A monthly review and outlook of the Asian Quality Bond market.

Market review - as at May 2021

The ongoing rollout of Covid vaccines in most countries and the relaxation of social distancing restrictions continued to support investor sentiment towards risk assets, including credit. In general, the reopening of economies and continuing fiscal support programs are expected to benefit corporate earnings. This has been underlined by recent quarterly earnings announcements in the US and Europe.

Early indications suggest discretionary expenditure is increasing rapidly as restrictions are being lifted and as economies are reopening. In general, consumers have significant spending power after more than a year of saving and, in some cases, following the receipt of income support payments. This augurs well for revenues and company profitability in the remainder of 2021 and beyond.

Against this backdrop, investment grade credit spreads consolidated close to previous levels and the JACI Investment Grade Index returned 0.38%. Returns were buoyed by a modest move lower in US Treasury yields. Speculation around a pickup in inflation in the US and ongoing concerns around Huarong overshadowed sentiment, and prevented the market from making more meaningful progress.

Huarong bonds remained volatile over the month, as various news stories emerged. A default remains unlikely in our view, partly because this would likely be unpalatable for the Chinese regulator and large shareholders. The company is still due to announce the appointment of a new President; this will be an important development that could expedite the re-organisation of the company and the divestment of non-core assets. The saga appears likely to continue in the near term and could have important implications for financial reform in China.

There was a fair amount of new issuance activity over the month. In general, strong appetite from investors enabled new issues to be priced at a premium to initial guidance.

Malaysia’s Sovereign Wealth Fund, Khazanah Nasional, returned to the dollar bond market with a USD1 billion, dual tranche senior sukuk offering. Pricing tightened during the issuance process, reflecting strong interest levels. The combined order book for the 5- and 10-year notes was more than five times over-subscribed.

Demand for new securities issued by components developer and producer AAC Technologies was even greater. The company’s new 5- and 10-year notes were more than six times over-subscribed, which again enabled the issuer to tighten pricing from initial guidance. The new bonds also fared well in secondary markets after the issuance process was complete, underlining the strong demand for high quality, yielding securities.

Performance review

The First Sentier Asian Quality Bond Fund returned 0.16% for the month of May on a net-of-fees SGD term.

The positive return was largely due to a move lower in US Treasury yield. Credit spreads consolidated within a tight range during the month amid strong investors’ interest in the primary issuance market.

On a relative basis, the fund underperformed the index as our short duration positioning went against us once again this month. Our moderate overweight in Huarong and other China asset management companies also detracted value as market remained nervous over the potential restructuring of the bonds issued by these companies.

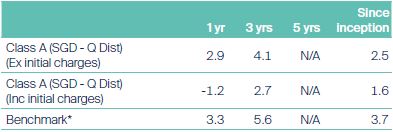

Annualised performance in SGD (%) 1

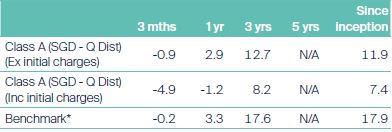

Cumulative performance in SGD (%) 1

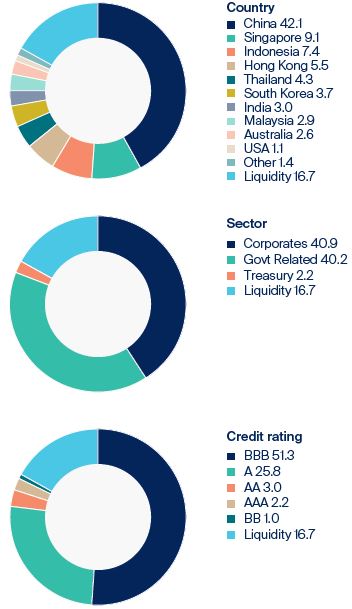

Asset allocation (%) 1

Top 10 holdings (%) 1

* The benchmark displayed is the J.P Morgan JACI Investment Grade Index (SGD Index) (Hedged to SGD).

1 Source: Lipper, First Sentier Investors. Single pricing basis with net income reinvested. Data as at 31 May 2021. The First Sentier Asian Quality Bond Fund inception date: 1 November 2016.

Fund positioning

We continued to increase diversification in the portfolio, investing in various new issues. The Fund participated in deals from Khazanah Nasional - Malaysia’s Sovereign Wealth Fund — and AAC Technologies, for example. The Fund also invested in new bonds issued by China Aluminium.

These purchases were partly funded by selling existing holdings in Resort World Las Vegas. The bonds have fared well recently following the gradual relaxation of social distancing restrictions, but we are mindful of the risk of further virus outbreaks that could adversely affect tourism and resort spending. Consequently we took the opportunity to bank in profits from the recent rally.

The short duration position in the US government bond market was maintained. This detracted from performance slightly during May as yields edged lower, but we continue to believe inflation could surprise on the upside in the coming months, in turn exerting upward pressure on Treasury yields.

Q2 2021 investment outlook

The optimism around global economic recovery we witnessed at the start of the year looks set to continue, with the rollout of Covid vaccines gathering pace. Progress varies between countries, but encouraging progress has been made overall. By the end of March, nearly 100 million adults in the US had received at least one shot, and more than 53 million — or more than 20% of the adult population — had been fully vaccinated. At this rate, all adults in the US could be vaccinated by July. China also appears to have done an effective job in containing the virus, and have also pledged to supply half a billion doses of Chinese vaccine to more than 45 countries. Progress in Europe has been slower, owing to issues with production and distribution in the region. Overall, we expect investors to continue to focus on the pace of vaccine rollouts worldwide, given the correlation between economic activity levels and corporate profitability.

Despite signs of success in the containment of the virus and good progress with the vaccine rollout, President Biden recommitted to supporting the US economy through massive fiscal stimulus. To put some numbers into perspective, the US$1.9 trillion package Biden has approved equates to almost 9% of GDP. The package includes US$400 billion of direct payments to households, suggesting there could be an immediate impact on discretionary spending and, in turn, inflation. The additional US$2+ trillion infrastructure spending plan could result in additional inflationary pressure over time. Risk assets have understandably cheered these moves, and while these stimulus packages are likely to be positive for the US economy, there are some potential implications for markets that investors need to be mindful of.

The massive stimulus announced — and the probability of even more to come — suggests US Treasury supply could continue to rise sharply in the months ahead, in turn exerting further upward pressure on yields. Moreover, the unprecedented size of the fiscal stimulus, along with highly accommodative monetary policy, means there is a genuine risk of inflation surprising on the upside in the months ahead. This is despite Federal Reserve officials assuring investors that higher inflation is likely to be transient, and that official interest rates will not be raised until 2024 at the earliest. The Federal Reserve’s central scenario seems plausible, but we believe there is a genuine risk that inflation surprises on the upside — perhaps increasing to its highest level since the Global Financial Crisis — and stays elevated for a longer period. We are also mindful that investors may have become too complacent regarding inflationary risks, with CPI being so low over the past decade. If higher inflation does materialize and remains persistent, we might therefore see bouts of volatility in financial markets, similar to those seen during the ‘taper tantrum’ period in 2013, when investors became jittery about the Federal Reserve reducing the scale of its quantitative easing program.

Approximately half of Asian corporates have reported earnings for the 2020 year, and the trend is clear. Firms have seen significantly lower revenues and earnings, and worsening debt and leverage ratios. The deterioration in credit fundamentals is not too unsettling at this stage, certainly among the investment grade universe. The decline in earnings so far has been most pronounced in Chinese high yield property names, such as Yuzhou, which reported losses of RMB166 million towards the end of March following two consecutive profit warnings. The good news is that may have seen the trough in earnings in this part of the market. That said, some caution is warranted, particularly with spreads on Asian investment grade issuers around 180 bps, below the 5 year average, and with ‘all in’ yields still on the low side.

Demand and supply dynamics in the Asian credit market remain supportive — new issues have generally seen strong demand among income-seeking investors. This helps explain why periodic sell-offs in recent years have tended to be quite shallow, and short lived. Indeed, any meaningful increase in spreads would present us with an opportunity to add some more risk into the portfolio, particularly if the spread widening coincided with a stabilization in US Treasury yields. We continue to monitor the new issuance calendar for new investment opportunities that are reasonably priced. Our dedicated credit analysts scrutinize the pricing and structure of new deals, looking for issues that can further diversify the portfolio.

With the likely increase in US Treasury supply in the years ahead to fund the additional fiscal stimulus, we see very little reason to change our structurally negative view on prospects for the US dollar. Nevertheless, should US Treasury yields continue to edge higher, and if the market starts pricing in an official interest rate hike earlier than 2024, we could see the US dollar strengthen in the next few months as investors further unwind the very crowded short dollar trade from last year. Consequently, we remain cautious around the duration risk associated with local currency bonds, especially higher beta issues like Indonesian and Indian bonds. On the other hand, any sell-offs could present interesting opportunities for us to initiate exposures in these securities given our concerns about the resilience of the US dollar over the longer term.

Source : Company data, First Sentier Investors, as of 31 May 2021

Important Information

This document is prepared by First Sentier Investors (Singapore) (“FSI”) (Co. Reg No. 196900420D.) whose views and opinions expressed or implied in the document are subject to change without notice. FSI accepts no liability whatsoever for any loss, whether direct or indirect, arising from any use of or reliance on this document. This document is published for general information and general circulation only and does not have any regard to the specific investment objectives, financial situation and particular needs of any specific person who may receive this document. Investors may wish to seek advice from a financial adviser and should read the Prospectus, available from First Sentier Investors (Singapore) or any of our Distributors before deciding to subscribe for the Fund. In the event that the investor chooses not to seek advice from a financial adviser, he should consider carefully whether the Fund in question is suitable for him. Past performance of the Fund or the Manager, and any economic and market trends or forecast, are not indicative of the future or likely performance of the Fund or the Manager. The value of units in the Fund, and any income accruing to the units from the Fund, may fall as well as rise. Investors should note that their investment is exposed to fluctuations in exchange rates if the base currency of the Fund and/or underlying investment is different from the currency of your investment. Units are not available to US persons.

Applications for units of the Fund must be made on the application forms accompanying the prospectus. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by First Sentier Investors (Singapore), and are subject to risks, including the possible loss of the principal amount invested.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of FSI’s portfolios at a certain point in time, and the holdings may change over time.

In the event of discrepancies between the marketing materials and the Prospectus, the Prospectus shall prevail.

In Singapore, this document is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors (registration number 53236800B) is a business division of First Sentier Investors (Singapore).

First Sentier Investors (Singapore) is part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

Get the right experience for you

Your location :  Singapore

Singapore

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom