Global Property Securities – Embodied carbon in buildings

The Global Property Securities team is committed to achieving our net zero targets. However, the full scope of the real estate sector’s contribution to global carbon emissions has not been fully quantified, which creates challenges in achieving this goal.

We believe that Scope 1 & 2 emissions data only gives a partial picture of property portfolio emissions and does not provide for full landlord accountability. Our carbon analysis is based on all owned real estate, including whether the energy is ‘controlled’ by the landlord or where it may be ‘non-controlled’. For instance, a real estate investment trust (REIT) may only own a minority stake in an asset or be in a leasing arrangement where the tenant has direct control of energy (typically under triple net lease contracts), which we see impacting the level of disclosures available to the market.

Currently, the built environment does not have a standardised methodology to account for the full range of Scope 3 and embodied carbon emissions, such as those associated with modernisation programmes. However, we view this as a key contributor to a building’s carbon emissions. Our investment process considers all emissions listed below and seeks company data on them:

- Scope 1: Direct GHG emissions occur from sources that are owned or controlled by the company, for example, emissions from combustion in owned or controlled boilers, furnaces, vehicles, etc.

- Scope 2: Accounts for GHG emissions from the generation of purchased electricity consumed by the company. Purchased electricity is defined as electricity that is purchased or otherwise brought into the organizational boundary of the company.

- Scope 3: Is an optional reporting category that allows for the treatment of all other indirect emissions. Scope 3 emissions are a consequence of the activities and operation of the reporting company within its value chain.

REITs have higher reporting standards in comparison to private owners and are therefore more scrutinised than their private counterparts.

We believe REITs are well-placed to standardise the measurement of Scope 3 and embodied carbon emissions, which will flow through to the rest of the built environment. Hence, we have taken steps to position ourselves to drive change in our investment universe and encourage REITs to set more ambitious net zero goals.

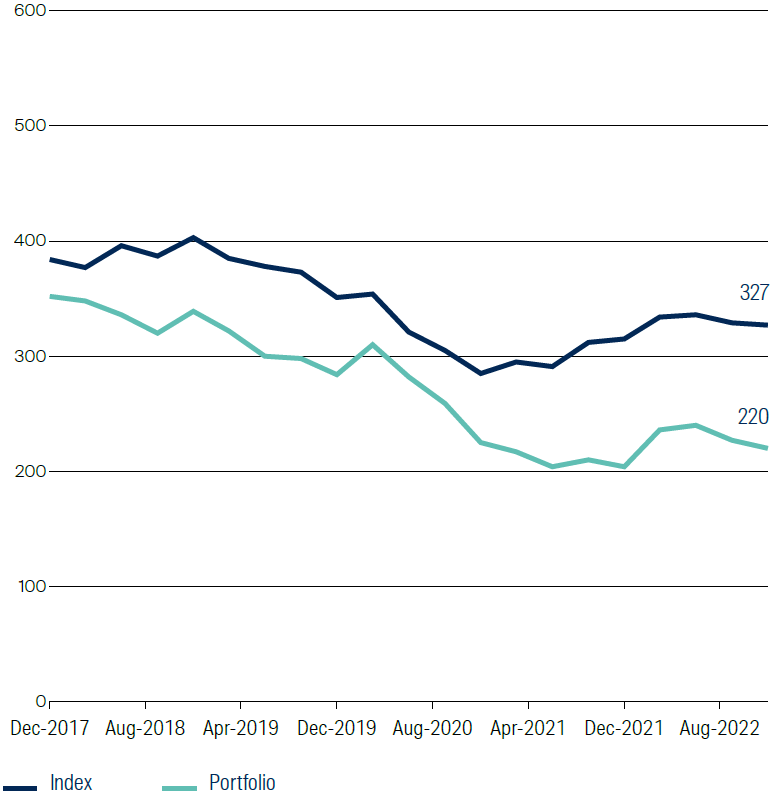

Through comprehensive research, we developed a tool [1] capable of undertaking high level analysis on all embodied carbon associated with development, redevelopment, and maintenance capital expenditure programmes at a company level.

As a result of our in-depth carbon analysis, we are now able to identify issues and to form a measurable carbon reduction target in our engagement process with companies. We have committed to a continuous engagement plan and reporting on the issue going forward.

[1] Ernst & Young was engaged by First Sentier Investors’ Global Property Securities team to undertake ‘limited assurance’ as defined by International Auditing Standards, over First Sentier Investor’s Portfolio Operational Carbon Emissions (Scope 1 and 2) Forecast to Net Zero for the year ended 30 June 2021. Based on the review, Ernst & Young determined the forecast was prepared and presented fairly, in all material respects, in accordance with the defined Criteria.

Stewart Investors Project Drawdown

Founded in 2014, Project Drawdown® is a non-profit organisation that seeks to help the world reach “drawdown” — the future point in time when levels of greenhouse gases in the atmosphere stop climbing and start to steadily decline.

Project Drawdown’s framework aims to connect substantive and existing solutions to stop climate change by reducing sources, supporting carbon sinks and improving society. Through rigorous and ongoing research, they have catalogued more than 90 climate change solutions which, if scaled up, can deliver the Paris Agreement’s 1.5°C temperature goal. The full set of solutions, along with the research that backs them, is publicly available at www.drawdown.org.

Drawdown’s solutions offer both breadth and depth of decarbonisationenabling investments and Stewart Investors utilises the solutions to help them understand the role companies can play in climate solutions and the contribution they can make to reducing emissions.

In investment terms, the abatement potential for these technologies can be thought of as “total addressable markets”, with some offering significant growth potential for companies (tailwinds), while on the flipside, some will point to significant declines in existing industries and practices (headwinds).

Viewing these areas in conjunction with other sustainable development challenges shows the cross-cutting nature of the carbon abatement challenge and consequent opportunities.

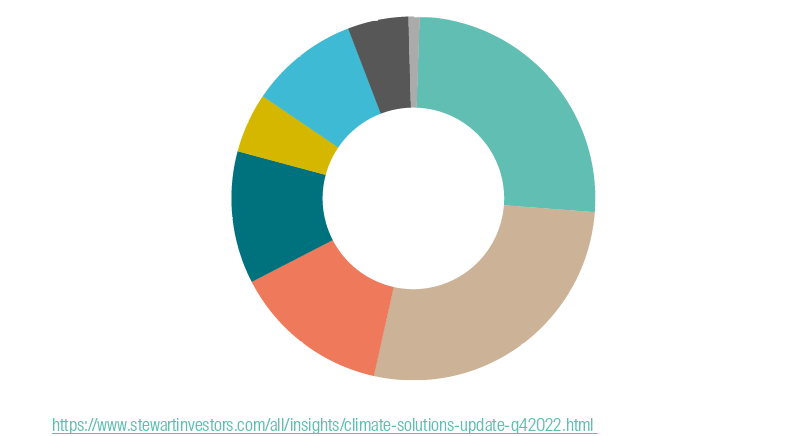

Stewart Investors map each investment against the more than 90 solutions which are captured in eight broader solutions (Buildings, Circular economy/ industry, Conservation/restoration, Energy, Food system, Human development, Transport and Water) shown in the chart to the right. The team’s focus is on whether the companies themselves are making a meaningful contribution and will have meaningful involvement with the delivery of any of those solutions.

In practice

Stewart Investors recently commissioned research into smallholder farmers, which found there are more than 500 million smallholder farmers globally producing up to 80% of some key commodities like palm oil, coffee and cocoa1. These farmers are also at the frontlines of a significant amount of agriculture-related deforestation.

Of Project Drawdown’s c.90 solutions, 22 are directly relevant to smallholder farmers, offering more than 540 gigatons of abatement potential or 34% of the total2. In this context, poverty alleviation, human rights and secure tenure of land for smallholder farmers are critical for delivering climate change solutions.

Stewart Investors publicly discloses the contributions being made by investee companies on its interactive Portfolio Explorer tool.

Figure 4. Drawdown solutions contributed to 1.5°C3

1. Stewart Investors and Project Drawdown solutions data. Gigatons CO2 Equivalent Reduced/Sequestered (2020–2050)

2. NIRAS-LTS research for Stewart Investors.

The data set out above are estimates based on data sourced by First Sentier Investors. This data is current as at 31/12/2022. It is based on information and representations sourced from third parties (including portfolio companies), which may ultimately prove to be inaccurate. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this data and no reliance should be placed on it by any third party.

Get the right experience for you

Your location :  Austria

Austria

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom