A monthly review and outlook of the Global Listed Infrastructure sector.

Market review - as at May 2021

Global Listed Infrastructure delivered stable returns in May, consolidating healthy year-to-date gains. The best performing infrastructure sector was Pipelines (+3%), reflecting exceptionally strong March quarter earnings numbers, a disciplined approach to capex spending, undemanding valuation multiples and a higher oil price. The worst performing infrastructure sectors were Electric Utilities (-2%), Multi-utilities (-1%) and Water Utilities (flat) as investors sought higher beta market segments.

The best performing infrastructure region was Latin America (+5%), which was led higher by its transport infrastructure stocks. Asia ex-Japan (+4%) also rose as investor enthusiasm for Chinese gas utilities’ structural growth and government support resulted in strong share price gains. The worst performing infrastructure region was Australia / NZ (-3%). New lockdown measures in the Australian state of Victoria, implemented following a fresh coronavirus outbreak, weighed on the region’s airports and toll road.

Fund performance

The Fund returned +0.3% after fees in May1 , 38 basis points ahead of the FTSE Global Core Infrastructure 50/50 TR Index (SGD).

The best performing stock in the portfolio was CCR (+14%), Brazil’s largest toll road operator, which rallied on increasing recognition of the substantial growth opportunities presented via the privatisation (and subsequent expansion) of Brazilian road, airport and rail assets. Brazil’s infrastructure minister noted this month that as a result of these initiatives, US$50 billion worth of investment is likely to have been contracted for the much-needed modernisation of Brazil’s infrastructure by the end of 2022.

Mexican airport operator ASUR (+6%) gained as the release of their April traffic showed the company continued to see a strong passenger recovery. The company is expected to benefit from increasing tourist volumes as the US vaccination rollout progresses. Data from the US TSA showed that nearly 2 million passengers were screened at US airports on the Friday before the Memorial Day long weekend — the highest number since the pandemic began.

The portfolio’s energy infrastructure holdings outperformed, led by US Liquefied Natural Gas (LNG) exporter Cheniere Energy (+10%). March quarter earnings numbers were 40% ahead of consensus, reflecting continued strength in global LNG market fundamentals. Magellan Midstream Partners (+8%) rallied on upgraded earnings guidance and the prospect of volume recovery for its refined products pipelines.

European transport infrastructure delivered mixed returns, with toll roads outperforming airports. French toll road operators Eiffage (+2%) and Vinci (+2%) performed well as French lockdowns were eased, and traffic on other French toll roads recovered towards pre-pandemic levels. However Flughafen Zurich (-3%) and AENA (-1%) lagged as the spread of a new coronavirus variant in the UK, along with a relatively restrictive new set of rules for UK travellers, caused investors to take a cautious approach to some European airports.

The worst performing stock in the portfolio was US electric utility and renewables leader NextEra Energy (-6%), which underperformed as investor focus turned to assets with most sensitivity to near-term recovery. The company is still positioned to benefit from the longer term theme of decarbonisation and large-scale renewables build-out throughout the US over coming years (further details shown below). Large-cap peers Eversource Energy (-5%) and Dominion Energy (-5%) also lagged in this environment, despite reasonable valuations and solid company fundamentals. In contrast CenterPoint Energy (+4%) fared better after the Texas senate passed legislation which should support additional capex investment opportunities for its Houston electric utility business.

Australian freight rail operator Aurizon (-4%) underperformed on mounting investor concerns that structural headwinds to demand for coal exports may affect its growth prospects. Our analysis suggests that at current valuation multiples (8% dividend yield, 7x EV/EBITDA, strong free cash flow), investors are being compensated for this longer term risk.

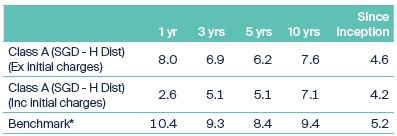

Annualised performance in SGD (%) 2

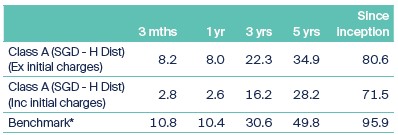

Cumulative performance in SGD (%) 2

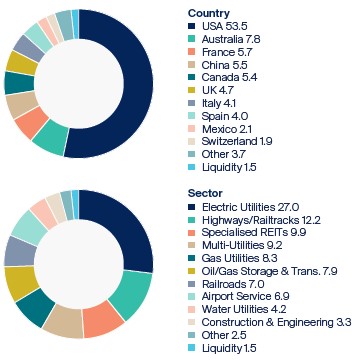

Asset allocation (%) 2

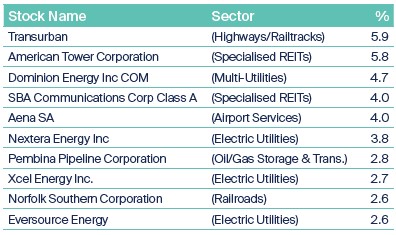

Top 10 holdings (%) 2

1 First Sentier Global Listed Infrastructure Fund’s cumulative return over one month. The performance of the fund is based on the Singapore unit trust, net of fees, expressed in SGD terms.

2 Source: Lipper & First Sentier Investors. Single pricing basis with net income reinvested. Data as at 31 May 2021. Allocation percentage is rounded to the nearest one decimal place and the total allocation percentage may not add up to 100%. First Sentier Global Listed Infrastructure Fund inception date: 3 March 2008.

* From inception - 31 May 08 : S&P Global Infrastructure Index; From 1 Jun 08 – 31 Mar 15 : UBS Global Infrastructure and Utilities 50-50 Index; From 1 Apr 15 : FTSE Global Core Infrastructure 50/50 Index.

All stock and sector performance data expressed in local currency terms. Source: Bloomberg.

Fund activity

The Fund initiated a position in Duke Energy, a large-cap, North Carolina-based utility with 7.8 million electric customers in six states and 1.6 million natural gas customers in five states. Its forecast rate base growth of 6% per annum until 2024 is expected to support earnings growth of between 4% and 6% per annum. Activist investor Elliot Investment Management is reported to have built a stake in the company and to be seeking to “add directors to its board and possible other actions to boost its stock price”. Having agreed to sell a 20% stake in its Duke Indiana subsidiary for a price well above its listed valuation multiples earlier this year, Duke may now be encouraged by Elliot to carry out further shareholder-friendly measures over coming months.

A holding in US Pacific Northwest electric utility Portland General Electric was divested after a period of strong outperformance reduced mispricing and moved the stock to a lower position within our investment process.

Market outlook and fund positioning

The Fund invests in a range of global listed infrastructure assets including toll roads, airports, railroads, utilities, pipelines, and wireless towers. These sectors share common characteristics, like barriers to entry and pricing power, which can provide investors with inflation-protected income and strong capital growth over the medium-term.

Toll roads represent the portfolio’s largest sector overweight. We believe these companies represent exceptional value at current levels. Traffic volumes have proved more resilient than those of other transport infrastructure assets; and toll roads are leading a return to normal demand levels as vaccine programs are rolled out. Using Sydney as a case study, data over 2020 and early 2021 has shown that whilst WFH has clearly impacted CBD office occupancy (consistent with anecdotal evidence of 2-3 days in the office and surveys of a desire to spend some time working from home), the impact on toll road traffic is much less pronounced. In fact, on certain roads, traffic is back to pre-pandemic levels.

The portfolio is also overweight Gas Utilities, The portfolio’s holdings in this sector consist of a Chinese operator benefitting from central government support for the transition to cleaner fuels; a Japanese gas utility trading at deep value, and specialist US and European names operating from strong strategic positions within niche markets.

The portfolio has an underweight exposure to Multi / Electric Utilities, as some utilities are traded at levels where limited mispricing is evident. That said, a substantial portion of the portfolio consists of high conviction positions in this space, with a focus on higher quality assets, material scope for capex-related earnings growth, or clear mispricing.

An underweight exposure to the Pipelines sector has been maintained. While the sector has delivered solid gains in recent months, we remain conscious of the structural headwinds that these companies could face as Net Zero initiatives gather pace.

Source : Company data, First Sentier Investors, as of end of May 2021.

Important Information

This document is prepared by First Sentier Investors (Singapore) (“FSI”) (Co. Reg No. 196900420D.) whose views and opinions expressed or implied in the document are subject to change without notice. FSI accepts no liability whatsoever for any loss, whether direct or indirect, arising from any use of or reliance on this document. This document is published for general information and general circulation only and does not have any regard to the specific investment objectives, financial situation and particular needs of any specific person who may receive this document. Investors may wish to seek advice from a financial adviser and should read the Prospectus, available from First Sentier Investors (Singapore) or any of our Distributors before deciding to subscribe for the Fund. In the event that the investor chooses not to seek advice from a financial adviser, he should consider carefully whether the Fund in question is suitable for him. Past performance of the Fund or the Manager, and any economic and market trends or forecast, are not indicative of the future or likely performance of the Fund or the Manager. The value of units in the Fund, and any income accruing to the units from the Fund, may fall as well as rise. Investors should note that their investment is exposed to fluctuations in exchange rates if the base currency of the Fund and/or underlying investment is different from the currency of your investment. Units are not available to US persons.

Applications for units of the Fund must be made on the application forms accompanying the prospectus. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by First Sentier Investors (Singapore), and are subject to risks, including the possible loss of the principal amount invested.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of FSI’s portfolios at a certain point in time, and the holdings may change over time.

In the event of discrepancies between the marketing materials and the Prospectus, the Prospectus shall prevail.

In Singapore, this document is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors (registration number 53236800B) is a business division of First Sentier Investors (Singapore).

First Sentier Investors (Singapore) is part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

Get the right experience for you

Your location :  Singapore

Singapore

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom