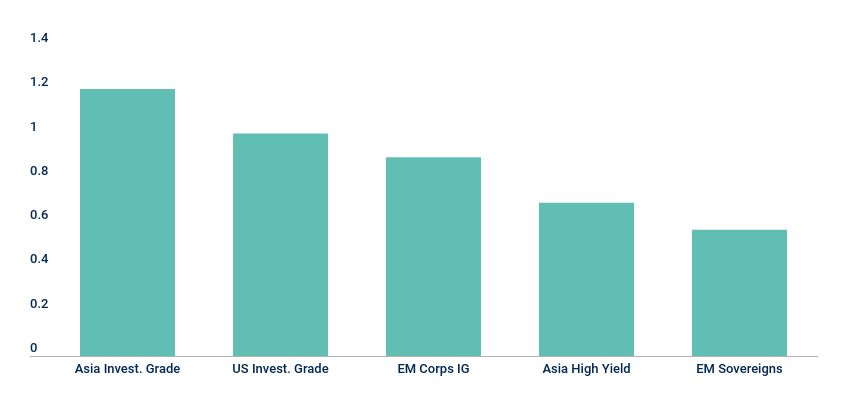

When we consider the reasons for stability in the context of the return profile, it is not surprising to us that on a risk adjusted return basis (Sharpe ratio) Asia investment grade is a standout. We have presented this as part of our case for Asia USD investment grade credit for many years. Not only does Asia compare favourably against other fixed income markets, but compares favourably across other asset classes as well.

Chart 3. Sharpe ratio

Source: Bloomberg, FSI as at 31 August 2020

Outlook

Global growth is suffering from the COVID-19 pandemic as economies have experienced lockdown and reopened at different times. These interrupt activities and challenge supply chains. The economic data shows that contraction is occurring across virtually all economies and is negatively impacting the outlook for global growth. Asia is not insulated from this with some countries impacted worse than others from the pandemic. Forecasts show that whilst growth is slowing in Asia, it remains the highest growth region in the global economy. Additionally, Asia’s share of global GDP has been rising over the last decade and that is expected to continue. This is supportive for Asian corporate health in general. Asian corporates were in good health prior to the pandemic and are likely to be the corporates best placed to survive the challenges for 2020 and beyond.

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (Author). The Author forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for the Author is available from First Sentier Investors on its website.

This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. Any opinions expressed in this material are the opinions of the Author only and are subject to change without notice. Such opinions are not a recommendation to hold, purchase or sell a particular financial product and may not include all of the information needed to make an investment decision in relation to such a financial product.

To the extent permitted by law, no liability is accepted by MUFG, the Author nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that the Author believes to be accurate and reliable, however neither the Author, MUFG, nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of the Author.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom