1. https://www.ilo.org/global/topics/forced-labour/publications/WCMS_854733/lang--en/index.htm

2. https://www.ilo.org/global/topics/forced-labour/publications/WCMS_854733/lang--en/index.htm

Engagement on the Russia/Ukraine conflict

Armed conflict has enormous humanitarian consequences, as well as long lasting economic, social and environmental repercussions. The Russia-Ukraine conflict is not the only conflict happening now (the Geneva Academy is currently monitoring over 110 armed conflicts1), however the sanctions relating to this conflict are unprecedented in scope and severity, at state level as well as for corporates.

In response to the invasion of Ukraine, many companies announced their withdrawal from Russia, sometimes without applying a human rights lens to their decision. After referencing and updating our Human Rights Toolkit and receiving specialised training, First Sentier Investors identified and engaged with several companies to determine:

- The nature of their involvement and how exposed they are.

- How the company is enhancing its due diligence to identify, prevent, and mitigate heightened human rights risks and comply with international humanitarian law.

- What measures the company is taking to ensure it actively monitors the situation, including through consultation with workers, affected communities, human rights groups, and/or humanitarian organisations.

- What measures the company has taken to ensure business relationships, products, services, operations, or other actions do not contribute to Russian military activities or occupation in Ukraine (this may or may not include a responsible exit).

- What actions the company has taken to mitigate the effects of any decisions taken on affected communities and workers and how regularly they are re-evaluating their response.

- What other actions the company is taking to promote respect for humanitarian law and human rights.

To date, the quality of company feedback and the response rate has been low, with only 10% of global companies that we invited to respond on the Russia-Ukraine conflict, providing a full or partial response to our questions. The majority of responses were generic. We are continuing to engage.

Next steps will be to follow up with the companies that have not responded in addition to engaging with the companies that provided partial responses to expand our findings. Where we identify examples of best practice, we will seek to share that information with companies that have scope to improve their approaches.

1. https://geneva-academy.ch/galleries/today-s-armed-conflicts

Investors Against Slavery and Trafficking APAC

IAST APAC is a group of investors working to help end modern slavery, focusing on the Asia-Pacific region. FSI is proud to convene and Chair the initiative, which comprises 37 investor organisations with AU$7.8 trillion in assets under management (AUM), together with the Australian Council of Superannuation Investors (ACSI), Walk Free and the Finance Against Slavery and Trafficking (FAST) initiative.

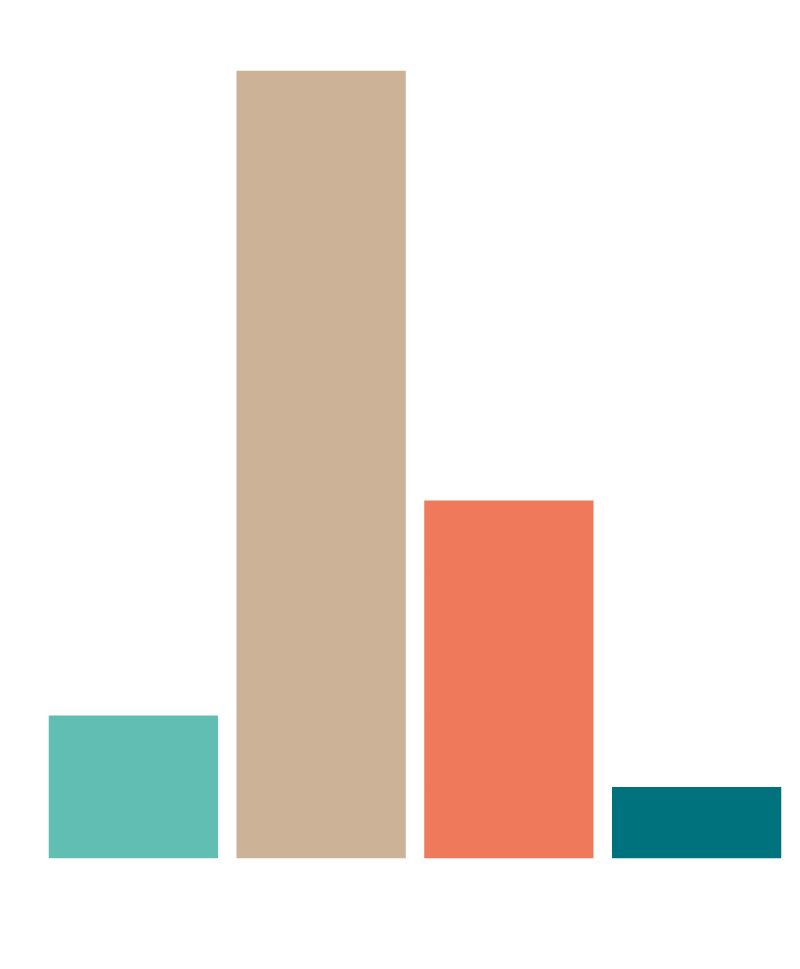

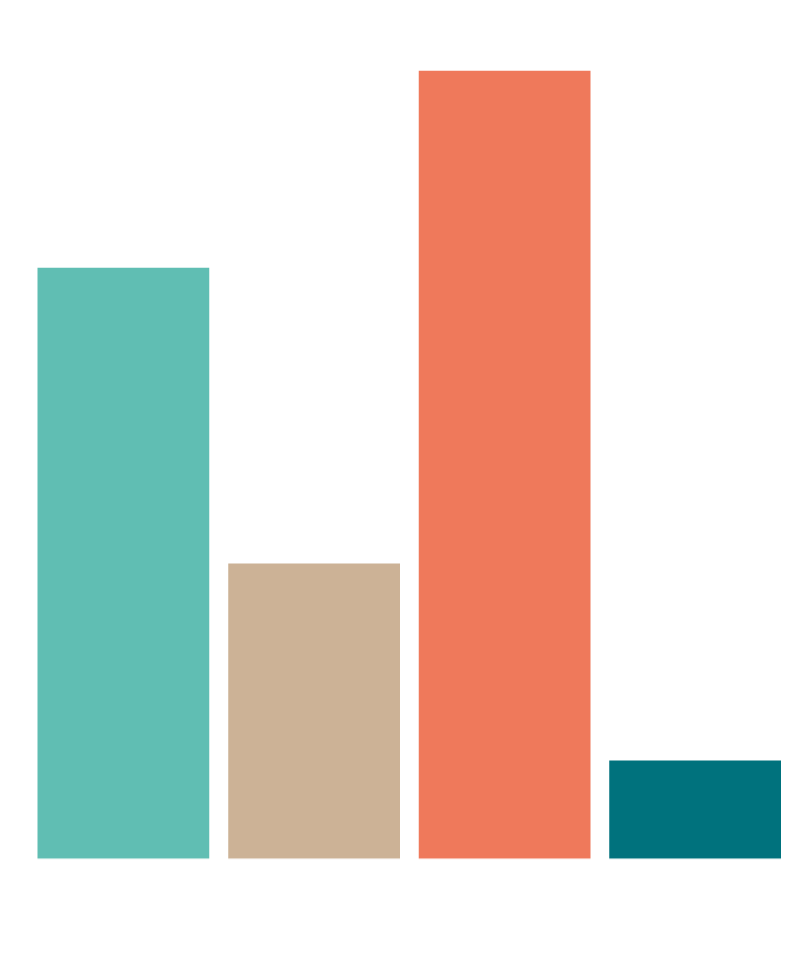

In 2022, IAST APAC focused on facilitating policy advocacy opportunities for members specifically in relation to the Australian Modern Slavery Act review, and it engaged with 24 focus companies across the consumer discretionary, consumer staples, technology and healthcare sectors and listed on the following exchanges: Australia, Hong Kong, Japan, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Vietnam.

The findings revealed that companies are at various stages of tackling modern slavery, and that many companies still coming to grips with the scale of the problem and what is required to address it.

However, the findings also revealed that several companies have made significant strides in finding, fixing and preventing modern slavery in their operations and supply chains.

The aim is to help these leaders go further, modelling best practice for other industry participants as they make progress on the issue, which will assist IAST APAC to more effectively support the companies that are earlier in their journey.

For further information, please see the IAST APAC Annual Report.

Source: IAST APAC Annual Report, data as at 30/6/22

Stewart Investors, conflict minerals collaborative engagement update

The issue

Tantalum, tin, tungsten, gold and cobalt (referred to collectively as conflict minerals) are vital materials and building blocks of the semiconductor industry. The poor traceability of these minerals along complex supply chains, including smelting and refining, can obscure the provenance of these minerals. This can lead to the inadvertent financing of armed conflict and the abuse of human rights.

Demands for a greener future necessitates more semiconductors and therefore more mineral mining.

The engagement initiative

Following specific company discussions and two commissioned research reports, in 2021, Stewart Investors launched an industry engagement initiative: Tackling conflict mineral content in the semiconductor supply chain. The initiative was supported by 160 signatories, collectively representing US$6.59 trillion in AUM.

With regulators and consumers also increasing their attention on the challenges of mineral sourcing within the semiconductor supply chain, the collaboration effort has attracted greater interest from a number of large financial institutions.

Actions

In 2022, Stewart Investors increased engagement efforts with:

- Companies, the team met with several companies in response to the initial letter;

- Industry bodies, at the Responsible Minerals Initiative (RMI) annual conference; and

- Civil bodies, having met with Global Witness to discuss the findings of field research recently carried out and published in their ITSCI Laundromat report. Click here to watch a short interview with Stewart Investors and Global Witness.

Findings

These engagements revealed the issue of improperly sourced minerals and associated human rights abuses to be more severe than initially anticipated, and progress has stalled due to companies’ challenges from reliance on third-party audits, the concentration of minerals in high-risk countries and a lack of sustained effort by companies. However, NGO pressure and geopolitical tensions are increasing governments’ focus on supply chain transparency leading companies to refocus their efforts on full supply chain mapping.

Achievements

Stewart Investors has raised the profile of investors’ concerns about this issue with key companies in the supply chain. Following this engagement, some companies have committed to improving transparency and one company has for the first time published a full list of the smelters and refiners they use.

The engagement has also raised the profile of investors’ concerns with the main industry body and civil bodies which has helped bring the issue to a wider audience and provided scope for further collaboration.

It is extremely early days for this multi-year engagement but it is clear that tracing mineral provenance is an extremely complex challenge for companies. Progress is slow. While there is a unanimous desire to improve practices, some companies are more eager and able to meet this challenge than others.

Next steps

Stewart Investors is now seeking to:

- Attract more signatories to underline a deepening commitment to this issue;

- Write again to all companies to assess and encourage progress;

- Formulate investor guidelines, with the RMI, to deepen the quality of company engagements; and

- Attend industry functions to learn and improve the quality of our engagement.

Get the right experience for you

Your location :  Finland

Finland

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom