A monthly review and outlook of the Global Listed Infrastructure sector.

Market review - as at July 2021

Global Listed Infrastructure gained in July, as quarterly earnings results highlighted the resilience and essential service nature of the asset class. The best performing infrastructure sectors were Water / Waste (+9%) and Electric Utilities (+4%), as investors sought defensive assets against a backdrop of rising Delta variant case numbers. The worst performing infrastructure sector was Pipelines (-2%), which consolidated strong year-to-date gains. Toll roads (-1%) also lagged, with Emerging Market operators affected by the uncertain pace of traffic recovery.

The best performing infrastructure region was Australia / NZ (+6%), as takeover bids for Sydney Airport (+35%, not held) and Spark Infrastructure (+24%, not held) provided the latest reminder of the intrinsic value available to investors within this asset class. The worst performing infrastructure region was Japan (-4%), as rising coronavirus case numbers and a longer and broader State of Emergency weighed on the country’s passenger rail stocks.

Fund performance

The Fund returned +2.4% after fees in July1 , 31 basis points ahead of the FTSE Global Core Infrastructure 50/50 TR Index (SGD).

The best performing stock in the portfolio was Severn Trent (+12%), which provides clean water and wastewater removal services to over 4 million homes and businesses across much of central England. The company remains on track to meet its Outcome Delivery Incentives (targets with material financial reward potential), and reiterated full year earnings guidance. The UK water regulator also approved an additional £800 million of investment for UK water utilities, as part of the sector’s green recovery program. Over half of the total was awarded to Severn Trent, to spend on environmental improvements such as river water quality improvements and flooding reduction measures.

Pennsylvania-based water and gas utility Essential Utilities (+7%) performed well on the appeal of its defensive business model, predictable earnings profile (the company has paid a quarterly dividend for 77 consecutive years), and proven ability to augment its earnings growth via small “tuck-in” acquisitions. Republic Services (+9%), which provides waste management services across 41 US states, announced better-than-expected June quarter earnings. Firm pricing and margin expansion were accompanied by a return to pre-pandemic volumes as the US economy improved, enabling the company to increase full year earnings guidance by 7%.

Mobile tower operators SBA Communications (+7%) and American Tower (+5%) continued to rally on the prospect of accelerating growth rates for their US operations during the second half of 2021. The deployment of new 5G spectrum by the “big three” US telecom companies — AT&T, T-Mobile / Sprint and Verizon — is driving healthy demand for new tower space, to the benefit of tower operators.

The worst performing stock in the portfolio was French-listed Rubis (-10%), a mid-cap energy supply and storage business which operates across a range of specialist markets. The company’s management team has a successful track record of acquiring energy infrastructure assets deemed non-core by larger operators, and driving improved operating performance through a de-centralised business model. Share price declines this month reflected a general “risk-off” mood, rather stock-specific developments.

Emerging Markets toll roads also underperformed. A Delta variant outbreak originating from Nanjing Airport, along with weakness in the broader Chinese stock market, weighed on Jiangsu Expressway (-6%). Negative sentiment also affected Mexican peer PINFRA (-6%), despite robust traffic volumes on most of its roads resulting in better-than-expected June quarter earnings.

US energy infrastructure stocks Magellan Midstream Partners (-5%) and Enterprise Products Partners (-5%) gave up ground. Although the robust operating environment supported healthy June quarter earnings numbers, investors were disappointed by a lack of detail about future capital management initiatives. Canadian peer Pembina Pipeline (+5%) fared better after receiving a C$350 million break fee from its one-time takeover target Inter Pipeline (-1%, not held). Inter Pipeline recommended instead that its shareholders accept a rival takeover bid from unlisted infrastructure manager Brookfield Infrastructure Partners.

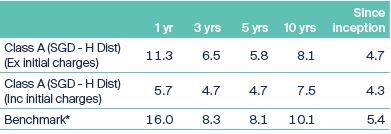

Annualised performance in SGD (%) 2

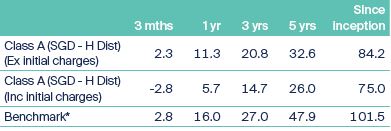

Cumulative performance in SGD (%) 2

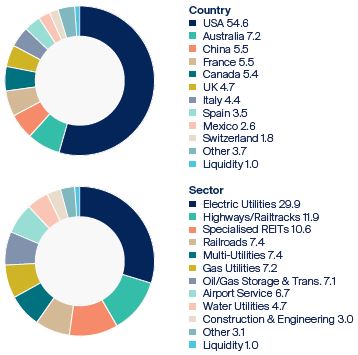

Asset allocation (%) 2

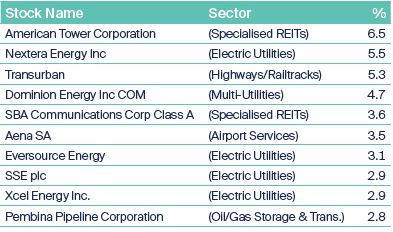

Top 10 holdings (%) 2

1 First Sentier Global Listed Infrastructure Fund’s cumulative return over one month. The performance of the fund is based on the Singapore unit trust, net of fees, expressed in SGD terms.

2 Source: Lipper & First Sentier Investors. Single pricing basis with net income reinvested. Data as at 31 July 2021. Allocation percentage is rounded to the nearest one decimal place and the total allocation percentage may not add up to 100%. First Sentier Global Listed Infrastructure Fund inception date: 3 March 2008.

* From inception - 31 May 08 : S&P Global Infrastructure Index; From 1 Jun 08 – 31 Mar 15 : UBS Global Infrastructure and Utilities 50-50 Index; From 1 Apr 15 : FTSE Global Core Infrastructure 50/50 Index.

All stock and sector performance data expressed in local currency terms. Source: Bloomberg.

Fund activity

The Fund initiated a position in CyrusOne, a data centre operator listed in the US. Data centres, like tower companies, are well positioned to benefit from the structural growth in data usage. Further, data centres are expected to benefit from the shift of IT workloads away from on-premises to colocation or cloud facilities. CyrusOne owns strategically located data centres in the US, and is building a presence in key European markets. Predictable cash flows are underpinned by multi-year contracts with enterprise and hyperscale customers. Disappointing strategy and elevated management turnover in recent years has seen the stock trade at a discount to peers, presenting an entry point for the Fund.

Regulated electric and gas utility National Grid was divested following a positive market reaction to its £8 billion acquisition of UK electricity distribution business Western Power Distribution from PPL Corp earlier in the year. UGI Corp was also sold after strong year-to-date share price gains, driven by improved investor sentiment towards its gas utility and energy infrastructure assets, moved the stock to a lower position within our investment process.

Market outlook and fund positioning

The Fund invests in a range of global listed infrastructure assets including toll roads, airports, railroads, utilities, pipelines, and wireless towers. These sectors share common characteristics, like barriers to entry and pricing power, which can provide investors with inflation-protected income and strong capital growth over the medium-term.

Toll roads represent the portfolio’s largest sector overweight, via positions in European, Asia Pacific and Latin American operators. We believe these companies represent exceptional value at current levels, with traffic volumes proving significantly more resilient than those of other transport infrastructure assets. While new coronavirus variants have clouded the near term outlook, we remain confident that toll roads will lead a return to normal demand levels as economic activity levels pick up.

The portfolio is also overweight water / waste companies. This exposure consists of stable, income-generative UK and US-listed water utilities, deriving regulated earnings from the provision of essential services. The pressing need for investment to replace and repair aging water pipe networks in the US represents an additional source of long-term earnings growth. The portfolio has also built a position in US waste management company Republic Services, which stands to benefit from higher waste volumes as the US economy continues to improve.

The portfolio is underweight electric / multi-utilities. While these companies represent a large segment of the global listed infrastructure universe, and are a good source of yield and defence, some have traded up to levels where limited mispricing is evident. That said, a substantial portion of the portfolio still consists of high conviction utility holdings. The portfolio’s focus is on companies with the scope to derive steady, low risk earnings growth from rate base investment (replacing ageing distribution networks, upgrading substations, expanding transmission lines); and the replacement of older coal-fired power stations with wind farms and solar power.

The portfolio also has an underweight exposure to Pipelines owing to the structural headwinds that these companies could face over the medium and long term, as decarbonization and Net Zero initiatives gather pace. Strong year-to-date gains for these companies have also contributed to our relatively cautious view. Within this space, the portfolio’s exposure is focused on those stocks that have agreed long term contracts with high quality counterparties; with lower sensitivity to commodity price movements.

Source : Company data, First Sentier Investors, as of end of July 2021.

Important Information

This document is prepared by First Sentier Investors (Singapore) (“FSI”) (Co. Reg No. 196900420D.) whose views and opinions expressed or implied in the document are subject to change without notice. FSI accepts no liability whatsoever for any loss, whether direct or indirect, arising from any use of or reliance on this document. This document is published for general information and general circulation only and does not have any regard to the specific investment objectives, financial situation and particular needs of any specific person who may receive this document. Investors may wish to seek advice from a financial adviser and should read the Prospectus, available from First Sentier Investors (Singapore) or any of our Distributors before deciding to subscribe for the Fund. In the event that the investor chooses not to seek advice from a financial adviser, he should consider carefully whether the Fund in question is suitable for him. Past performance of the Fund or the Manager, and any economic and market trends or forecast, are not indicative of the future or likely performance of the Fund or the Manager. The value of units in the Fund, and any income accruing to the units from the Fund, may fall as well as rise. Investors should note that their investment is exposed to fluctuations in exchange rates if the base currency of the Fund and/or underlying investment is different from the currency of your investment. Units are not available to US persons.

Applications for units of the Fund must be made on the application forms accompanying the prospectus. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by First Sentier Investors (Singapore), and are subject to risks, including the possible loss of the principal amount invested.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of FSI’s portfolios at a certain point in time, and the holdings may change over time.

In the event of discrepancies between the marketing materials and the Prospectus, the Prospectus shall prevail.

In Singapore, this document is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors (registration number 53236800B) is a business division of First Sentier Investors (Singapore).

First Sentier Investors (Singapore) is part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

Get the right experience for you

Your location :  Singapore

Singapore

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom